Nebraska Self-Employed Plumbing Services Contract

Description

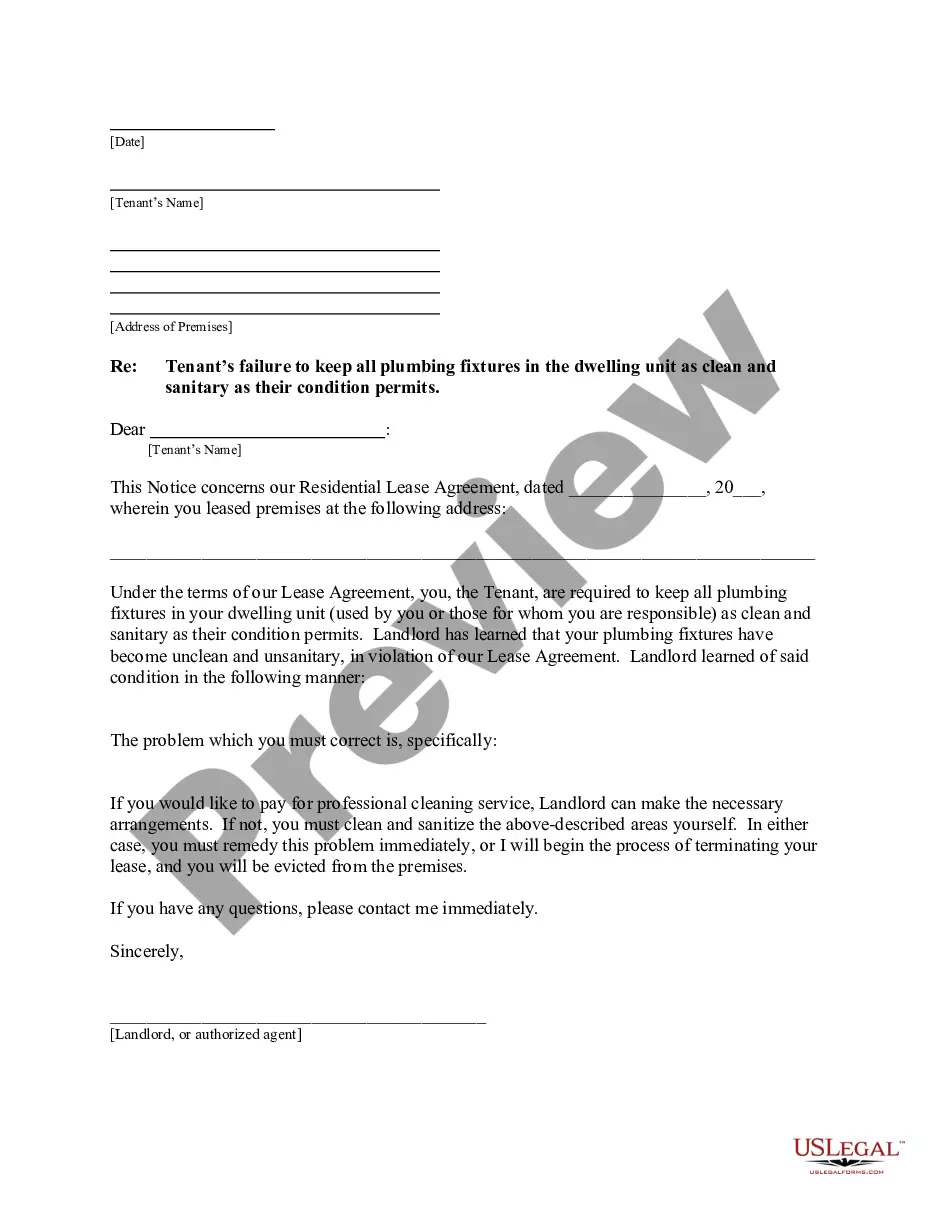

How to fill out Self-Employed Plumbing Services Contract?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest forms like the Nebraska Self-Employed Plumbing Services Contract in just minutes.

If you already have a membership, Log In and retrieve the Nebraska Self-Employed Plumbing Services Contract from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Every template you purchase has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

Access the Nebraska Self-Employed Plumbing Services Contract with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct form for your city/county. Click the Preview button to review the form’s content. Check the form summary to make sure you have chosen the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are happy with the form, confirm your choice by clicking the Buy now button. Then, select your preferred pricing plan and enter your information to create an account.

- Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Choose the file format and download the form to your device.

- Make modifications. Fill out, edit, print, and sign the downloaded Nebraska Self-Employed Plumbing Services Contract.

Form popularity

FAQ

Yes, plumbing work in Nebraska is often subject to sales tax, especially when it involves the sale of materials or tangible personal property. Service providers should ensure they understand which aspects of their work are taxable. Utilizing a Nebraska Self-Employed Plumbing Services Contract can help you outline these details and stay compliant with state tax laws.

In Nebraska, subcontractors generally do not require a contractor's license if they are working under a licensed general contractor. However, they must comply with local regulations and may need specific permits for their work. It’s important to clarify these details in your Nebraska Self-Employed Plumbing Services Contract to avoid any compliance issues.

An Option 3 contractor in Nebraska refers to a specific type of contractor who is licensed and meets certain criteria set by the state. These contractors can perform various construction and plumbing tasks without needing additional permits. Understanding this classification can help you navigate your obligations under a Nebraska Self-Employed Plumbing Services Contract.

Certain services are exempt from sales tax in Nebraska, including specific professional services and personal services. For instance, services that do not involve tangible goods may not fall under taxable categories. Familiarizing yourself with these exemptions can help you structure your Nebraska Self-Employed Plumbing Services Contract efficiently.

In Nebraska, the taxation of labor can vary based on the type of service provided. Generally, labor related to installation, maintenance, or repair of tangible personal property, such as plumbing systems, may be taxable. It’s essential to understand these specifics to accurately reflect your services in your Nebraska Self-Employed Plumbing Services Contract and invoices.

To establish yourself as an independent contractor, begin by defining your services and target market. Create a business plan and obtain the necessary licenses or permits for plumbing services in Nebraska. Building a professional presence through a Nebraska Self-Employed Plumbing Services Contract can help you attract clients. This contract not only outlines your services but also sets clear expectations for your clients, enhancing your credibility.

Choosing between an LLC and being an independent contractor depends on your business goals. An LLC can provide liability protection and potential tax benefits, while being an independent contractor offers simplicity in management. If you decide to form an LLC, consider drafting a Nebraska Self-Employed Plumbing Services Contract to ensure all terms are legally binding. This can provide peace of mind as you grow your plumbing services.

Operating as a contractor without a license in Nebraska is not advisable. Most cities and counties require a license to perform plumbing work legally. Working without a license could lead to fines and legal issues, jeopardizing your business. To protect yourself and your clients, securing a license and using a Nebraska Self-Employed Plumbing Services Contract is essential.

To become an independent contractor in Nebraska, start by registering your business with the state. You will need to obtain any necessary licenses and permits relevant to plumbing services. After setting up your business structure, consider drafting a Nebraska Self-Employed Plumbing Services Contract to outline your terms of service. This contract provides clarity for both you and your clients, ensuring a smooth working relationship.

Yes, Nebraska requires a contractor license for individuals offering plumbing services. To legally operate as a plumber, you must obtain the appropriate licensing from the state. This ensures that all plumbing services adhere to safety regulations and industry standards. If you are looking to establish yourself through a Nebraska Self-Employed Plumbing Services Contract, securing your license is a crucial step.