Florida Revocable Trust for Property

Description

How to fill out Revocable Trust For Property?

If you want to acquire, download, or print authentic document templates, utilize US Legal Forms, the largest assortment of legitimate forms available online.

Make the most of the site's straightforward and user-friendly search functionality to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Each legal document template you purchase is yours indefinitely.

You have access to every form you downloaded within your account. Go to the My documents section and select a form to print or download again.

- Use US Legal Forms to obtain the Florida Revocable Trust for Property in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Obtain button to access the Florida Revocable Trust for Property.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct region/state.

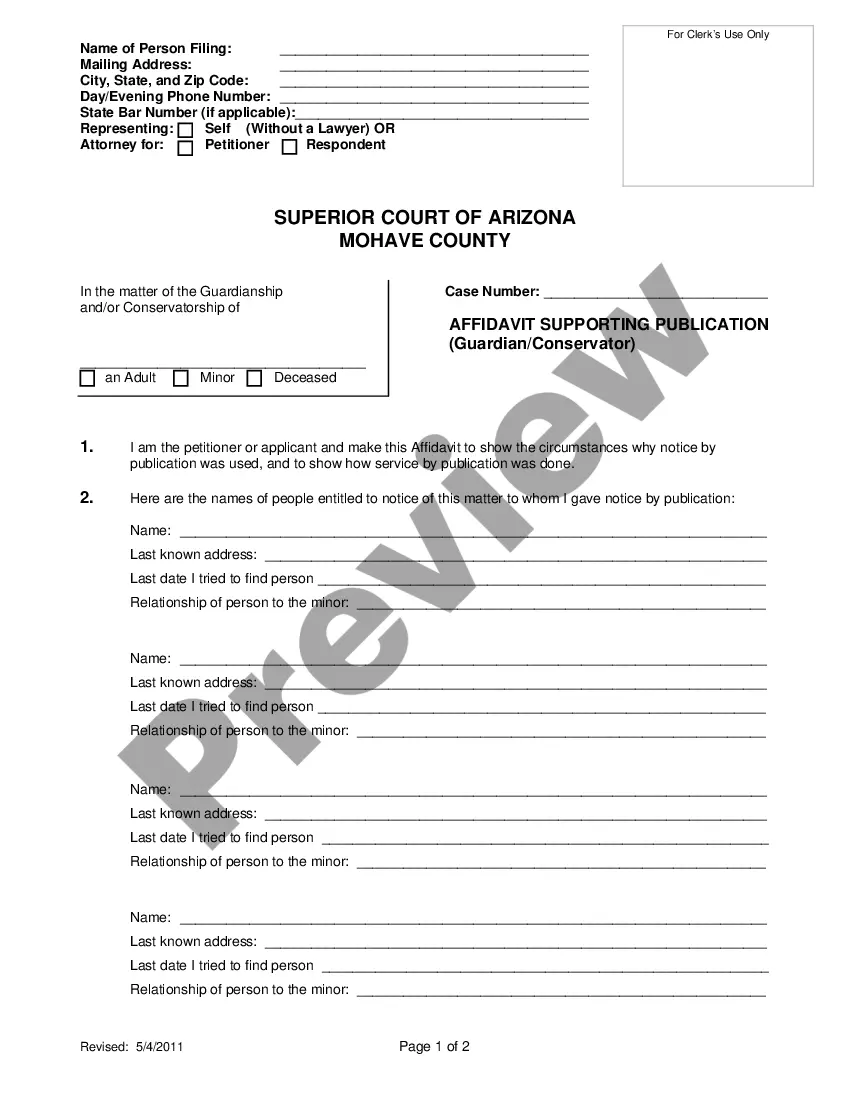

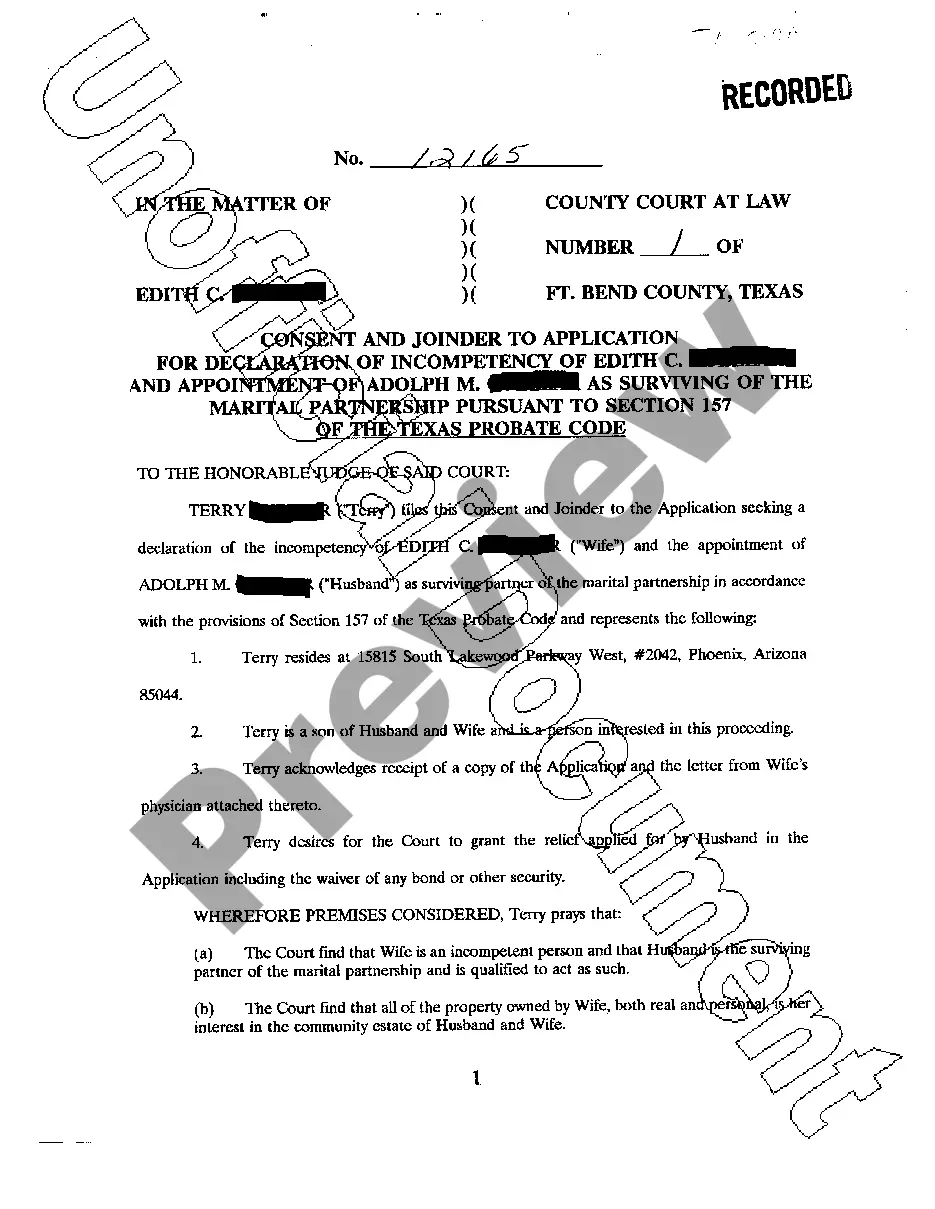

- Step 2. Use the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the form you require, click the Buy now button. Choose your preferred pricing plan and enter your details to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Florida Revocable Trust for Property.

Form popularity

FAQ

Setting up a Florida Revocable Trust for Property involves several steps, including deciding on the assets you want to place in the trust and choosing a trustee. You will need to create a written trust document that outlines the terms and conditions, ensuring it complies with Florida laws. To simplify this process, consider utilizing USLegalForms, where you can find templates and detailed instructions to facilitate the establishment of your trust.

You do not necessarily need an attorney to set up a Florida Revocable Trust for Property, but having professional assistance can provide clarity and avoid mistakes. An attorney familiar with Florida laws can help you navigate the legal requirements and ensure your trust meets your specific needs. Therefore, you can use resources like USLegalForms to find templates and guidance for creating your trust yourself, but expert advice can enhance your understanding and peace of mind.

Using a Florida Revocable Trust for Property ensures that your estate plan is both effective and user-friendly. It allows you to control your assets while you are alive and designates how they will be distributed after your death, which is particularly beneficial if you own multiple properties. Trusts can also reduce the burden on your loved ones during a challenging time by simplifying the transfer process. Consider utilizing platforms like US Legal Forms to create your trust efficiently and securely.

