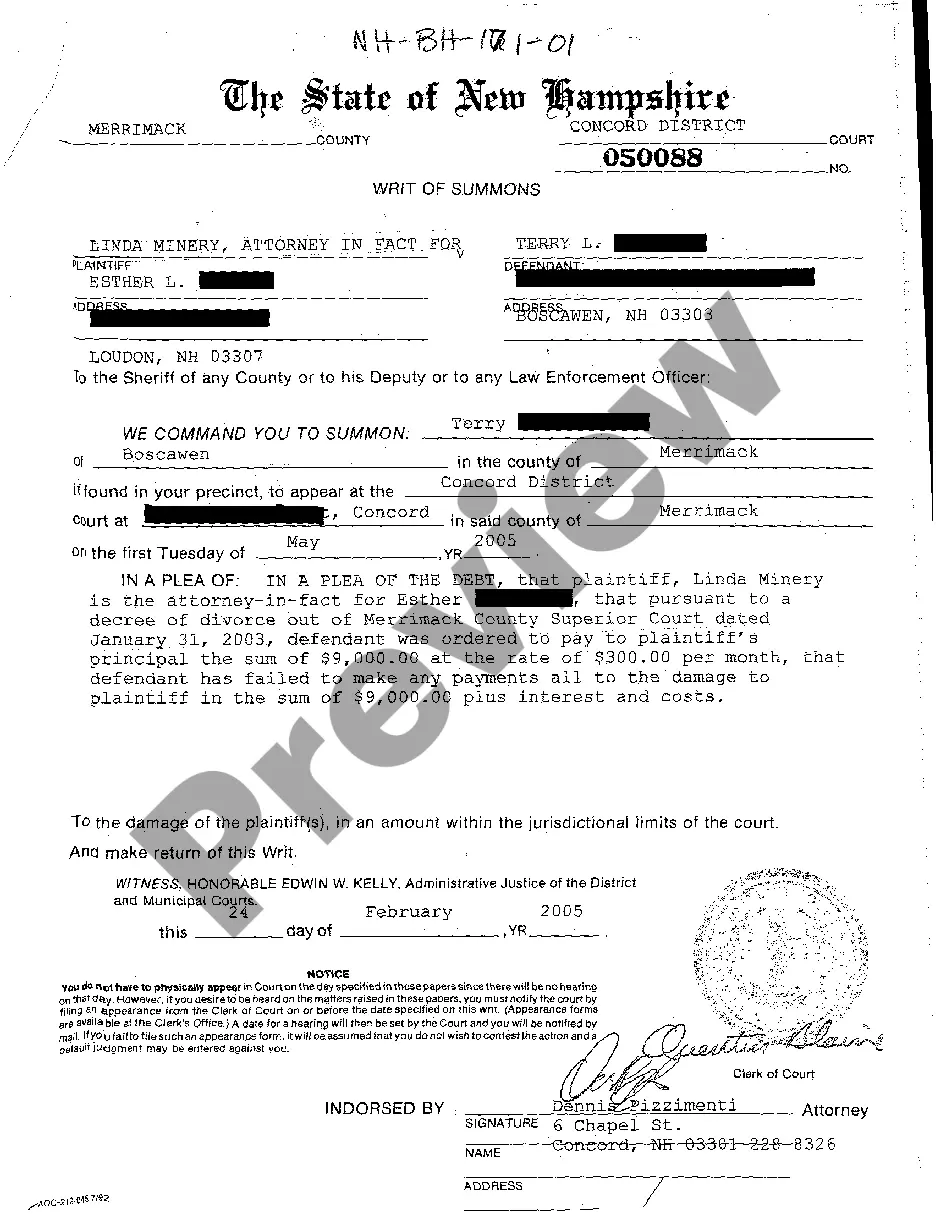

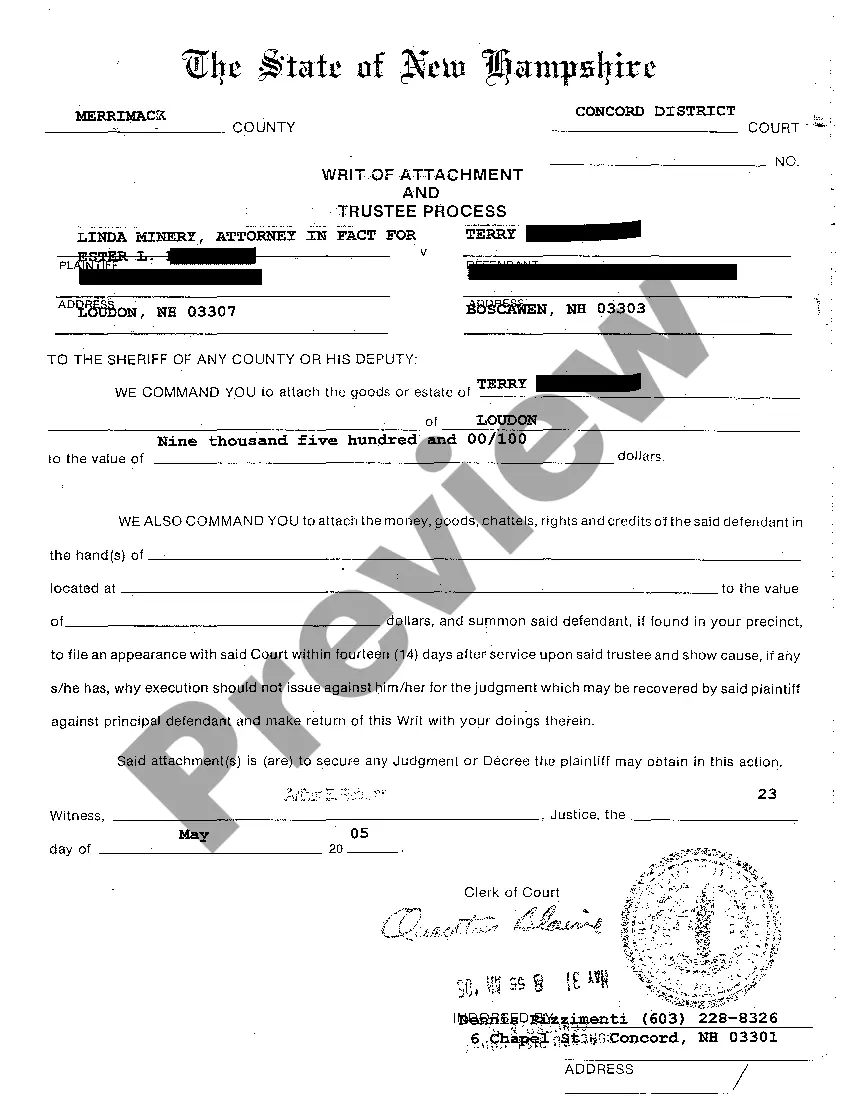

