Nebraska Insulation Services Contract - Self-Employed

Description

How to fill out Insulation Services Contract - Self-Employed?

Are you in a location where you need paperwork for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust isn’t easy.

US Legal Forms provides thousands of form templates, including the Nebraska Insulation Services Contract - Self-Employed, which are designed to comply with federal and state requirements.

You can access all the document templates you’ve purchased in the My documents section.

You can always obtain an extra copy of the Nebraska Insulation Services Contract - Self-Employed as needed. Just click on the required form to download or print the template.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Nebraska Insulation Services Contract - Self-Employed template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

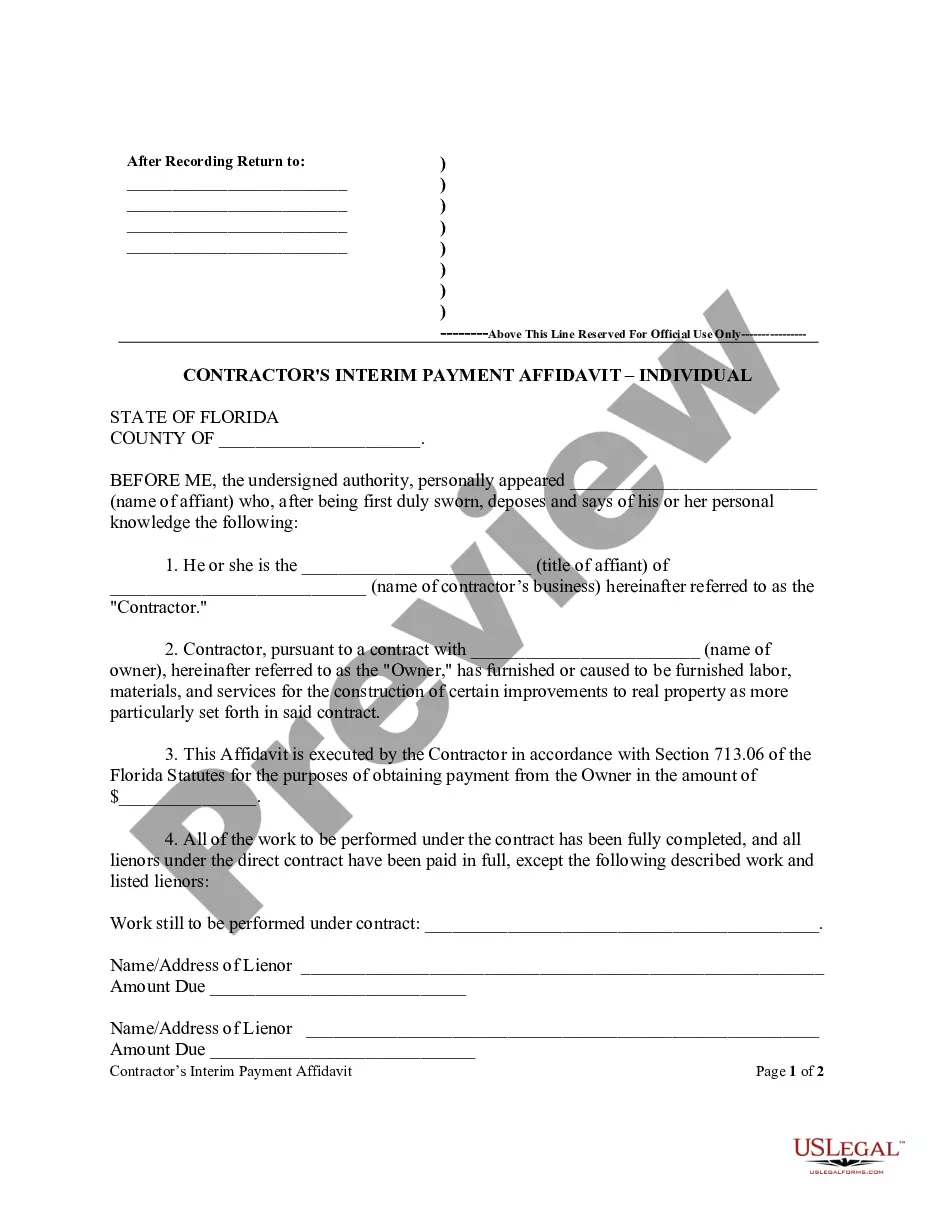

- Utilize the Preview option to review the document.

