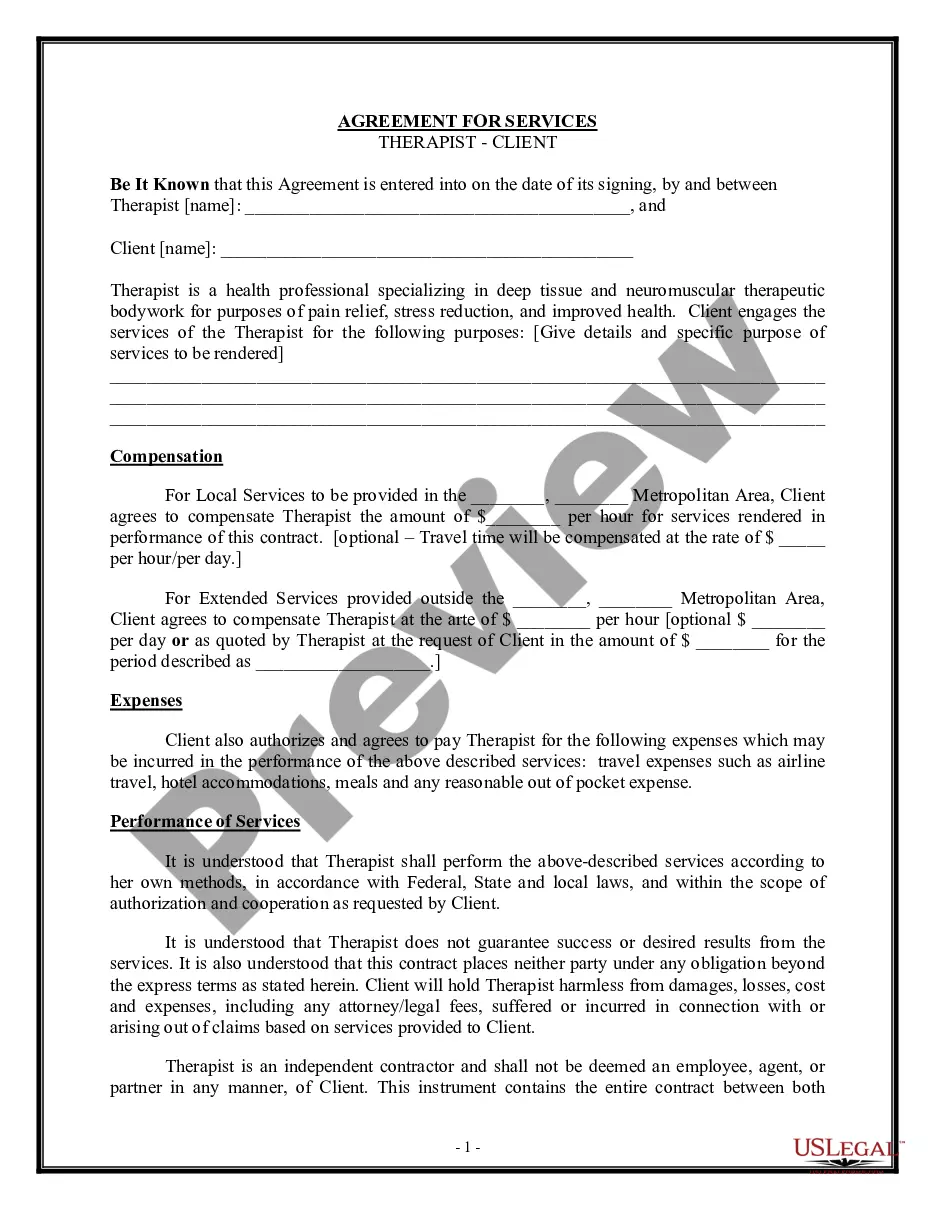

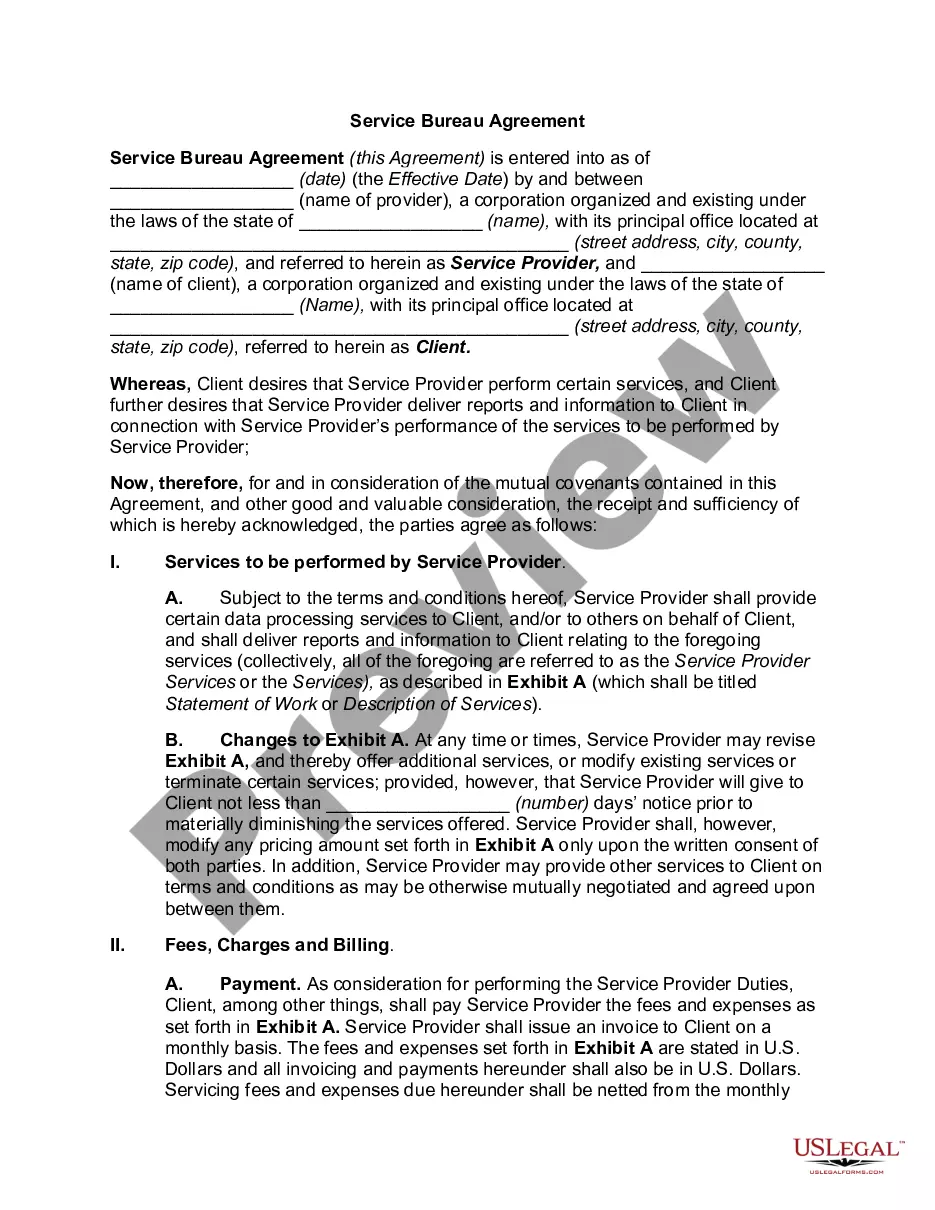

This office lease provision states that Base Rent shall be $25.50 per rentable square foot. During the Renewal Term, Base Rent shall be increased by the change, if any, in the Consumer Price Index. In no event will the Renewal Rental Rate be less than the Base Rent.

Nebraska Provision Calculating the Rent Increase

Description

How to fill out Provision Calculating The Rent Increase?

It is possible to commit time on-line trying to find the legal record format which fits the federal and state needs you want. US Legal Forms gives thousands of legal kinds which are evaluated by specialists. It is simple to download or print the Nebraska Provision Calculating the Rent Increase from my assistance.

If you currently have a US Legal Forms profile, you are able to log in and click the Down load option. Next, you are able to full, edit, print, or indicator the Nebraska Provision Calculating the Rent Increase. Every single legal record format you acquire is your own property forever. To acquire yet another duplicate of the purchased type, visit the My Forms tab and click the related option.

If you work with the US Legal Forms website the first time, follow the basic recommendations listed below:

- Very first, be sure that you have chosen the proper record format for your county/city of your choosing. See the type outline to ensure you have picked the proper type. If available, use the Review option to search with the record format at the same time.

- If you want to get yet another version from the type, use the Search area to find the format that suits you and needs.

- Upon having found the format you would like, just click Purchase now to continue.

- Select the rates plan you would like, enter your qualifications, and register for a merchant account on US Legal Forms.

- Total the deal. You may use your bank card or PayPal profile to fund the legal type.

- Select the format from the record and download it for your device.

- Make adjustments for your record if possible. It is possible to full, edit and indicator and print Nebraska Provision Calculating the Rent Increase.

