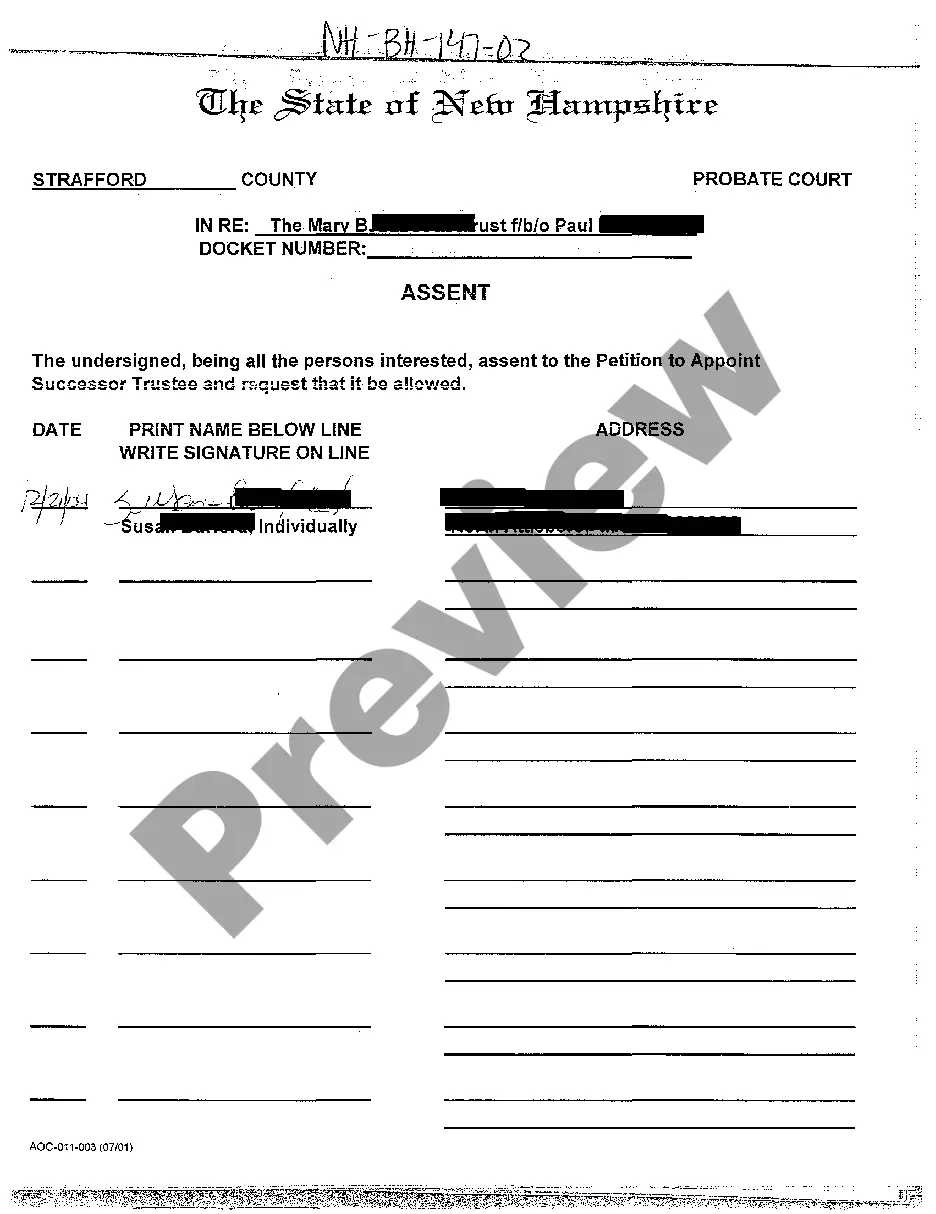

New Hampshire Assent to Petition to Authorize Distributions From the Supplemental Care Trust for the Benefit of Incapacitated

Description

How to fill out New Hampshire Assent To Petition To Authorize Distributions From The Supplemental Care Trust For The Benefit Of Incapacitated?

