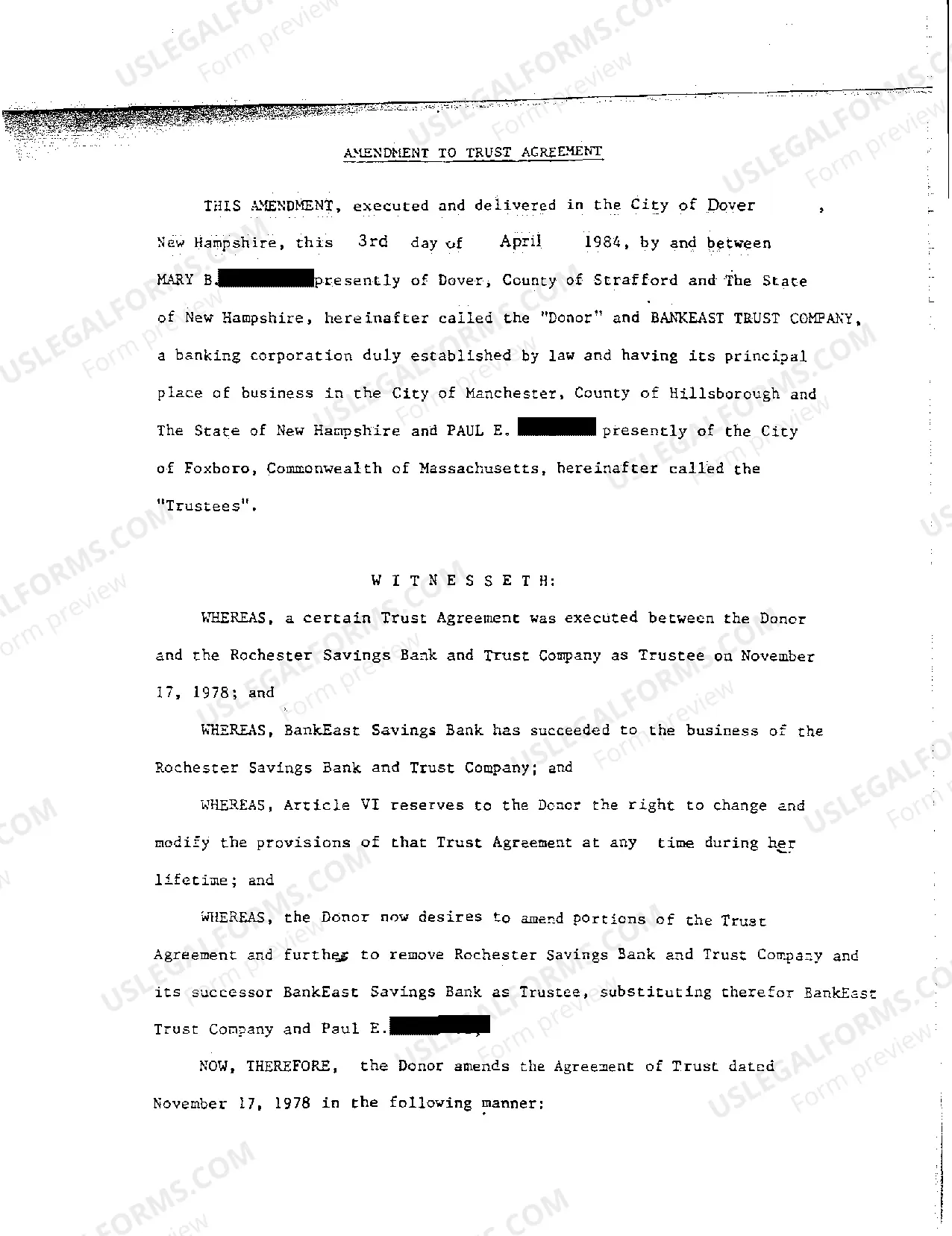

New Hampshire Petition to Appoint Successor Trustee

Description

How to fill out New Hampshire Petition To Appoint Successor Trustee?

Avoid costly lawyers and find the New Hampshire Petition to Appoint Successor Trustee you need at a affordable price on the US Legal Forms website. Use our simple groups functionality to search for and obtain legal and tax forms. Read their descriptions and preview them just before downloading. Additionally, US Legal Forms provides customers with step-by-step instructions on how to download and fill out every form.

US Legal Forms customers just must log in and download the particular form they need to their My Forms tab. Those, who haven’t got a subscription yet need to stick to the tips listed below:

- Ensure the New Hampshire Petition to Appoint Successor Trustee is eligible for use where you live.

- If available, look through the description and use the Preview option before downloading the sample.

- If you’re sure the template meets your needs, click Buy Now.

- If the form is wrong, use the search engine to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the template to the gadget or print it out.

Right after downloading, you can complete the New Hampshire Petition to Appoint Successor Trustee by hand or an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

A trustee cannot comingle trust assets with any other assets.If the trustee is not the grantor or a beneficiary, the trustee is not permitted to use the trust property for his or her own benefit. Of course the trustee should not steal trust assets, but this responsibility also encompasses misappropriation of assets.

