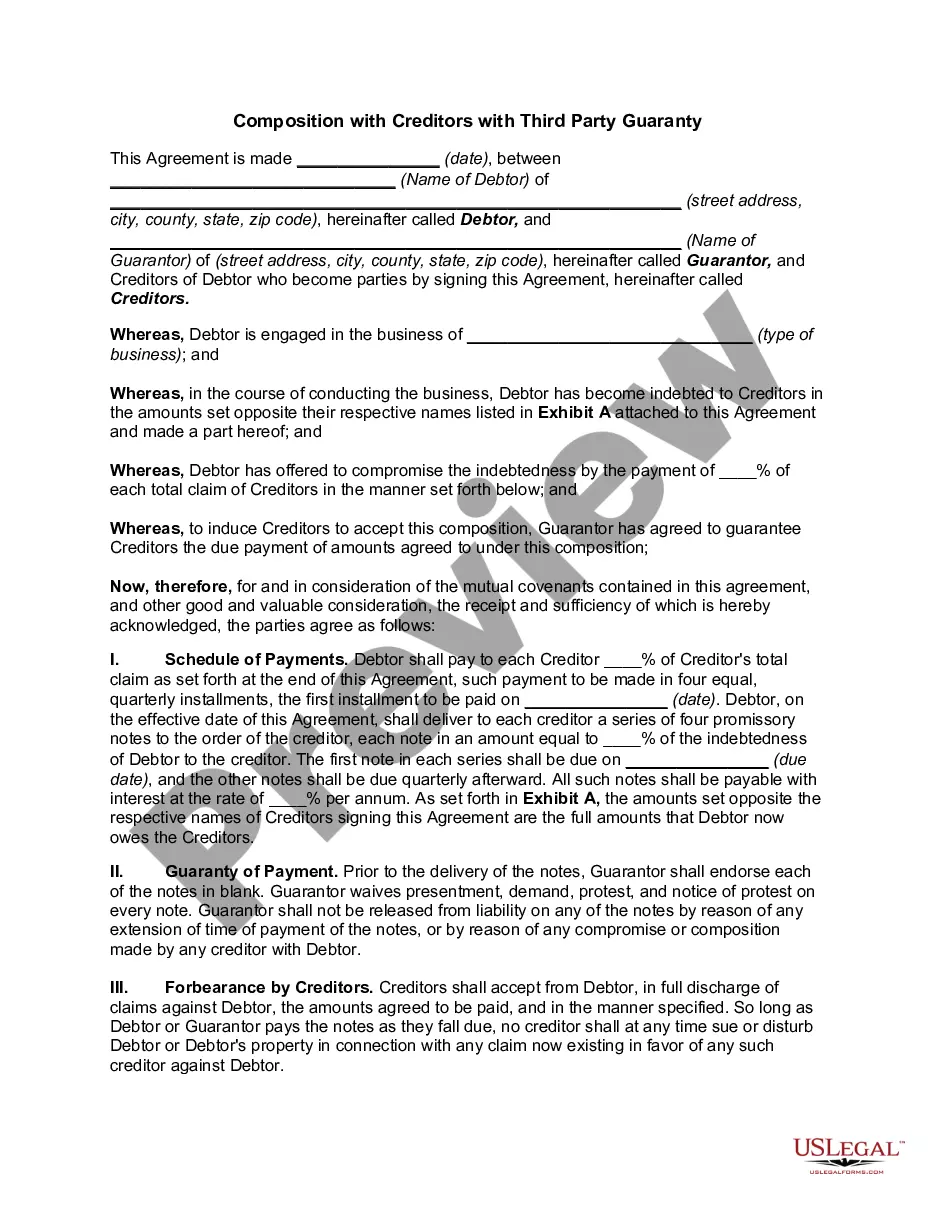

A Legacy is a gift of property or money under the terms of the will of a person who has died. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Hampshire Assignment of Legacy in Order to Pay Indebtedness

Description

How to fill out Assignment Of Legacy In Order To Pay Indebtedness?

Are you currently in the situation the place you require papers for either enterprise or specific reasons nearly every day? There are a lot of authorized file templates available online, but discovering versions you can rely isn`t easy. US Legal Forms delivers a huge number of kind templates, just like the New Hampshire Assignment of Legacy in Order to Pay Indebtedness, which can be published to fulfill federal and state specifications.

Should you be previously knowledgeable about US Legal Forms internet site and possess a free account, simply log in. After that, it is possible to down load the New Hampshire Assignment of Legacy in Order to Pay Indebtedness web template.

If you do not come with an accounts and need to begin using US Legal Forms, adopt these measures:

- Get the kind you want and ensure it is for the right city/region.

- Utilize the Preview switch to analyze the form.

- Look at the outline to actually have chosen the appropriate kind.

- When the kind isn`t what you`re searching for, use the Lookup field to discover the kind that meets your requirements and specifications.

- When you get the right kind, click on Get now.

- Select the pricing program you need, fill in the required info to produce your money, and purchase your order making use of your PayPal or Visa or Mastercard.

- Pick a handy document file format and down load your version.

Locate every one of the file templates you may have purchased in the My Forms food list. You can obtain a extra version of New Hampshire Assignment of Legacy in Order to Pay Indebtedness at any time, if needed. Just click the necessary kind to down load or print out the file web template.

Use US Legal Forms, the most substantial selection of authorized types, to conserve some time and avoid faults. The services delivers appropriately manufactured authorized file templates which you can use for a selection of reasons. Make a free account on US Legal Forms and start generating your lifestyle a little easier.

