This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Hampshire Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Confidentiality Agreement And Covenant Not To Compete?

You might spend numerous hours online trying to locate the legal document template that meets both state and federal requirements you have.

US Legal Forms offers a multitude of legal documents that have been assessed by professionals.

You can either download or print the New Hampshire Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Non-Compete Clause from our services.

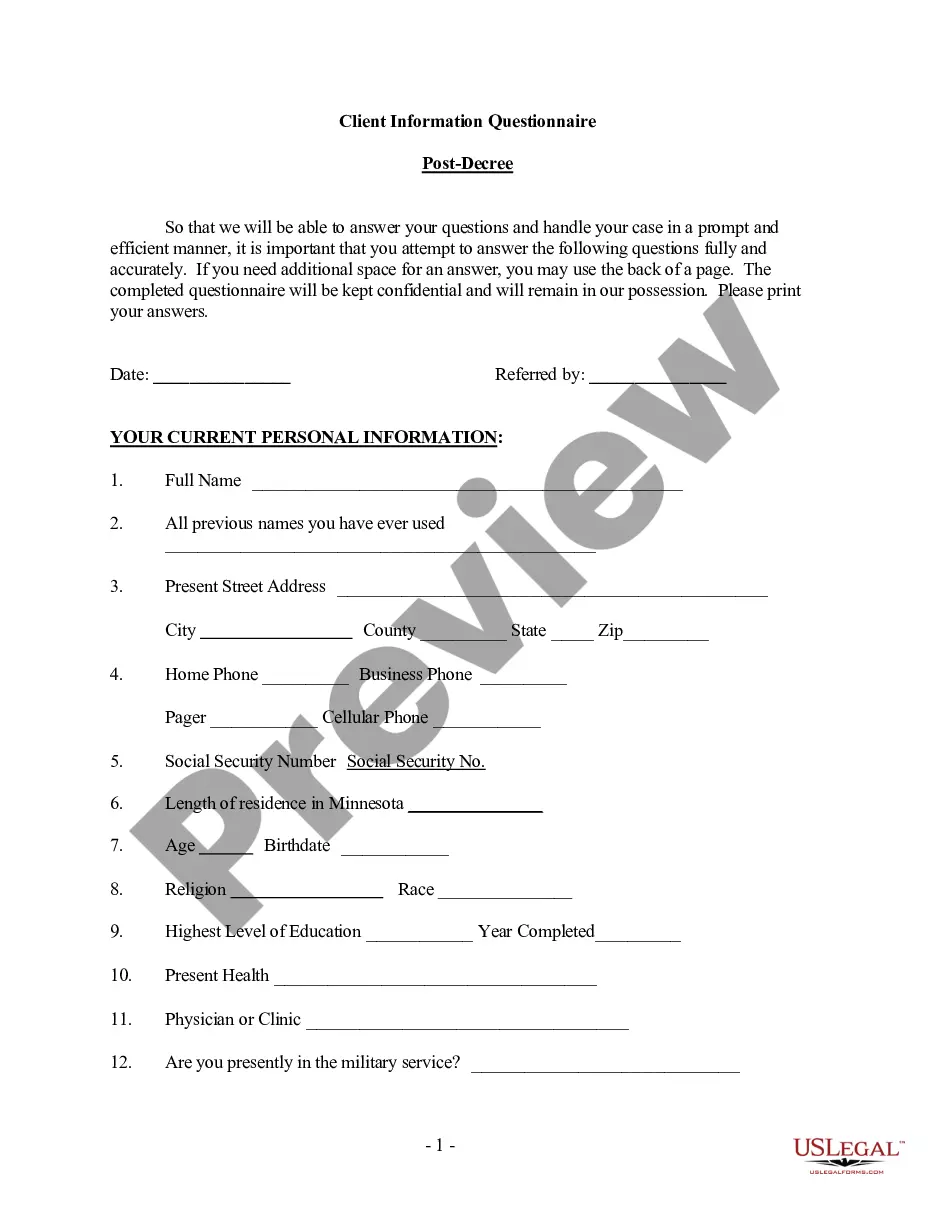

First, ensure that you have chosen the correct document template for the region/city that you select. Review the document details to confirm you have picked the right template. If available, utilize the Review option to examine the document template as well.

- If you possess a US Legal Forms account, you are able to sign in and select the Download option.

- Subsequently, you can fill out, modify, print, or sign the New Hampshire Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Non-Compete Clause.

- Every legal document template you purchase is yours to keep indefinitely.

- To obtain another copy of the purchased template, navigate to the My documents tab and select the appropriate option.

- If this is your first time using the US Legal Forms website, adhere to the straightforward instructions below.

Form popularity

FAQ

The indemnification clause for independent contractors is an essential part of a New Hampshire Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. This clause outlines the responsibilities of the contractor to compensate the client for damages incurred due to the contractor's actions, negligence, or breach of contract. It serves to protect the client from potential losses, providing peace of mind when working with independent contractors.

The confidentiality clause for independent contractors is a critical component of a New Hampshire Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete. This clause typically includes terms that require the contractor to keep all client information, project details, and other sensitive data private. By doing so, it reinforces the importance of protecting business interests and creates a secure working environment.

In an employment contract, a confidentiality clause is a provision that protects the confidentiality of sensitive information shared between the employer and employee. This clause is crucial in a New Hampshire Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete, as it prevents employees from disclosing any internal processes, client data, or market strategies. Such protection is vital for maintaining a competitive advantage in the industry.

An example of a confidentiality clause in a New Hampshire Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete typically states that the contractor must not share any proprietary information with third parties. It can specify consequences for violations, such as legal action or financial penalties. This clause clearly outlines the nature of the confidential information, ensuring both parties understand their responsibilities.

The confidentiality clause in a New Hampshire Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete ensures that sensitive information shared between the parties remains private. This clause protects trade secrets, business strategies, and client information from being disclosed to unauthorized individuals. By incorporating this clause, independent contractors commit to maintaining confidentiality, which fosters trust and protects business interests.

Yes, a covenant not to compete can be enforceable in an employment contract in New Hampshire, but certain conditions must be met. The New Hampshire Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete must protect legitimate business interests, such as trade secrets or client relationships. Additionally, the terms should be reasonable in scope, duration, and geographical area to ensure fairness. If you are considering such an agreement, using US Legal Forms can help you draft a comprehensive contract that aligns with New Hampshire laws and regulations.

To navigate around a non-compete clause, you might consider negotiating changes to the agreement or focusing on roles that do not violate the contract's terms. It’s also beneficial to review the exact wording of the agreement to find any gaps or weaknesses. Legal advice can offer insights into potential strategies for working within the framework of your New Hampshire Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete.

Certain states, such as California, North Dakota, and Oklahoma, have laws that prohibit non-compete agreements outright. These states emphasize employee mobility and the right to work without unnecessary restrictions. However, many other states, including New Hampshire, enforce non-compete clauses with specific conditions.

New Hampshire does allow non-compete agreements, provided they adhere to legal guidelines. The law requires that these agreements protect legitimate business interests and that they are not overly restrictive on the employee’s ability to earn a living. The New Hampshire Contract with Consultant as Self-Employed Independent Contractor with Confidentiality Agreement and Covenant not to Compete may contain such clauses, but they must be reasonable in nature.

A noncompete agreement can be voided for several reasons, such as if it lacks consideration, is overly broad in its restrictions, or if it violates public policy. If the agreement is found to be unreasonable in terms of duration or geographical scope, courts may also rule it void. Furthermore, if a party proves that they were coerced into signing the agreement, it may also be rendered unenforceable.