Nebraska Designation of Rights, Privileges and Preferences of Preferred Stock

Description

How to fill out Designation Of Rights, Privileges And Preferences Of Preferred Stock?

If you need to comprehensive, obtain, or print out lawful document templates, use US Legal Forms, the largest variety of lawful varieties, that can be found online. Take advantage of the site`s simple and handy look for to get the files you want. Various templates for enterprise and specific reasons are sorted by groups and says, or key phrases. Use US Legal Forms to get the Nebraska Designation of Rights, Privileges and Preferences of Preferred Stock within a handful of click throughs.

If you are already a US Legal Forms customer, log in to the profile and then click the Download button to have the Nebraska Designation of Rights, Privileges and Preferences of Preferred Stock. You can also access varieties you formerly downloaded within the My Forms tab of the profile.

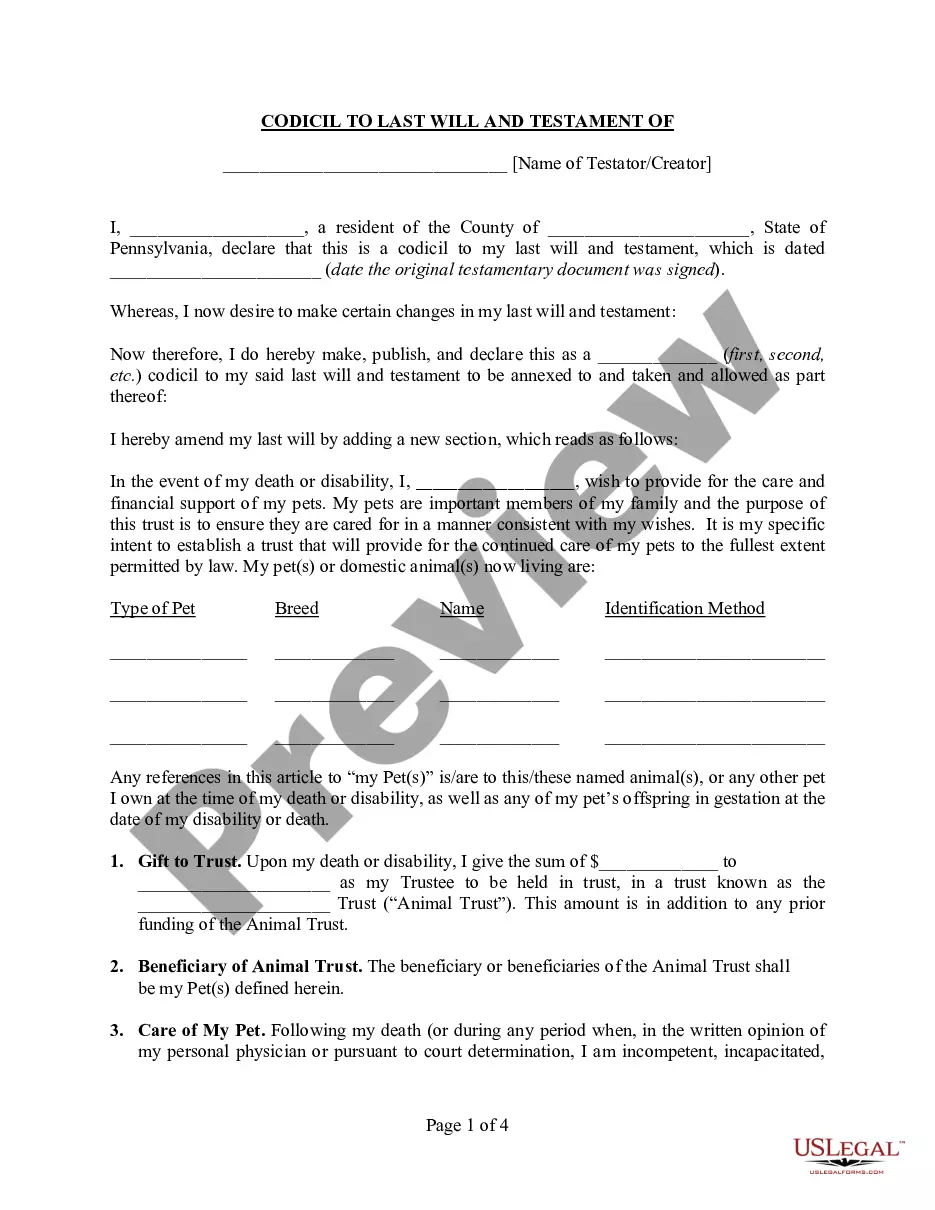

If you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for that proper area/nation.

- Step 2. Utilize the Review method to examine the form`s information. Don`t overlook to read the description.

- Step 3. If you are not satisfied with the kind, utilize the Search industry at the top of the screen to find other models of the lawful kind format.

- Step 4. Upon having discovered the shape you want, select the Buy now button. Pick the rates prepare you favor and include your accreditations to sign up to have an profile.

- Step 5. Procedure the purchase. You can utilize your charge card or PayPal profile to finish the purchase.

- Step 6. Pick the file format of the lawful kind and obtain it on your product.

- Step 7. Comprehensive, change and print out or signal the Nebraska Designation of Rights, Privileges and Preferences of Preferred Stock.

Every single lawful document format you buy is the one you have permanently. You might have acces to every single kind you downloaded in your acccount. Click the My Forms portion and choose a kind to print out or obtain once more.

Compete and obtain, and print out the Nebraska Designation of Rights, Privileges and Preferences of Preferred Stock with US Legal Forms. There are many skilled and condition-specific varieties you may use for your personal enterprise or specific requirements.

Form popularity

FAQ

Issuing new shares typically requires approval from the company's shareholders. This may involve holding a vote at a shareholder meeting or obtaining written consent from a majority of shareholders. The approval process will depend on the company's bylaws and state laws governing the issuance of new shares.

Board approval, either by written consent or at a board meeting (for more about the differences between board consents and board meetings, please see our article), is required for every issuance of a security, whether that security is common stock, preferred stock, a warrant, an option or a note that is convertible ...

Under current Section 312.03(b), shareholder approval is required when a company sells shares to a related party if the amount to be issued exceeds 1% of the number of shares or voting power outstanding before issuance.

Preferred typically have no voting rights, whereas common stockholders do. Preferred stockholders may have the option to convert shares to common shares but not vice versa. Preferred shares may be callable where the company can demand to repurchase them at par value.

The most common issuers of preferred stocks are banks, insurance companies, utilities and real estate investment trusts, or REITs. Companies issuing preferreds may have more than one offering for you to vet. Often you may find several different offerings of preferreds from the same issuer but with different yields.

Participating Preference shares are a type of 'Preference' or 'Preferred' shares with special rights to participate in surplus profits in the event of liquidation, after all the other shareholders have been paid. These shareholders will receive a fixed rate of dividend and a share in the company's extra earnings.

8-1404 Death of decedent; information regarding financial or property interests; furnished; to whom; affidavit; contents; immunity from liability; applicability of section.

Issuance of Preferred Stock: When a company issues preferred stock, it debits (increases) the cash account on the balance sheet for the total value received and credits (increases) the ?preferred stock? account in the equity section of the balance sheet.