Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Hampshire Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

US Legal Forms - among the most extensive collections of legal documents in the United States - offers a variety of legal template forms available for download or creation.

By utilizing the platform, you can discover thousands of forms for business and personal use, organized by categories, states, or keywords.

You can access the latest editions of documents such as the New Hampshire Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee within moments.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

Once satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select your preferred payment plan and provide your information to sign up for an account.

- If you already hold a subscription, Log In to download the New Hampshire Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee from the US Legal Forms library.

- The Download button will appear on each document you view.

- You can access all previously saved documents in the My documents section of your account.

- If this is your initial use of US Legal Forms, here are simple guidelines to help you get started.

- Ensure you have selected the correct form for your location/area.

- Select the Review option to verify the form's details.

Form popularity

FAQ

Generally, a trustee cannot revoke a trust unless they have been granted explicit authority by the grantor or the trust document itself allows for such an action. The trustee's role is to manage and distribute the assets according to the trust’s terms rather than make unilateral decisions regarding its revocation. Consulting resources like uslegalforms can clarify the complexities surrounding the New Hampshire Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

Dissolving a trust can have various tax implications, including potential taxation on capital gains from asset sales or income generated from trust activities. This is especially relevant when considering the distribution of remaining trust assets to beneficiaries. Understanding these consequences in the context of the New Hampshire Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can guide you through efficient tax management.

An example of revocation of trust occurs when a grantor decides to remove specific assets from the trust or terminates the trust entirely. For instance, if a trust initially included a family home, the grantor can issue a formal revocation notice to remove that asset. Such actions are addressed through mechanisms like the New Hampshire Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

To nullify a revocable trust, the grantor must follow the trust’s terms for revocation, often involving a written statement of revocation. It is crucial to ensure that all beneficiaries and trustees are informed about this decision. Tools and resources available on uslegalforms can help facilitate this process effectively while ensuring compliance with the New Hampshire Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

A revocable trust can be revoked by the grantor at any time before it becomes irrevocable. This typically involves a formal procedure, which may require written notice or a specific revocation document. Utilizing services like those provided by uslegalforms can ensure that the revocation process, including compliance with New Hampshire Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, is handled correctly.

A revocable trust becomes irrevocable once the grantor, the person who created the trust, passes away or explicitly states their intention to revoke it. This change means that the assets in the trust can no longer be altered or removed by the grantor. Moreover, it is essential to understand that any partial revocation, such as through the New Hampshire Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, can also affect the trust's status.

Setting up a revocable trust in New Hampshire involves creating a trust document that outlines your wishes and designates a trustee. You will need to transfer assets into the trust to ensure they are managed according to your preferences. It's beneficial to consult with legal professionals or use platforms like uslegalforms to access tailored documents and instructions. This ensures compliance with New Hampshire Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, streamlining the process for you.

A revocation of trust is the process of canceling a trust agreement, thereby terminating its legal effects. In New Hampshire, you can revoke your trust at any time, provided you follow the appropriate legal steps. This process typically involves a written document indicating your intention to revoke the trust. Exploring the New Hampshire Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can help you navigate this important decision.

Yes, a trust can help avoid the probate process in New Hampshire. When you set up a trust, your assets transfer to the trust, which means they typically pass directly to your beneficiaries without being subject to probate. This can save time and reduce costs for your heirs. Understanding the New Hampshire Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can further clarify how trusts function within the probate framework.

