Colorado Sale and Servicing Agreement

Description

How to fill out Sale And Servicing Agreement?

Are you in the placement in which you need to have papers for sometimes business or person uses almost every working day? There are plenty of legitimate record layouts available on the net, but discovering ones you can rely on isn`t easy. US Legal Forms provides a large number of type layouts, just like the Colorado Sale and Servicing Agreement, that are created to fulfill federal and state demands.

Should you be previously knowledgeable about US Legal Forms site and possess a merchant account, merely log in. After that, you are able to download the Colorado Sale and Servicing Agreement format.

Should you not provide an account and would like to begin to use US Legal Forms, abide by these steps:

- Find the type you want and ensure it is for your appropriate metropolis/state.

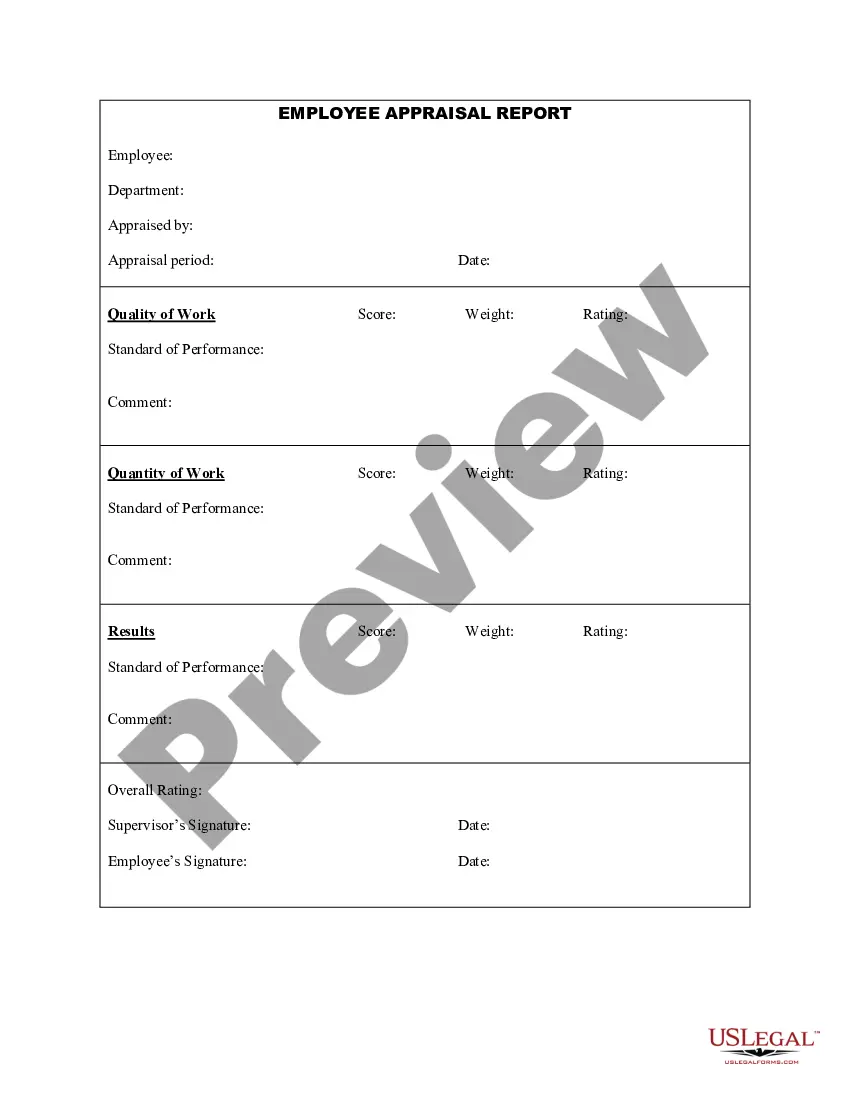

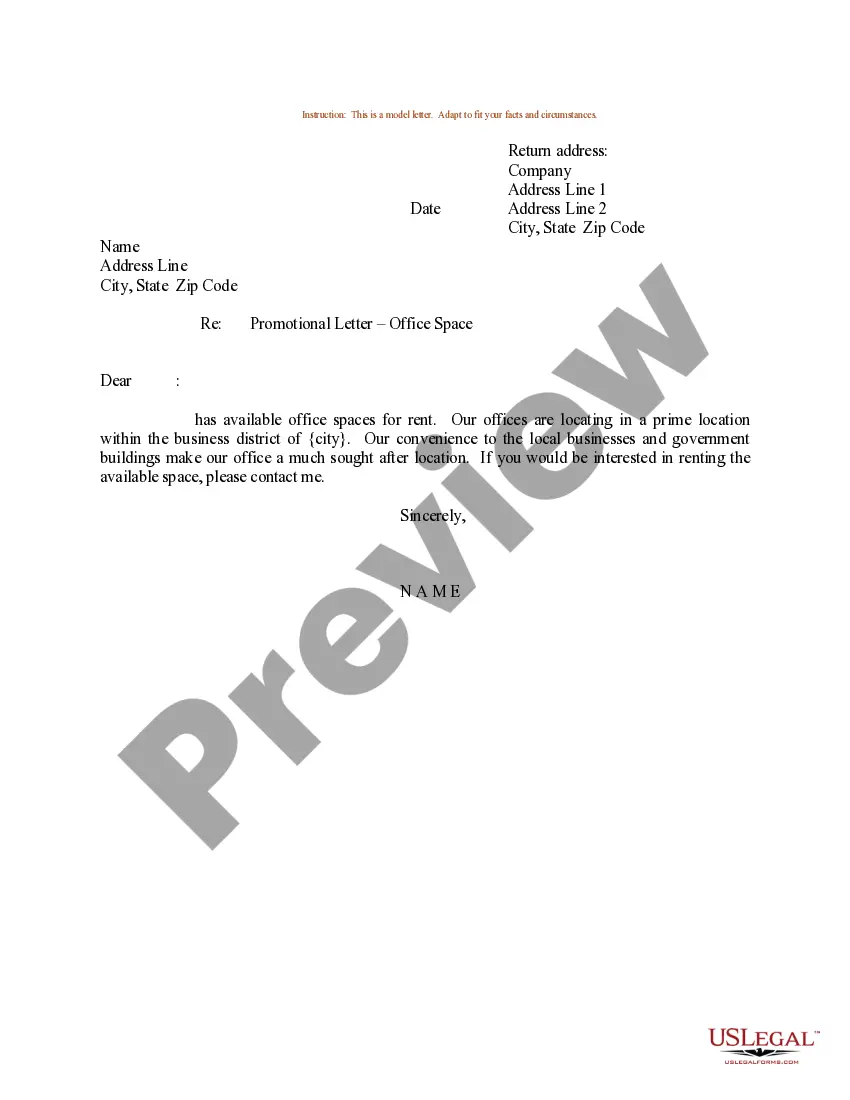

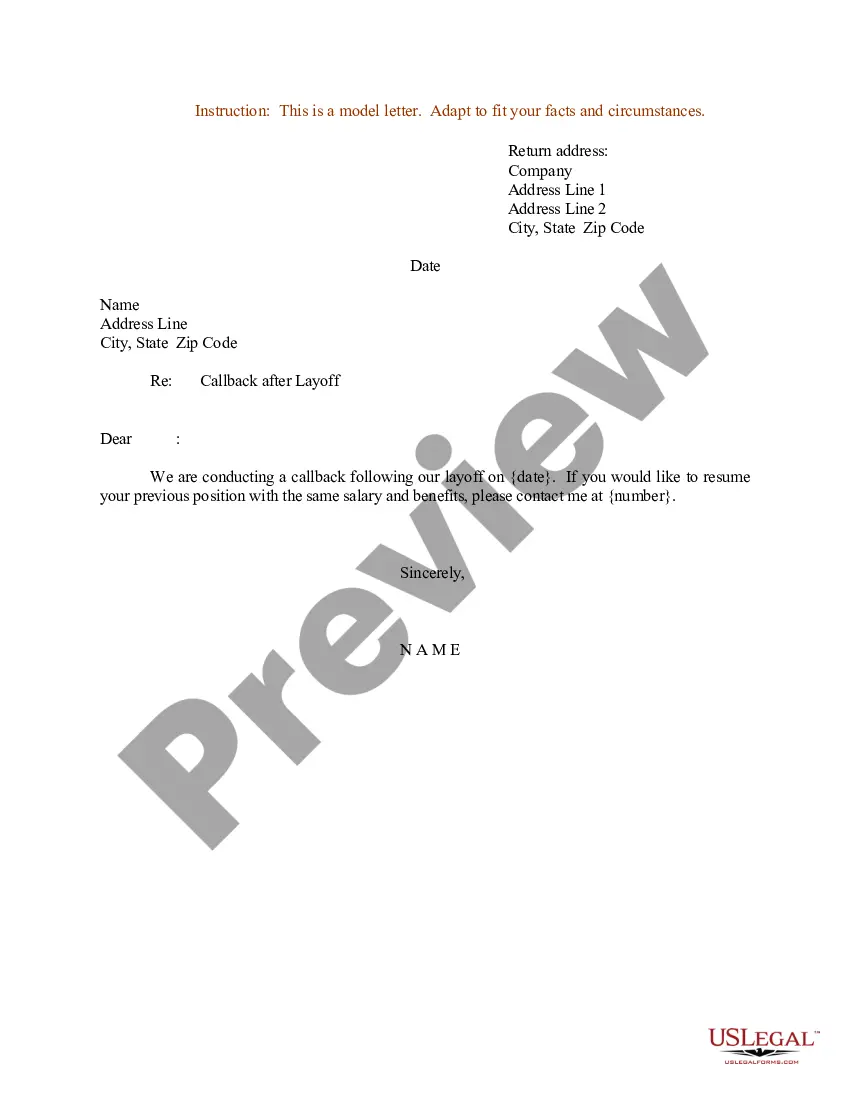

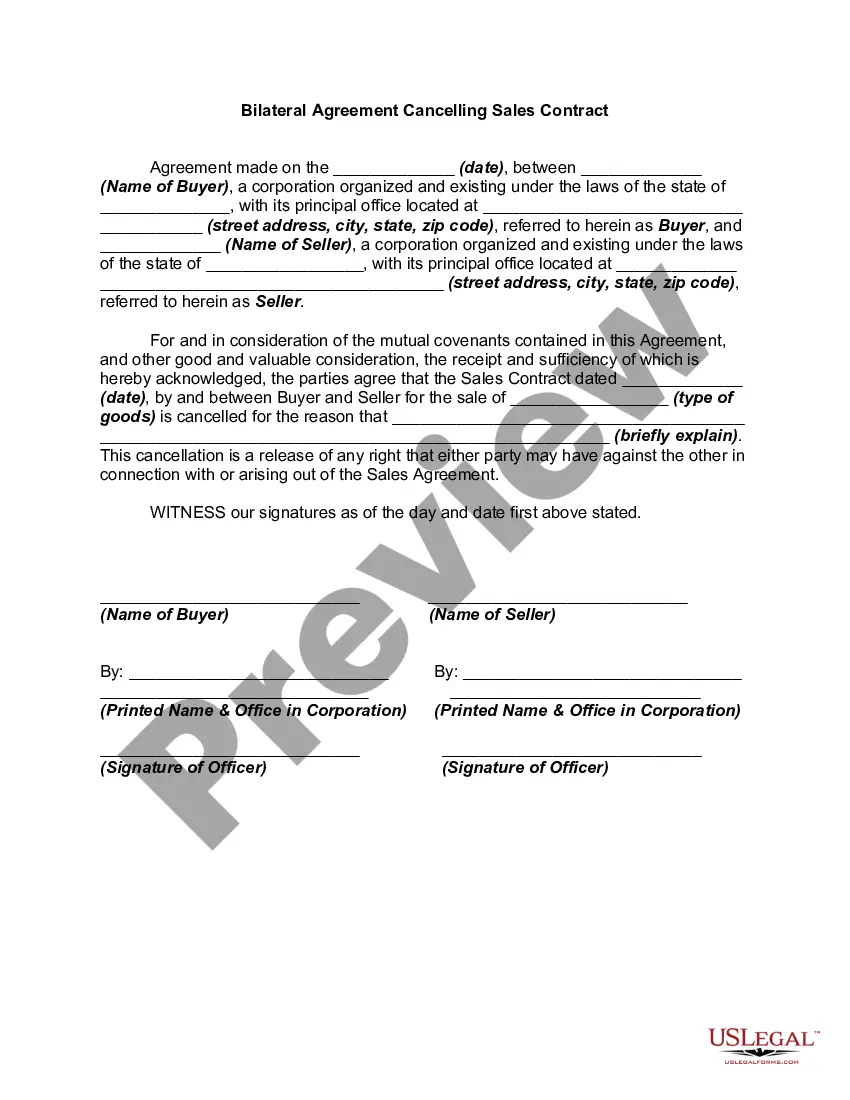

