New Hampshire Sample Letter for Expense Account Statement

Description

How to fill out Sample Letter For Expense Account Statement?

Are you presently in a situation where you require documents for both professional or personal use every day.

There are many reliable document templates accessible online, but locating ones you can trust isn't straightforward.

US Legal Forms offers a vast array of form templates, such as the New Hampshire Sample Letter for Expense Account Statement, designed to comply with state and federal regulations.

Once you have located the correct form, click Acquire now.

Choose the pricing plan you prefer, enter the necessary details to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess a free account, simply Log In.

- Then, you can download the New Hampshire Sample Letter for Expense Account Statement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/region.

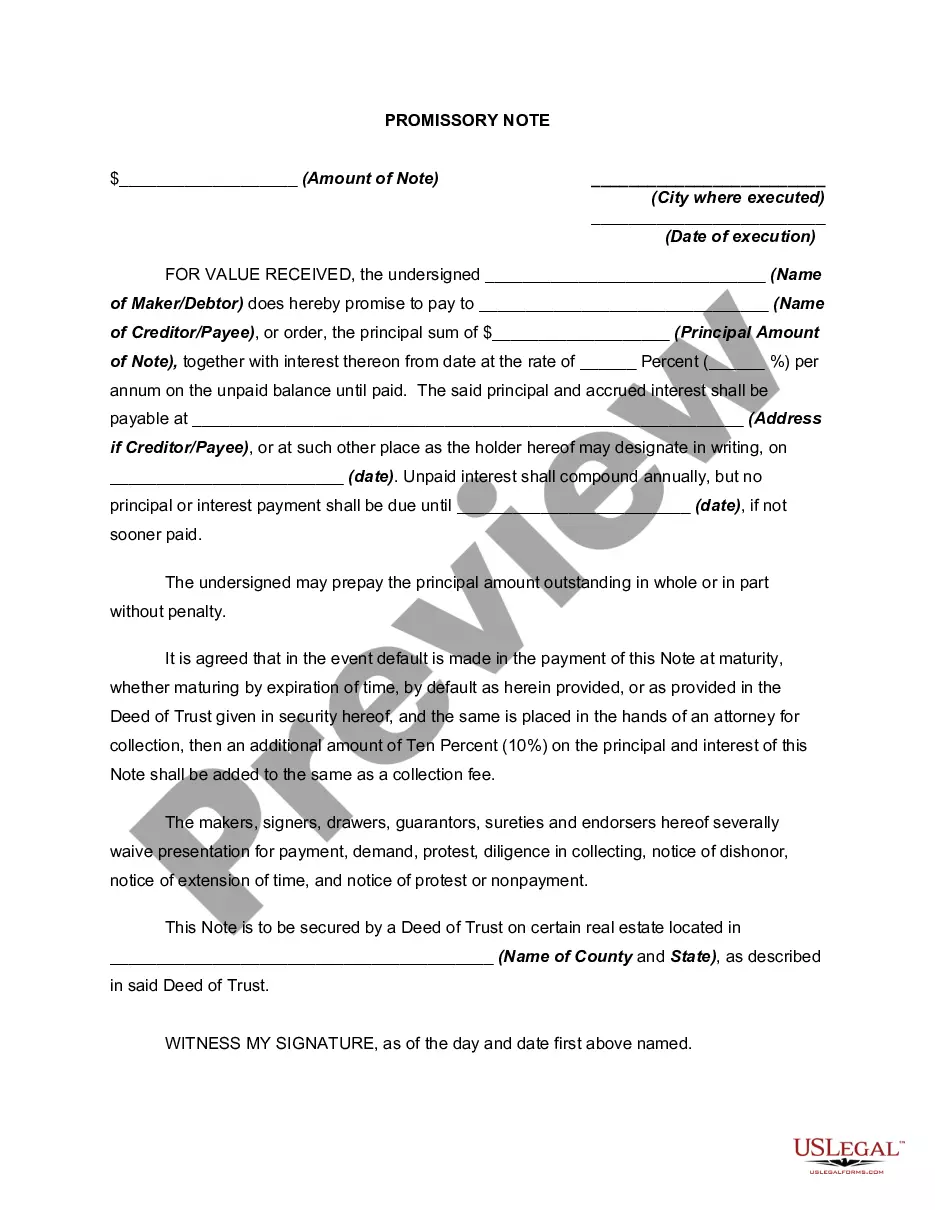

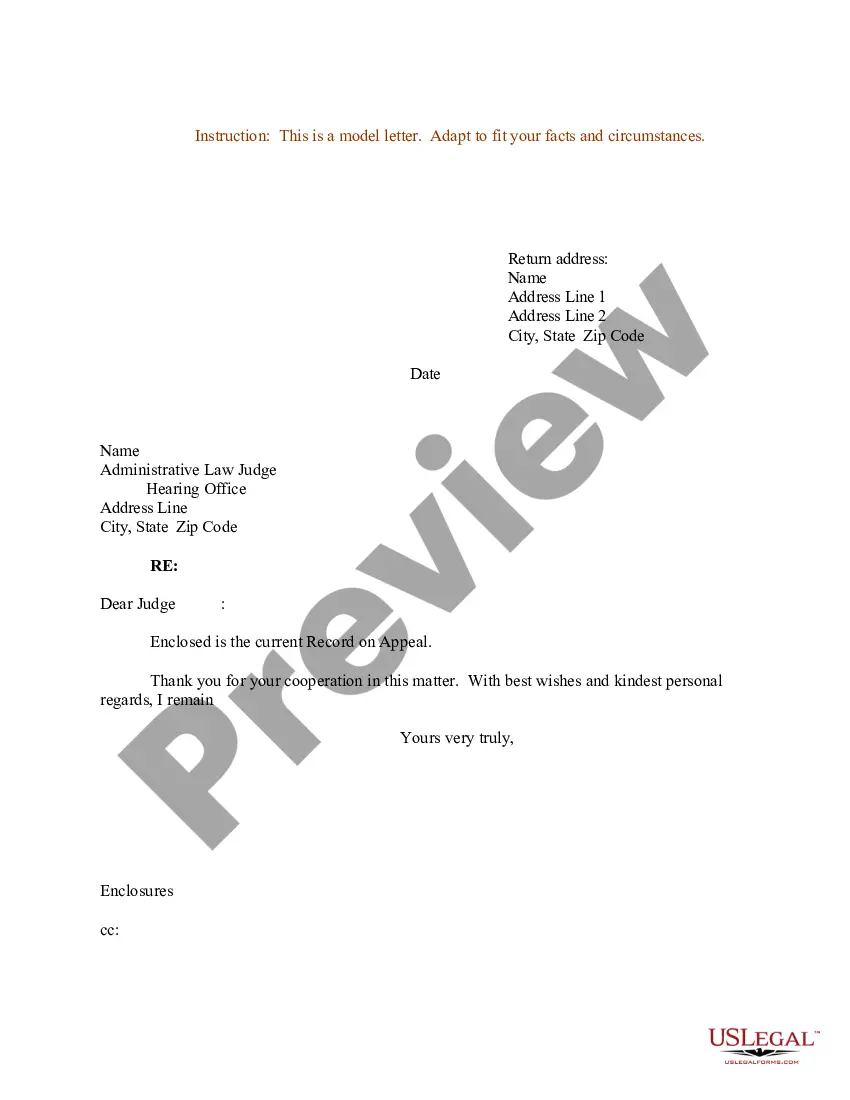

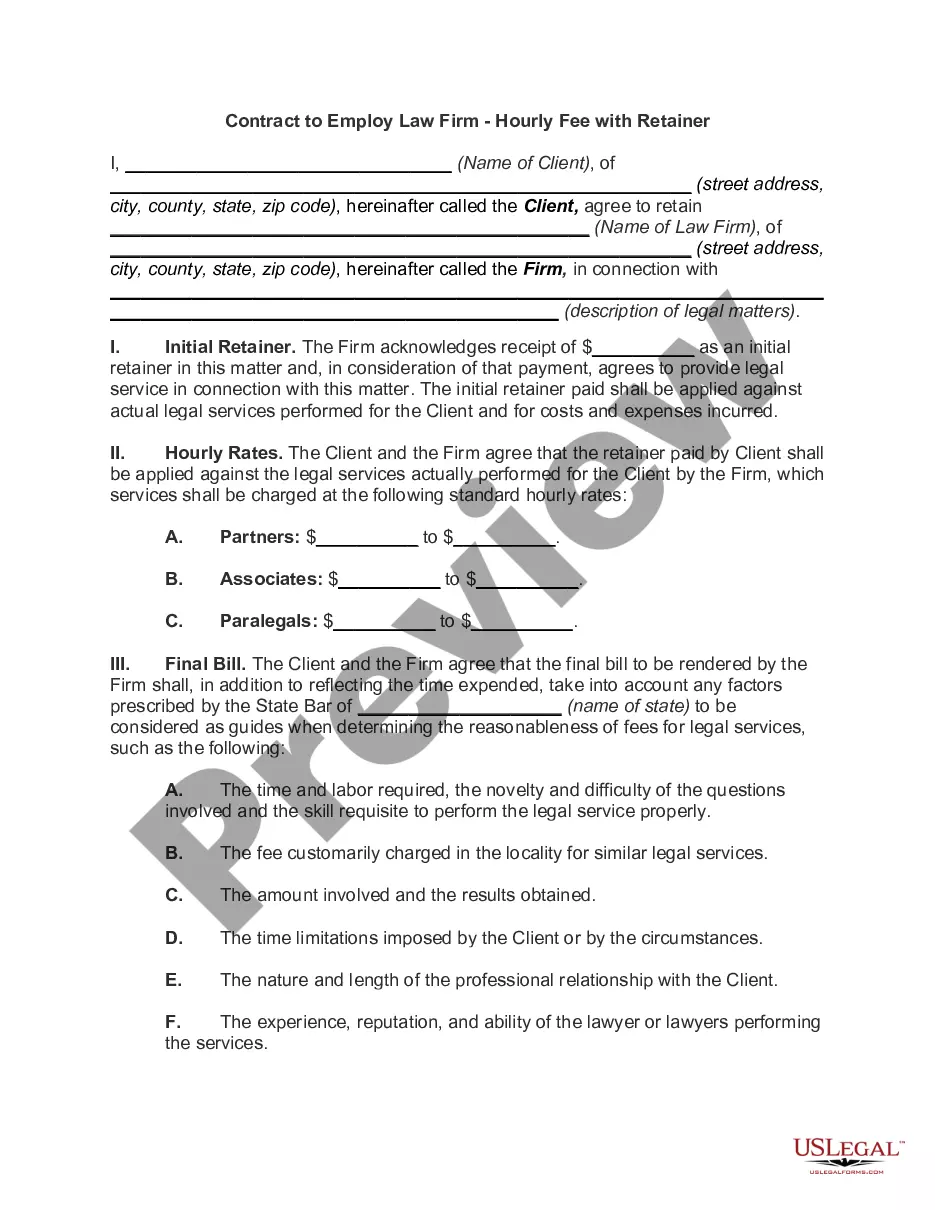

- Use the Preview button to review the form.

- Check the summary to confirm that you have selected the right form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that suits your needs.

Form popularity

FAQ

New Hampshire does not tax partnership income at the state level; instead, income passes through to individual partners. Therefore, partners report their share of income on their personal state returns. It is advisable to maintain clear records with tools like a New Hampshire Sample Letter for Expense Account Statement to manage expenses accurately.

