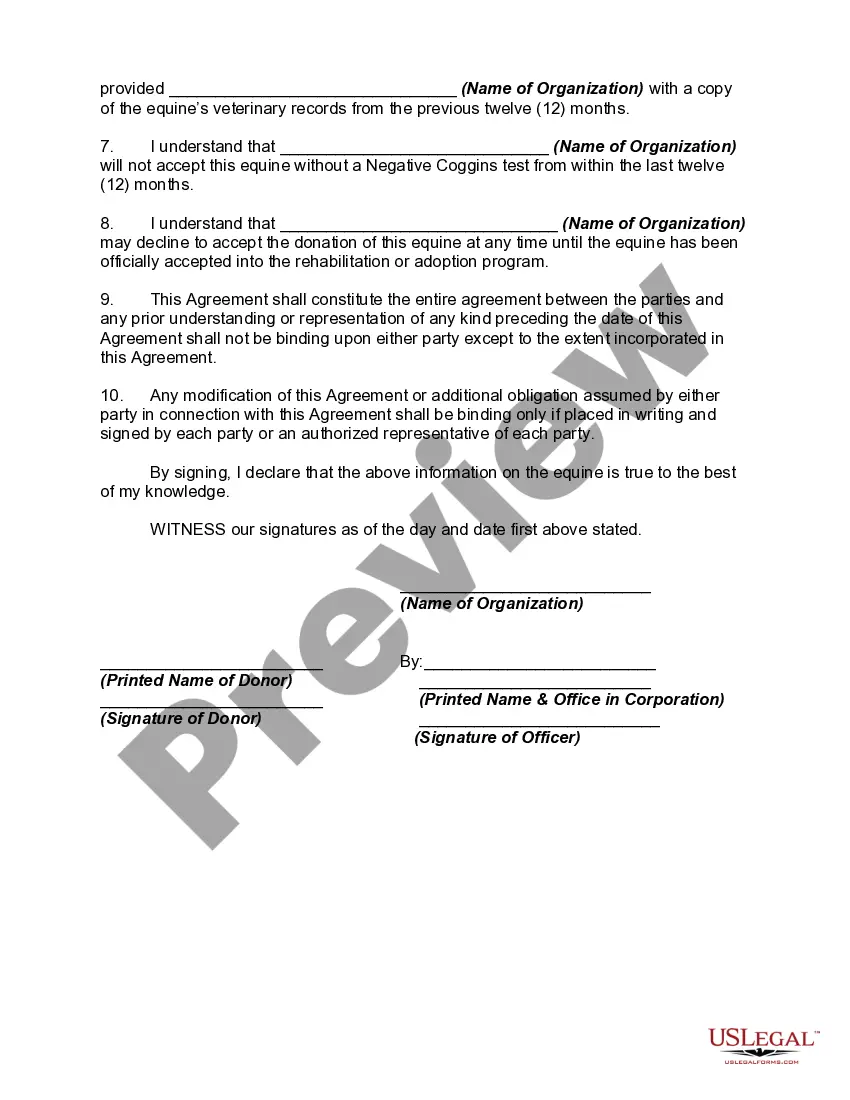

This form is an example of a contract to donate a horse to a rescue or other organization. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nebraska Equine or Horse Donation Contract

Description

How to fill out Equine Or Horse Donation Contract?

You can spend hours online trying to find the legal document template that meets your state and federal requirements. US Legal Forms offers thousands of legal forms that can be reviewed by experts.

It is easy to download or print the Nebraska Equine or Horse Donation Contract from our service.

If you possess a US Legal Forms account, you can Log In and then click the Download button. After that, you can complete, edit, print, or sign the Nebraska Equine or Horse Donation Contract. Each legal document template you obtain is yours permanently.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make adjustments to your document if necessary. You can complete, edit, sign, and print the Nebraska Equine or Horse Donation Contract. Download and print thousands of document layouts using the US Legal Forms website, which offers the largest variety of legal forms. Utilize expert and state-specific templates to meet your business or personal needs.

- To get another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/area of choice. Check the form details to ensure you have chosen the right one.

- If available, use the Preview button to view the document template at the same time.

- If you wish to find another version of the form, utilize the Search field to locate the template that fulfills your needs and requirements.

- Once you have identified the template you want, simply click Get now to proceed.

- Select the pricing option you prefer, input your details, and create an account on US Legal Forms.

Form popularity

FAQ

Yes, contributions made to a registered horse rescue organization can be tax-deductible. To qualify, the horse rescue must be recognized by the IRS as a charity. By drafting a Nebraska Equine or Horse Donation Contract, you create a clear record of your donation, which can aid in your tax deduction process. Keep thorough documentation to maximize your benefits when tax season arrives.

The amount you need to donate for a tax write-off varies based on the valuation of the horse and the charity's guidelines. Generally, you can deduct the fair market value of the horse if it meets specific criteria. A Nebraska Equine or Horse Donation Contract can help you establish this value, making it easier for your tax preparation. Consulting with a tax professional will ensure you make the most of your donation.

For tax purposes, a horse is typically classified as personal property, similar to other forms of tangible assets. If the horse is used for business, such as racing or breeding, there may be additional tax considerations. When creating a Nebraska Equine or Horse Donation Contract, specify the horse's purpose to ensure clarity in documentation. This classification can affect your deductible amounts if you decide to donate.

Yes, donating a horse can be tax-deductible if you contribute to an IRS-approved charity. It’s crucial to ensure that the organization has the appropriate tax-exempt status. Utilizing a Nebraska Equine or Horse Donation Contract helps to document the transfer and provides proof of the donation for tax purposes. Always consult with a tax advisor to understand the implications fully.

To secure funding for a horse rescue, consider applying for grants specifically designed for animal welfare organizations. You can also reach out to donors who are interested in providing support for your mission. Using a Nebraska Equine or Horse Donation Contract can formalize donations and help build trust with your contributors. Furthermore, leveraging online crowdfunding platforms can significantly increase your chances of receiving necessary funds.

Typically, a horse bill of sale does not need to be notarized, but notarization can add an extra layer of security. Notarizing the document verifies the identities of both parties and can help in case of disputes. If you are considering a Nebraska Equine or Horse Donation Contract, consulting with a legal professional can provide clarity on this requirement.

Sponsoring a horse means providing financial support to cover its care, including food, medical treatment, and shelter. This commitment often involves a direct relationship with the charity, allowing you to receive updates about the horse and its journey. By utilizing a Nebraska Equine or Horse Donation Contract, you can formalize your support and ensure that your contribution directly impacts the horse's wellbeing. This connection enriches both the horse's life and your experience as a supporter.

When looking to donate to a horse charity, consider organizations that align with your values and commitment to improving equine welfare. The best horse charities often emphasize transparency, community impact, and support for rescue efforts. Look for those that utilize a Nebraska Equine or Horse Donation Contract, ensuring that your contribution effectively supports the care of horses in need. Research various options to find a charity that resonates with your mission.

To get rid of an unwanted horse, consider options like rehoming, donating, or contacting local rescues. Each option requires careful consideration to ensure the horse's welfare. A Nebraska Equine or Horse Donation Contract can guide you through the process, ensuring that all parties agree on the horse's future.

Yes, you can potentially receive a tax write-off for donating a horse, but the benefits depend on the horse's value and the organization you donate to. It's essential to provide accurate documentation and abide by IRS guidelines. Utilizing a Nebraska Equine or Horse Donation Contract can help you create the necessary records to support your tax deductions.