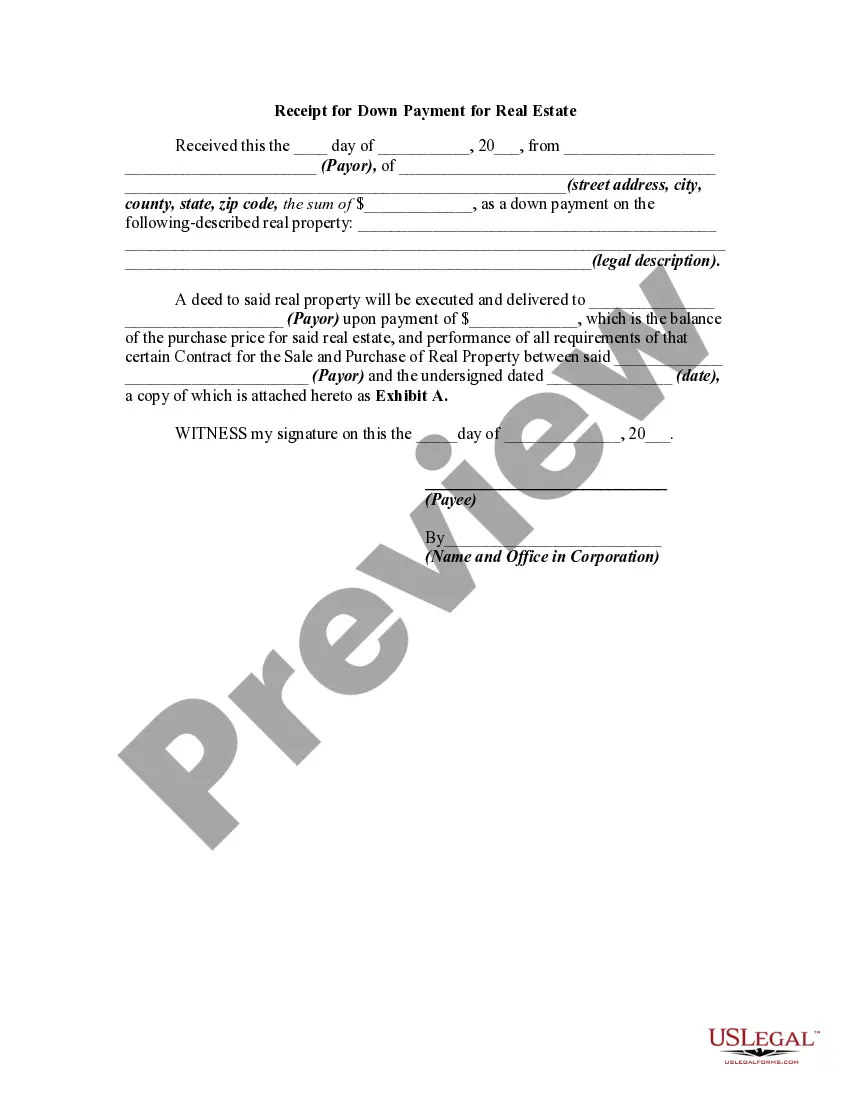

New Hampshire Receipt for Down Payment for Real Estate

Description

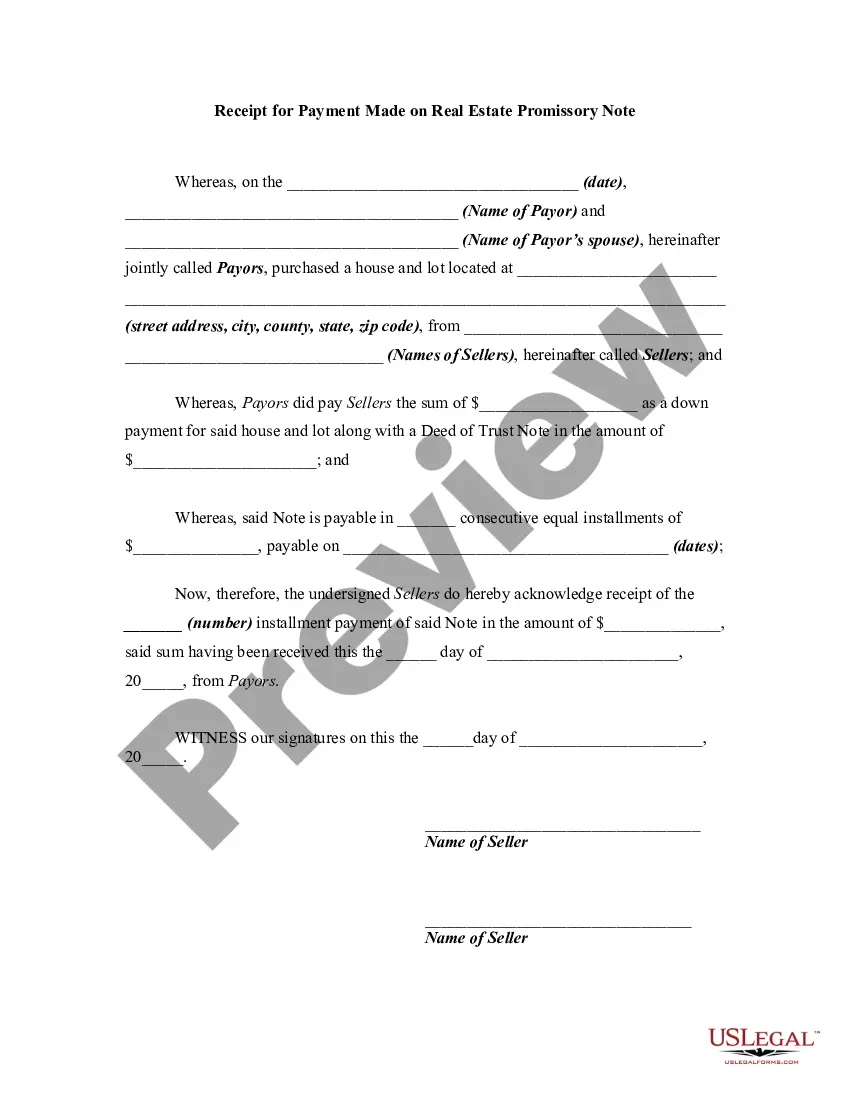

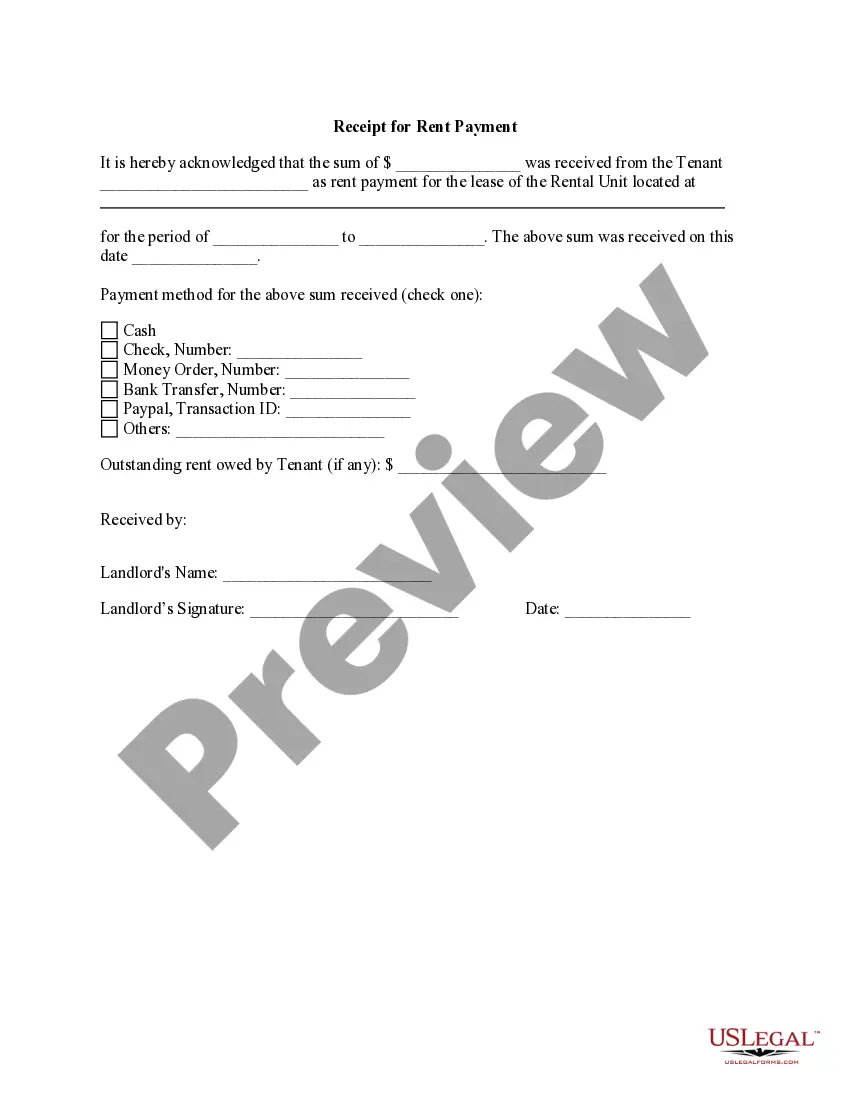

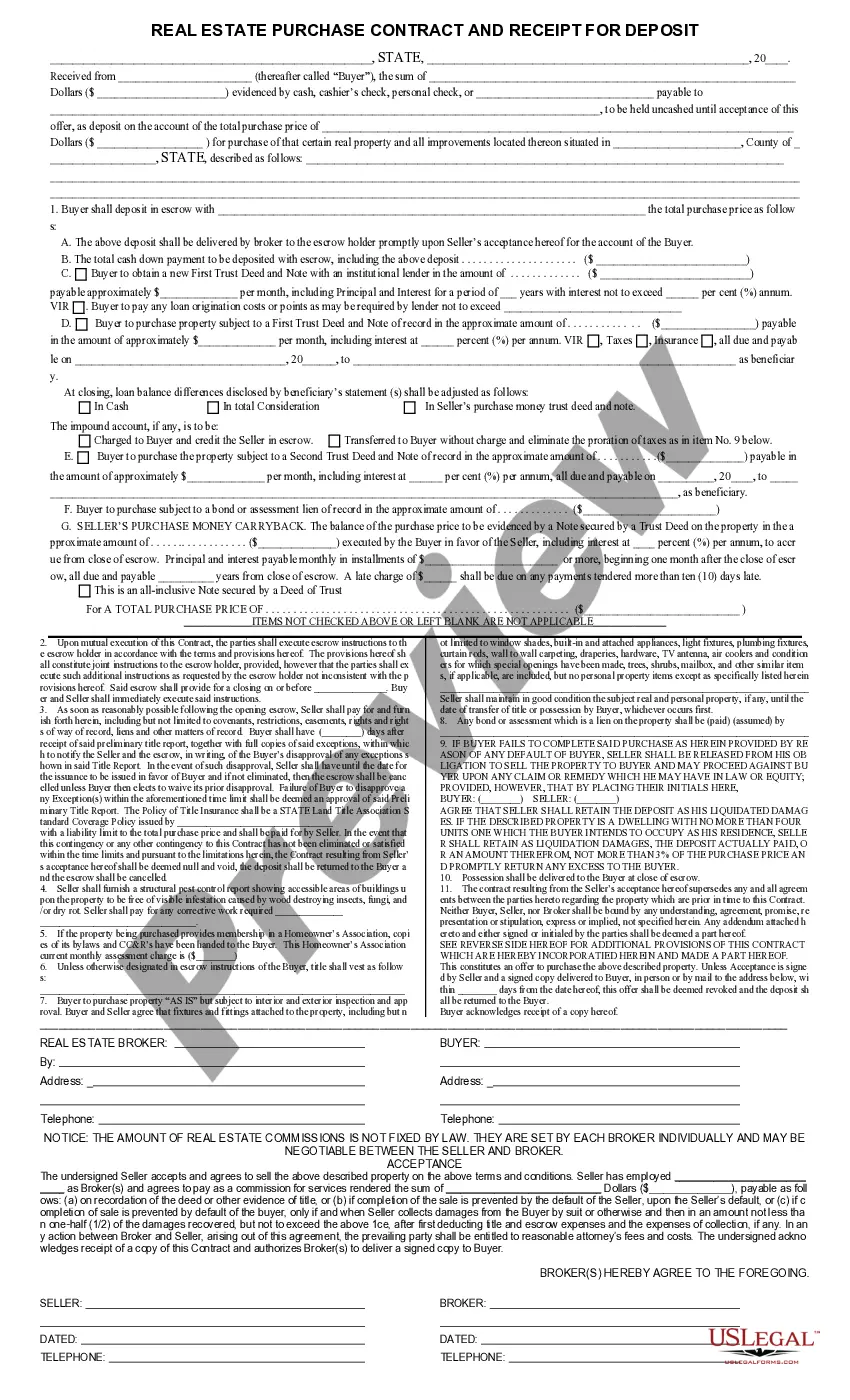

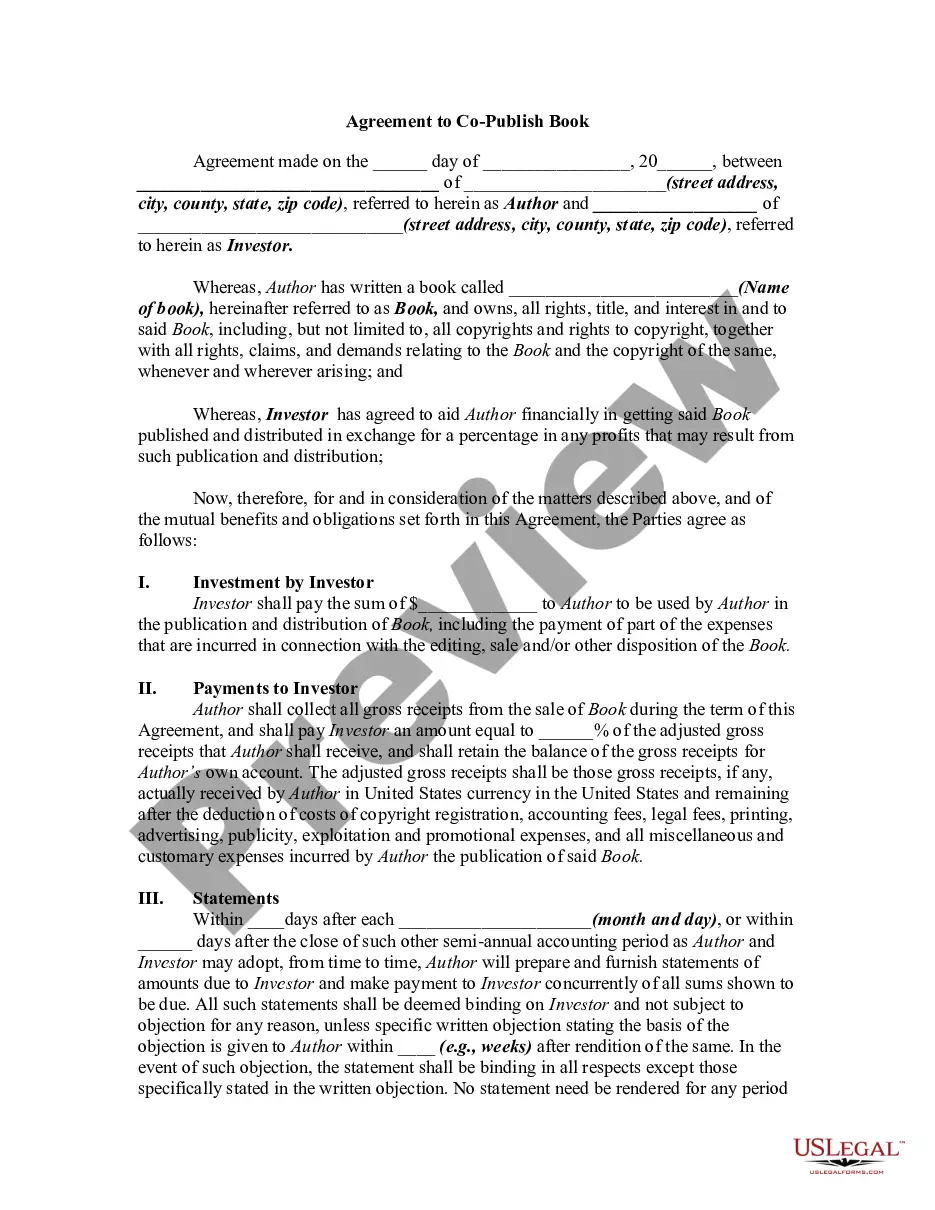

How to fill out Receipt For Down Payment For Real Estate?

If you require to complete, acquire, or print legal document templates, utilize US Legal Forms, the most significant collection of legal forms that can be accessed online.

Utilize the website's straightforward and convenient search feature to locate the documents you need. Various templates for business and personal purposes are categorized by types and states, or keywords.

Employ US Legal Forms to obtain the New Hampshire Receipt for Down Payment for Real Estate within just a few clicks.

Every legal document template you obtain is your property indefinitely. You will have access to every form you saved within your account. Simply select the My documents section and choose a form to print or download again.

