Nebraska Option Agreement

Description

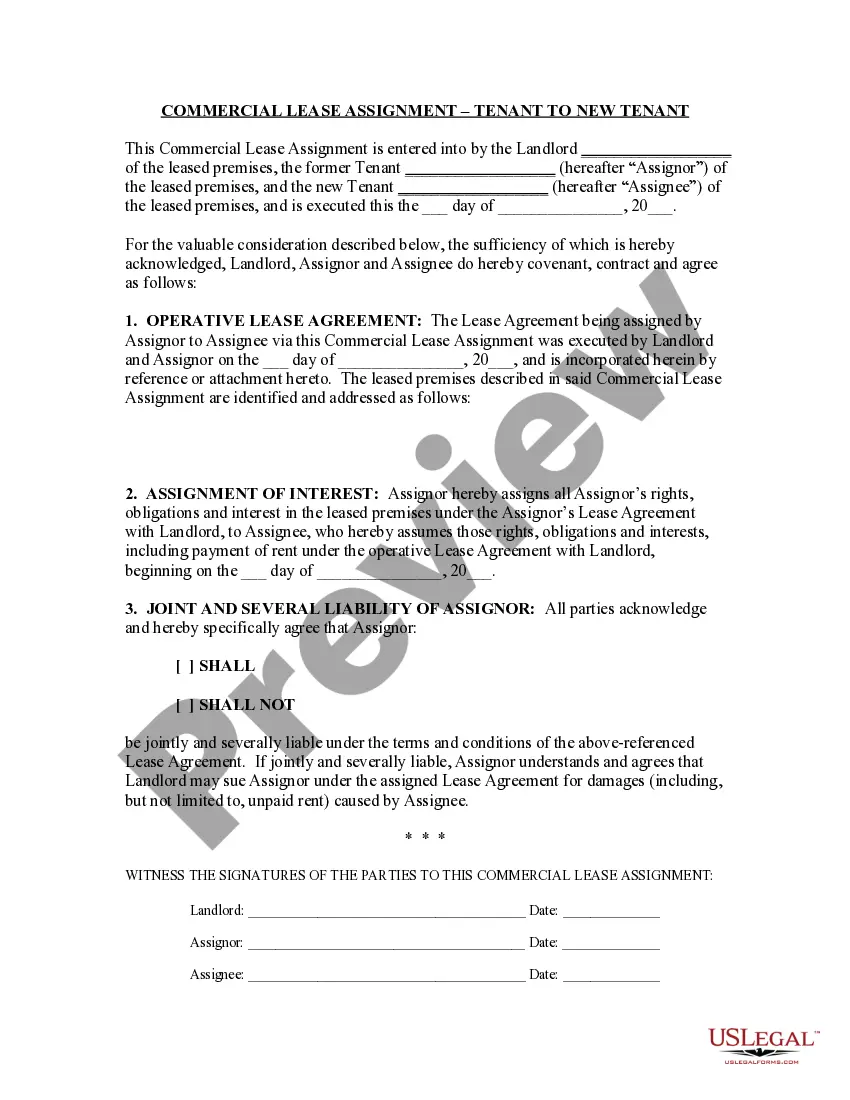

How to fill out Option Agreement?

Choosing the best legal record design can be quite a have a problem. Needless to say, there are plenty of layouts accessible on the Internet, but how do you find the legal develop you want? Use the US Legal Forms website. The assistance gives a huge number of layouts, like the Nebraska Option Agreement, which can be used for organization and private demands. All the varieties are examined by experts and satisfy federal and state demands.

In case you are presently listed, log in to your accounts and click the Down load option to get the Nebraska Option Agreement. Make use of your accounts to search throughout the legal varieties you may have acquired earlier. Proceed to the My Forms tab of your respective accounts and obtain yet another duplicate of your record you want.

In case you are a brand new user of US Legal Forms, here are simple recommendations that you can stick to:

- Very first, be sure you have chosen the proper develop for the town/region. You may look over the shape using the Preview option and read the shape outline to ensure this is basically the right one for you.

- If the develop does not satisfy your preferences, use the Seach area to discover the correct develop.

- When you are sure that the shape is acceptable, go through the Get now option to get the develop.

- Pick the prices program you would like and enter the needed info. Design your accounts and pay for your order with your PayPal accounts or charge card.

- Pick the document format and obtain the legal record design to your gadget.

- Total, change and print out and sign the acquired Nebraska Option Agreement.

US Legal Forms may be the largest catalogue of legal varieties in which you will find numerous record layouts. Use the company to obtain professionally-created papers that stick to state demands.

Form popularity

FAQ

The Nebraska Option Enrollment program gives families the opportunity to attend a public school in a district with which they do not reside in the boundaries of.

If the new building is built by an Option 1 contractor, sales tax will only be collected on the total amount charged for the annexed building materials, provided the labor charge is separately stated. If not separately stated, then the entire amount charged by the Option 1 contractor is taxable.

The Nebraska Contractor Registration Act requires contractors and subcontractors doing business in Nebraska to register with the Nebraska Department of Labor. While the registration is a requirement, it does not ensure quality of work or protect against fraud.

The Nebraska state sales and use tax rate is 5.5%. In addition, local sales and use taxes can be set at 0.5%, 1%, 1.5%, 1.75%, or 2%, as adopted by city or county governments. Are there county as well as city sales and use taxes in Nebraska?

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)Aircraft owned by an out-of-state resident or businessNoneLabor for items to be shipped out-of-stateNoneProperty purchased in other states to be used in another stateNoneProperty shipped out-of-stateNone3 more rows

Yes. You are required to collect sales tax on the total amount charged for the building materials. The charge for your contractor labor is not taxable, provided it is separately stated.

017.06D(1) Option 2 contractors are retailers for any sales of building materials or other property that is not annexed. Option 2 contractors must collect sales tax on the total amount charged unless the sale is otherwise exempt.

Option 1 contractors must remit use tax on all parts and materials purchased or withdrawn from inventory and used to repair the building or replace or repair the fixtures that are covered by the warranty or service agreement.