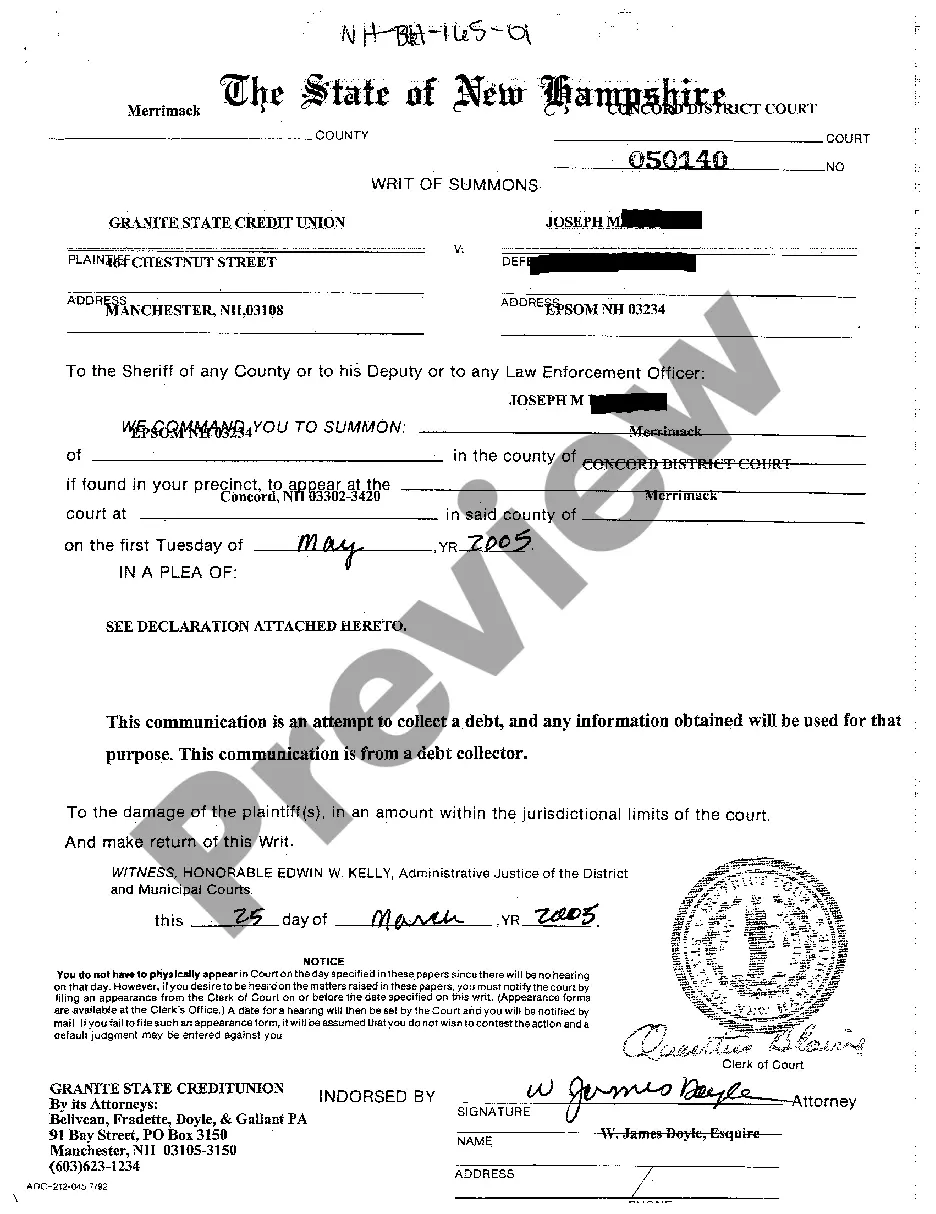

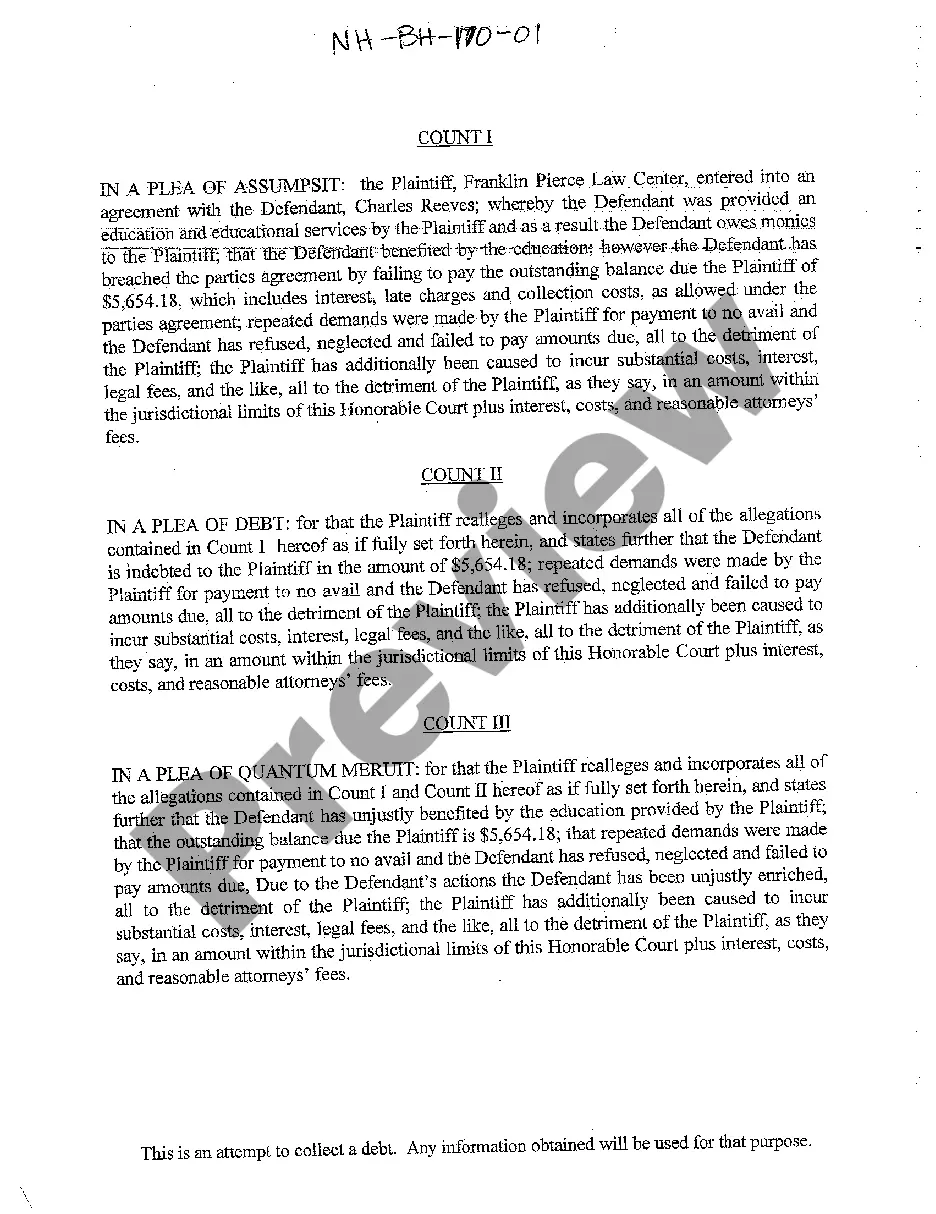

