This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

New Hampshire Application for Certificate of Discharge of IRS Lien

Description

How to fill out Application For Certificate Of Discharge Of IRS Lien?

Have you ever found yourself needing to obtain documents for both business or personal purposes nearly every day.

There are numerous authentic document templates accessible online, but finding versions you can rely on is not simple.

US Legal Forms provides thousands of form templates, including the New Hampshire Application for Certificate of Discharge of IRS Lien, which are designed to comply with state and federal regulations.

When you locate the appropriate form, click Get now.

Choose the pricing plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Hampshire Application for Certificate of Discharge of IRS Lien template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

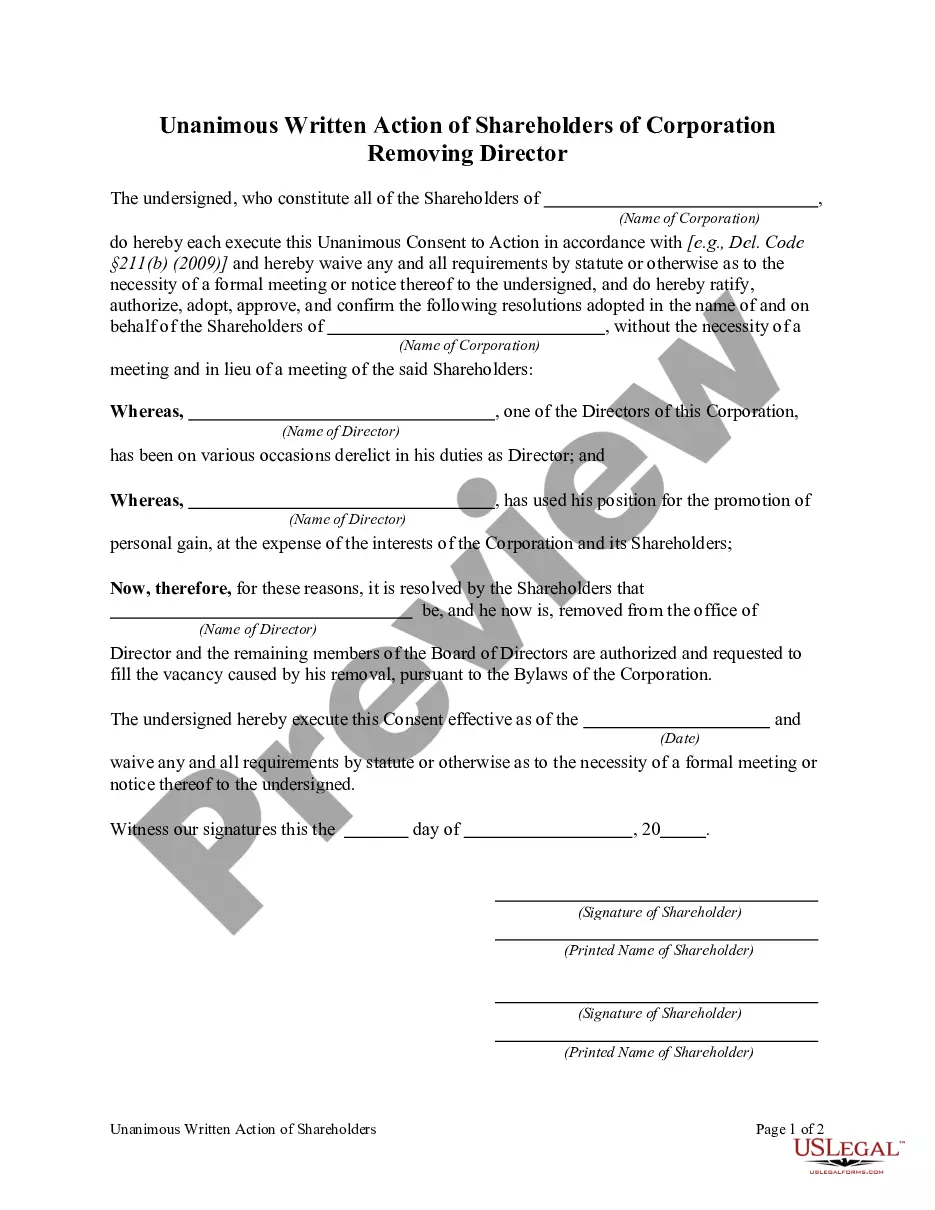

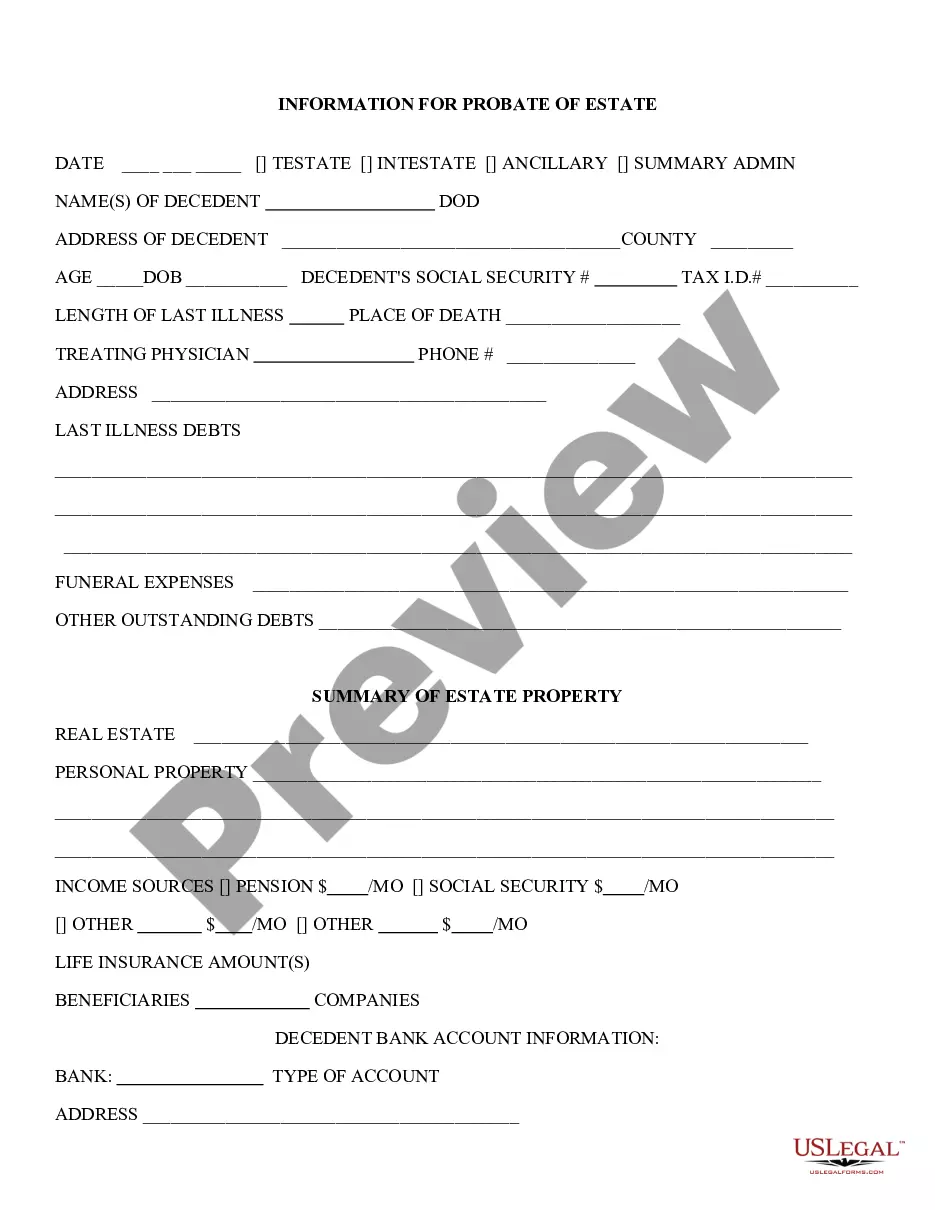

- Use the Preview button to review the form.

- Check the description to confirm that you have chosen the right form.

- If the form does not meet your needs, use the Lookup section to find the form that fits your criteria.

Form popularity

FAQ

To obtain an IRS lien payoff letter, you need to contact the IRS directly or submit a written request. This letter provides the total amount owed to satisfy the lien, which is crucial when applying for a New Hampshire Application for Certificate of Discharge of IRS Lien. You can simplify this process by using platforms like USLegalForms, which guide you through the necessary steps and paperwork to obtain your lien payoff letter efficiently. Having this letter can expedite the discharge process and help you regain financial freedom.

Form 14135 is officially known as the Application for Certificate of Discharge of Federal Tax Lien. This form allows taxpayers in New Hampshire to request the release of an IRS lien on their property, provided they meet certain conditions. By filing the New Hampshire Application for Certificate of Discharge of IRS Lien, you can clear your title and sell or refinance your property without the burden of the lien. It's essential to understand the requirements and process to ensure a smooth application.

To obtain a lien release from the IRS, you need to address the outstanding tax liability that led to the lien. Once the debt is settled, you can file the New Hampshire Application for Certificate of Discharge of IRS Lien. This application helps you formally request the release of the lien, allowing you to clear your credit record. Using platforms like US Legal Forms can simplify this process by providing the necessary documents and guidance.