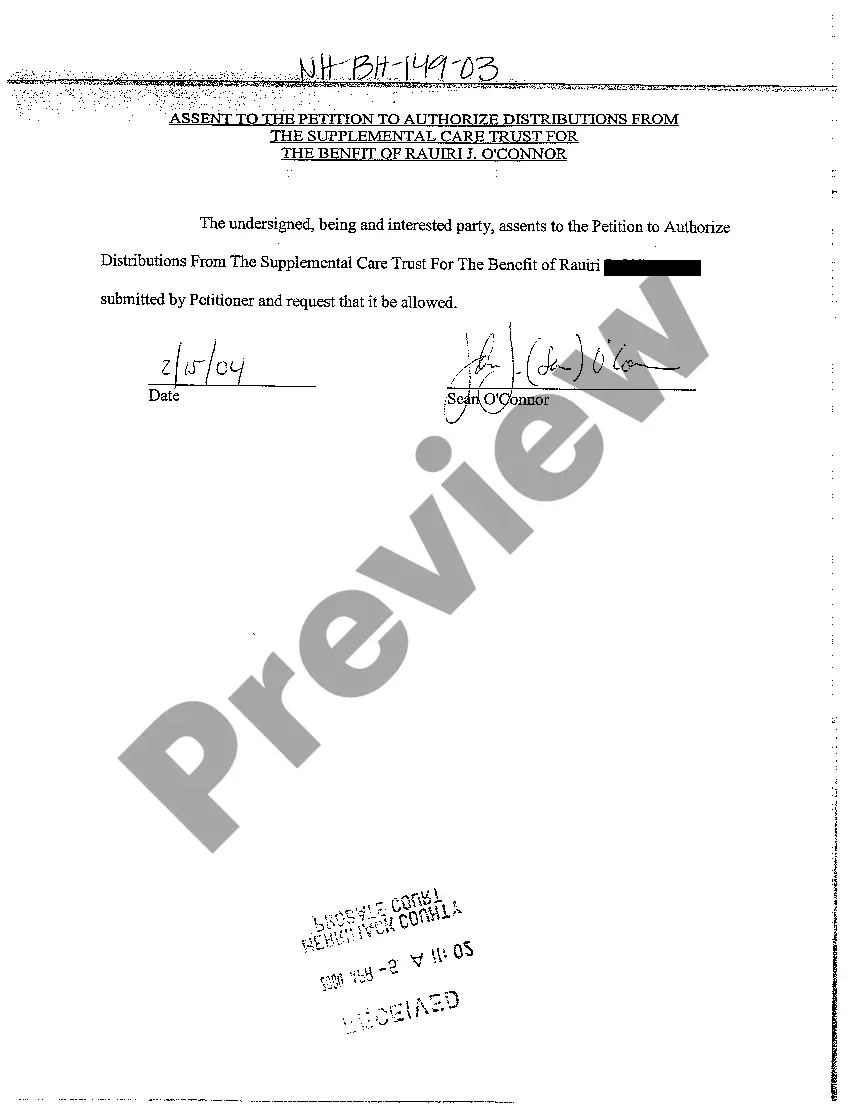

Avoid expensive lawyers and find the New Hampshire Assent to Petition to Authorize Distributions From the Supplemental Care Trust for the Benefit of Incapacitated you want at a affordable price on the US Legal Forms site. Use our simple groups functionality to search for and obtain legal and tax documents. Read their descriptions and preview them before downloading. Additionally, US Legal Forms provides users with step-by-step tips on how to obtain and fill out every template.

US Legal Forms subscribers simply must log in and get the specific document they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to follow the tips below:

- Ensure the New Hampshire Assent to Petition to Authorize Distributions From the Supplemental Care Trust for the Benefit of Incapacitated is eligible for use in your state.

- If available, look through the description and make use of the Preview option before downloading the templates.

- If you’re confident the document suits you, click on Buy Now.

- If the form is wrong, use the search engine to get the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Select obtain the form in PDF or DOCX.

