Are you in a situation that you require paperwork for either enterprise or individual purposes just about every working day? There are tons of authorized papers layouts available on the net, but locating types you can rely on is not easy. US Legal Forms delivers 1000s of form layouts, such as the New Hampshire Plan of Liquidation and Dissolution of a Corporation, which are created in order to meet state and federal needs.

In case you are previously knowledgeable about US Legal Forms web site and also have your account, basically log in. Following that, you are able to acquire the New Hampshire Plan of Liquidation and Dissolution of a Corporation template.

If you do not provide an profile and wish to begin using US Legal Forms, follow these steps:

- Find the form you want and ensure it is for that proper metropolis/region.

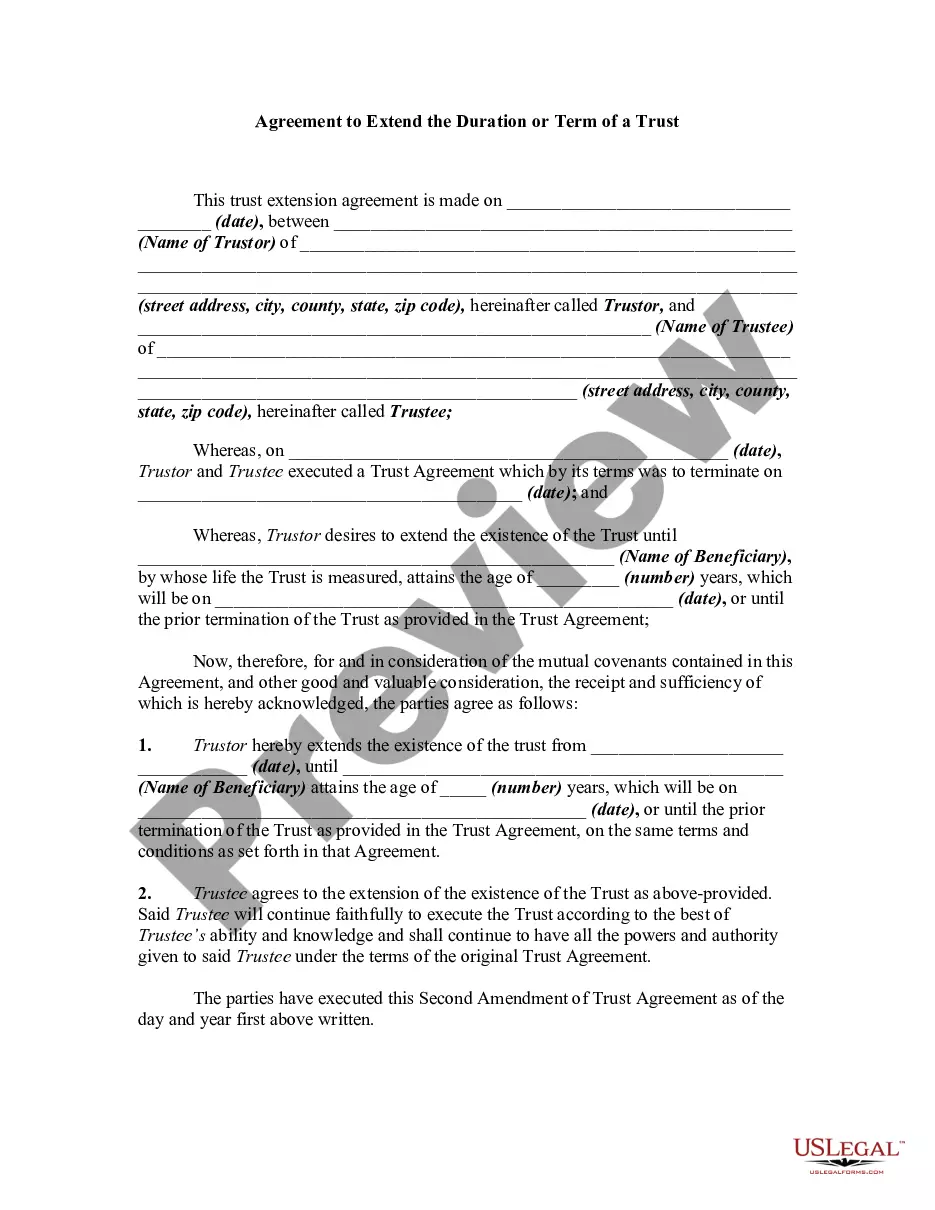

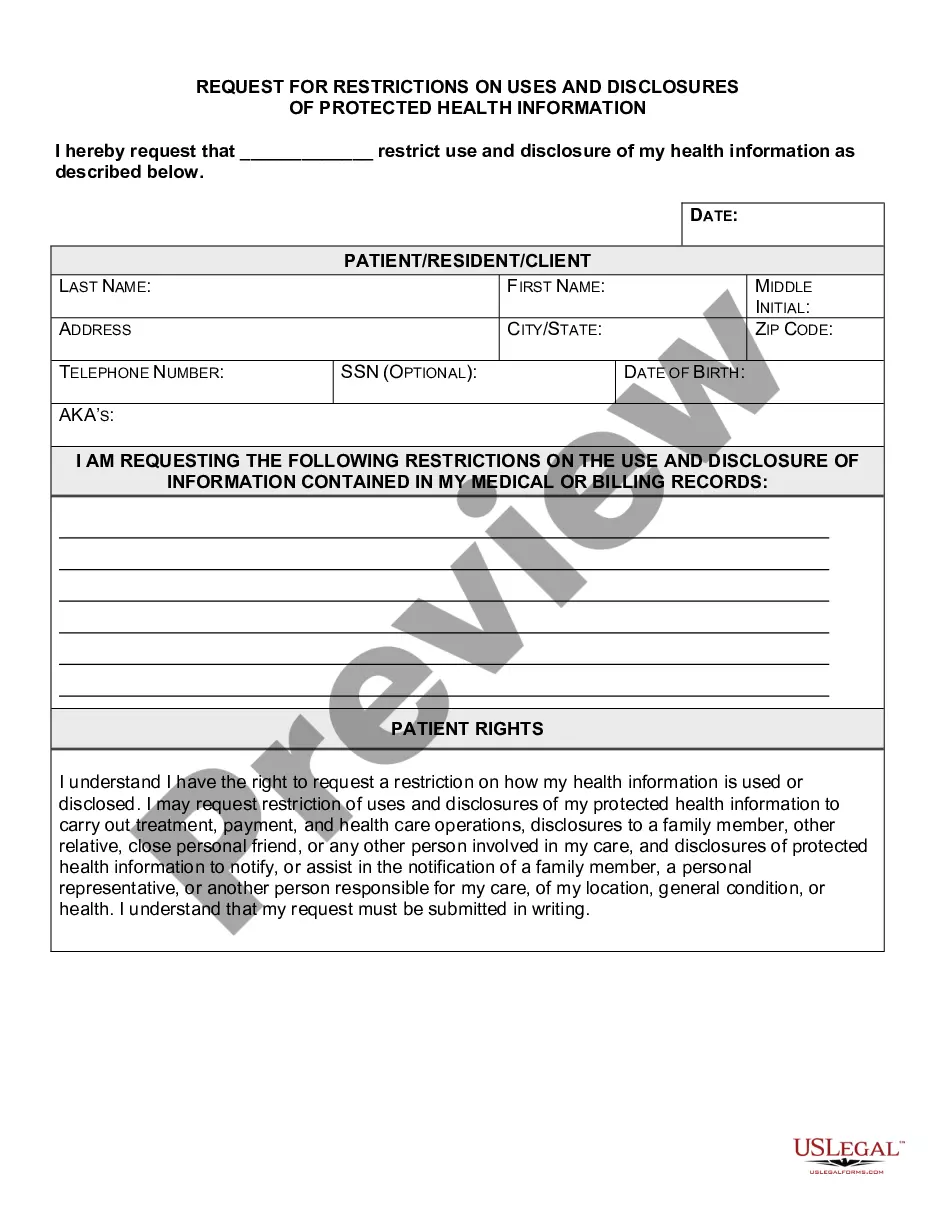

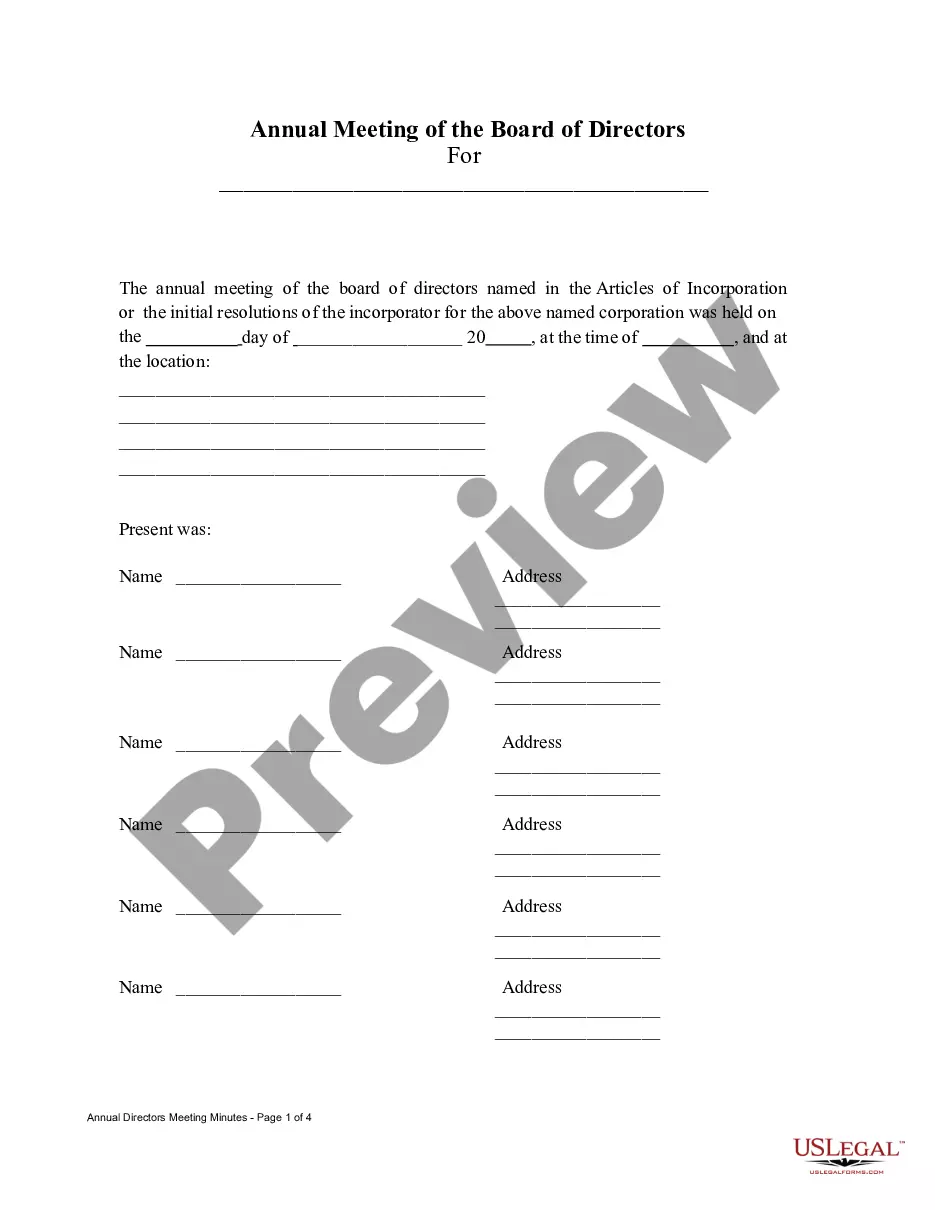

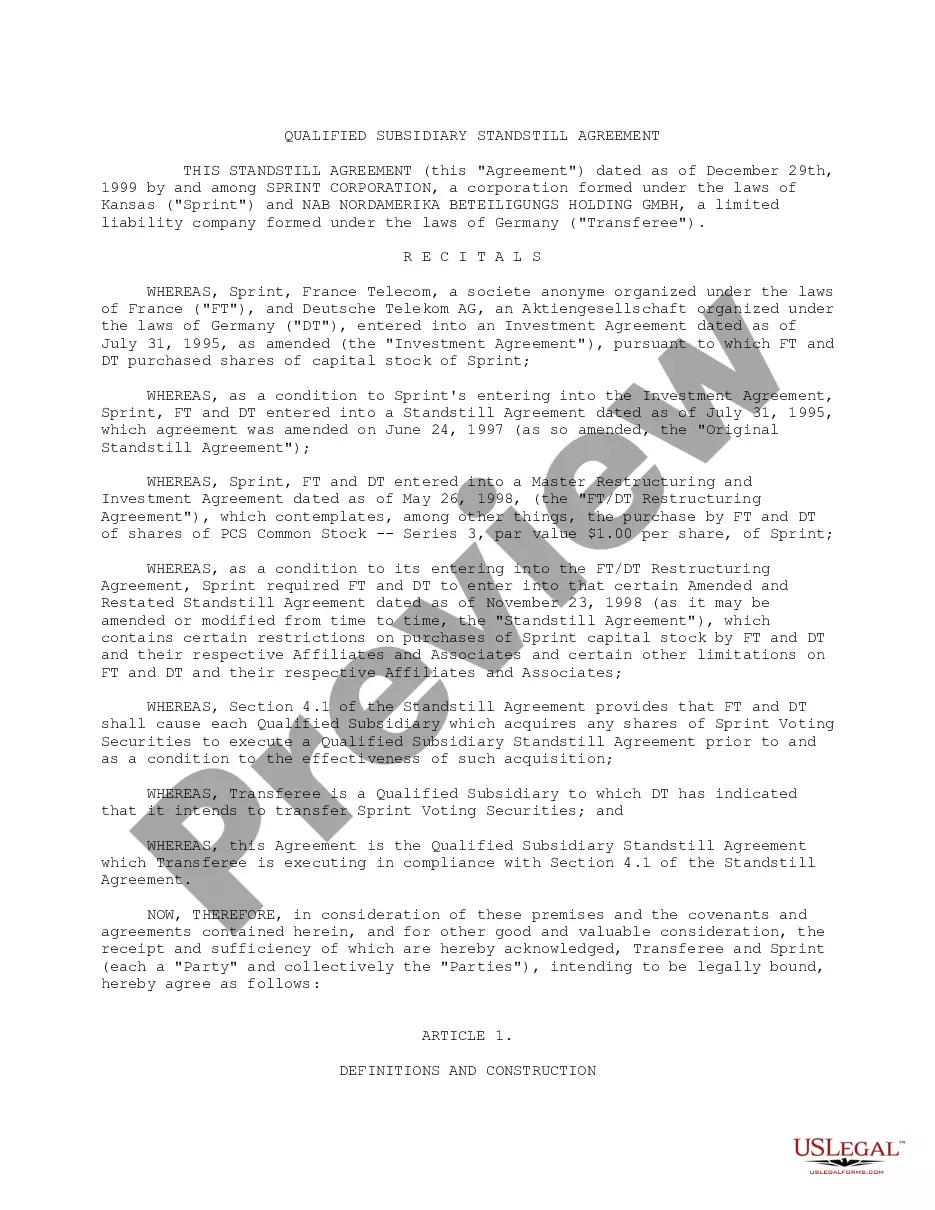

- Utilize the Preview key to examine the form.

- See the outline to ensure that you have chosen the right form.

- In case the form is not what you`re searching for, utilize the Research discipline to find the form that meets your requirements and needs.

- If you obtain the proper form, just click Buy now.

- Opt for the prices program you would like, fill in the specified information to generate your account, and purchase the transaction making use of your PayPal or Visa or Mastercard.

- Pick a practical file formatting and acquire your duplicate.

Find each of the papers layouts you possess purchased in the My Forms food list. You can obtain a extra duplicate of New Hampshire Plan of Liquidation and Dissolution of a Corporation whenever, if required. Just click on the required form to acquire or printing the papers template.

Use US Legal Forms, the most substantial variety of authorized types, to conserve time as well as steer clear of mistakes. The assistance delivers appropriately created authorized papers layouts that can be used for a range of purposes. Generate your account on US Legal Forms and commence generating your life a little easier.