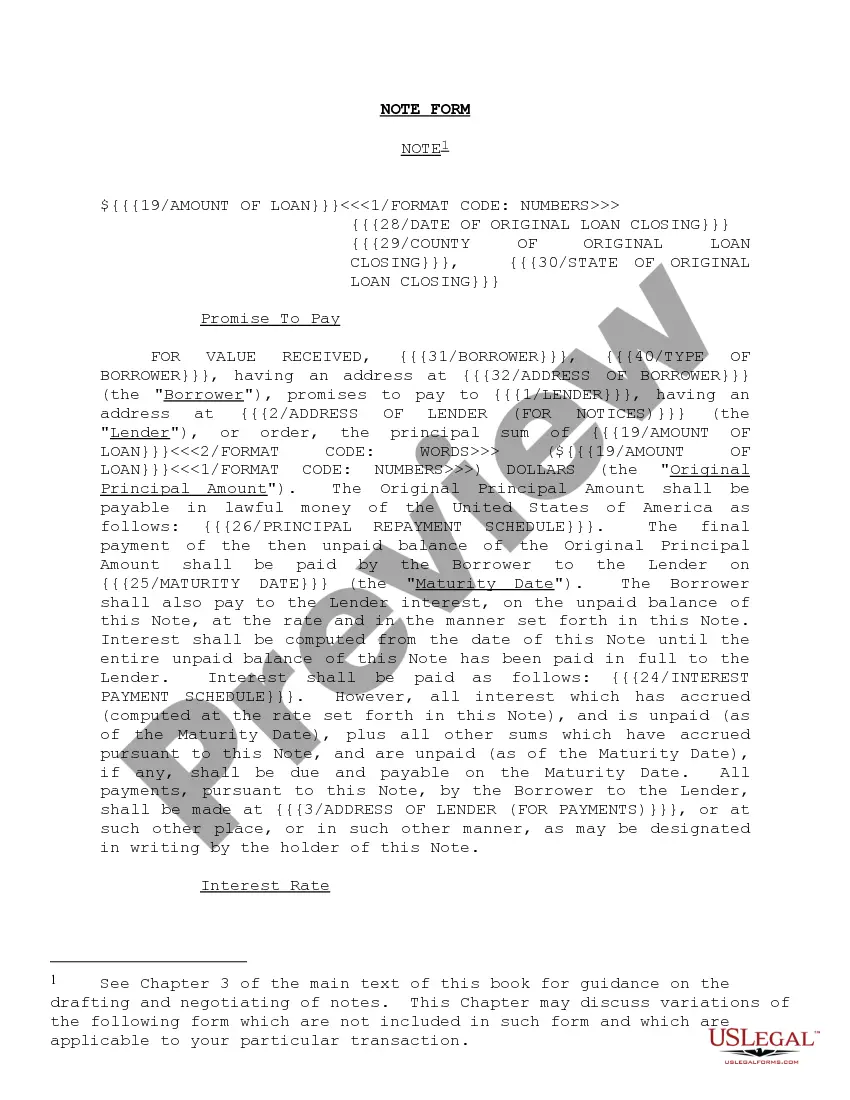

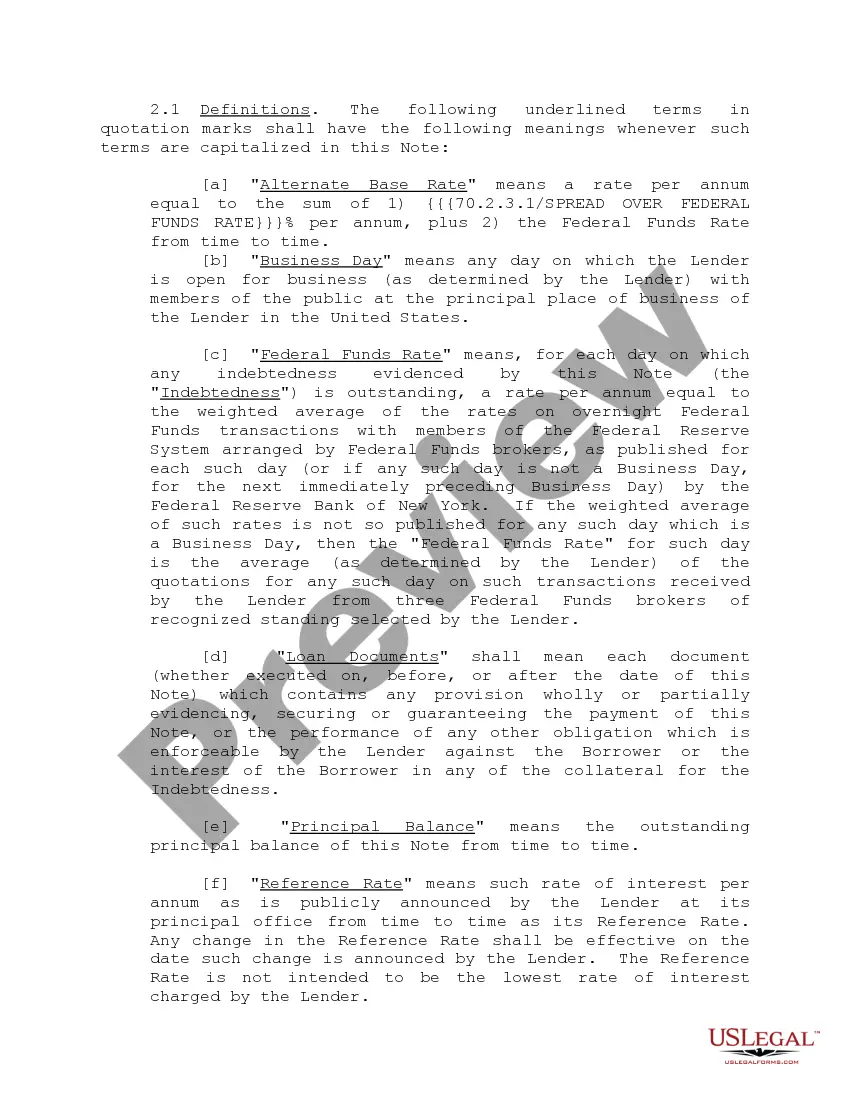

"Note Form and Variations" is a American Lawyer Media form. This form is for your note payments with different variations.

Nebraska Note Form and Variations

Description

How to fill out Note Form And Variations?

Have you been inside a position the place you will need files for both enterprise or specific functions almost every day? There are tons of legal papers themes available online, but finding types you can trust isn`t effortless. US Legal Forms provides a huge number of type themes, like the Nebraska Note Form and Variations, that are published in order to meet state and federal specifications.

When you are presently familiar with US Legal Forms web site and also have an account, just log in. Afterward, you may obtain the Nebraska Note Form and Variations template.

Should you not have an account and need to begin to use US Legal Forms, adopt these measures:

- Get the type you will need and ensure it is for the correct town/county.

- Use the Review button to review the shape.

- Look at the explanation to actually have selected the appropriate type.

- If the type isn`t what you`re trying to find, take advantage of the Search field to find the type that suits you and specifications.

- If you get the correct type, simply click Get now.

- Opt for the costs prepare you would like, fill in the desired information and facts to make your bank account, and pay for the order with your PayPal or Visa or Mastercard.

- Pick a convenient file format and obtain your duplicate.

Find every one of the papers themes you have bought in the My Forms food selection. You can get a extra duplicate of Nebraska Note Form and Variations at any time, if needed. Just select the essential type to obtain or produce the papers template.

Use US Legal Forms, one of the most extensive variety of legal types, to save lots of some time and stay away from faults. The services provides expertly made legal papers themes that you can use for a selection of functions. Produce an account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

Claiming more allowances will lower the amount of income tax that's taken out of your check. Conversely, if the total number of allowances you're claiming is zero, that means you'll have the most income tax withheld from your take-home pay.

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

Just divide the amount you usually pay in federal taxes by the number of paychecks you receive in a year to find out how much extra should be withheld each pay period.

If too much money is withheld throughout the year, you'll receive a tax refund. If too little is withheld, you'll probably owe money to the IRS when you file your tax return. Withholding tax is typically made up of federal, state, local and FICA taxes.

You can claim exemption from withholding only if both the following situations apply: For the prior year, you had a right to a refund of all federal income tax withheld because you had no tax liability. For the current year, you expect a refund of all federal income tax withheld because you expect to have no liability.

Will Changing Withholding Affect My Paycheck? Yes, changing your tax withholding will change your take-home pay amount, though your gross pay will not change. Increasing your tax withholding reduces your net paycheck amount, while decreasing your withholding increases it.