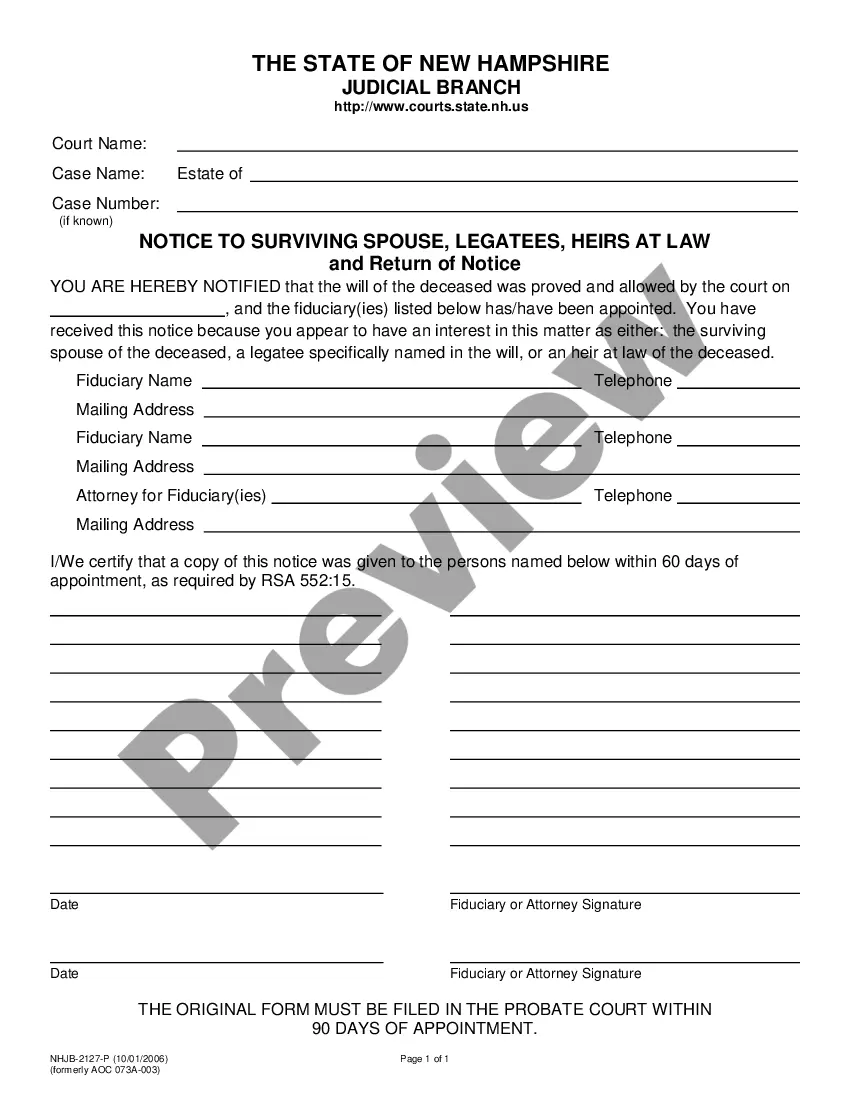

This is an official form from the New Hampshire Judicial Branch that is completed by the executor to notify each individual or entity named in the will that they appear to have an interest in the deceased's estate. It is also intended to advise each individual or entity that the court has allowed the will and whom the court has appointed to manage and settle the deceased's estate. This form complies with all applicable laws and statutes. USLF amends and updates the forms as is required by New Hampshire statutes and law.

New Hampshire Notice to Spouse, Legatees, Heirs at Law and Return of Notice

Description

How to fill out New Hampshire Notice To Spouse, Legatees, Heirs At Law And Return Of Notice?

US Legal Forms is really a unique system to find any legal or tax form for completing, such as New Hampshire Notice to Spouse, Legatees, Heirs at Law and Return of Notice. If you’re tired with wasting time seeking suitable examples and paying money on document preparation/lawyer service fees, then US Legal Forms is precisely what you’re searching for.

To experience all of the service’s advantages, you don't need to download any application but simply pick a subscription plan and create an account. If you have one, just log in and look for the right template, save it, and fill it out. Saved files are kept in the My Forms folder.

If you don't have a subscription but need to have New Hampshire Notice to Spouse, Legatees, Heirs at Law and Return of Notice, take a look at the recommendations listed below:

- Double-check that the form you’re checking out applies in the state you want it in.

- Preview the sample and look at its description.

- Click Buy Now to access the register page.

- Choose a pricing plan and continue registering by entering some information.

- Choose a payment method to complete the sign up.

- Save the document by selecting your preferred format (.docx or .pdf)

Now, fill out the file online or print it. If you are unsure regarding your New Hampshire Notice to Spouse, Legatees, Heirs at Law and Return of Notice form, contact a attorney to analyze it before you decide to send or file it. Begin without hassles!

Form popularity

FAQ

Yes an estate can have 2 administrators but it is not likely. If a names co-executors the Court may allow this, but if two people want to serve as co-administrators most Courts say "No" to the future conflicts between adminsitrators.

If the estate is small and has a reasonable amount of debt, six to eight months is a fair expectation. With a larger estate, it will likely be more than a year before everything settles. This is especially true if there's a lot of debt or real estate in multiple states.

Probate is the process through which a deceased person's property, known as the estate, is passed to his or her heirs and legatees (people named in the will). The entire process, supervised by the probate court, can take up to a year to fifteen months.

Small estates involving only personal property with a value of $10,000 or less are eligible for a simplified form of administration called Voluntary or Small Estate Administration, if the decedent died prior to January 1, 2006.

How Long Does Probate in New Hampshire Take? Probate will take at least six months by the time you file all the paperwork and pay creditors.

In New Hampshire, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).