This form is a Class Action Complaint. Plaintiffs seek damages and injunctive relief from defendants for liability under the Racketeer Influenced and Corrupt Organizations Act(RICO). Plaintiffs contend that the defendants' actions justify an award of substantial punitive damages against each.

New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers

Description

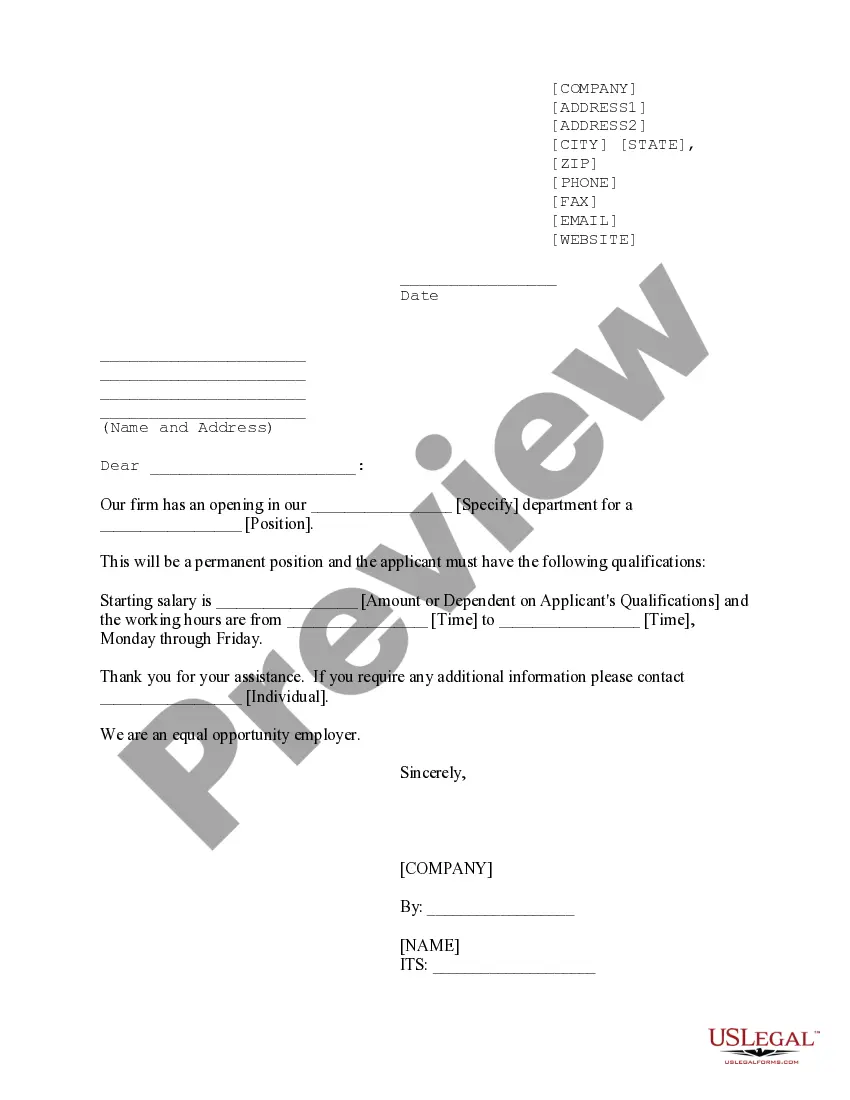

How to fill out Complaint For Class Action For Wrongful Conduct - RICO - By Insurers?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal document templates that you can download or print. By using the site, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers in moments.

If you already have a subscription, Log In and download the New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

If you are looking to use US Legal Forms for the first time, here are simple instructions to get you started: Ensure you have selected the correct form for your area/county. Click the Preview button to review the form's content. Check the form details to make sure that you have chosen the right form. If the form does not meet your requirements, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose the payment plan you prefer and provide your information to register for an account.

- Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Select the format and download the form to your device.

- Make changes. Complete, modify, and print or sign the downloaded New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers.

- Every template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements and needs.

Form popularity

FAQ

In New Hampshire, the statute of limitations for filing a complaint under the Consumer Protection Act is three years from the date of the violation. This timeframe is important for individuals contemplating a New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers. Understanding this limit ensures that you take timely action to protect your rights. Uslegalforms can assist you in preparing your legal documents within this crucial timeframe.

The insurance commissioner of New Hampshire oversees the state's insurance regulations and consumer protections. This position plays a vital role in ensuring insurers comply with the law, which is especially relevant for those considering a New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers. The current commissioner is responsible for addressing consumer concerns and enforcing state regulations. For more information, you can visit the New Hampshire Department of Insurance website.

In New Hampshire, the consumer protection law aims to protect consumers from unfair, deceptive, or fraudulent practices. This law is crucial for individuals who may seek to file a New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers. It provides a framework for consumers to assert their rights and seek remedies against companies that engage in misconduct. You can learn more about these protections through uslegalforms, which offers resources and forms to help you navigate this process.

Writing a complaint letter against an insurance company requires a clear expression of your concerns. Begin with your personal information and a description of your issue, including specific examples. If you are contemplating a New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers, make sure to document all interactions with the insurer to support your case.

To complain about insurance in New Hampshire, you can start by contacting the New Hampshire Department of Insurance. They provide guidance on filing complaints and can help resolve issues with insurers. If your situation does not improve, consider exploring options for a New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers for a more structured resolution.

Writing a complaint letter to an insurance company involves a straightforward approach. Start with your contact information and the insurance company's details, followed by a clear statement of your complaint. Be sure to include any relevant documents and indicate if you are considering a New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers to seek resolution.

Using strong yet respectful language in your complaint can enhance its impact. Words like 'unacceptable,' 'disappointed,' and 'urgent' convey seriousness. These terms help articulate your feelings effectively, especially when discussing potential legal actions such as a New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers.

To write a powerful complaint letter, focus on clarity and structure. Begin with a polite greeting, then clearly state your issue, including relevant details and dates. End with a call to action, specifying what resolution you seek, as this can be crucial if you decide to pursue a New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers.

When writing a dispute letter to an insurance company, start with a clear outline of your issue. Include your policy number, specific claim details, and a concise summary of the dispute. It's vital to reference any pertinent documents and state your desired outcome, particularly if you are considering a New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers.

While complaint statistics can vary yearly, certain major insurance companies often receive higher complaint rates. Consumers may find that companies with larger market shares tend to attract more complaints, particularly regarding claims handling. This trend highlights the importance of researching customer feedback and considering a New Hampshire Complaint for Class Action For Wrongful Conduct - RICO - by Insurers when facing issues with a provider.