New Hampshire Stock Retirement Agreement

Description

How to fill out Stock Retirement Agreement?

You might spend time on the web attempting to locate the legal document format that fulfills the state and federal requirements you will need.

US Legal Forms provides an extensive collection of legal templates that are verified by professionals.

You can effortlessly download or print the New Hampshire Stock Retirement Agreement from our service.

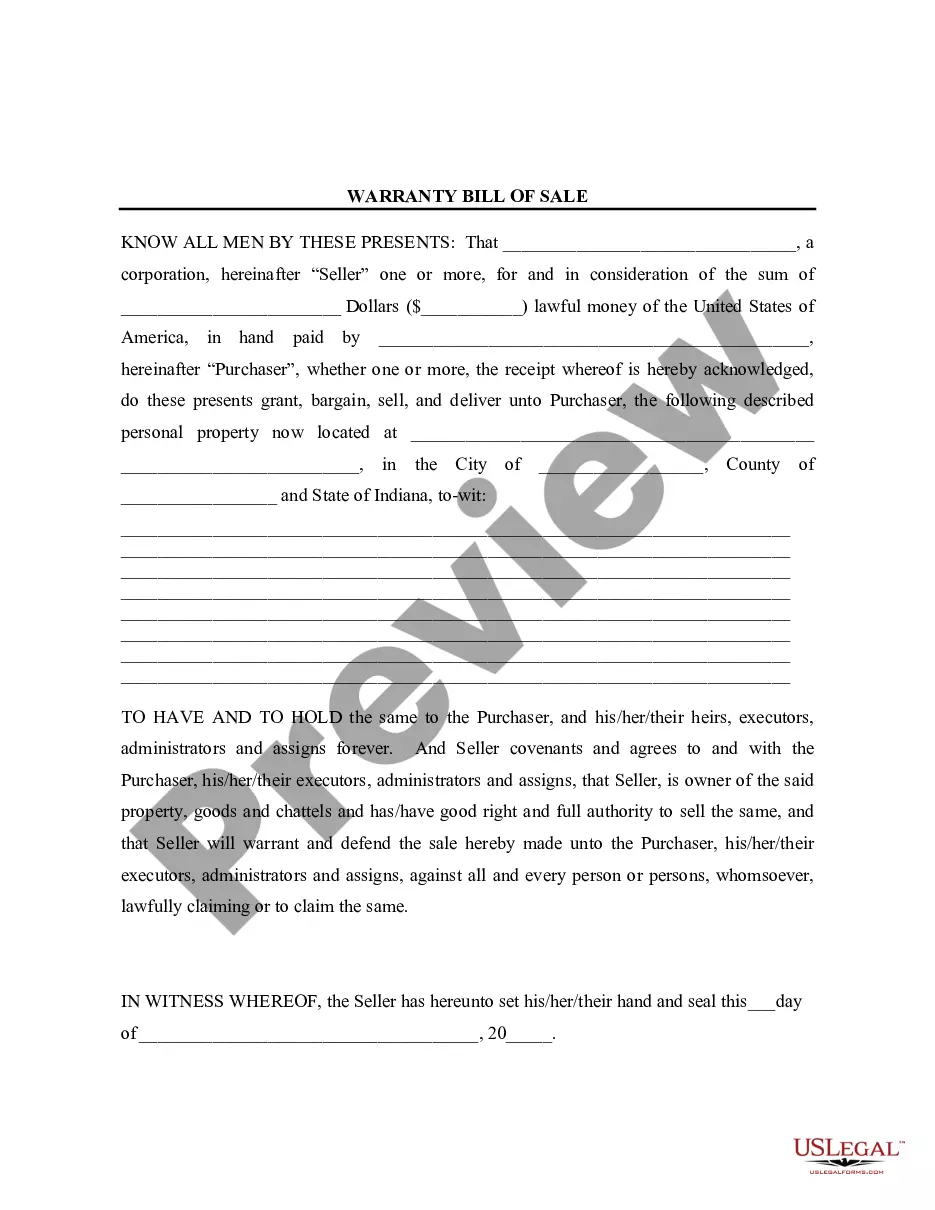

If available, use the Preview button to examine the document format as well. If you wish to obtain another copy of the template, use the Lookup field to find the format that suits you and your requirements.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, edit, print, or sign the New Hampshire Stock Retirement Agreement.