Complete and download and print the New Hampshire Receipt for Down Payment for Real Estate with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal requirements.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download option to retrieve the New Hampshire Receipt for Down Payment for Real Estate.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, consult the instructions outlined below.

- Step 1. Confirm you have selected the form for the appropriate city/state.

- Step 2. Utilize the Preview option to review the form's details. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other types in the legal form format.

- Step 4. Once you have located the form you need, click the Buy Now option. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the New Hampshire Receipt for Down Payment for Real Estate.

Form popularity

FAQ

The form for the NH property tax exemption is typically the Application for Property Tax Exemptions, also known as the PA 29 form. This form allows property owners to apply for exemptions based on specific criteria, such as disability or income level. Completing this form can provide financial relief, helping homeowners manage their responsibilities better. Ensuring that all paperwork, including the New Hampshire Receipt for Down Payment for Real Estate, is in order will support your efforts in obtaining these exemptions.

Anyone who is purchasing property in New Hampshire and making a down payment needs to file the DP10 form. This includes first-time homebuyers and those who are upgrading or changing residences. Filing a DP10 ensures proper documentation of the down payment, helping to avoid any misunderstandings during the closing process. Proper submission of this form, along with the New Hampshire Receipt for Down Payment for Real Estate, can facilitate a smooth transaction.