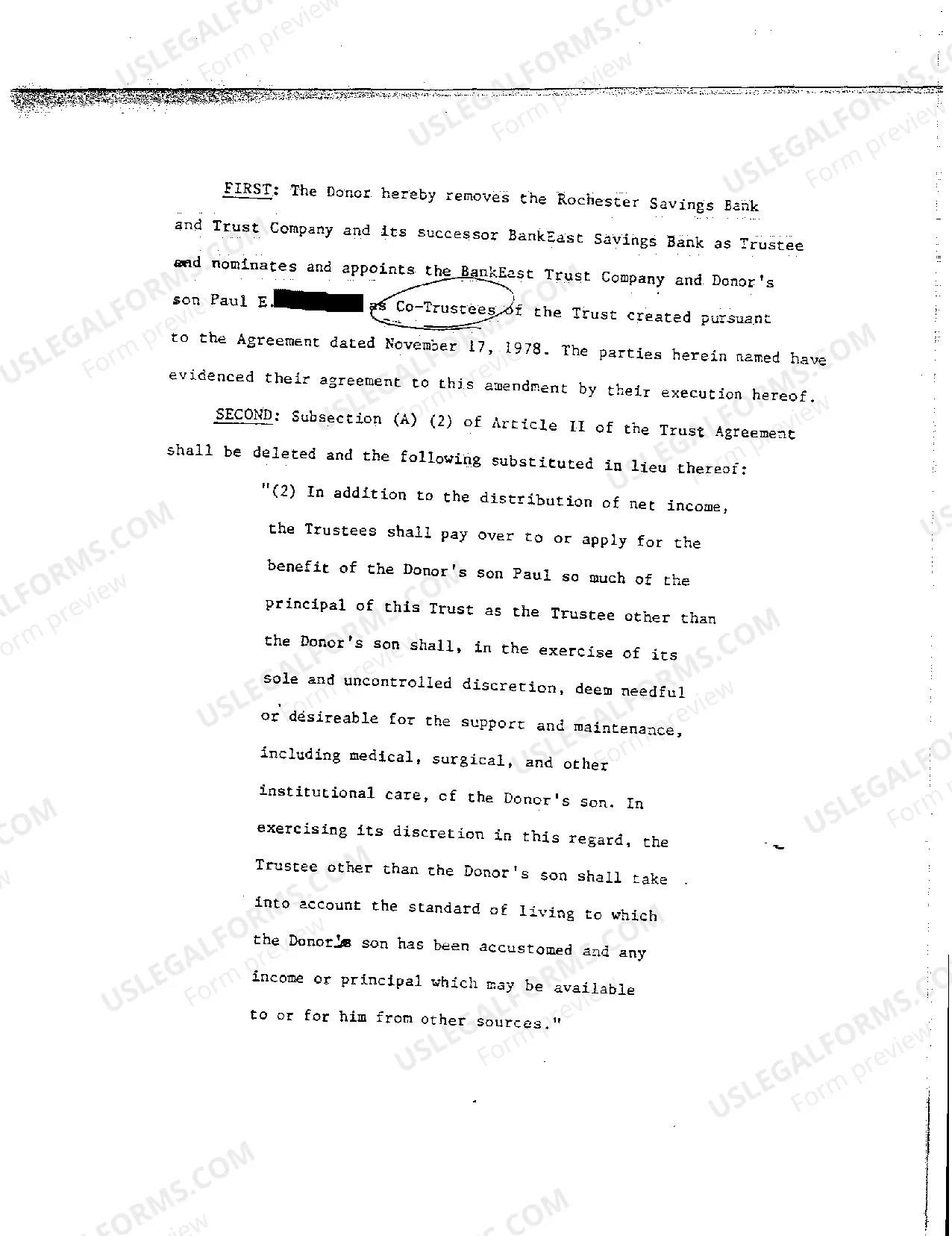

Successor trustees have to willingly accept their role usually by signing a consent to serve or affidavit of appointment. If an existing trustee wishes to change their successor trustee, they must make an actual amendment to the trust. Most courts won't accept informal, self-made changes.

If you're asked to be a trustee If someone asks you to be a trustee, it usually means they trust you to do the right thing for them and the people who benefit from the trust.You must agree with all of the other trustees when making trust decisions.

Once you follow that directive, the Trustee must step down and a successor Trustee can be appointed.Once a Trustee resigns, then either the next person named would act, or maybe you can appoint someone new if the Trust terms allow you to do that. Either way, a new Trustee will be in office when a Trustee resigns.

Operational liabilities If the charity is not incorporated and cannot meet its obligations, the trustees are personally liable and the members of an association may be liable as the charity does not have its own separate legal personality.

Successor trustees are appointed in the trust document itself. The trustor will specify who they want to take over management of the trust if and when they can't do it themselves.

Can the Successor Trustee Be a Beneficiary of the Trust? It's perfectly legal to name a beneficiary of the trust (someone who will receive trust property after your death) as successor trustee. In fact, it's common.

When the grantor dies, the trust becomes irrevocable and management or distribution of the assets passes to a successor trustee. Most trusts name the successor trustee when the trust is established; however, if you need to change or add a successor trustee, you can do so by amending the document.

A person appointed as trustee does not have to accept the appointment. He or she can decline to serve, usually by written instrument. After appointment and acceptance, a trustee may resign, generally only by a written instrument. A trustee may also be removed according to the terms of the trust or by court action.