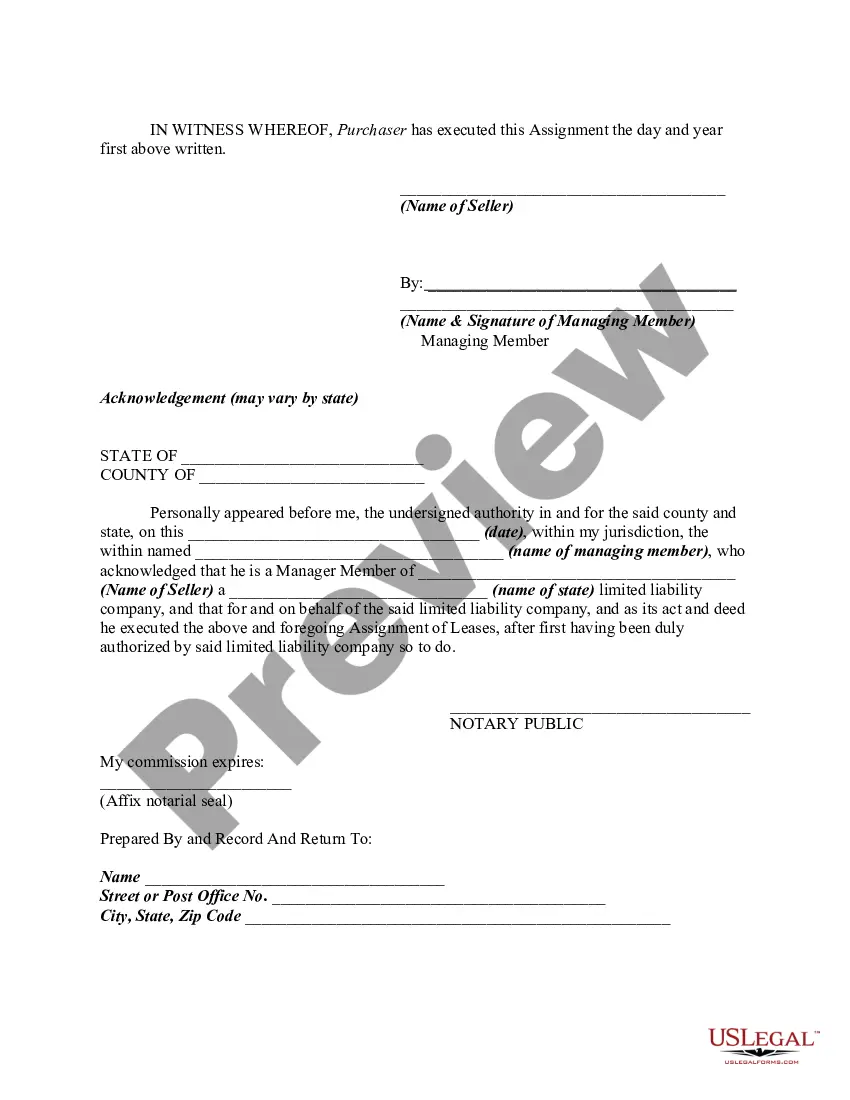

This document assigns specific leases on the property as well as any leases that are not specifically named. This is an outright assignment as opposed to a collateral assignment. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Hampshire Assignment of General and Specific Leases

Description

How to fill out Assignment Of General And Specific Leases?

Locating the appropriate legal document format can be a struggle.

Naturally, there are numerous online templates accessible, but how can you identify the specific legal type you require? Utilize the US Legal Forms website.

The service provides an extensive collection of templates, including the New Hampshire Assignment of General and Specific Leases, suitable for both business and personal purposes.

You can preview the form using the Review button and examine the form description to ensure it fits your needs.

- All variations are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Obtain button to acquire the New Hampshire Assignment of General and Specific Leases.

- Use your account to browse the legal forms you may have previously acquired.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps to follow.

- Firstly, confirm that you have selected the correct type for your city/county.

Form popularity

FAQ

The New Hampshire standard lease agreement serves as a legal framework that defines the terms of rental agreements in the state. This document outlines rent, duration, and responsibilities, ensuring clarity for both landlords and tenants. Understanding the standard lease can significantly aid in navigating the process of New Hampshire Assignment of General and Specific Leases.

A lease is a contract between a landlord and a tenant, while an assignment of lease allows the tenant to transfer their rights and responsibilities to another party. When you assign a lease, the original tenant may remain liable unless the landlord releases them. Knowing this difference is essential for anyone considering the New Hampshire Assignment of General and Specific Leases, especially if you may want to transfer your responsibilities.

In New Hampshire, there is no specific limit on how much a landlord can increase rent, provided they give proper notice to the tenant. Generally, rental increases become effective at the end of the lease term unless otherwise specified. By understanding these policies, especially in the context of the New Hampshire Assignment of General and Specific Leases, you can better plan your finances.

Yes, a lease agreement can typically be assigned if the landlord allows it within the terms of the lease. An assignment transfers the lease's rights and obligations to another party. Knowing how the New Hampshire Assignment of General and Specific Leases works can help streamline this process while protecting your interests.

Rental laws in New Hampshire govern how landlords and tenants interact and outline their rights and responsibilities. These laws cover various aspects, including security deposits, eviction procedures, and lease agreements. Familiarizing yourself with these regulations can help prevent misunderstandings and facilitate smoother transactions related to the New Hampshire Assignment of General and Specific Leases.

The New Hampshire standard residential lease agreement outlines the terms between landlords and tenants in rental situations. Typically, it includes details such as rent amounts, duration of the lease, and responsibilities regarding maintenance. Understanding this lease is critical for both parties, especially when considering the New Hampshire Assignment of General and Specific Leases.

Avoiding property tax altogether is not a common scenario in New Hampshire, as it is a significant revenue source for local governments. However, residents can utilize exemptions, deferrals, and tax relief programs to alleviate some tax burdens. Consulting with experts familiar with the New Hampshire Assignment of General and Specific Leases can provide strategic insights into managing property taxes effectively.

While completely avoiding property taxes in New Hampshire may not be feasible, you can minimize your tax burden through various exemptions and tax relief programs. Engaging with local authorities to explore options such as tax abatements or enrolling in senior tax relief programs can be beneficial. Additionally, structuring property agreements like the New Hampshire Assignment of General and Specific Leases may provide further advantages.

The NH DP 10 form is required for any business entity that must report their business profits tax liability. Corporations, partnerships, and some limited liability companies fall under this requirement. It's important to understand your obligations when it comes to these forms, especially in relation to the New Hampshire Assignment of General and Specific Leases.

BPT, or Business Profits Tax, and BET, or Business Enterprise Tax, are two taxes imposed on businesses in New Hampshire. BPT is calculated based on the profits made, while BET is based on the enterprise's gross receipts. Both taxes come into play when structuring business agreements, including the New Hampshire Assignment of General and Specific Leases.