Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Cosmetologist Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal templates in the USA - provides a range of legal document formats that you can download or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents such as the Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor in just a few moments.

If you already have a subscription, Log In and download the Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will be visible on every document you view. You can access all previously saved forms in the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the document to your device. Edit. Fill out, modify, print, and sign the saved Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor. Each template you add to your account does not expire and is yours permanently. So, if you wish to download or create another copy, simply go to the My documents section and click on the form you need. Access the Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most extensive libraries of legal document formats. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are some simple steps to help you get started:

- Ensure you have selected the correct form for your location/region.

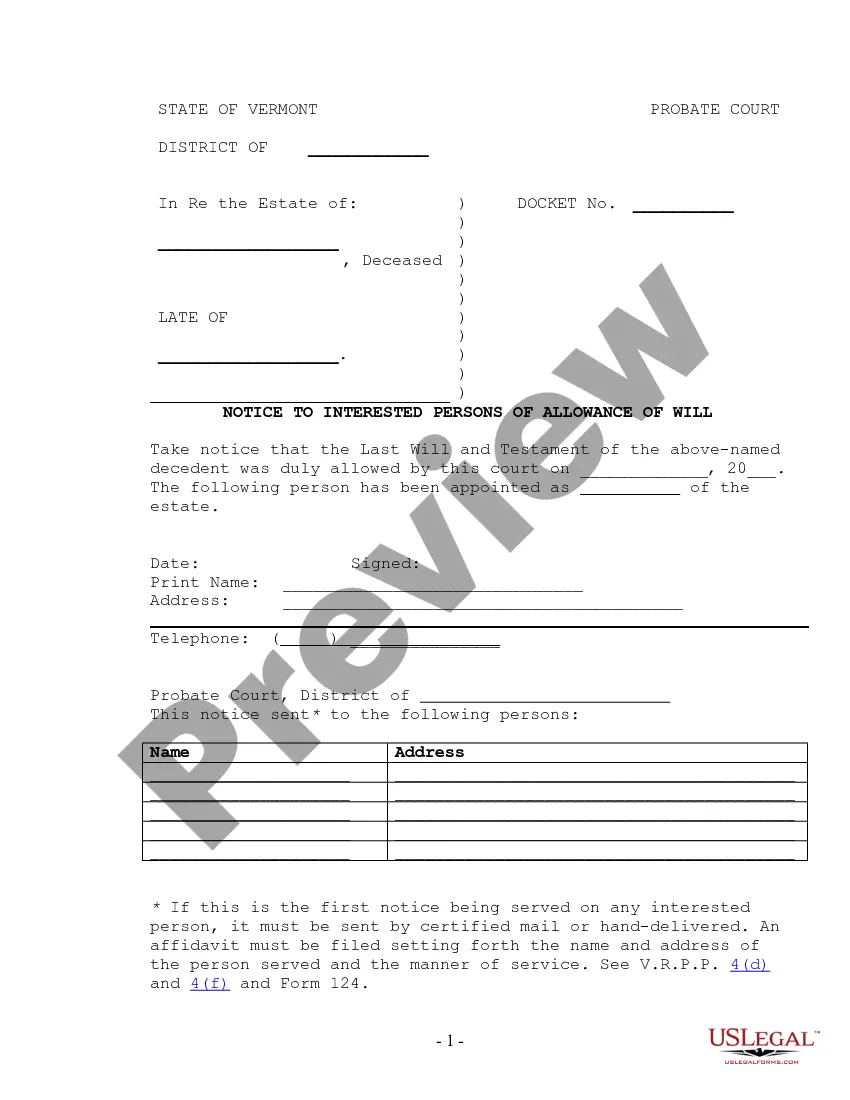

- Click the Preview button to review the content of the form.

- Check the form description to make sure you have chosen the right document.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

Form popularity

FAQ

Yes, receiving a 1099 form typically means you are considered self-employed. This form indicates you have earned income as an independent contractor, which aligns with the Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor. It's crucial to manage your financial records effectively, as you’ll need to report this income and handle any self-employment taxes that apply.

Both terms convey similar meanings, but 'self-employed' often indicates a broader range of business activities. When discussing your services under a Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor, using either term is appropriate depending on the context. It may be beneficial to use 'independent contractor' when discussing specific contractual relationships, as it implies a formal agreement between parties.

An independent contractor in cosmetology operates their business as a self-directed entity, providing beauty services without being an employee of a salon. This arrangement is often outlined in a Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor, which specifies service expectations, compensation, and operational independence. Such contractors enjoy the freedom to set their schedule and attract their clientele, enhancing their business potential.

A person qualifies as being self-employed when they conduct business independently and earn income through their own efforts. Under a Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor, you must not depend on an employer for a paycheck but generate your revenue from your services or products. Common indicators include filing a Schedule C tax form and receiving 1099 forms for the work completed.

Yes, an independent contractor counts as self-employed in the context of work and taxes. When operating under a Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor, individuals manage their business and receive payments directly for their services. This classification provides flexibility, but also comes with responsibilities like self-employment taxes and maintaining proper records.

To write an independent contractor agreement for a Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor, start by defining the parties involved and the nature of work. Include terms such as payment schedules, responsibilities, termination clauses, and any specific requirements for cosmetologists. It's essential to ensure clarity in roles and regulations to avoid disputes. Using platforms like uslegalforms can streamline this process by providing templates tailored to your needs.

Filing taxes as an independent contractor can be straightforward, especially if you maintain organized records throughout the year. While the process may feel daunting, understanding the necessary forms and requirements allows for a smoother experience. With resources and guidance, such as those offered by uslegalforms, you can simplify the filing process under your Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor.

Independent hairstylists typically file their taxes by first gathering all income and expense records. After organizing these documents, they fill out Form 1040 and Schedule C to report their earnings and claim applicable deductions. Utilizing platforms like uslegalforms can help streamline the process, ensuring you adhere to the requirements of a Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor.

Yes, independent contractors file as self-employed individuals. You will report your earnings and expenses using Schedule C alongside your 1040 tax form. This method is essential for hairstylists working under a Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor, as it enables you to deduct business expenses that can reduce your taxable income.

Hair stylists can show proof of income by providing several documents, such as client invoices, bank deposit slips, and 1099 forms received from clients. Ideally, you should maintain organized records of your earnings throughout the year, especially when operating under a Nebraska Cosmetologist Agreement - Self-Employed Independent Contractor. Having these documents on hand makes it easier to prove your income for loans or financial applications.