The tax deadline in New Hampshire typically falls on April 15th, similar to federal tax deadlines. If you require additional time, remember to file for an extension in advance. A New Hampshire Sample Letter for Expense Account Statement can assist in ensuring your documents are well-organized for timely submission.

Yes, New Hampshire requires certain residents to file a state tax return, especially for interest and dividend income. The process is straightforward, and the forms are available online. To support your filing, you may consider using a New Hampshire Sample Letter for Expense Account Statement to document your expenses and provide essential details.

While New Hampshire does not provide an automatic extension for tax returns, you can apply for one if necessary. Be sure to check the specifics on the New Hampshire Department of Revenue website for details on requesting an extension. A New Hampshire Sample Letter for Expense Account Statement can complement your extension request by clarifying your expenses.

New Hampshire does not have a general automatic extension for filing state tax returns. However, you can request an extension through the appropriate forms if you need additional time. Utilizing a New Hampshire Sample Letter for Expense Account Statement can help organize your records before submission.

Currently, New Hampshire has not announced any plans to eliminate its tax on interest and dividends entirely by 2025. However, tax policies can change, so it is important to stay updated on state announcements. Using a New Hampshire Sample Letter for Expense Account Statement can help you prepare for any potential changes in tax obligations.

In New Hampshire, partnerships do not file a separate tax return for income. Instead, the income is reported directly on the personal returns of the partners. For clear records, consider compiling a New Hampshire Sample Letter for Expense Account Statement that outlines each partner’s share of expenses.

If you earn income in New Hampshire, even without a state income tax, you may still have requirements for reporting certain types of income, like interest and dividends. Be sure to review your financial situation closely or consult a tax professional for detailed advice. A well-prepared New Hampshire Sample Letter for Expense Account Statement can be beneficial in supporting your filings.

You can obtain New Hampshire tax forms from the New Hampshire Department of Revenue Administration's website. They provide a variety of forms necessary for filing state taxes. Additionally, you can create a New Hampshire Sample Letter for Expense Account Statement that may include any needed supporting documents to help clarify your financial reporting.

Yes, if you are a resident of New Hampshire or you have income sourced from the state, you generally need to file a New Hampshire state tax return. However, New Hampshire does not have a traditional income tax; instead, it taxes interest and dividends. For thorough documentation, using a New Hampshire Sample Letter for Expense Account Statement can help outline your expenses accurately.