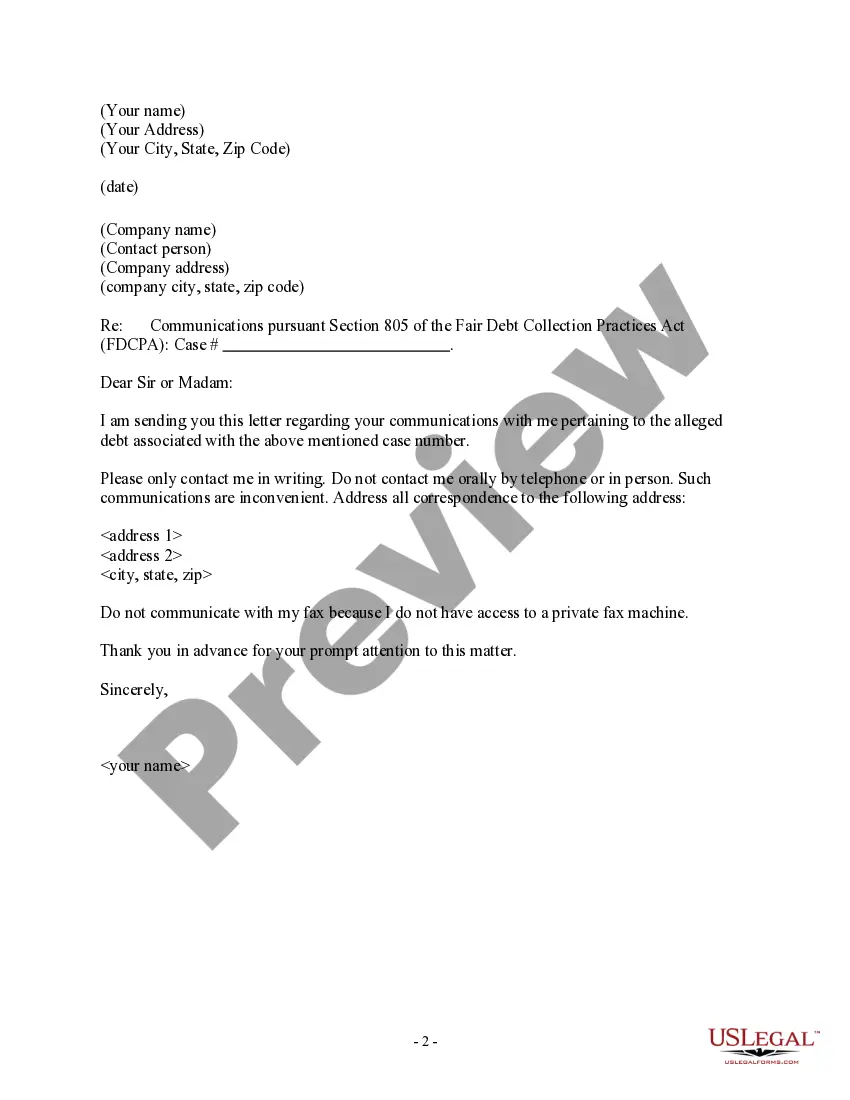

Nebraska Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

US Legal Forms - one of the largest collections of legal documents in the country - offers a diverse assortment of legal template documents that you can download or print.

By using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords.

You can find the latest versions of documents such as the Nebraska Letter to Debt Collector - Only Contact Me In Writing within seconds.

Read the form description to ensure you have chosen the right document.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you already hold a subscription, Log In and download the Nebraska Letter to Debt Collector - Only Contact Me In Writing from the US Legal Forms catalog.

- The Download button will appear on each form you view.

- You can access all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, follow these simple instructions to get started.

- Make sure you have selected the correct form for your area/state.

- Click the Preview button to review the form's contents.

Form popularity

FAQ

Old (Time-Barred) Debts In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

Steps to Respond to a Debt Collection Case in NebraskaCreate an Answer document.Respond to each allegation included in the Complaint.Put forth affirmative defenses.File a copy of your Answer with the court and serve the Plaintiff.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

