New Hampshire Corporations - Resolution for Any Corporate Action

Description

How to fill out Corporations - Resolution For Any Corporate Action?

Are you currently in a situation where you require documentation for either business or personal use on a daily basis.

There are many legal document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms provides thousands of forms, including the New Hampshire Corporations - Resolution for Any Corporate Action, which can be printed to satisfy state and federal requirements.

Once you find the right form, simply click Buy now.

Select the pricing plan you want, fill in the required information to create your account, and purchase the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Hampshire Corporations - Resolution for Any Corporate Action template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

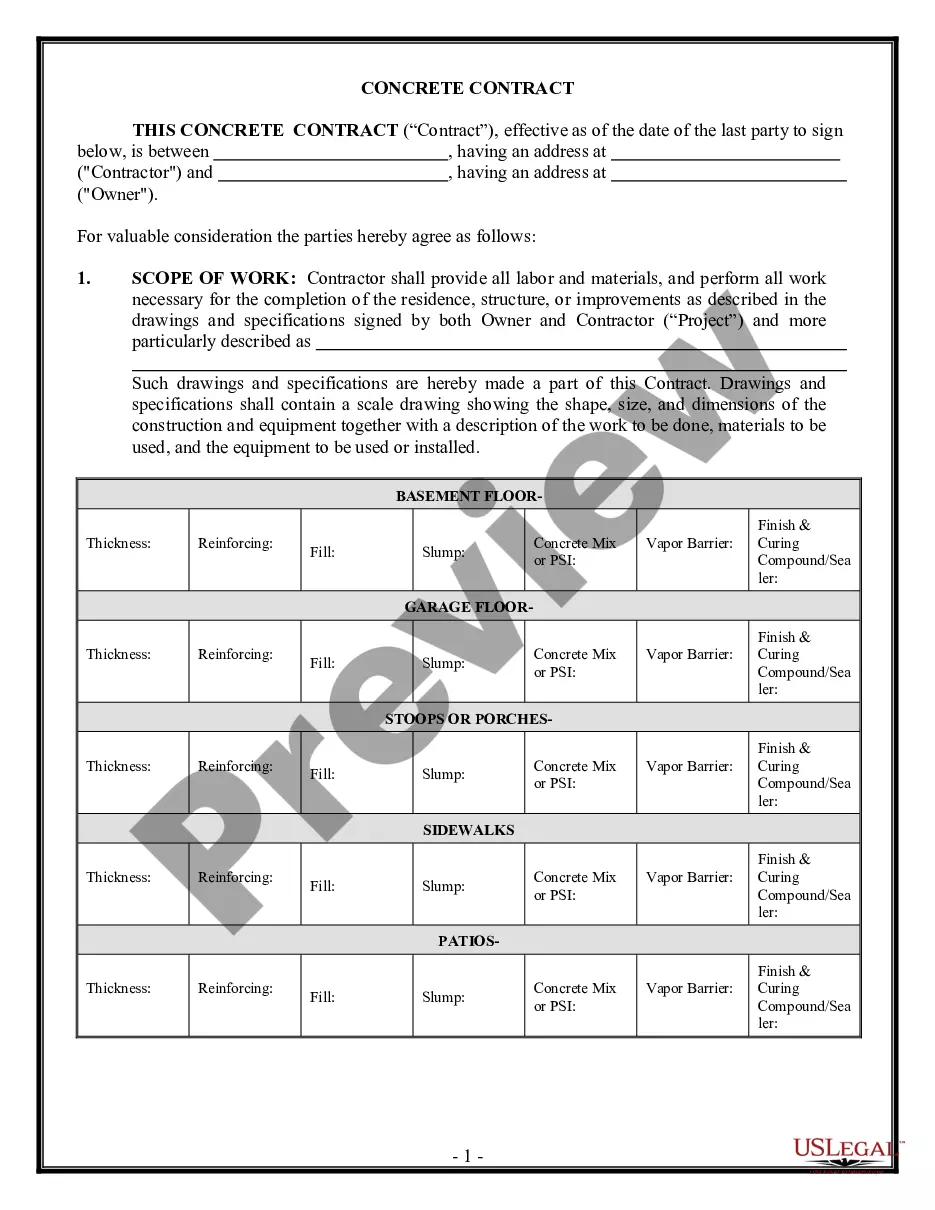

- Utilize the Review option to examine the form.

- Check the description to confirm you have chosen the right form.

- If the form isn’t what you’re looking for, use the Search box to locate the form that fits your needs and specifications.

Form popularity

FAQ

NH QuickStart is a streamlined service designed to facilitate the formation of corporations in New Hampshire. This program offers an efficient way for entrepreneurs to create their businesses while ensuring compliance with state regulations. By utilizing NH QuickStart, new corporations can quickly address any necessary corporate actions, setting a solid foundation for success. For optimal results, consider the resolution for any corporate action provided through this service.

The Corporate Transparency Act in New Hampshire mandates that certain entities report their beneficial owners to the state. This legislation is part of a broader effort to combat fraud and improve the integrity of New Hampshire corporations. Providing transparent ownership information not only promotes accountability but also supports corporations in building trust with the public. When resolving corporate actions, compliance with this act is crucial.

The New Hampshire Transparency Act aims to enhance corporate governance by requiring public disclosure of ownership information. This law directly impacts New Hampshire corporations, ensuring they maintain accurate records of their shareholders. By adhering to these regulations, businesses can establish trust with clients and stakeholders. For any corporate action resolution, understanding this act is essential.

A BOI report in New Hampshire refers to the beneficial ownership information report. This document outlines the individuals who hold significant control or ownership interest in a company. Understanding the importance of this report is vital for New Hampshire Corporations - Resolution for Any Corporate Action, as it enhances transparency and aids in compliance with state regulations.

In New Hampshire, all LLCs, corporations, and certain other entities must file an annual report. This requirement ensures that the state has up-to-date information about your company. Staying compliant is crucial for all New Hampshire Corporations - Resolution for Any Corporate Action, fostering operational legitimacy and trust.

Yes, New Hampshire recognizes S corporations. These entities benefit from pass-through taxation, allowing income to avoid double taxation at both corporate and personal levels. If you're exploring alternative structures for your business, consider how New Hampshire Corporations - Resolution for Any Corporate Action could strategically benefit your financial planning.

Filing an annual report for your LLC in New Hampshire costs $100 if filed online and $125 if submitted by mail. This report is essential for maintaining your company's good standing and ensures compliance with state regulations. It is a crucial part of ensuring New Hampshire Corporations - Resolution for Any Corporate Action is handled smoothly.

The approval process for an LLC in New Hampshire typically takes about 1 to 2 weeks, assuming all your documents are correctly filled out. However, this timeline can vary depending on the volume of applications received. To expedite the process, consider using reliable services like uslegalforms, which specialize in New Hampshire Corporations - Resolution for Any Corporate Action.

There are several methods for dissolving New Hampshire Corporations - Resolution for Any Corporate Action. The most common include voluntary dissolution through a board resolution or administrative dissolution due to non-compliance with state regulations. Each method has different requirements, so it’s crucial to understand which path to take based on your corporation's circumstances.

To file a Beneficial Ownership Information (BOI) report in New Hampshire, follow the guidelines set by the Secretary of State. Gather the required information about beneficial owners and prepare the necessary forms. Utilizing legal resources, such as uslegalforms, can streamline the process and ensure accuracy.