Nebraska Option to Purchase Common Stock

Description

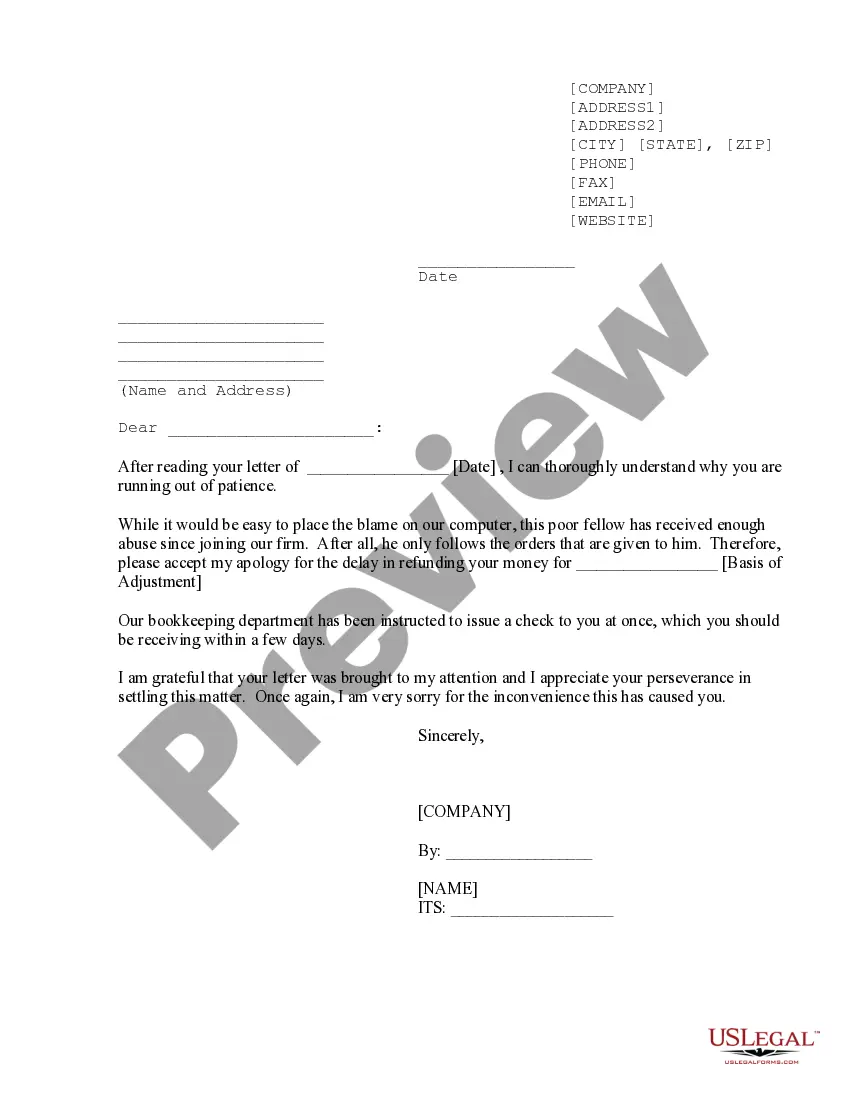

How to fill out Option To Purchase Common Stock?

Choosing the best legal record design can be a have difficulties. Naturally, there are a variety of layouts available on the net, but how can you obtain the legal type you need? Use the US Legal Forms web site. The service provides thousands of layouts, like the Nebraska Option to Purchase Common Stock, which can be used for enterprise and private requires. Every one of the forms are inspected by experts and meet state and federal needs.

Should you be already signed up, log in for your bank account and click on the Download option to obtain the Nebraska Option to Purchase Common Stock. Make use of your bank account to appear from the legal forms you may have purchased previously. Visit the My Forms tab of the bank account and have yet another version in the record you need.

Should you be a whole new customer of US Legal Forms, listed here are simple guidelines for you to comply with:

- Very first, be sure you have selected the right type for your personal metropolis/county. You can look through the form while using Review option and browse the form outline to ensure it is the best for you.

- When the type does not meet your expectations, use the Seach area to find the proper type.

- When you are certain the form is acceptable, click on the Buy now option to obtain the type.

- Choose the rates program you desire and type in the required information and facts. Build your bank account and buy the order utilizing your PayPal bank account or bank card.

- Pick the submit file format and download the legal record design for your product.

- Full, edit and print out and sign the obtained Nebraska Option to Purchase Common Stock.

US Legal Forms is the biggest library of legal forms that you can discover various record layouts. Use the service to download appropriately-made paperwork that comply with express needs.

Form popularity

FAQ

Hear this out loud PauseThe lifetime capital gains exemption (LCGE) allows people to realize tax-free capital gains, if the property disposed of qualifies. The lifetime capital gains exemption for qualified farm or fishing property and qualified small business corporation shares is $971,190 in 2023, up from $913,630 in 2022.

Nebraska's special capital gains exclusion was adopted in 1987 as part of the Employment and Investment Growth Act. This allows individual taxpayers to make a one-time election to exclude Nebraska income capital gains from the sale of the stock of a qualified corporation.

Hear this out loud PauseNebraska Capital Gains Tax Long- and short-term capital gains are included as regular income on your Nebraska income tax return. That means they are taxed at the rates listed above (2.46% - 6.84%), depending on your total taxable income.

You have taxable income or deductible loss when you sell the stock you bought by exercising the option. You generally treat this amount as a capital gain or loss. However, if you don't meet special holding period requirements, you'll have to treat income from the sale as ordinary income.