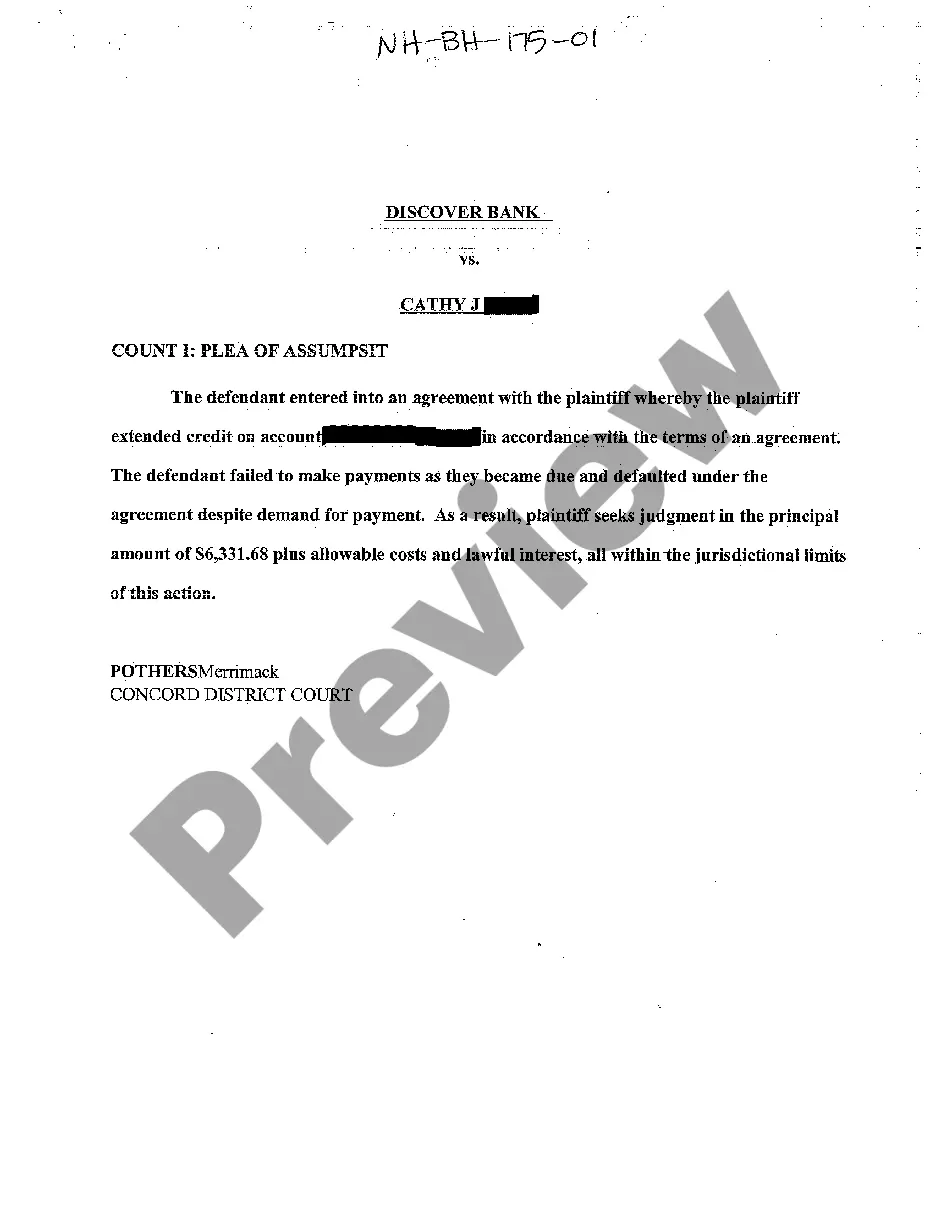

New Hampshire Writ of Summons for Debt Collection Owed to Ex-Wife for Support

Description

How to fill out New Hampshire Writ Of Summons For Debt Collection Owed To Ex-Wife For Support?

