A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner

Description

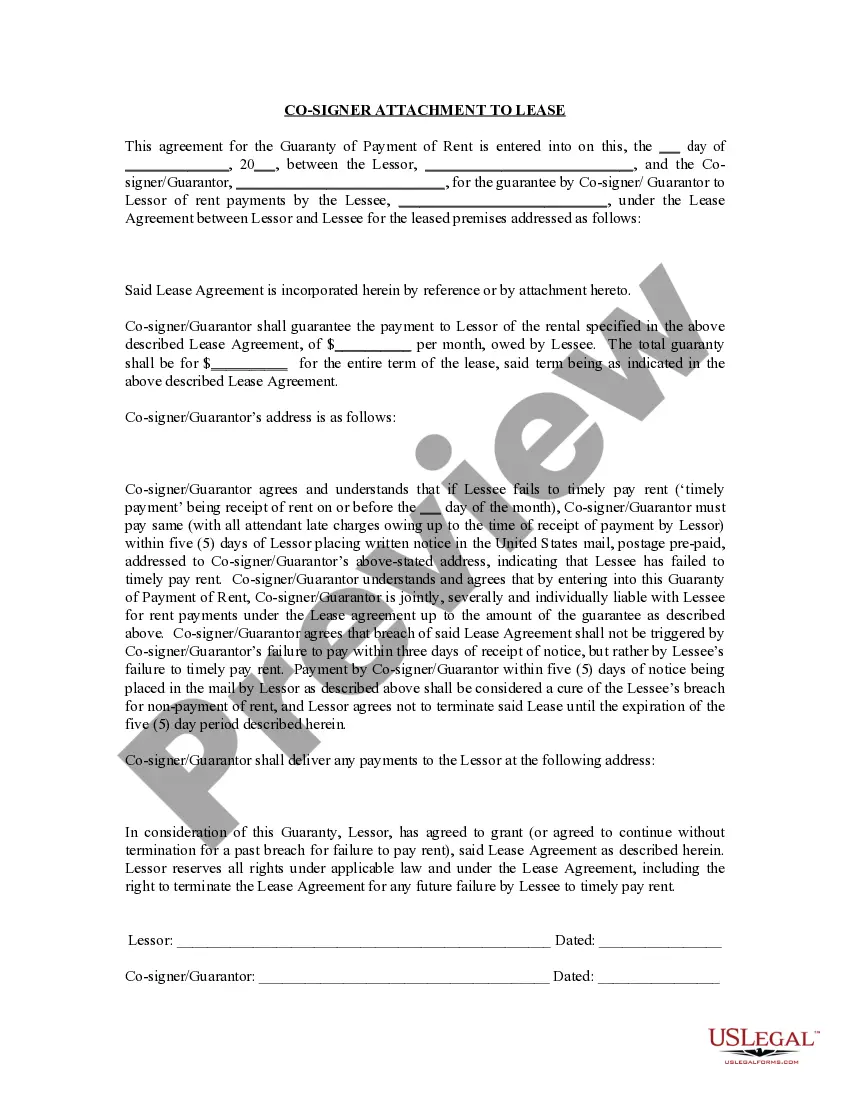

How to fill out New Hampshire Guaranty Attachment To Lease For Guarantor Or Cosigner?

Avoid expensive attorneys and find the New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner you want at a affordable price on the US Legal Forms website. Use our simple categories function to find and obtain legal and tax documents. Go through their descriptions and preview them before downloading. Moreover, US Legal Forms provides users with step-by-step tips on how to obtain and complete every single form.

US Legal Forms customers just have to log in and download the particular document they need to their My Forms tab. Those, who haven’t got a subscription yet must follow the tips below:

- Make sure the New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner is eligible for use in your state.

- If available, read the description and use the Preview option prior to downloading the sample.

- If you’re confident the template meets your needs, click on Buy Now.

- If the template is wrong, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

After downloading, you are able to complete the New Hampshire Guaranty Attachment to Lease for Guarantor or Cosigner manually or by using an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

When The Lease Is Up When having a guarantor on the lease, the best way to be able to have him removed as soon as possible is to set a good payment record with the landlord.

A co-signer, on the other hand, will usually have their name on the title of the home or automobile. Guarantors are usually liable for default only when the lender has done everything possible to get the primary borrower to make the payments.

A Guarantor Agreement Form is a written document that defines the terms and conditions in the event a tenant or buyer is not able to fulfill the payment on time.The obligations of a guarantor include paying the rent on time and avoiding doing damage to the property.

The guarantor covenanted under the lease that the tenant would pay the rent and sums due under the lease and will observe the tenant's covenants. In the event of tenant default, the guarantor covenanted to make good to the landlord on demand all loss, damage, costs and expenses arising or incurred by the landlord.

Guarantors sign the lease and are responsible for the payments under the law, but they don't occupy the apartment nor are they entitled to occupy it.

A guarantor is another word for cosigner, and by definition, a guarantor is someone who guarantees to be legally responsible for paying the rent as stipulated by the lease, but only if the tenant cannot pay for one reason or another.

The cosigner, simply by signing on to the debt, is liable for the debt without the creditor needing to to take any additional actions. The guarantor is only liable for the debt after the creditor has exhausted all other options of collections from the original borrower.

Co-signers have equal responsibility for payment of monthly rental costs, while a guarantor is generally sought for payment only when the primary signer is unable to make the rental payment.

The Basics: A Co-signor is part owner of the property, may or may not live in the property and is responsible for the debt repayment. A Guarantor is responsible for the debt repayment if the borrower (applicant) is unable to pay but has no benefits of owning any part of the property.