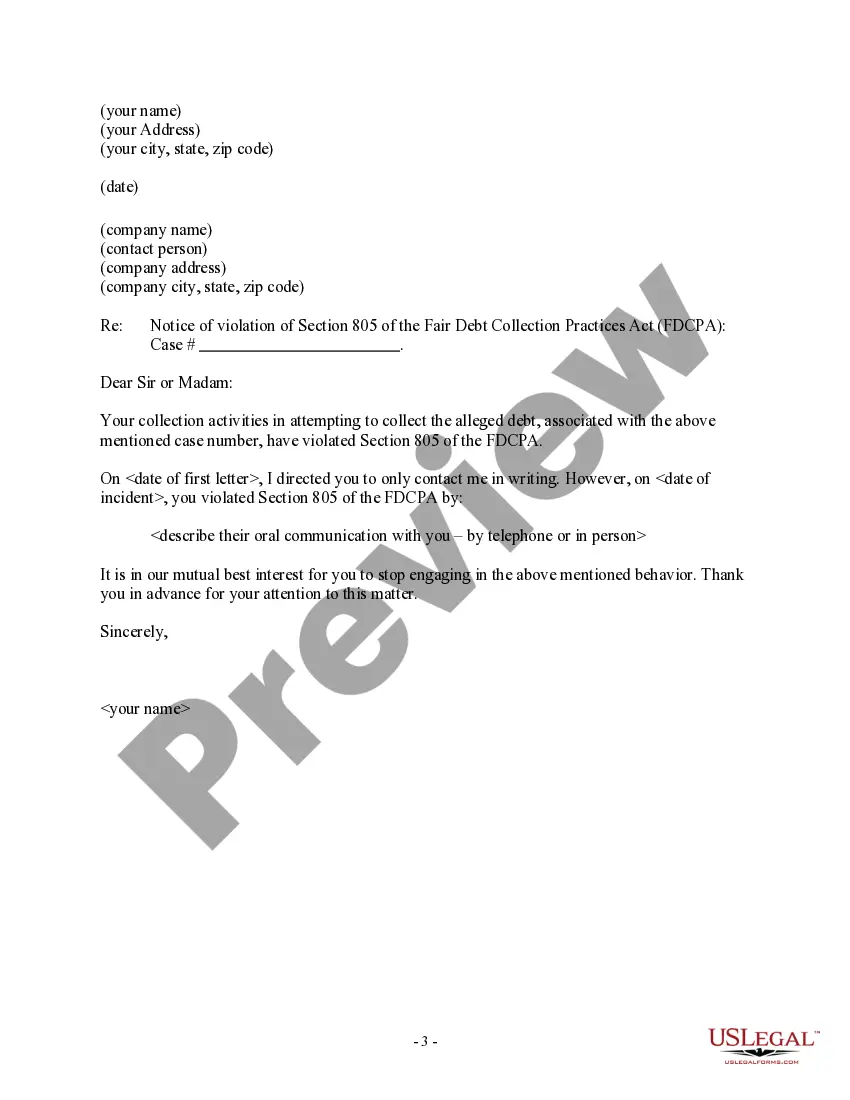

Once the collection company receives the letter, it must stop trying to collect the debt until sending you written verification of the debt, like a copy of the original bill for the amount you owe. Consider sending your letter by certified mail and requesting a return receipt to show that the collector got it.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

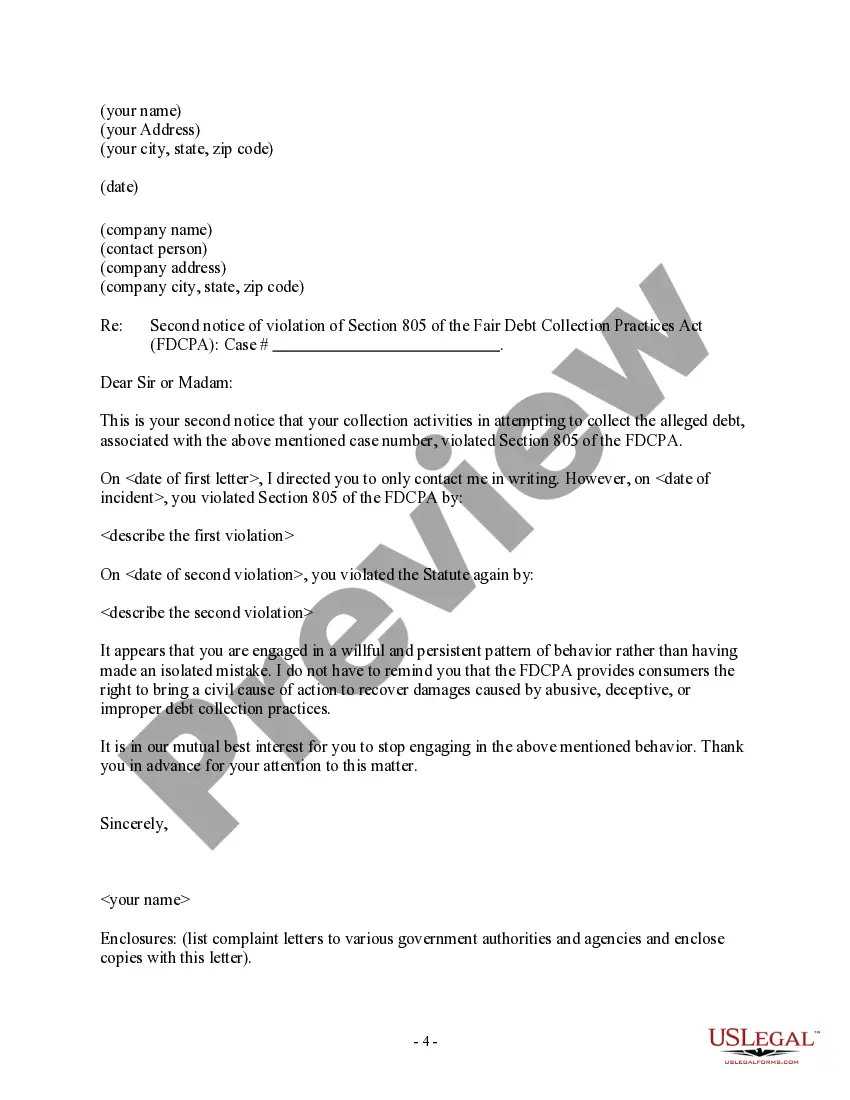

Fortunately, there are legal actions you can take to stop this harassment:Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

You have the right to tell a debt collector to stop communicating with you. To stop communication, send a letter to the debt collector and keep a copy of the letter. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Debt collectors are allowed to call you, but they cannot always leave a message on your answering machine. There are a few main instances when debt collectors might be sued for violating the privacy of those who are in debt, through a voicemail message. One of those instances is when it is accessed by a third party.

When it comes to consumer debt in the state of Nebraska, the statute of limitations 5 years from the last payment made. This means that a creditor or debt collector may not sue you for debt after five years have passed. If the agreement was verbal, then that number is reduced to 4 years in the state of Nebraska.