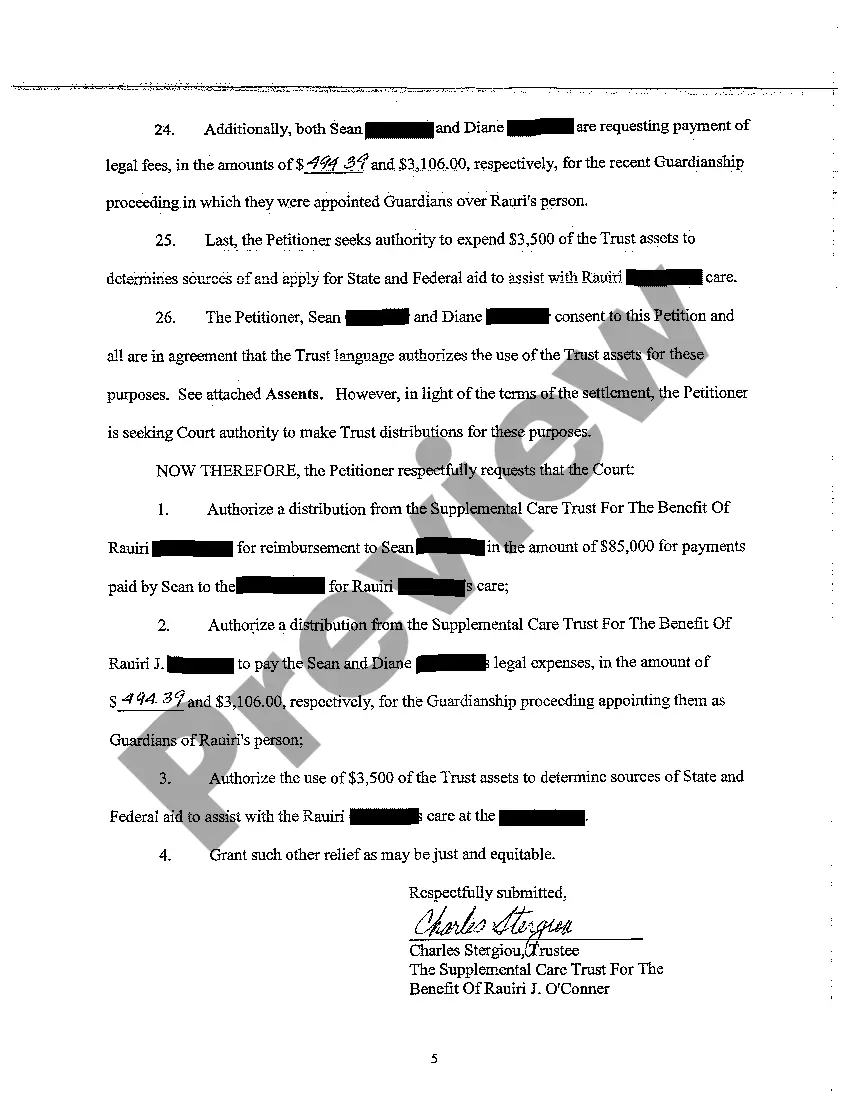

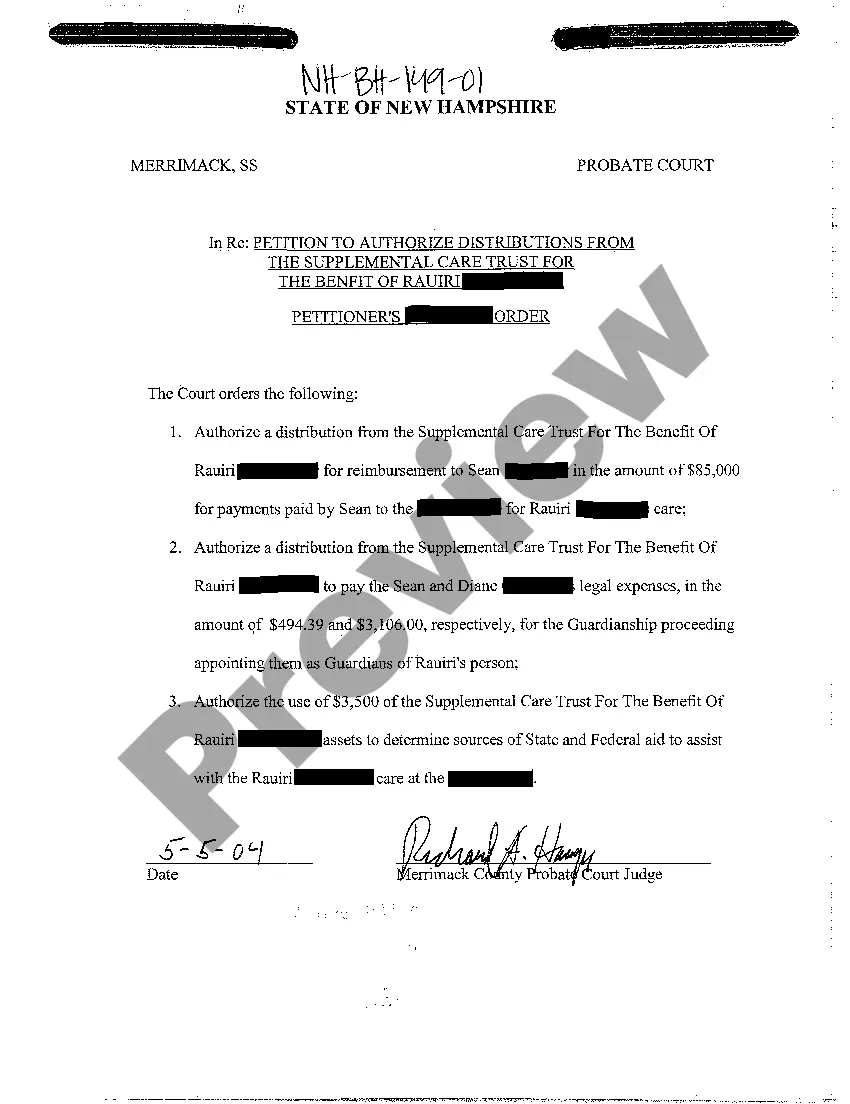

New Hampshire Petition to Authorize Distribution From The Supplemental Care Trust for the Benefit of Incapacitated

Description

How to fill out New Hampshire Petition To Authorize Distribution From The Supplemental Care Trust For The Benefit Of Incapacitated?

Avoid expensive lawyers and find the New Hampshire Petition to Authorize Distribution From The Supplemental Care Trust for the Benefit of Incapacitated you want at a reasonable price on the US Legal Forms website. Use our simple categories function to search for and obtain legal and tax files. Go through their descriptions and preview them before downloading. In addition, US Legal Forms provides customers with step-by-step tips on how to download and fill out every form.

US Legal Forms subscribers merely need to log in and download the specific form they need to their My Forms tab. Those, who haven’t got a subscription yet need to stick to the guidelines listed below:

- Ensure the New Hampshire Petition to Authorize Distribution From The Supplemental Care Trust for the Benefit of Incapacitated is eligible for use where you live.

- If available, read the description and use the Preview option just before downloading the templates.

- If you’re sure the template is right for you, click Buy Now.

- If the template is incorrect, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Select obtain the document in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the template to your device or print it out.

After downloading, you can complete the New Hampshire Petition to Authorize Distribution From The Supplemental Care Trust for the Benefit of Incapacitated by hand or by using an editing software program. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

If you fail to receive a trust distribution, you may want to consider filing a petition to remove the trustee. A trust beneficiary has the right to file a petition with the court seeking to remove the trustee. A beneficiary can also ask the court to suspend the trustee pending removal.