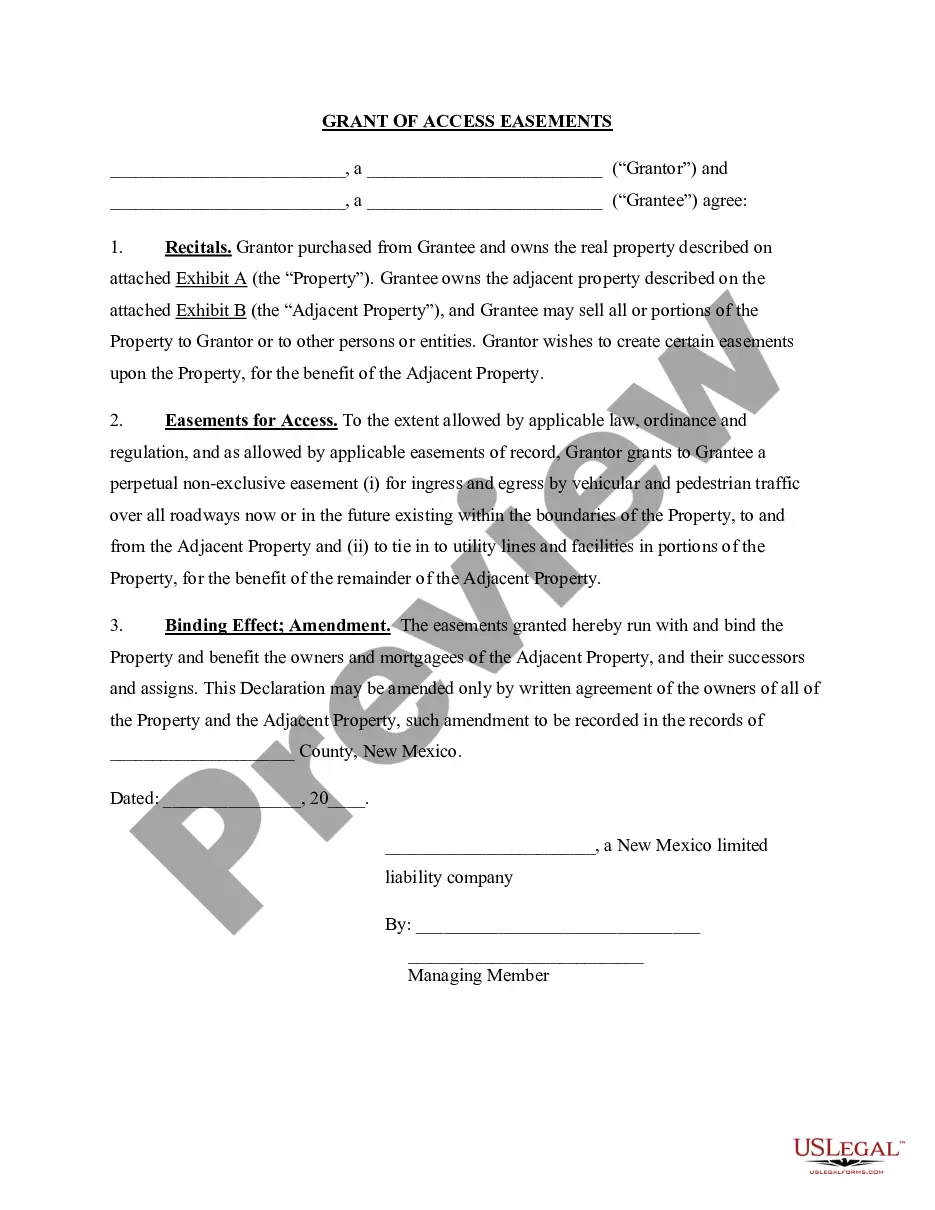

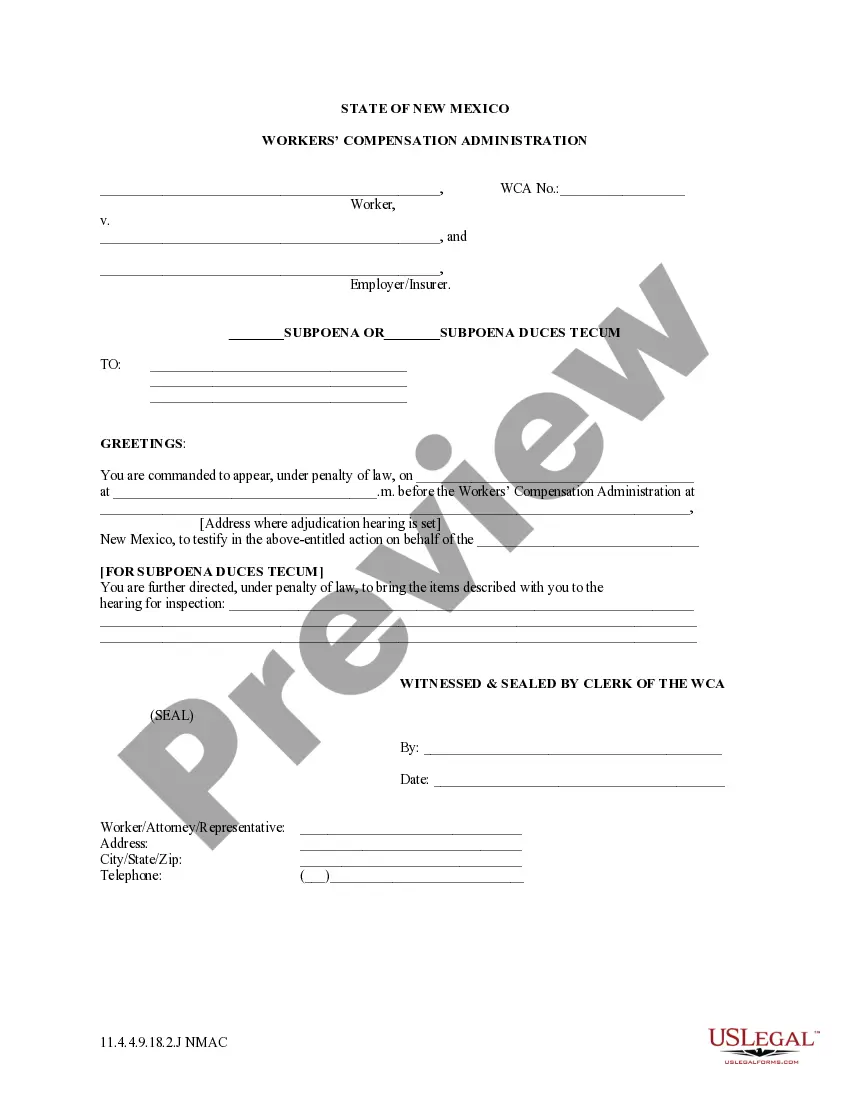

US Legal Forms is really a unique system where you can find any legal or tax document for filling out, including New Hampshire Writ of Summons for Debt Collection Owed to Ex-Wife for Support. If you’re tired with wasting time looking for perfect examples and paying money on file preparation/legal professional fees, then US Legal Forms is exactly what you’re seeking.

To experience all of the service’s benefits, you don't have to install any software but simply select a subscription plan and create your account. If you already have one, just log in and look for a suitable sample, download it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need to have New Hampshire Writ of Summons for Debt Collection Owed to Ex-Wife for Support, have a look at the guidelines below:

- make sure that the form you’re taking a look at is valid in the state you want it in.

- Preview the sample and read its description.

- Click Buy Now to access the sign up page.

- Pick a pricing plan and carry on signing up by entering some info.

- Choose a payment method to finish the sign up.

- Save the file by selecting the preferred format (.docx or .pdf)

Now, fill out the document online or print out it. If you feel unsure about your New Hampshire Writ of Summons for Debt Collection Owed to Ex-Wife for Support form, speak to a legal professional to check it before you send or file it. Begin without hassles!

Form popularity

FAQ

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment.Your debt could be statute barred if, during the time limit: you (or if it's a joint debt, anyone you owe the money with), haven't made any payments towards the debt.

