New Hampshire Revocable Trust for Married Couple

Description

How to fill out Revocable Trust For Married Couple?

Are you currently in a situation where you require documents for various business or personal purposes almost every day.

There are many authentic document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast selection of form templates, including the New Hampshire Revocable Trust for Married Couple, designed to meet federal and state requirements.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the New Hampshire Revocable Trust for Married Couple at any time if necessary. Simply click on the desired form to download or print the document template. Use US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. The service provides professionally created legal document templates suitable for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the New Hampshire Revocable Trust for Married Couple template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

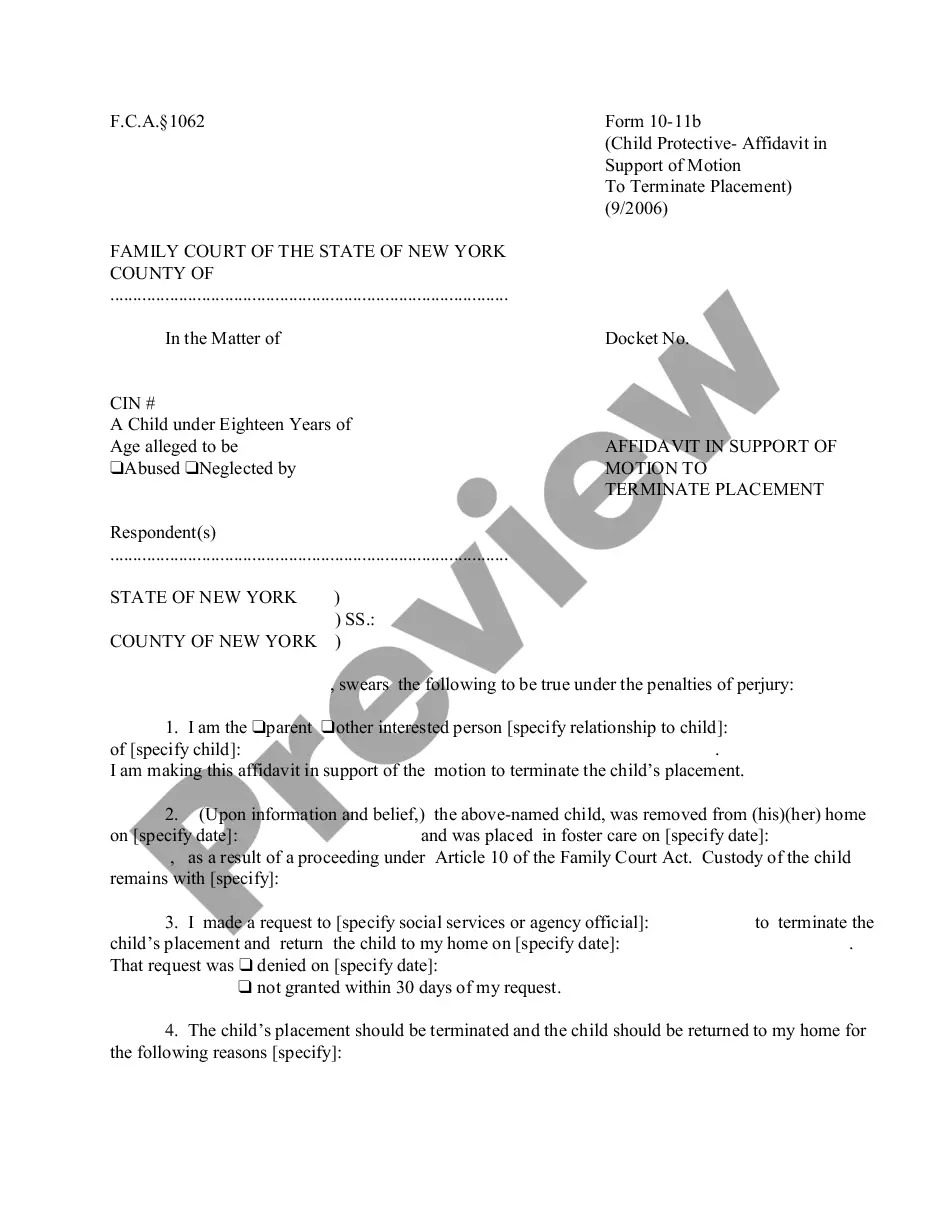

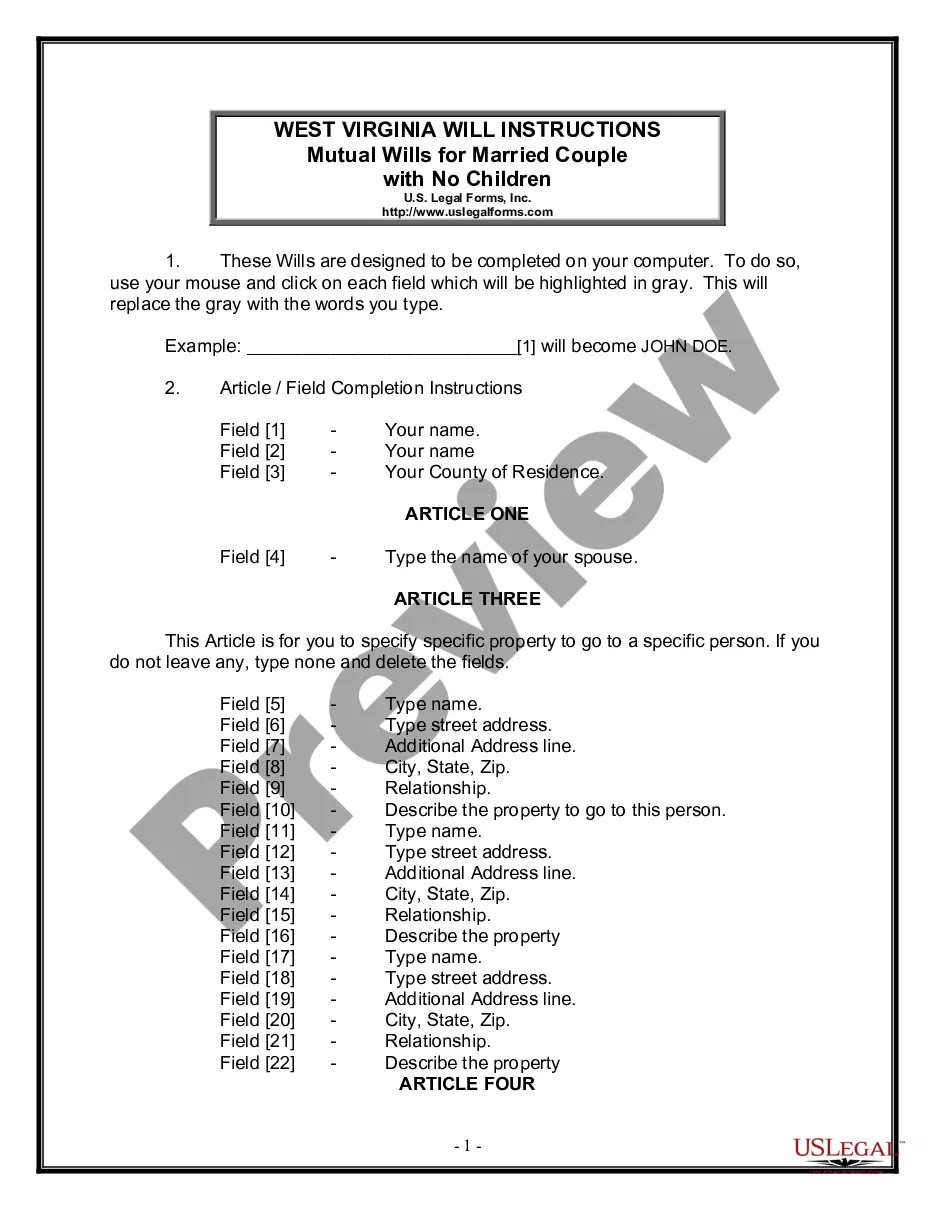

- Use the Preview option to check the form.

- Review the description to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Lookup field to find the form that meets your needs and criteria.

- Once you find the appropriate form, click Purchase now.

- Select the payment plan you prefer, complete the necessary details to create your account, and finalize your order using your PayPal or credit card.

Form popularity

FAQ

In New Hampshire, a New Hampshire Revocable Trust for Married Couple is typically not taxed while the couple is alive, as the income is reported on their personal tax returns. However, once the trust becomes irrevocable after the passing of both spouses, it may be subject to different tax rules. It is vital to consult with a tax professional to understand potential tax implications based on your specific situation and the trust structure.

Creating a New Hampshire Revocable Trust for Married Couple involves a few essential steps. First, both spouses should decide on the assets to transfer into the trust. Next, you need to draft the trust document, specifying how the assets will be managed and distributed. Finally, you must transfer the ownership of the assets to the trust, ensuring your wishes are clearly stated and legally binding.

Remarried couples often benefit from a revocable trust, such as the New Hampshire Revocable Trust for Married Couple. This trust provides the flexibility to protect individual assets while accommodating the new family structure. It allows for clear designations of beneficiaries, which can help prevent family disputes and ensure that everyone understands their rights.