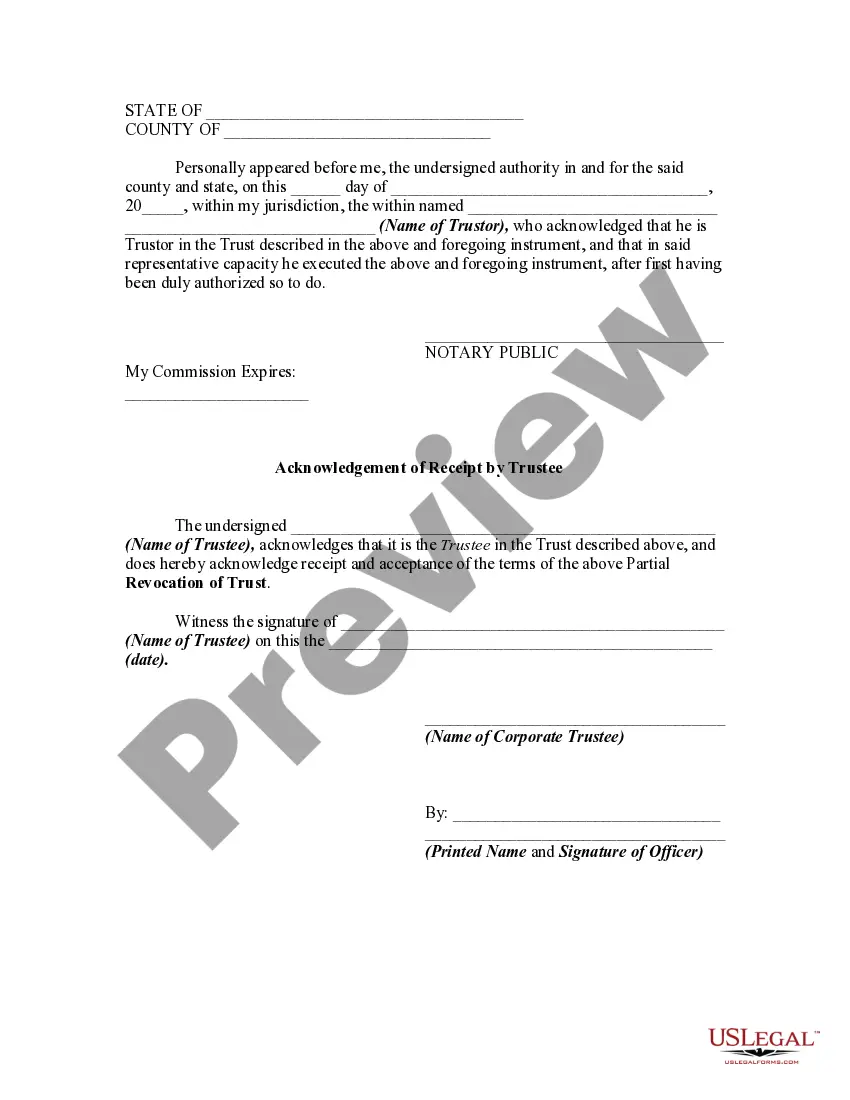

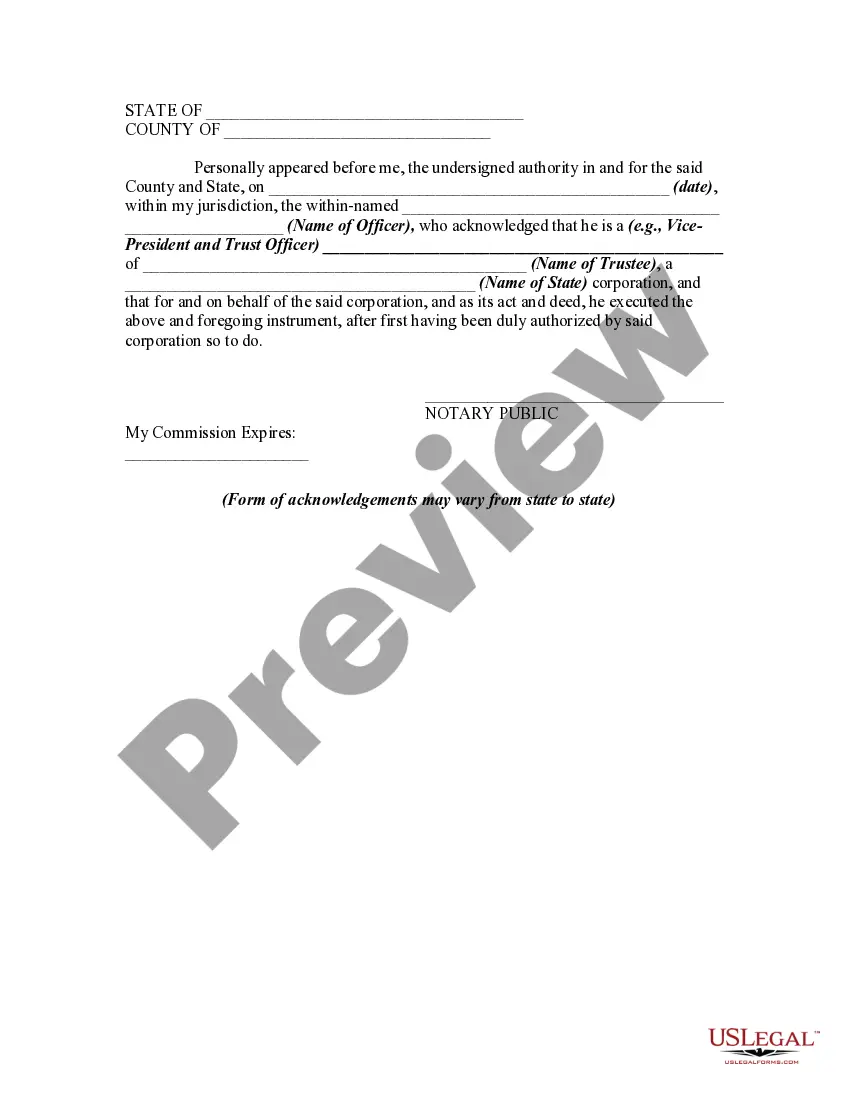

In New Hampshire, a trust does not require notarization to be valid, although some legal documents associated with the trust may benefit from this step for added authenticity. However, completing a New Hampshire Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee may involve using notarized forms. It often enhances the trust's acceptance during legal proceedings or when dealing with financial institutions. Consulting professionals can ensure that all documents meet legal requirements.