Nebraska Participation Agreement in Connection with Secured Loan Agreement

Description

Participations in the loan are sold by the lead bank to other banks. A separate contract called a loan participation agreement is structured and agreed among the banks. Loan participations can either be made with equal risk sharing for all loan participants, or on a senior/subordinated basis, where the senior lender is paid first and the subordinate loan participation paid only if there is sufficient funds left over to make the payments.

How to fill out Participation Agreement In Connection With Secured Loan Agreement?

Are you currently in a situation where you frequently require documents for either professional or personal reasons.

There are numerous legal document templates accessible online, but finding reliable ones isn’t straightforward.

US Legal Forms offers thousands of template forms, including the Nebraska Participation Agreement in Relation to Secured Loan Agreement, designed to satisfy state and federal regulations.

When you find the appropriate form, click Buy now.

Select the payment plan you prefer, complete the necessary information to create your account, and finalize the order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Nebraska Participation Agreement in Relation to Secured Loan Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct state/region.

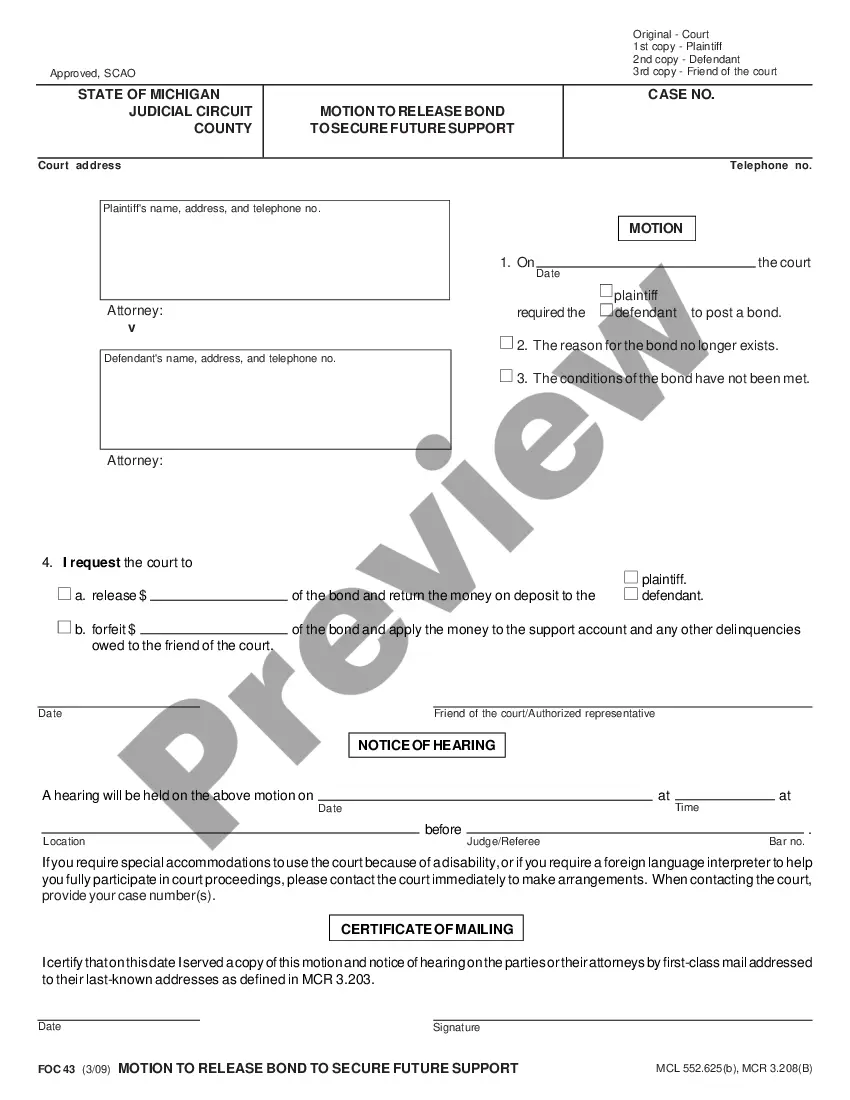

- Utilize the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form does not meet your needs, use the Search box to find the form that suits your requirements.

Form popularity

FAQ

Participation agreements, in the form promulgated by The Loan Syndications and Trading Association, Inc. (LSTA), are widely regarded as dependable vehicles for conveying loan ownership interests from a lender to a participant as true sales in the United States.

Participation mortgages reduce the risk to participants and allow them to increase their purchasing power. Many of these mortgages, therefore, tend to come with lower interest rates, especially when multiple lenders are also involved.

Participations are a long-established means by which both: Lenders can reduce their exposure to a borrower's credit risk by selling interests in their loans. An investor can acquire an interest in a borrower's loan without becoming a lender under the loan agreement.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties.

Generally, participation agreements involve one or more participants who purchase an interest in the underlying loan, but a single lender, the lead lender, retains control over the loan and manages the relationship with the borrower.

A loan participation involves a sharing or selling of ownership interests in a loan between two or more financial institutions. Normally, but not always, a lead bank originates the loan, closes the loan and then sells ownership interests to one or more participating banks.

The distinction is simple, but important. Generally, an assignment is the actual sale of the loan, in whole or in part. The assignee is now the owner of the loan (or the part assigned) and is considered the lender under the loan agreement.

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.