Nebraska Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

Are you in the place the place you require paperwork for either business or personal purposes just about every day time? There are a lot of authorized papers themes available on the net, but locating kinds you can depend on is not effortless. US Legal Forms gives a huge number of form themes, just like the Nebraska Term Sheet - Series A Preferred Stock Financing of a Company, which are created to meet federal and state needs.

When you are presently informed about US Legal Forms site and have your account, merely log in. After that, you can obtain the Nebraska Term Sheet - Series A Preferred Stock Financing of a Company web template.

If you do not come with an profile and want to begin using US Legal Forms, follow these steps:

- Get the form you want and ensure it is for that proper area/region.

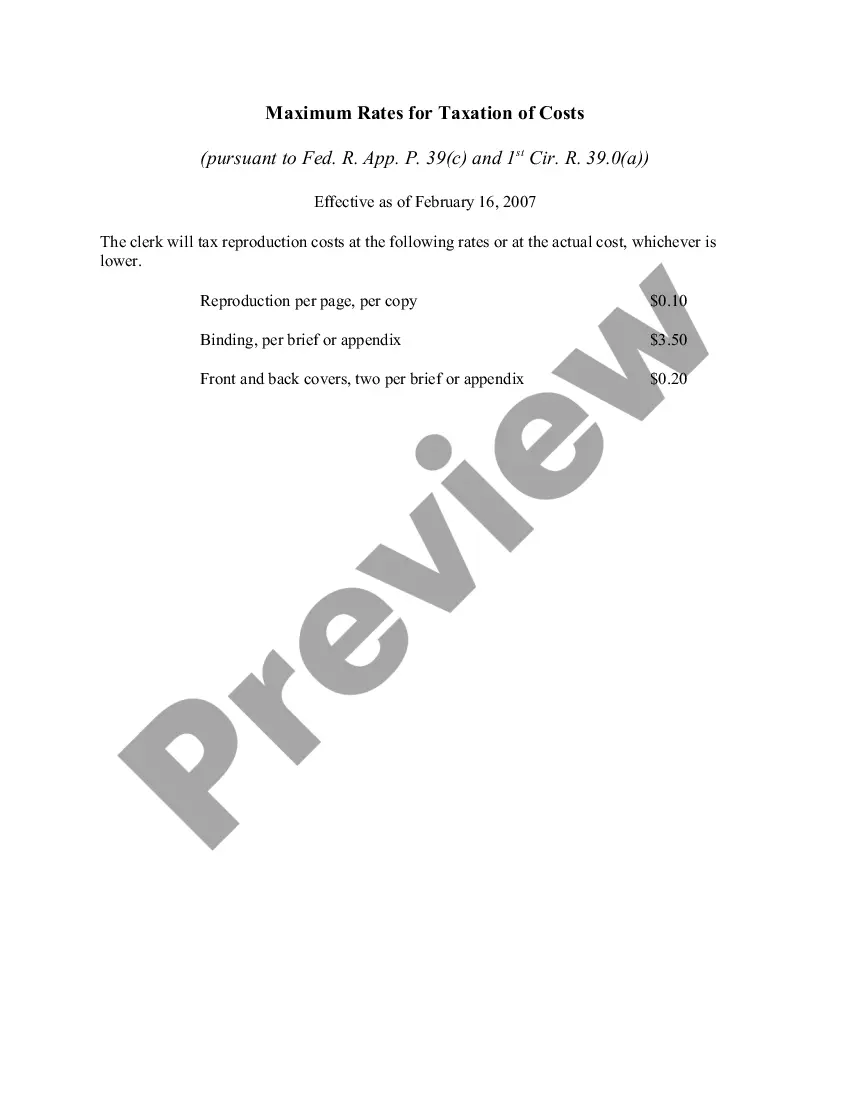

- Make use of the Review key to examine the form.

- Look at the information to actually have selected the right form.

- In case the form is not what you are searching for, take advantage of the Search field to obtain the form that suits you and needs.

- Once you get the proper form, simply click Purchase now.

- Select the costs strategy you want, submit the necessary info to make your money, and purchase an order using your PayPal or bank card.

- Pick a practical document formatting and obtain your copy.

Locate every one of the papers themes you have purchased in the My Forms menu. You can get a further copy of Nebraska Term Sheet - Series A Preferred Stock Financing of a Company whenever, if possible. Just click the required form to obtain or produce the papers web template.

