New Hampshire Limited Liability Partnership Agreement

Description

How to fill out Limited Liability Partnership Agreement?

It is feasible to spend numerous hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by experts.

You can actually procure or print the New Hampshire Limited Liability Partnership Agreement from our services.

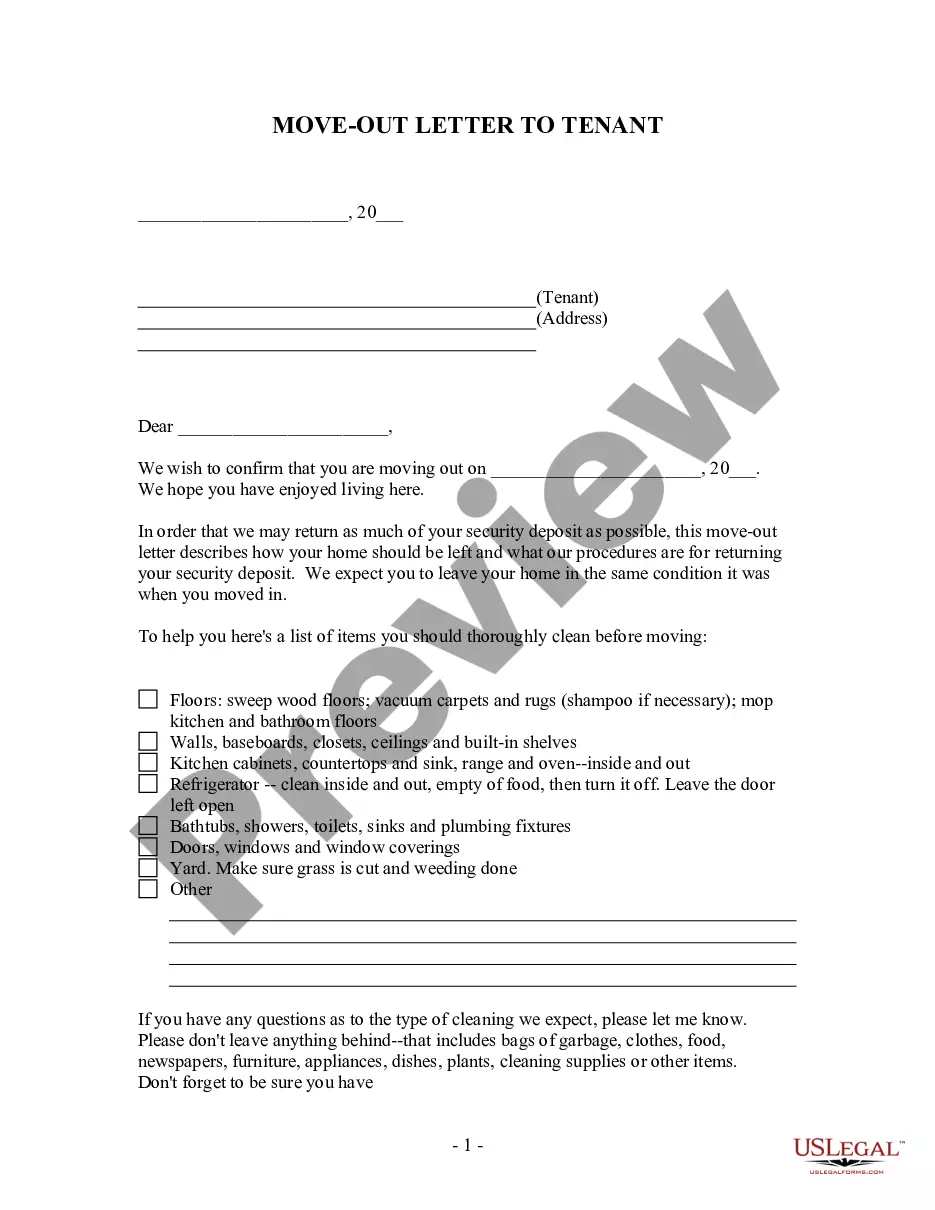

If available, use the Review button to preview the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Download button.

- After that, you can fill out, modify, print, or sign the New Hampshire Limited Liability Partnership Agreement.

- Each legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Check the form description to confirm that you have chosen the appropriate form.

Form popularity

FAQ

Yes, Limited Liability Companies (LLCs) often implement partnership agreements, commonly referred to as operating agreements. These documents outline the roles and responsibilities of each member, as well as the operational procedures. When forming a New Hampshire Limited Liability Partnership Agreement, it is essential to create clear terms that protect the interests of all partners. Using a reliable service like USLegalForms can greatly facilitate this process, ensuring your partnership agreement is comprehensive and tailored to your needs.

To form a New Hampshire Limited Liability Partnership Agreement, you need to file the appropriate documentation with the state. This includes submitting the registration application and paying the required fees. Additionally, you'll want to draft a partnership agreement that outlines the roles, responsibilities, and profit-sharing arrangements among partners. Using a reliable platform like USLegalForms can simplify this process, providing templates and guidance for a smooth formation.

Writing a limited partnership agreement involves detailing the roles of general and limited partners, outlining contributions, and defining profit-sharing arrangements. Additionally, it should cover terms for dissolution and what happens in case of disputes. Consider using a New Hampshire Limited Liability Partnership Agreement template to simplify the process and ensure all legal requirements are met.

Your New Hampshire LLC may not be in good standing due to missed annual filings, unpaid fees, or not complying with state regulations. It is crucial to resolve these issues to restore good standing. Regular checks on your status and working with resources like USLegalForms can help you stay compliant and avoid these pitfalls.

A good example of a limited partnership could be a real estate investment group where a general partner manages the properties while limited partners invest capital. This setup allows the general partner to leverage the expertise of limited partners while limiting their liabilities. This structure can be effectively encapsulated in a New Hampshire Limited Liability Partnership Agreement to ensure all parties understand their roles.

Writing a simple partnership agreement involves outlining the partnership's name, purpose, and each partner's contributions as well as profit-sharing ratios. It should also address the decision-making process and dispute resolution methods. Utilizing a template for a New Hampshire Limited Liability Partnership Agreement can simplify this process, ensuring you cover essential legal points.

The structure of a limited partnership typically consists of at least one general partner and one limited partner. The general partner is responsible for managing the business and assumes liability for the partnership's debts. Conversely, the limited partner’s liability is restricted to their investment, making the New Hampshire Limited Liability Partnership Agreement vital for clarity on each partner’s role and liability.

To form a Limited Liability Partnership in New Hampshire, you need to file a certificate of limited liability partnership with the Secretary of State. Drafting a comprehensive New Hampshire Limited Liability Partnership Agreement is also essential, as it lays out the rights and responsibilities of the partners. Once these documents are filed, your partnership will be officially recognized.

A limited partnership in New Hampshire requires at least one general partner and one limited partner. General partners manage the business, while limited partners contribute capital but do not participate in daily operations. Additionally, a New Hampshire Limited Liability Partnership Agreement must outline the terms and conditions governing the partnership.

An LLC may not be in good standing for several reasons, including failure to file annual reports, non-payment of state fees, or not adhering to state rules. In New Hampshire, when an LLC does not maintain good standing, it risks losing its legal protections. It is essential to keep your company compliant by addressing any outstanding issues to prevent complications.