- Every legal document format you acquire is yours permanently.

- To obtain another copy of a purchased template, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the area/city of your choice.

- Review the template outline to ensure you have chosen the proper template.

Form popularity

FAQ

While the exact formula can vary, a common approach involves your average salary, multiplied by the number of years you worked, and then by a specified benefit percentage. The New Hampshire Stock Retirement Agreement often clarifies this formula for its participants. Understanding this formula is essential for confident financial planning. Using services from platforms like US Legal Forms can provide you with additional clarity and support.

NH retirement is calculated by assessing your earnings history, contribution rates, and service years. The New Hampshire Stock Retirement Agreement usually reflects these key components, ensuring a straightforward calculation process for retirees. Knowing how your retirement is calculated allows you to plan your future effectively. Accessing tools and resources like those from US Legal Forms can enhance your understanding of this process.

To calculate your NHS pension, consider your salary, length of service, and the specific plan provisions that apply to you. Each plan may have different formulas that align with the New Hampshire Stock Retirement Agreement, helping you estimate your retirement income. It’s crucial to understand these elements to make informed financial decisions. Tools provided by US Legal Forms can guide you through the necessary calculations.

Calculating your pension involves determining your average salary over your working years and multiplying it by your years of service. The New Hampshire Stock Retirement Agreement can be particularly helpful because it typically outlines how these calculations are made for New Hampshire residents. By being informed about your specific benefits, you can plan your retirement more effectively. Online platforms like US Legal Forms can assist you with relevant documents.

To calculate your NH pension, you generally need your final average salary, years of service, and a benefit multiplier. The New Hampshire Stock Retirement Agreement often incorporates these factors to provide clarity on your retirement benefits. Understanding this calculation helps ensure you receive the maximum benefits you are entitled to. Utilizing resources like US Legal Forms can simplify the process.

To retire in New Hampshire, you need to meet age and service criteria, which usually includes being at least 60 years old and having worked for a minimum duration. The New Hampshire Stock Retirement Agreement outlines specific contributions you and your employer must make. Additionally, consider factors like your health care benefits and any other retirement savings plans you may have. Understanding these requirements helps ensure a smooth transition into retirement.

To qualify for a pension in New Hampshire, you generally must serve at least 10 years in a qualifying position. This requirement applies even if you are part of the New Hampshire Stock Retirement Agreement. By working the necessary period, you secure your pension benefits, providing you with a reliable income after retirement. Make sure you stay informed on any updates to the rules, as they can change.

You can begin to collect retirement benefits in New Hampshire once you reach the age of 60, provided you meet the required years of service. If you are part of the New Hampshire Stock Retirement Agreement, understanding the specific age requirements and criteria will help you plan your retirement effectively. Additionally, eligible members may access early retirement options under certain conditions. Planning ahead ensures you can make the most of your retirement years.

In New Hampshire, you typically need to work for a minimum of 10 years to become fully vested in your retirement benefits. Once you reach this milestone, your rights to the benefits in the New Hampshire Stock Retirement Agreement become secured. This means that even if you leave the job, you will still receive the retirement benefits you have earned. It's a strategic way to encourage long-term employment within state roles.

The New Hampshire retirement system primarily focuses on providing financial security for public employees after they retire. It operates through a mix of pension plans and deferred benefits, ensuring that your contributions, along with employer matches, grow over time. The New Hampshire Stock Retirement Agreement plays a crucial role in managing your investment options. This allows retirees to enjoy a stable income in their golden years.