Use US Legal Forms, probably the most considerable selection of authorized varieties, to save lots of some time and avoid faults. The assistance gives professionally made authorized papers themes which can be used for a selection of purposes. Produce your account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

No-Shop/Confidentiality Provision = Binding Everything in a term sheet can be broken down into two parts in terms of what's binding: a ?No-Shop?/confidentiality provision, and everything else. Most term sheets have a No-Shop/confidentiality provision.

Key elements of a VC term sheet Money raised. Your investor will likely require that you raise a minimum amount of money before they disburse their funds. ... Pre-money valuation. ... Non-participating liquidation preference. ... conversion to common. ... Anti-dilution provisions. ... The pay-to-play provision. ... Boardroom makeup. ... Dividends.

Keep your VC pitch short, easy to scan and packed with valuable information A clear explanation of the problem your product or service is solving. The size of your market and potential competitors. Growth models. Evidence that your team can pull it off.

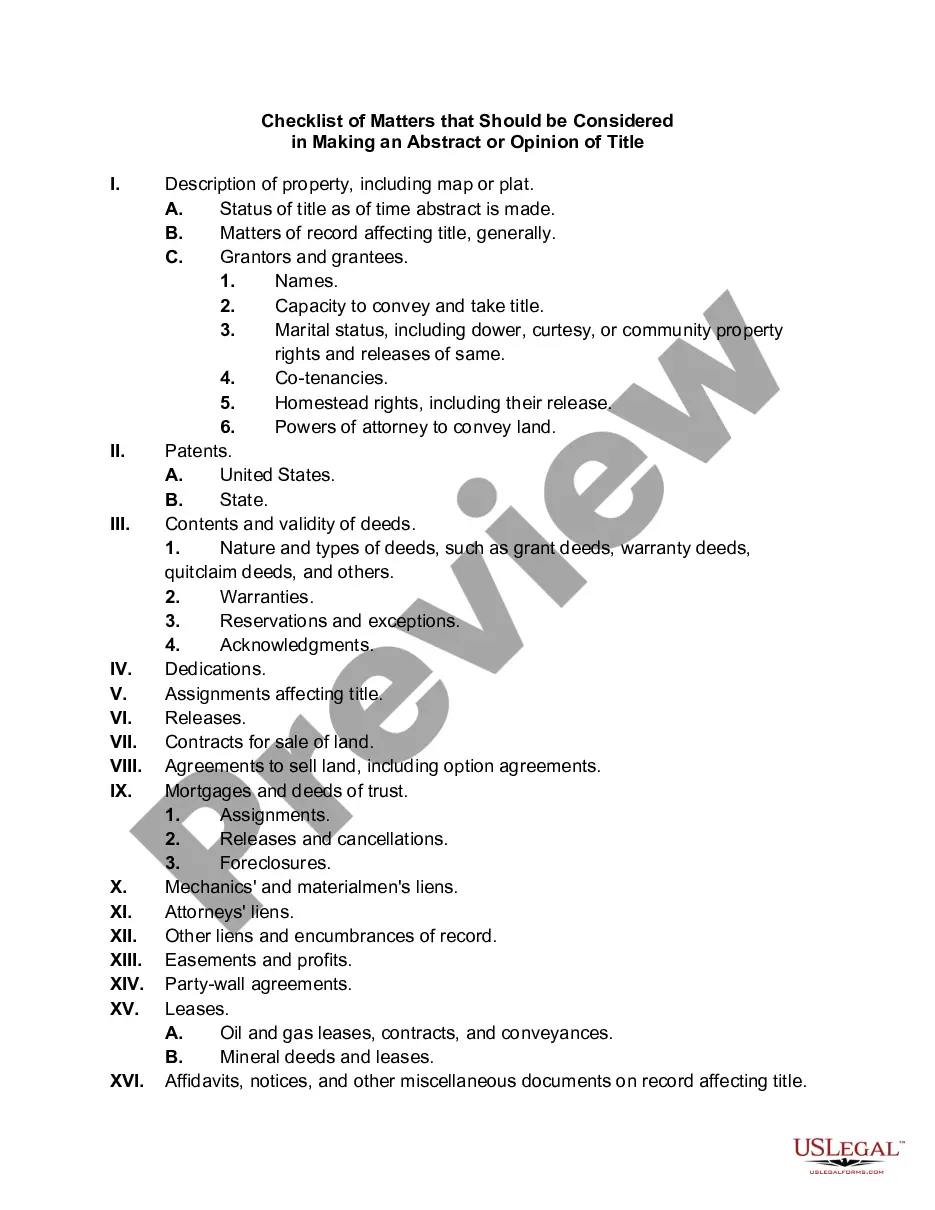

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

Founders who receive a term sheet need to understand, from a legal perspective, how to manage the process. Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.