Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information

Description

How to fill out Exit Procedure Acknowledgment Regarding Proprietary Information?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

Through the site, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information within moments.

If you already have a subscription, Log In and download the Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply visit the My documents section and click on the form you need.

Gain access to the Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

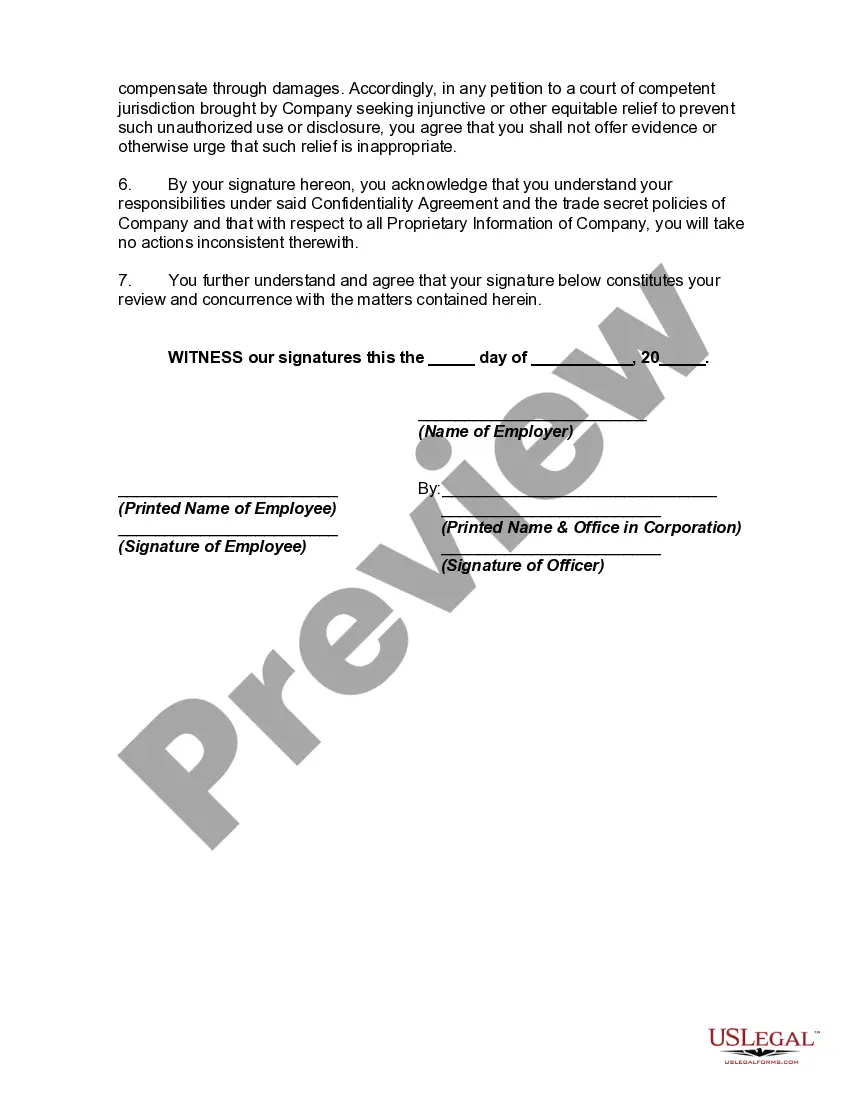

- Ensure you have chosen the correct form for your state/county. Click the Preview button to review the content of the form. Read the description of the form to ensure you have selected the right one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once you are happy with the form, confirm your choice by clicking the Get now button. Then, choose the pricing plan you prefer and provide your credentials to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

- Select the file format and download the form to your device.

- Make adjustments. Fill out, modify, print, and sign the downloaded Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information.

Form popularity

FAQ

Certain individuals, such as those earning below the minimum income threshold or individuals qualifying for specific exclusions, may not need to file a return in Nebraska. It's important to assess your financial situation carefully. For confidence in understanding these requirements, refer to our information on the Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information to ensure compliance.

Filing a separate state tax return is often required for those earning income in multiple states or when your residency changes. Knowing when to file separately can help you avoid tax complications. If you have specific questions regarding your situation, exploring our resources on the Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information may prove beneficial.

In Nebraska, the perfection period refers to the time frame within which a lien or claim must be filed to establish priority. This period can vary based on the type of lien and specific circumstances. Knowing the perfection period is crucial, especially when dealing with the Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information, as timely filings can impact legal outcomes significantly.

The requirement to file a Nebraska tax return hinges on several factors, including your residency and income level. Typically, individuals who earn above a certain threshold in Nebraska must file. If you need assistance in navigating the requirements, our platform offers tools to help you understand the Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information in relation to your filing obligations.

Whether you need to file a Nebraska return depends on your income and residency status. If you earn income in Nebraska or are a resident, you may need to submit a return. Understanding the filing requirements can seem complex; thus, it may be helpful to refer to our educational resources on the Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information for detailed steps.

Generally, you do not need to attach your federal return to your Nebraska tax return. However, you still need to report all your income accurately on your Nebraska return. It is essential to understand the specific forms required by Nebraska, especially if you have filed using the Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information. Always check the latest guidelines or consult a tax professional for clarity.

The Nebraska Supreme Court is located in Lincoln, Nebraska. As the highest court in the state, it is responsible for overseeing the interpretation of Nebraska law. If you need information regarding legal procedures or decisions, this court serves as a pivotal resource. For topics like the Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information, it is crucial to consult the court's rulings and guidelines.

Yes, a notary can refuse to notarize a document in Nebraska under certain conditions. If the notary suspects fraud or if the signer does not have adequate identification, they are obligated to decline. This protects the validity of the Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information and ensures adherence to ethical standards.

A complete notarial acknowledgment in Nebraska signifies that the signer has personally appeared before the notary. It must include the notary’s signature, seal, and the date of the acknowledgment. This affirmation is essential for documents linked to the Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information, as it confirms the authenticity of the signing.

The two most important criteria for proper notarization in Nebraska are the presence of the signer and the notary's verification of the signer’s identity. Both elements must be fulfilled to ensure that the document adheres to legal standards, especially for those involving the Nebraska Exit Procedure Acknowledgment Regarding Proprietary Information. This process safeguards against fraud and upholds the integrity of legal documents.