Nebraska Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Means Test Calculation For Use In Chapter 7 - Post 2005?

Choosing the right legitimate record web template might be a struggle. Obviously, there are plenty of web templates available online, but how will you find the legitimate form you require? Use the US Legal Forms site. The support offers a huge number of web templates, such as the Nebraska Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005, that can be used for organization and personal needs. Each of the forms are examined by specialists and meet up with state and federal demands.

Should you be previously registered, log in to the profile and click the Download switch to find the Nebraska Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005. Utilize your profile to look throughout the legitimate forms you have bought in the past. Proceed to the My Forms tab of your profile and acquire an additional backup in the record you require.

Should you be a brand new end user of US Legal Forms, listed here are easy directions so that you can stick to:

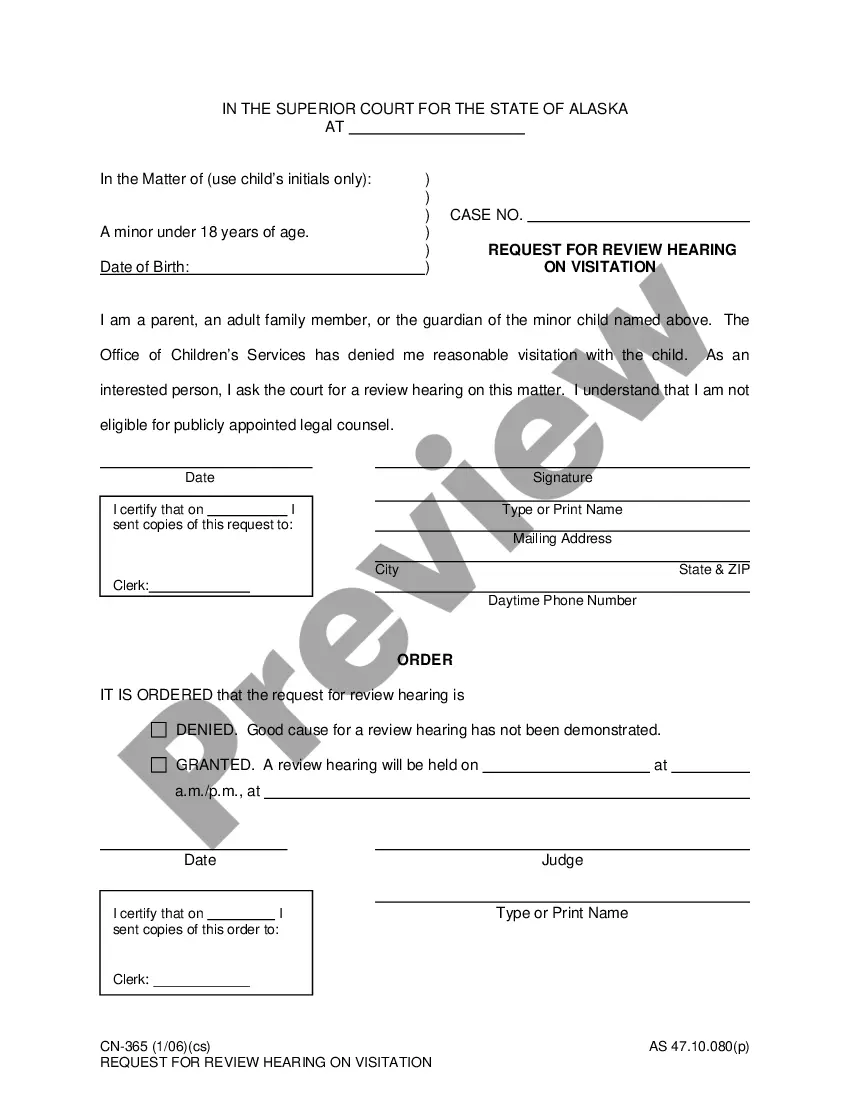

- First, make sure you have chosen the proper form for the town/region. You can look through the form making use of the Review switch and browse the form explanation to ensure this is basically the best for you.

- In case the form does not meet up with your expectations, utilize the Seach industry to get the appropriate form.

- When you are sure that the form is proper, go through the Buy now switch to find the form.

- Pick the costs strategy you would like and enter the needed info. Create your profile and pay money for the order using your PayPal profile or credit card.

- Opt for the data file format and acquire the legitimate record web template to the device.

- Comprehensive, edit and print out and sign the obtained Nebraska Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005.

US Legal Forms may be the biggest local library of legitimate forms in which you can find different record web templates. Use the service to acquire appropriately-created files that stick to state demands.

Form popularity

FAQ

Calculation of Current Monthly Income: To begin the means test, debtors calculate their current monthly income, which equates to twice the gross income earned in the six months leading up to the bankruptcy filing.

The means test compares a debtor's income for the previous six months to what he or she owes on debts. If a person has enough money coming in to gradually pay down debts, the bankruptcy judge is unlikely to allow a Chapter 7 discharge.

Income is calculated by looking at the debtor's income for the six-months prior to filing. A debtor who previously had a higher income but has been laid off in the last year, for example, would be able to rely on their most recent income to satisfy the Means Test.

You can earn a high income and still pass the means test if you have substantial expenses like a hefty mortgage, multiple car payments, taxes, childcare, health care, or care of an elderly or disabled person. However, if your disposable income is more than a certain sum, you will not be able to file.

In the test, you compare your income with the median income of a similar size household in your state. If your income is lower, you pass the test.

The means test is calculated by comparing the debtor's average income for the past six months (current monthly income), annualized, to the median income for households of the same size in the debtor's state of residence.

The U.S. bankruptcy code doesn't specify a minimum dollar amount someone must owe to make them eligible for a qualified filing. In short, any debt is enough debt. More important than the size of your debt is the size of your income. How much money you earn affects whether you qualify for Chapter 7.

If you would like to file a Chapter 7 bankruptcy you must pass the Nebraska means test. The test only applies to higher income filers which means that if your income is below the Nebraska median for your household size you are exempt from the test and may file a Chapter 7.