To apply for a certificate of discharge from a federal tax lien, complete Form 14135 and submit it to the IRS. Ensure you provide all required information about the property and the tax lien. You may also want to utilize resources like the New Hampshire Application for Certificate of Discharge of IRS Lien for guidance. This process can help clear your property title, allowing you to move forward.

Getting a lien payoff from the IRS involves requesting the payoff amount directly from them. You can call the IRS or access your account online to get this information. Be prepared with your tax details and any necessary identification. This step is crucial before you proceed with applying for a Certificate of Discharge.

To apply for a federal tax lien discharge, you must file Form 14135 with the IRS. This form requests the discharge of a lien on specific property, which can be beneficial if you plan to sell or refinance. Completing the New Hampshire Application for Certificate of Discharge of IRS Lien can simplify this process. Make sure to include all required information and documentation with your application.

To obtain a copy of a federal tax lien, you can request it directly from the IRS. You may need to provide specific details about the lien, including your tax identification number. Alternatively, you can check local county records, as they often maintain copies of filed liens. This step is vital if you need documentation for your records or for applying for a Certificate of Discharge.

Yes, New Hampshire does allow for the imposition of tax liens by the IRS. This means that if you have an unpaid federal tax obligation, the IRS can file a lien against your property. Understanding how tax liens work in New Hampshire is crucial, especially if you are looking to apply for a Certificate of Discharge.

Form 14135, which is used for the Certificate of Discharge of Property from Federal Tax Lien, should be filed with the IRS. You can send the completed form to the address listed in the form instructions based on your state. If you reside in New Hampshire, ensure you follow the specific guidelines applicable to your situation.

Yes, you can remove a federal tax lien under certain conditions. Typically, this involves paying off the underlying tax debt or negotiating an agreement with the IRS. Once the debt is settled, you can file for a discharge. For assistance, consider using the New Hampshire Application for Certificate of Discharge of IRS Lien to streamline the process.