The right of an employee to compensation is based on either an express or implied contract. Whether the employment contract is express or implied, it need not be formalized in order for the terms of employment to begin. Once employment has begun, the employment contract represents the right of the employee to be paid the wages agreed upon for services he or she has performed and the right of an employer to receive the services for which the wages have been paid.

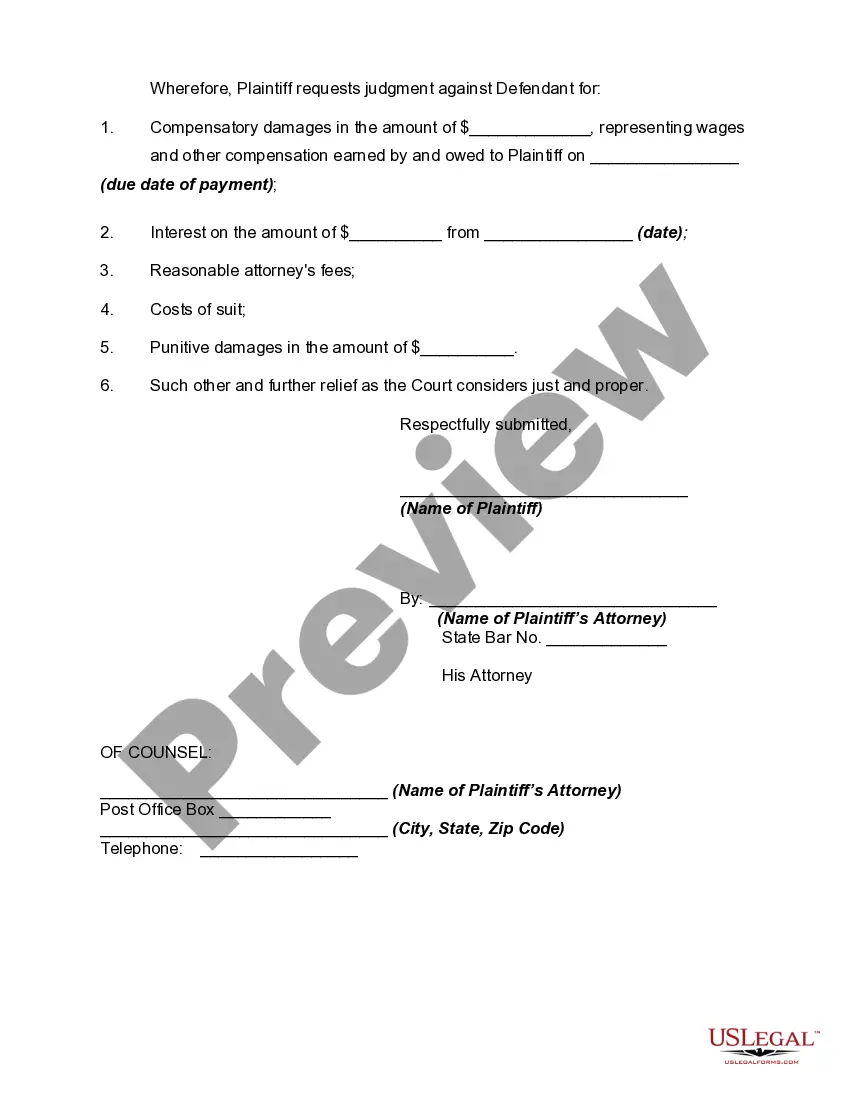

Nebraska Complaint for Recovery of Unpaid Wages

Description

How to fill out Complaint For Recovery Of Unpaid Wages?

Are you presently within a place that you need papers for both enterprise or person uses nearly every day? There are a variety of lawful file themes available online, but finding types you can rely is not easy. US Legal Forms delivers a huge number of form themes, such as the Nebraska Complaint for Recovery of Unpaid Wages, which are composed to satisfy state and federal needs.

When you are already acquainted with US Legal Forms site and get your account, basically log in. After that, it is possible to download the Nebraska Complaint for Recovery of Unpaid Wages format.

If you do not have an profile and would like to start using US Legal Forms, abide by these steps:

- Get the form you require and ensure it is for that correct town/region.

- Use the Review button to examine the form.

- Look at the outline to actually have chosen the appropriate form.

- In the event the form is not what you are looking for, make use of the Look for discipline to find the form that fits your needs and needs.

- Whenever you find the correct form, click on Acquire now.

- Select the pricing program you would like, fill in the desired info to make your money, and purchase an order using your PayPal or bank card.

- Select a hassle-free document format and download your backup.

Find each of the file themes you possess purchased in the My Forms menu. You may get a further backup of Nebraska Complaint for Recovery of Unpaid Wages at any time, if needed. Just click the needed form to download or print out the file format.

Use US Legal Forms, by far the most substantial collection of lawful varieties, to save lots of time as well as avoid mistakes. The assistance delivers appropriately made lawful file themes which you can use for a range of uses. Create your account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

An employer may deduct, withhold, or divert a portion of an employee's wages only when the employer is required to or may do so by state or federal law or by order of a court of competent jurisdiction or the employer has a written agreement with the employee to deduct, withhold, or divert.

How can I or my attorney pursue a claim in court in Nebraska? Instead of filing a claim with the Nebraska Department of Labor, you can file a lawsuit in court. The statute of limitations for such a lawsuit is two years, or three years if your employer willfully and knowingly broke the law.

Nebraska law requires that final wages be paid on the next regular pay day or within two weeks of the termination, whichever is sooner. This law applies regardless of whether you are terminated or you voluntarily quit. What is the current minimum wage in Nebraska?

The court or government agency will submit a "writ of garnishment" to the debtor's employer informing them of the wage garnishment. Wage garnishment rules require an employer to withhold a certain percentage from a debtor's paycheck until that person is no longer in default on their debt.

It is illegal for your employer to withhold your wages. But employers often get away with wage theft because workers are often pressured not to speak up about it for fear of employer retaliation and wrongfully losing their jobs.

Nebraska law requires that all final wages be paid on the next regular payday or within two weeks of the termination date, whichever is sooner. This law applies whether you were terminated or voluntarily resigned. Final wages may not be withheld pending return of employer's property.

§48-1230, an employer must issue a final paycheck to a terminated employee on the next regularly scheduled pay date, or within two (2) weeks, whichever is earlier.