Nebraska Self-Employed Window Washer Services Contract

Description

How to fill out Self-Employed Window Washer Services Contract?

Are you in a situation where you require documents for various organizational or personal tasks almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Nebraska Self-Employed Window Washer Services Contract, which are crafted to comply with state and federal requirements.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Nebraska Self-Employed Window Washer Services Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

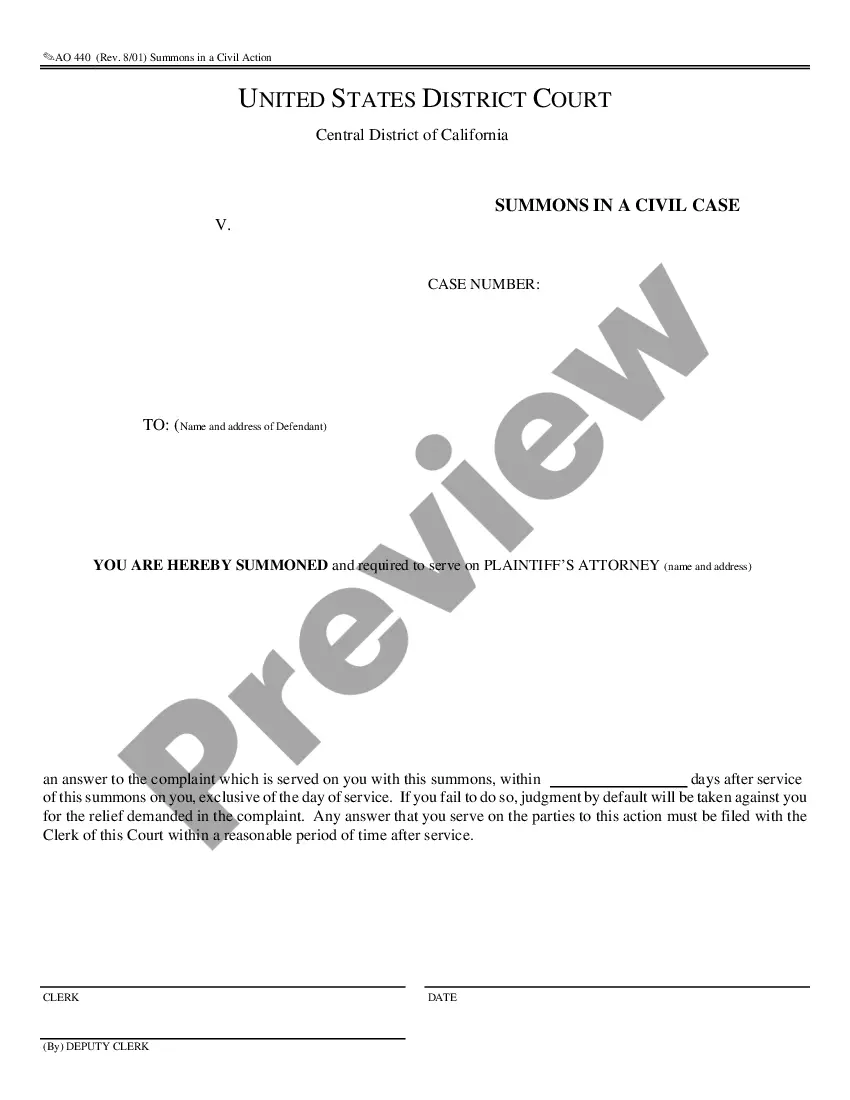

- Use the Preview button to examine the form.

- Read the description to confirm you have selected the right form.

- If the form isn’t what you’re looking for, use the Search field to find a form that meets your criteria.

- Once you find the appropriate form, click Get now.

Form popularity

FAQ

Writing a contract for cleaning services, such as a Nebraska Self-Employed Window Washer Services Contract, involves a few key steps. Start by including the parties involved, the scope of services, and payment terms. You should also define the duration of the contract and any conditions for termination. Using platforms like US Legal Forms can simplify this process by providing templates to ensure legal compliance and clarity.

To obtain a contract for your cleaning business, begin by targeting your ideal clients and understanding their needs. Crafting a tailored Nebraska Self-Employed Window Washer Services Contract can set you apart from competitors. Utilize online resources or platforms that specialize in connecting service providers with clients. Following up with potential clients shows determination and could increase your chances of success.

To land your first commercial cleaning contract, start by building a strong portfolio that showcases your work. Leverage online platforms or community bulletin boards to advertise your Nebraska Self-Employed Window Washer Services Contract. Word-of-mouth referrals can also play a pivotal role in gaining trust. Joining local business groups may provide valuable connections and leads.

Becoming an independent contractor in Nebraska involves registering your business and obtaining any necessary licenses. Understand the requirements for your Nebraska Self-Employed Window Washer Services Contract, including insurance and liability coverage. Setting up an organization can simplify your operations and open doors for new opportunities. Always keep your business paperwork in order to maintain professionalism.

In Nebraska, you typically do not need a special contractor's license solely for window cleaning. However, if your services expand beyond cleaning, you may need to look into additional licensing. Always check local regulations to verify what requirements apply to your Nebraska Self-Employed Window Washer Services Contract. Compliance with local laws is essential for your business’s success.

To secure a commercial window cleaning contract, start by networking within your community and showcasing your skills. Create a compelling proposal that highlights the benefits of your Nebraska Self-Employed Window Washer Services Contract. Additionally, using platforms that connect service providers with businesses can help you find potential clients. Ensure your proposal speaks directly to their needs for effective results.

Contract law in Nebraska governs the agreements made between parties. It requires mutual consent and an understanding of the terms involved in the Nebraska Self-Employed Window Washer Services Contract. To be legally binding, a contract must also include consideration and a lawful purpose. Understanding these principles can help ensure your agreements, especially those for window washing services, are enforceable.

Writing a cleaning contract agreement involves several key elements like scope of work, payment terms, and duration of service. For window washers, a Nebraska Self-Employed Window Washer Services Contract should clearly define the services offered and other conditions. You can utilize templates available on platforms like U.S. Legal Forms to ensure that your contract is comprehensive and adheres to legal standards. This simplifies the process and protects both parties involved.

In Nebraska, various items and services qualify for sales tax exemption. This typically includes services that are personal in nature, such as window washing performed under certain conditions. Knowing these exemptions can be beneficial when drafting a Nebraska Self-Employed Window Washer Services Contract, as it will guide you on which services may not incur additional fees. For more detailed information, consider consulting a tax professional.

Including sales tax in your invoices is typically advisable for services subject to taxation. For self-employed window washers in Nebraska, it ensures that both you and the clients maintain clarity about service costs. When creating your Nebraska Self-Employed Window Washer Services Contract, clearly state whether tax will be included in your service charges. This avoids confusion and establishes transparent communication.