- Make use of the Review switch to examine the shape.

- Browse the explanation to ensure that you have chosen the appropriate type.

- In the event the type isn`t what you`re looking for, use the Look for discipline to discover the type that meets your needs and demands.

- Whenever you find the appropriate type, click Get now.

- Pick the pricing program you need, fill in the required details to create your account, and pay money for your order making use of your PayPal or charge card.

- Select a convenient file format and download your copy.

Locate all of the record layouts you may have bought in the My Forms food list. You can aquire a further copy of Colorado Sale and Servicing Agreement at any time, if necessary. Just go through the necessary type to download or produce the record format.

Use US Legal Forms, the most extensive selection of legitimate varieties, in order to save time as well as prevent mistakes. The support provides professionally manufactured legitimate record layouts that can be used for an array of uses. Create a merchant account on US Legal Forms and initiate creating your life easier.

Form popularity

FAQ

For tax year 2022 (taxes filed in 2023), Colorado's state income tax rate is 4.4%. Previously, Colorado taxed income at a fixed rate of 4.55%, but the passage of Proposition 121 lowered the rate by 0.15% for tax years 2022 and forward.

State Sales Tax The state sales/use tax rate is 2.9% with exemptions A, B, C, D, E, F, G, H, K, L, M. Additional state sales/use tax exemptions can be found at .TaxColorado.com. The Colorado sales tax Service Fee rate (also known as the Vendor's Fee) is 0.0222 (2.22%).

Here's how to calculate the sales tax on an item or service: Know the retail price and the sales tax percentage. Divide the sales tax percentage by 100 to get a decimal. Multiply the retail price by the decimal to calculate the sales tax amount.

Maintenance agreements when sold in connection with the sale or lease of taxable tangible personal property are generally subject to Colorado sales or use tax unless the maintenance contract is separable and separately stated from the sale or lease of the taxable tangible personal property.

Any person or entity that will engage in the business of selling at retail must first obtain a sales tax license, unless that person or entity is specifically exempted from licensing requirements.

Colorado state sales tax is imposed at a rate of 2.9%. Any sale made in Colorado may also be subject to state-administered local sales taxes. Tax rate information for state-administered local sales taxes is available online for how to look up sales use tax rates(opens in new window).

For tax years 2022 and later, the Colorado income tax rate is set at 4.4%. For individuals with Colorado taxable incomes of less than $50,000, the Department publishes tax tables which approximate the individual's Colorado tax determined at the applicable prescribed rate.

Retailer's use tax does not include any local city taxes that may be applicable. You can read more about Colorado sales tax and retailer's use tax at the Colorado Department of Revenue website. The Colorado state sales tax rate is 2.9%.