Setting up a revocable trust in NH is a straightforward process. First, determine your assets and beneficiaries. Next, you should draft the trust document, making sure it complies with New Hampshire laws, ideally with the help of a legal professional. Platforms like uslegalforms can also guide you in creating a valid New Hampshire Revocable Trust for Married Couple, ensuring your estate planning is solid.

The best type of trust for a married couple is often a revocable trust, like the New Hampshire Revocable Trust for Married Couple. This trust provides both spouses with control over their assets while allowing for modifications as needed. It's an effective way to ensure smooth transitions of assets, especially when planning for the future.

When one spouse dies, a joint revocable trust automatically becomes irrevocable, protecting the remaining spouse's interests. The surviving spouse typically continues to manage the trust, and assets transfer without going through probate. It is crucial to have a clear plan in place, ensuring that the New Hampshire Revocable Trust for Married Couple provides the intended support.

The most popular form of marital trust is the revocable living trust, specifically the New Hampshire Revocable Trust for Married Couple. This trust type allows for the management of assets while both spouses are alive and seamlessly transitions to benefit the surviving spouse after one passes. It provides flexibility, ensuring that your estate planning goals are met efficiently.

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly define their intentions and beneficiaries. Clarity helps avoid disputes and ensures that the New Hampshire Revocable Trust for Married Couple meets your family's needs. Additionally, neglecting to update the trust as circumstances change can lead to complications down the road.

While a joint trust, like a New Hampshire Revocable Trust for Married Couple, offers benefits, there are disadvantages to consider. One challenge is that both spouses must agree on any changes, which can complicate decision-making. Additionally, if one spouse passes away, the trust can become irrevocable, limiting future flexibility.

The best trust for a married couple is typically a New Hampshire Revocable Trust for Married Couple. This type of trust allows both spouses to maintain control over their assets during their lifetime while offering flexibility for changes. It also simplifies the transfer of assets upon death, avoiding probate, and ensuring that your wishes are followed.