- Click Download and find your template in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, you are able to fill out the New Hampshire Assent to Petition to Authorize Distributions From the Supplemental Care Trust for the Benefit of Incapacitated by hand or with the help of an editing software program. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

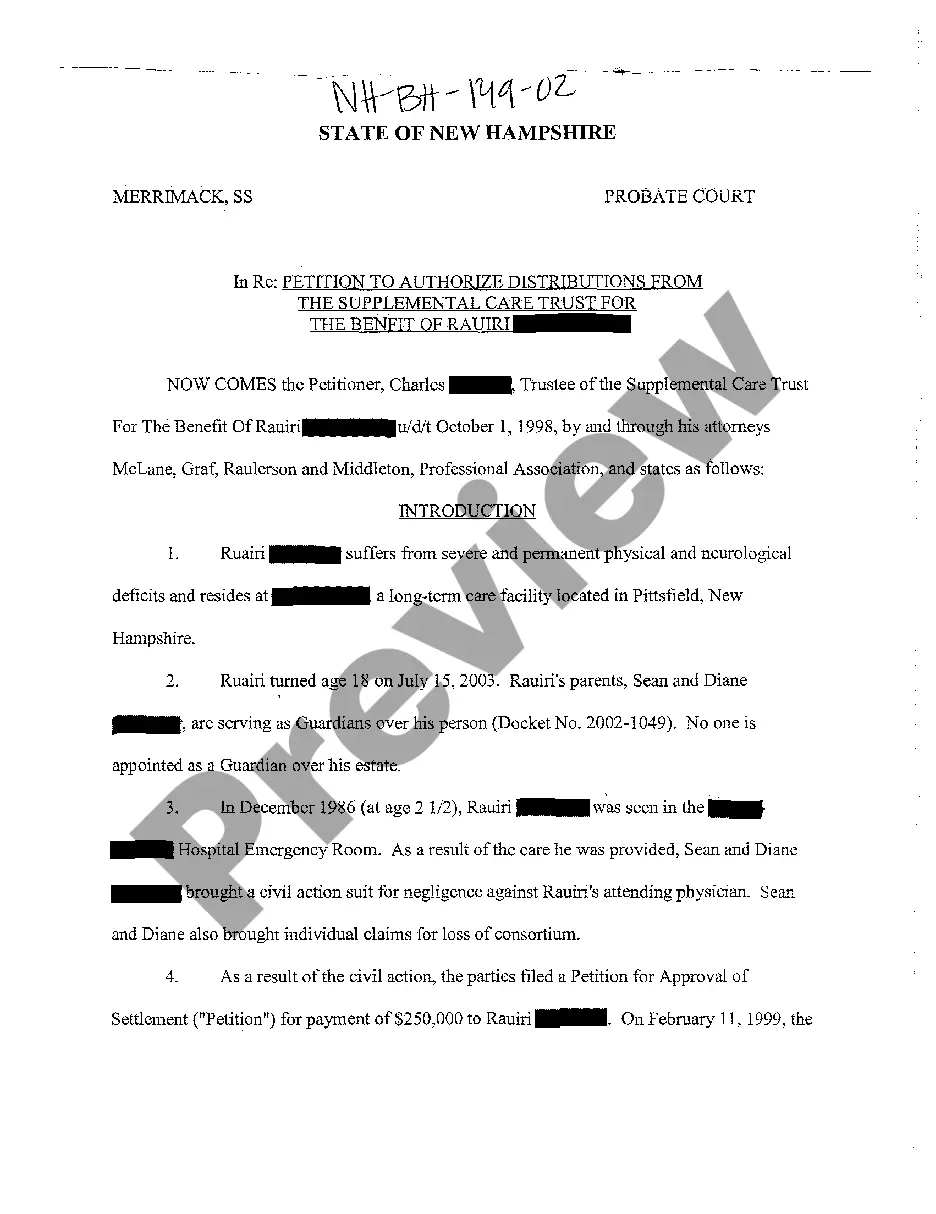

A supplemental needs trust is a third party trust when assets other than those assets belonging to the disabled person are used to fund the trust. To keep its status as a third-party trust, no funds belonging to the disabled person nor funds to which the disabled person is entitled should be used to fund the trust.

Medication and medical equipment not covered by Medicare or Medicaid. Insurance premiums (health, life, dental, auto, renter's, etc.) Personal assistance. Job coaching. Home renovations to improve accessibility. Private counseling or case management.

