US Legal Forms - among the greatest libraries of lawful kinds in the USA - offers a wide range of lawful papers themes you can acquire or print out. Making use of the internet site, you can get 1000s of kinds for business and personal uses, categorized by groups, states, or keywords and phrases.You can get the most recent versions of kinds just like the Nebraska Contest of Final Account and Proposed Distributions in a Probate Estate in seconds.

If you already possess a registration, log in and acquire Nebraska Contest of Final Account and Proposed Distributions in a Probate Estate from your US Legal Forms local library. The Obtain button can look on each develop you perspective. You have access to all in the past saved kinds in the My Forms tab of the accounts.

In order to use US Legal Forms the first time, listed below are basic directions to help you started out:

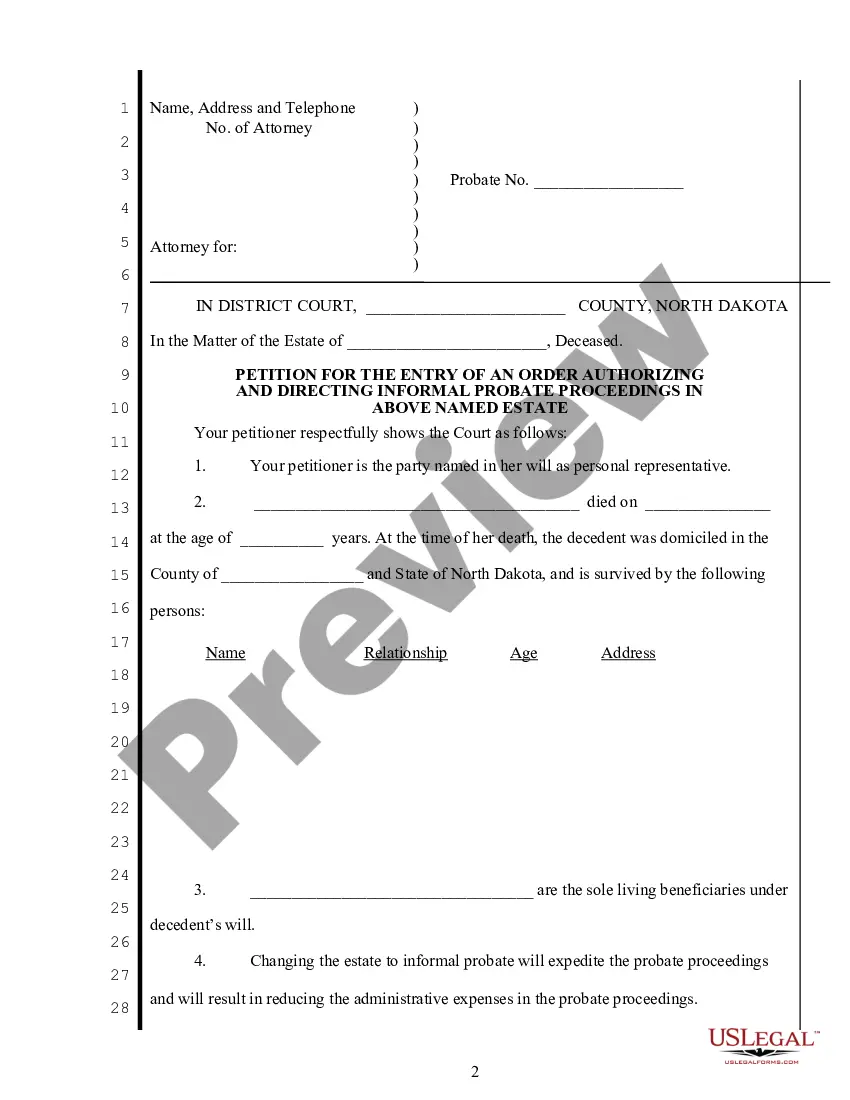

- Be sure you have picked out the correct develop for the area/state. Go through the Preview button to analyze the form`s articles. Read the develop explanation to ensure that you have selected the appropriate develop.

- When the develop does not match your specifications, utilize the Lookup field at the top of the display screen to discover the one which does.

- When you are pleased with the shape, affirm your selection by simply clicking the Buy now button. Then, opt for the rates prepare you want and offer your references to register on an accounts.

- Method the deal. Utilize your credit card or PayPal accounts to complete the deal.

- Choose the formatting and acquire the shape in your product.

- Make alterations. Fill out, modify and print out and indicator the saved Nebraska Contest of Final Account and Proposed Distributions in a Probate Estate.

Every web template you included with your bank account lacks an expiration date and is also your own forever. So, if you would like acquire or print out one more version, just visit the My Forms section and click on the develop you need.

Get access to the Nebraska Contest of Final Account and Proposed Distributions in a Probate Estate with US Legal Forms, the most substantial local library of lawful papers themes. Use 1000s of professional and status-specific themes that fulfill your small business or personal requires and specifications.