Nebraska Agreement for Sales of Data Processing Equipment

Description

How to fill out Agreement For Sales Of Data Processing Equipment?

Are you currently in the circumstance where you need documents for both business or personal reasons every day.

There are numerous legal document templates available online, but finding reliable ones is challenging.

US Legal Forms offers a vast array of form templates, including the Nebraska Agreement for Sale of Data Processing Equipment, which are designed to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nebraska Agreement for Sale of Data Processing Equipment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

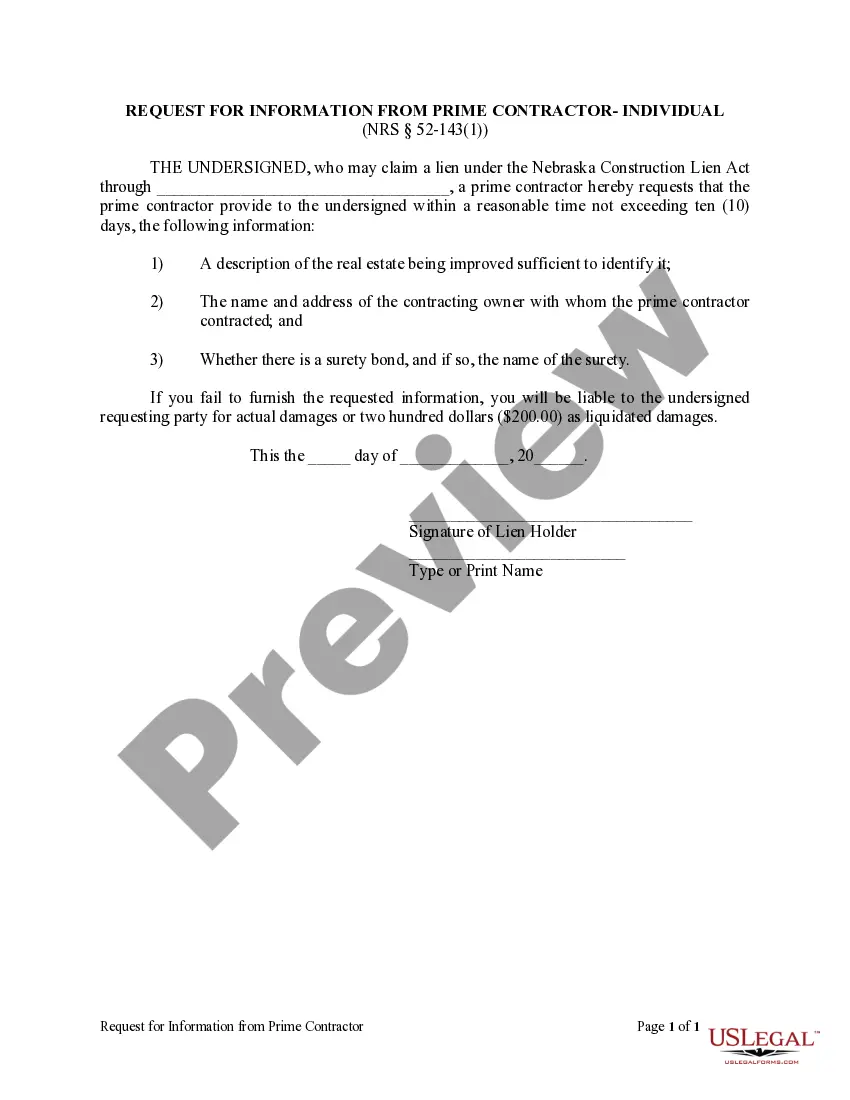

- Utilize the Preview button to review the form.

- Check the details to confirm that you have selected the correct document.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and specifications.

- Once you find the appropriate form, click Purchase now.

- Choose the pricing plan you prefer, fill in the required information to create your account, and pay for your order using PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents list. You can obtain an additional copy of the Nebraska Agreement for Sale of Data Processing Equipment anytime if necessary. Just select the required form to download or print the document template.

Form popularity

FAQ

In Nebraska, several categories of items are exempt from sales tax, including certain types of agricultural equipment and specific medical devices. Understanding these exemptions can aid businesses and consumers in making informed purchases, including when negotiating the Nebraska Agreement for Sales of Data Processing Equipment. For those curious about additional exemptions, consider exploring resources on platforms like USLegalForms to uncover what applies to your situation.

In Nebraska, a Form 6 is used for exemption claims related to sales tax on specific transactions. Businesses may use this form to assert that certain items, including data processing equipment, qualify for tax exemptions under state law. Understanding how to properly complete this form can actually streamline your business dealings, especially when executing the Nebraska Agreement for Sales of Data Processing Equipment. It's beneficial to seek guidance if needed.

To accurately fill out Nebraska Form 13, start by entering your name and address, followed by the details of the property in question. Be prepared to submit proof of your eligibility for credits or exemptions that apply to your situation. This process can be essential for those engaged in the Nebraska Agreement for Sales of Data Processing Equipment, as accurate reporting is key for tax assessments. Utilize guides available through USLegalForms for additional support.

Filling out Nebraska Form 13 requires providing specific information, including your personal details, property information, and tax valuation. The form helps ensure you receive accurate assessments relevant to your financial activities, such as the Nebraska Agreement for Sales of Data Processing Equipment. It's advisable to consult official resources or services like USLegalForms to ensure correct completion of the form.

To qualify for the Nebraska homestead exemption, you must be a homeowner and meet age, disability, or income requirements. The exemption helps reduce property taxes, making it easier for you to manage your finances. If you’re involved with the Nebraska Agreement for Sales of Data Processing Equipment, understanding this exemption could benefit your overall financial planning. Ensure you gather the necessary documents to apply.

The Nebraska property tax credit is available to homeowners and certain renters who meet specific income qualifications. Generally, you must demonstrate financial need through income thresholds set by the state. This can be especially relevant when considering agreements like the Nebraska Agreement for Sales of Data Processing Equipment, as property holdings may influence operational costs. Explore this credit to alleviate some financial burdens.

The universal opt-out mechanism in Nebraska allows consumers to opt-out of certain data processing practices. This includes provisions related to the Nebraska Agreement for Sales of Data Processing Equipment, ensuring that personal data is not used without consent. This mechanism aims to protect individual privacy while providing transparency in data handling. Ensuring compliance with this mechanism through legal forms from uslegalforms helps streamline the process for businesses and consumers alike.

In Nebraska, a verbal agreement can be binding, but certain types of contracts must be in writing to be enforceable. Specifically, the Nebraska Agreement for Sales of Data Processing Equipment should be documented to ensure clarity and prevent misunderstandings. Verbal agreements may lead to disputes, so it’s wise to have a clear, written record. Using uslegalforms, you can create a solid written agreement that meets Nebraska's legal requirements.