In New Hampshire, the seller typically pays the real estate transfer tax during a property sale. However, buyers and sellers can negotiate this responsibility. Understanding these roles is crucial, especially when preparing necessary documentation like the New Hampshire Receipt for Down Payment for Real Estate. Clarity in these transactions can help ensure a smoother closing process.

Yes, New Hampshire is gradually phasing out the interest and dividend tax. This process is aimed at easing the financial burden on residents and encouraging investment. As this shift occurs, residents can benefit from increased disposable income, which can help in making larger down payments on real estate. This change aligns well with our focus on facilitating down payments, like the New Hampshire Receipt for Down Payment for Real Estate.

New Hampshire does not levy a traditional state real estate tax; however, local municipalities impose property taxes based on assessed values. When you buy property, you will need to consider these local taxes in your financial plans. Additionally, understanding the tax implications is crucial when handling the New Hampshire Receipt for Down Payment for Real Estate. This receipt can be an essential part of your real estate transaction, ensuring you are prepared for any local obligations.

A 10% down payment is generally considered a strong choice when purchasing a home. It can help reduce your monthly mortgage payments and potentially eliminate the need for private mortgage insurance. That being said, you should always assess your financial position and long-term goals before committing. Keeping your New Hampshire Receipt for Down Payment for Real Estate organized will be valuable in documenting this investment.

In New Hampshire, tax forms are available from the New Hampshire Department of Revenue Administration's website. You can download the necessary forms, including those related to the New Hampshire Receipt for Down Payment for Real Estate. Additionally, local tax offices may also have printed forms available. It's a good idea to check online first for any updates or new forms.