Don't ignore it. If you do this, the court will simply rule in the issuer or debt collector's favor. Try to work things out. Answer the summons. Consult an attorney. Go to court. Respond to the ruling.

A creditor isn't going to risk not recovering the $2,000 it must pay to a collection attorney to sue you over a $285.00 debt.A general rule of thumb is that if you owe less than $1,000 the odds that you will be sued are very low, particularly if you're creditor is a large corporation.

If the debtor still refuses to pay the unsecured debt, the creditor can file a lawsuit against the debtor. Once a court grants judgment in favor of the creditor, it can usually take money from the debtor's bank account or garnish the debtor's wages.

Unpaid credit card debt is not forgiven after 7 years, however. You could still be sued for unpaid credit card debt after 7 years, and you may or may not be able to use the age of the debt as a winning defense, depending on the state's statute of limitations. In most states, it's between 3 and 10 years.

Don't ignore it. If you do this, the court will simply rule in the issuer or debt collector's favor. Try to work things out. Answer the summons. Consult an attorney. Go to court. Respond to the ruling.

Debt collectors will go to considerable lengths to collect large debts. If a debt collector sues you, you will be notified of the lawsuit via a summons, which will tell you why you are being sued, for how much and what date you must appear in court.

Contracts and open accounts: 3 years, (RSA 508:4). Notes secured by a mortgage: 20 years and applies even if the mortgage has been foreclosed, (RSA 508:6).

Respond to the Lawsuit or Debt Claim. Challenge the Company's Legal Right to Sue. Push Back on Burden of Proof. Point to the Statute of Limitations. Hire Your Own Attorney. File a Countersuit if the Creditor Overstepped Regulations. File a Petition of Bankruptcy.