Nebraska Sample Letter for Tax Clearance Letters

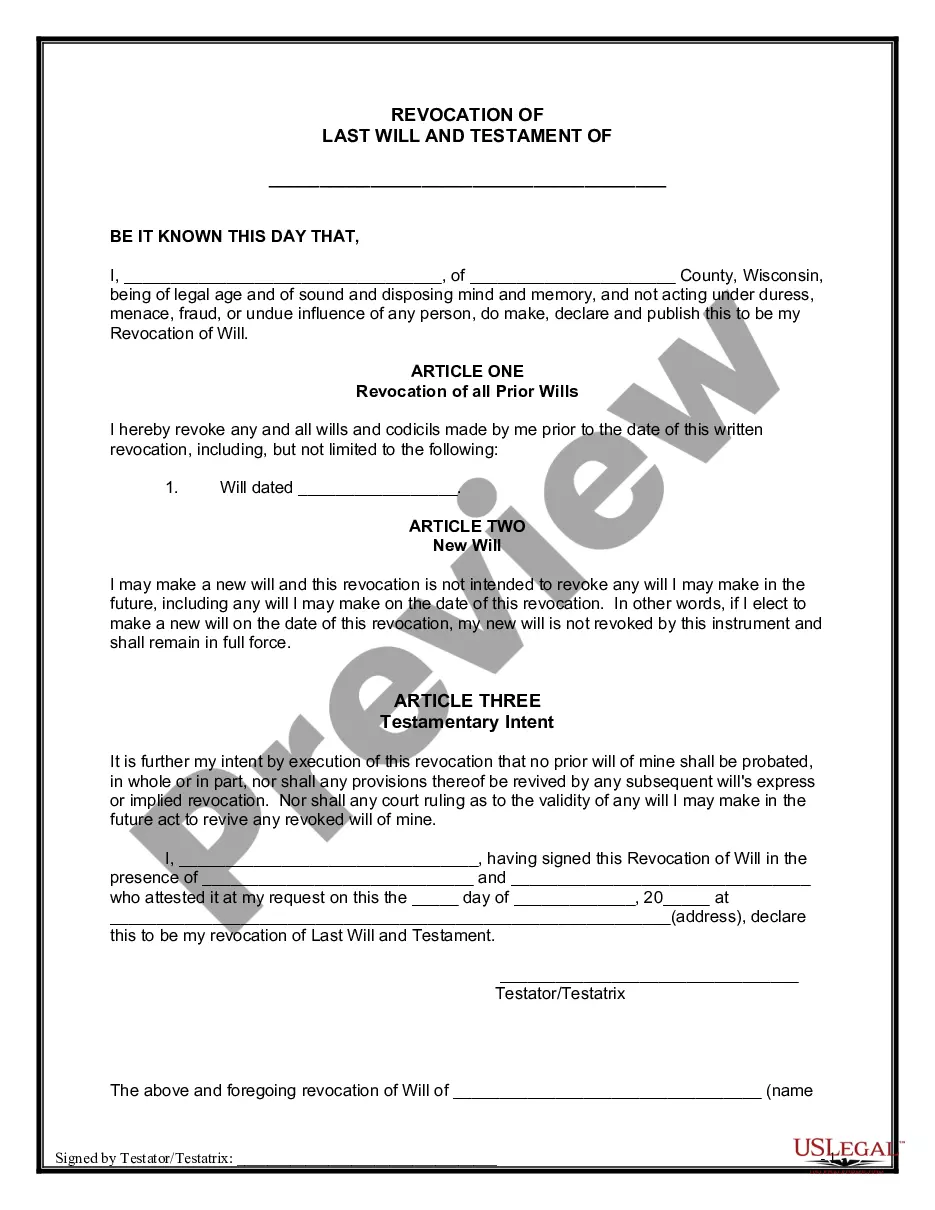

Description

How to fill out Sample Letter For Tax Clearance Letters?

US Legal Forms - among the biggest libraries of authorized forms in America - offers a wide array of authorized file themes you may obtain or print out. Making use of the website, you can get thousands of forms for enterprise and specific reasons, sorted by classes, says, or key phrases.You can find the newest models of forms like the Nebraska Sample Letter for Tax Clearance Letters in seconds.

If you have a subscription, log in and obtain Nebraska Sample Letter for Tax Clearance Letters through the US Legal Forms local library. The Download button will appear on each and every develop you see. You have accessibility to all earlier downloaded forms inside the My Forms tab of the profile.

In order to use US Legal Forms the first time, listed here are straightforward instructions to help you started:

- Ensure you have picked out the proper develop to your city/area. Click on the Preview button to examine the form`s content material. Look at the develop description to actually have chosen the proper develop.

- In the event the develop does not match your requirements, utilize the Lookup discipline at the top of the screen to discover the one who does.

- Should you be happy with the form, confirm your selection by visiting the Acquire now button. Then, choose the prices prepare you prefer and provide your credentials to register on an profile.

- Approach the transaction. Use your credit card or PayPal profile to perform the transaction.

- Find the format and obtain the form in your device.

- Make changes. Load, edit and print out and indication the downloaded Nebraska Sample Letter for Tax Clearance Letters.

Each design you included in your account lacks an expiry day and is the one you have permanently. So, if you want to obtain or print out one more duplicate, just go to the My Forms area and click on the develop you need.

Get access to the Nebraska Sample Letter for Tax Clearance Letters with US Legal Forms, probably the most comprehensive local library of authorized file themes. Use thousands of skilled and condition-specific themes that meet your small business or specific requires and requirements.

Form popularity

FAQ

Clearance report means a report issued by a risk assessor, a lead-based paint inspector, or a dust sampling technician that finds that the area tested has passed a clearance examination, and that specifies the steps taken to ensure the absence of lead-based paint hazards, including confirmation that any encapsulation ...

Purpose. A Clearance Letter is a document that contains information about your clean criminal record. These letters are sometimes needed when applying for a visa, other travel purposes, or when adopting a child.

Employers who cancel their income tax withholding account should, within 30 days after discontinuing business, file a final Nebraska Reconciliation of Income Tax Withheld, Form W-3N, and attach the state copy of each Wage and Tax Statement, Federal Form W-2, issued to each employee.

A tax clearance letter is a document issued by a state government branch, which certifies that certain tax obligations of the seller have been met or are current, and that no amount of tax is outstanding to the state.

This Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in Nebraska. Also, when owners of an existing business change, a Form 20 needs to be filed.

A Tax Compliance Certificate is a document issued by a Secretary of State or State Department of Revenue. The Tax Compliance Certificate is evidence that a Corporation, LLC or Non Profit is in Good Standing with respect to any tax returns due and taxes payable to the state.

A clearance certificate confirms that all tax liabilities of an individual or entity have been paid. The certificate is applicable upon the sale of a business, transfer of ownership, or the death of an individual.

A clearance certificate will allow you, as the legal representative, to distribute assets without the risk of being personally responsible for unpaid amounts the person who died, estate, trust, or corporation might owe to the CRA. Your financial institution or lawyers may also ask you for a clearance certificate.