- Read the description to confirm that you’ve selected the correct form.

- If the form isn’t what you’re looking for, use the Search area to find the form that meets your needs and specifications.

- When you find the right form, click Get now.

- Select the pricing plan you want, complete the necessary information to create your account, and process the payment via PayPal or Visa/Mastercard.

- Choose a convenient format and download your copy.

Form popularity

FAQ

To qualify as an independent contractor, you need to meet specific criteria set by the IRS. Generally, you must have control over how you complete your work, provide your own tools, and work for multiple clients. The Nebraska Insulation Services Contract - Self-Employed can help clarify your role and ensure compliance with regulations. For assistance in navigating these requirements, consider using resources like uslegalforms to streamline the process.

Yes, having a Nebraska Insulation Services Contract - Self-Employed is essential for independent contractors. This contract helps outline the scope of work, payment terms, and other responsibilities between you and your clients. Without a contract, you risk misunderstandings and disputes, which can impact your business. Utilizing platforms like uslegalforms can help you create a solid contract that protects your interests.

Self-employed individuals in Nebraska are subject to the self-employment tax, which includes Social Security and Medicare taxes. For 2023, the self-employment tax rate remains at 15.3% on net earnings from self-employment. As someone engaging in a Nebraska Insulation Services Contract - Self-Employed, it's crucial to factor this tax when estimating income and expenses. Accessing resources and tools on platforms like uslegalforms can simplify managing your taxes and ensuring compliance.

In Nebraska, certain services are not subject to sales tax, providing relief for those operating under a Nebraska Insulation Services Contract - Self-Employed. For example, services related to manufacturing or repair work may fall into the non-taxable category. It’s important to carefully review the specific definitions and exemptions outlined by the Nebraska Department of Revenue. Understanding these nuances can help you maximize your services without incurring additional tax costs.

The new federal rule regarding independent contractors impacts how they can be classified, especially in the context of a Nebraska Insulation Services Contract - Self-Employed. This rule focuses on factors such as control and the nature of the work relationship. It aims to clarify and strengthen the standards for classifying workers, which may influence your contracting options. Keeping up with these changes is vital, and USLegalForms can provide tailored resources to help navigate these complexities.

Yes, you can work as a contractor without formally registering a company, especially under a Nebraska Insulation Services Contract - Self-Employed. This means you can operate as a sole proprietor and still complete insulation contracts. However, lacking a registered company might limit some benefits, like liability protection. You should understand the implications of this structure and ensure you meet all local regulations applicable to your work.

While it's not mandatory for a contractor to have an LLC when operating under a Nebraska Insulation Services Contract - Self-Employed, forming an LLC can provide significant benefits. An LLC can protect your personal assets from business liabilities and offer more credibility with clients. Additionally, it can simplify tax filings and compliance, making your business operations smoother. Establishing an LLC shows you are serious about your work and can attract more clients.

An option 3 contractor in Nebraska refers to a specific license classification that allows contractors to perform work without being required to show proof of experience or education in certain trades. This option provides flexibility for individuals looking to enter the contracting field. Connecting this classification with the Nebraska Insulation Services Contract - Self-Employed can clarify your available paths in the business.

Yes, Nebraska may require a contractor license depending on the services you offer and your location within the state. Certain specialized trades do have licensing requirements, while others may not. Be sure to check local regulations related to the Nebraska Insulation Services Contract - Self-Employed for specific guidance.

You are not required to have an LLC to work as a contractor; you can operate as a sole proprietorship. However, forming an LLC can provide you with personal liability protection and may simplify tax reporting. It's worthwhile to consider the Nebraska Insulation Services Contract - Self-Employed to explore the benefits of both structures.