Nebraska Stock Option Agreement of Ichargeit.Com, Inc.

Description

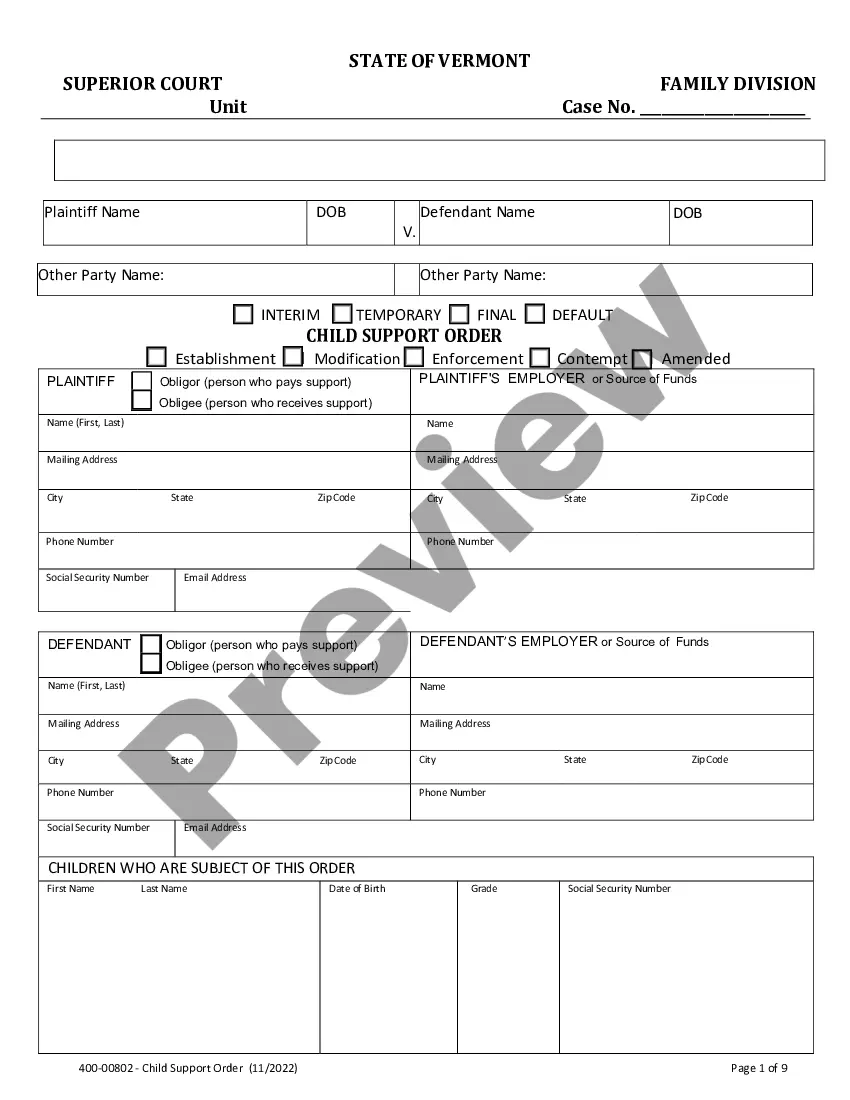

How to fill out Stock Option Agreement Of Ichargeit.Com, Inc.?

Are you within a situation in which you require papers for either company or individual functions just about every time? There are plenty of lawful document themes available online, but locating kinds you can trust is not straightforward. US Legal Forms provides a large number of develop themes, just like the Nebraska Stock Option Agreement of Ichargeit.Com, Inc., that happen to be created to meet state and federal needs.

If you are already familiar with US Legal Forms internet site and also have a free account, just log in. Following that, it is possible to down load the Nebraska Stock Option Agreement of Ichargeit.Com, Inc. format.

Should you not offer an accounts and need to begin to use US Legal Forms, abide by these steps:

- Get the develop you want and ensure it is for your proper metropolis/county.

- Utilize the Preview button to examine the shape.

- See the explanation to actually have selected the right develop.

- If the develop is not what you are searching for, utilize the Lookup discipline to find the develop that meets your requirements and needs.

- If you discover the proper develop, simply click Purchase now.

- Pick the prices plan you need, complete the necessary details to create your money, and pay for the transaction using your PayPal or credit card.

- Decide on a practical file formatting and down load your duplicate.

Find all of the document themes you might have purchased in the My Forms food selection. You may get a further duplicate of Nebraska Stock Option Agreement of Ichargeit.Com, Inc. whenever, if necessary. Just go through the necessary develop to down load or print the document format.

Use US Legal Forms, probably the most extensive variety of lawful varieties, to save lots of time and avoid faults. The support provides expertly created lawful document themes which can be used for a variety of functions. Produce a free account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

A stock option provides an employee with the opportunity to purchase a set number of shares of company stock at a certain price within a certain period of time. The price is called the ?grant price? or ?strike price.? This price is usually based on a discounted price of the stock at the time of hire.

For example, you may be granted the right to buy 1,000 shares, with the options vesting 25% per year over four years with a term of 10 years. So 25% of the ESOs, conferring the right to buy 250 shares would vest in one year from the option grant date, another 25% would vest two years from the grant date, and so on.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

This Amendment may be executed in counterparts, each of which when signed by the Company or Employee will be deemed an original and all of which together will be deemed the same agreement.

ESOP is an employee benefit plan that gives the employee the right to purchase a certain number of shares in the company at a pre-determined price (typically face value or a discounted market price) after a pre-determined period. However, a company cannot just grant options by issuing a simple letter to its employees.

An employee stock option agreement (sometimes known as a share option agreement) is a contract between an employer and employee that guarantees the employee's right to purchase stock in the employer's company at a specified price after a certain period of continuous employment.