The primary benefit of a Florida Revocable Trust for Property is the streamlined management of your assets. It offers privacy since trust assets don't go through probate, making your financial affairs less public. Moreover, it provides peace of mind knowing that your directives regarding asset distribution will be honored, regardless of your circumstances at the time. Using a trust can also minimize potential estate taxes, adding further financial advantages.

Yes, putting your house in a Florida Revocable Trust for Property is a wise decision. This action can protect your home from probate, ensuring a smoother transfer of ownership to your beneficiaries. By doing this, you maintain control of your property during your lifetime while paving a straightforward path for your heirs. It also allows for continued management of your assets in case you become incapacitated.

The greatest advantage of a Florida Revocable Trust for Property is its flexibility. You can amend or revoke the trust at any time during your lifetime, allowing you to adapt to changing circumstances. This feature ensures that your assets are managed according to your desires while providing a clear plan for asset distribution upon your passing. Additionally, it can help you avoid the lengthy probate process, making it easier for your heirs.

Placing your property in a Florida Revocable Trust for Property involves transferring the title of the property into the trust's name. This process can vary depending on the type of property, so it is advisable to consult with a legal professional. Platforms like US Legal Forms can guide you through the necessary steps and documentation to ensure everything is completed correctly.

To obtain a Florida Revocable Trust for Property, you typically start by consulting with an attorney who specializes in estate planning. They will help you list your assets and outline your wishes for distribution. Alternatively, platforms like US Legal Forms provide resources and templates to assist you in creating your trust efficiently.

While there are many advantages to a Florida Revocable Trust for Property, some drawbacks exist. These trusts do not provide asset protection from creditors, meaning your assets can still be claimed. Moreover, they require proper management and funding, which might necessitate hiring a professional to ensure everything is correctly executed.

A common mistake parents make when setting up a trust fund is failing to update the trust as circumstances change. This can include not adding new children or not adjusting the distribution rules after significant life events. To avoid this mistake, it is vital to periodically review and amend your Florida Revocable Trust for Property to reflect your current wishes.