While all special needs trusts must file annual income tax returns, only larger third-party trusts that earn more than they distribute each year actually pay any taxes. The others pass through their income to the beneficiary with special needs.

If a third-party SNT is considered a grantor trust, all items of income, deduction and credit are generally taxed to the individual(s) who created and funded the SNT (typically parents or other relatives of the beneficiary with a disability).All items of income, deduction and credit are reported on Form 1041.

Failure to set up a special needs trust might affect them, even if not as much as another person who receives, say, SSI and Medicaid. Even someone receiving Medicare will have some effect from having a higher income.

Generally, for income tax purposes, the FP SNT will be taxed as a grantor trust with respect to the beneficiary during his or her lifetime. 11 This means that all income, deductions, and/or credits with respect to the assets of the FP SNT will be reported on the beneficiary's individual tax return.

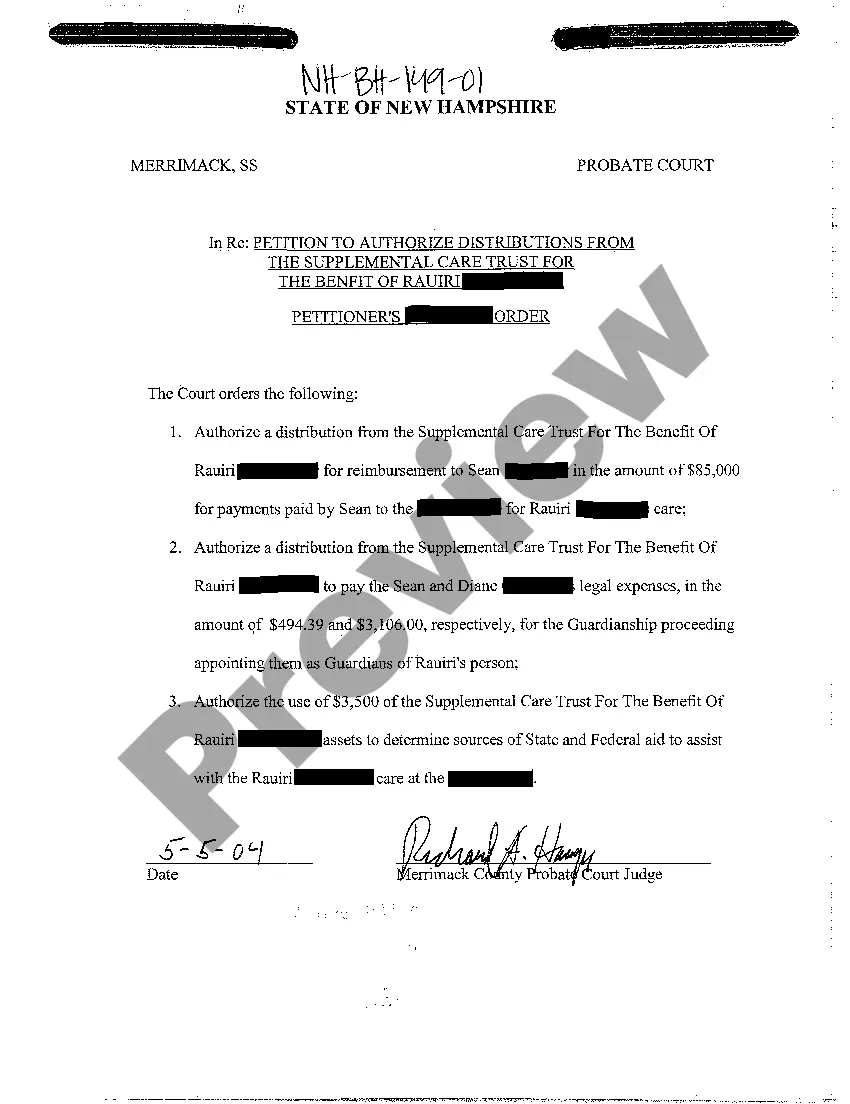

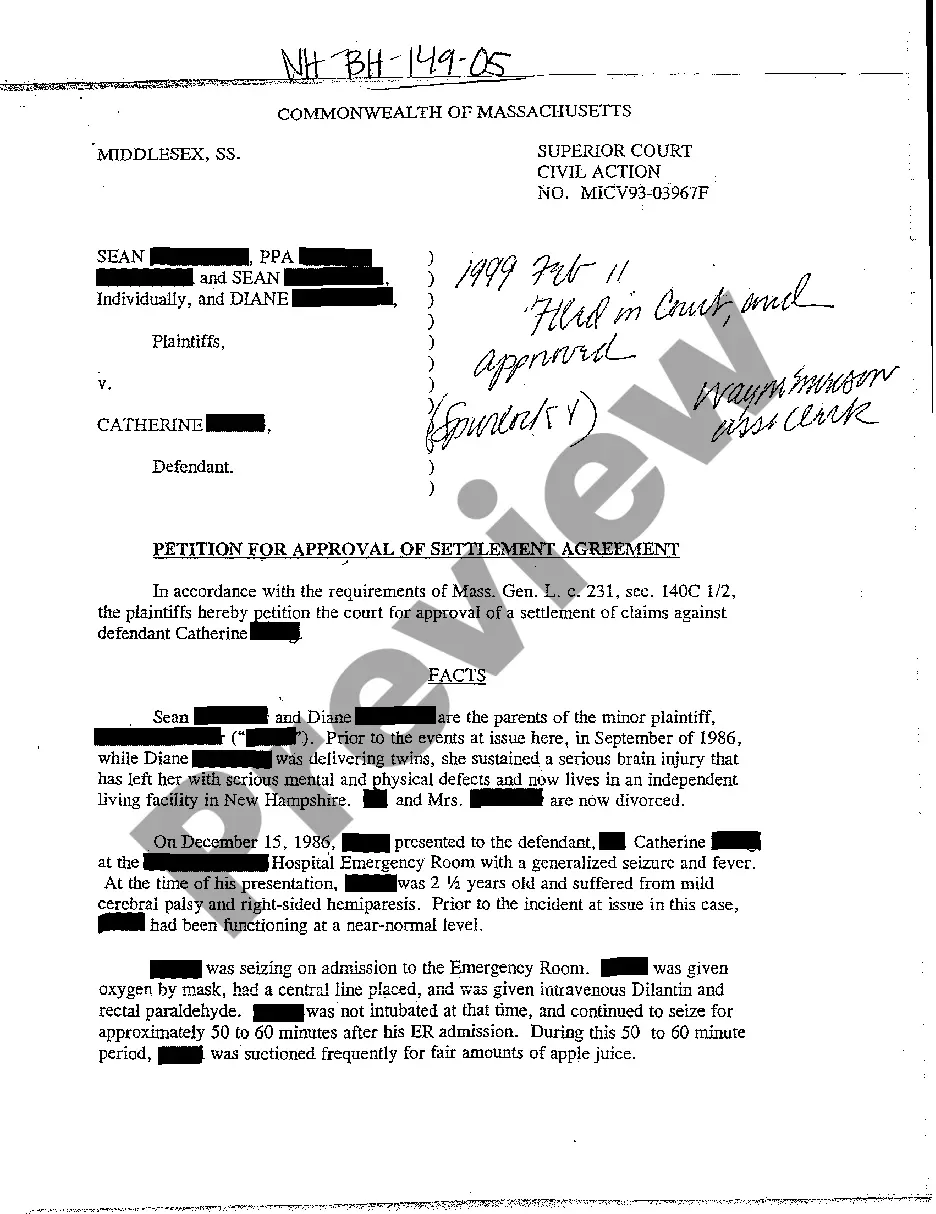

Supplemental Needs Trusts are often used to receive an inheritance or personal injury litigation proceeds on behalf of an individual with a disability, in order to allow the person to qualify for Medicaid benefits despite their receipt of the settlement.

The term "special needs trust" refers to the purpose of the trust -- to pay for the beneficiary's unique or special needs. In short, the name is focused more on the beneficiary, while the name "supplemental needs trust" addresses the shortfalls of our public benefits programs.

If you're a trust beneficiary there are different rules depending on the type of trust. You might have to pay tax through Self Assessment or you might be entitled to a tax refund.If you're the beneficiary of a bare trust you are responsible for declaring and paying tax on its income.