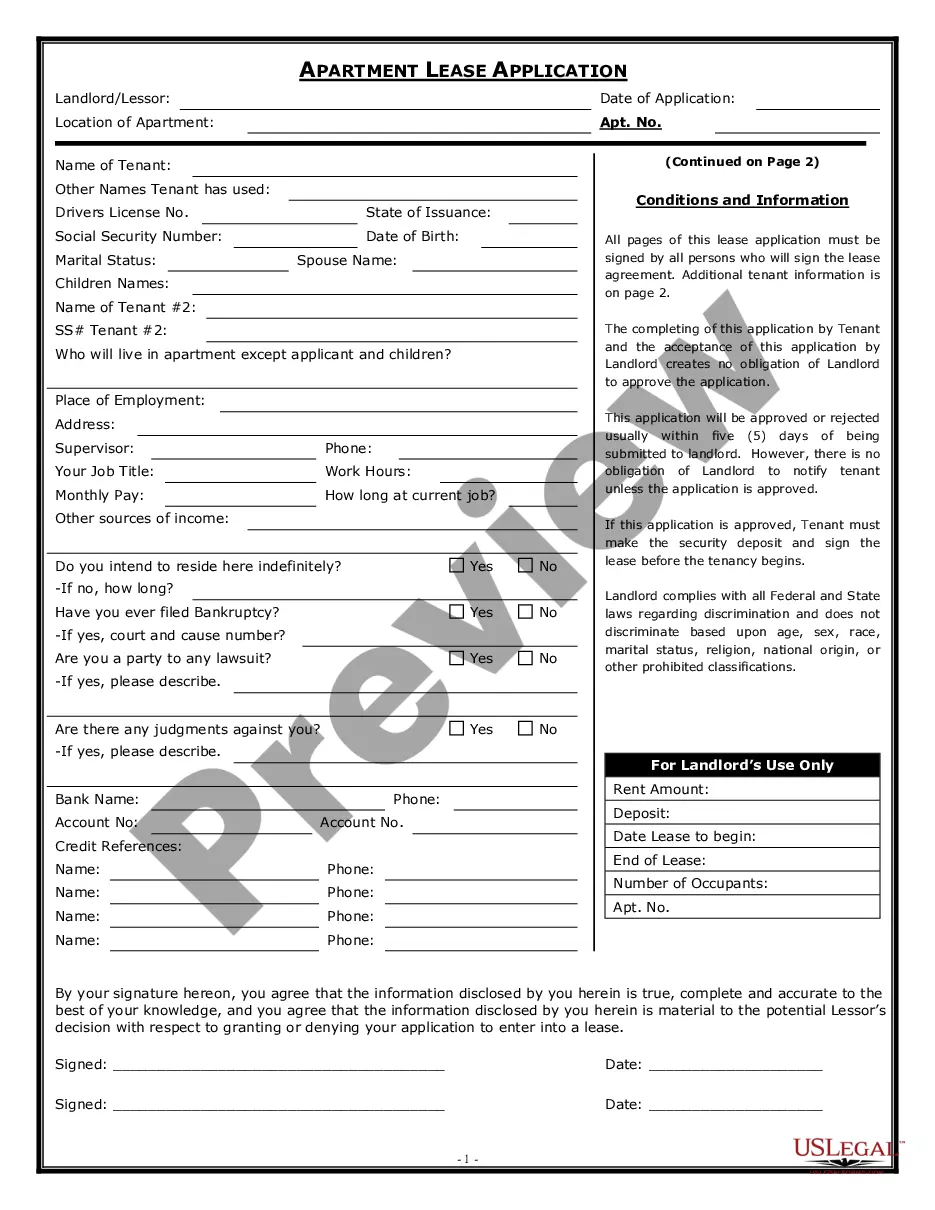

Form popularity

FAQ

In New Hampshire, the statute of limitations period for most types of debt is three years. That said, the statute of limitations period in New Hampshire for auto loan debt is four years, for credit card debt is three years, for medical debt is six years, and for mortgage debt is twenty years.

Assignments, however, almost never apply to a beneficiary's interests in a trust. Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors.

STATUS REPORTS - Estates Opened Solely to Pursue a Cause of Action. In estates opened solely to pursue a cause of action, a Fiduciary may file a motion to postpone the filing of annual accounts while the underlying legal action is pending.

The Estate Settlement Timeline: There is no specific deadline for this in New Hampshire law, but it is generally best to do so within 30 days to prevent unnecessary delays in the probate process.

The limited time window in which debt collectors and creditors can sue debtors for nonpayment of credit card bills in New Hampshire is 3 years. The statute applies to "written contracts" or "open accounts. In most cases, once the statute of limitations on a case "runs out," the legal claim is not valid any longer.

Creditors have a certain time frame, typically six months from the date of appointment of the executor or administrator, to file their claims for payment. If the estate has enough assets, the debts are paid. If not, creditors are generally paid on a pro-rata basis.

The short answer is that an Executor is not liable for the Deceased's debts. However, an Executor is liable for any errors or omissions made in the course of administering an Estate. This includes failing to pay debts or liabilities of the Estate.

Even without a statutory guideline on executor fees in New Hampshire, the general understanding among legal professionals suggests that an executor can expect to receive about 2-4% of the estate's value. However, this percentage can vary based on the specifics of the estate and the executor's duties.