Special needs trusts pay for comforts and luxuries -- "special needs" -- that could not be paid for by public assistance funds. This means that if money from the trust is used for food or shelter costs on a regular basis or distributed directly to the beneficiary, such payments will count as income to the beneficiary.

The beneficiary of a special needs trust will usually (but not always) be disabled. While a beneficiary may also act as trustee in some types of trusts, a special needs trust beneficiary will almost never be able to act as trustee.Incapacity of a beneficiary may sometimes be important as well.

The term "special needs trust" refers to the purpose of the trust -- to pay for the beneficiary's unique or special needs. In short, the name is focused more on the beneficiary, while the name "supplemental needs trust" addresses the shortfalls of our public benefits programs.

This type of trust is sometimes also called a "supplemental needs trust." Special needs trusts are irrevocableneither creditors nor the winner of a lawsuit can access funds designated for the beneficiary.

A special needs trust is a legal arrangement and fiduciary relationship that allows a physically or mentally disabled or chronically ill person to receive income without reducing their eligibility for the public assistance disability benefits provided by Social Security, Supplemental Security Income, Medicare or

The Trustee can pay themselves from the trust funds based on the terms of the trust or the state's laws. Some trusts stipulate hourly or flat fees for trustee duties. Professional trustees can earn over $100 per hour, while corporate trustees make 1-2% of the trust's assets as annual compensation.

Medication and medical equipment not covered by Medicare or Medicaid. Insurance premiums (health, life, dental, auto, renter's, etc.) Personal assistance. Job coaching. Home renovations to improve accessibility. Private counseling or case management.

The person serving as trustee of the special needs trust can usually pay for anything for the person with special needs, as long as the purchase is not against public policy or illegal and does not violate the terms of the trust.