Down load and print thousands of record layouts using the US Legal Forms site, which provides the largest selection of legal kinds. Use skilled and condition-certain layouts to tackle your company or person needs.

Form popularity

FAQ

Your landlord cannot increase your rent during the initial term of the rental agreement. After a year-long rental agreement ends, it is common for the agreement to become a month-to- month rental agreement.

(2) If rent is unpaid when due and the tenant fails to pay rent within seven calendar days after written notice by the landlord of nonpayment and his or her intention to terminate the rental agreement if the rent is not paid within that period of time, the landlord may terminate the rental agreement.

Nebraska state does not have rent control laws but does allow its cities and towns to create their own rent control laws. In areas without rent control, landlords can charge any amount of rent and increase rent as often as they like.

Rent ? Nebraska has no legal maximum for what a landlord may charge for rent. There is also no limit on the amount a landlord may raise the rent, and they are not required to give any notice.

Keep the property in a safe and habitable condition. keep common areas safe and clean. maintain electrical, plumbing, heating, ventilation and appliances supplied by the landlord. provide running water, reasonable amounts of hot water and reasonable heat.

(2) The landlord may enter the dwelling unit without consent of the tenant in case of emergency. (b) Enter only at reasonable times. (4) The landlord has no other right of access except by court order, as permitted by subsection (2) of section 76-1432, or if the tenant has abandoned or surrendered the premises.

Nebraska landlords may charge whatever they deem reasonable as a late fee, as long as it is included in the lease agreement. Repairs ? Landlords must make essential repairs within 14 days. If they fail to make the repairs, the tenant may withhold rent.

That percentage difference is determined by multiplying the original rent by the amount of the increase and then adding the dollar different to the original rent. The steps: Convert the percentage figure (3.1%) into a decimal by dividing it by 100. Example: 3.1 / 100 = .