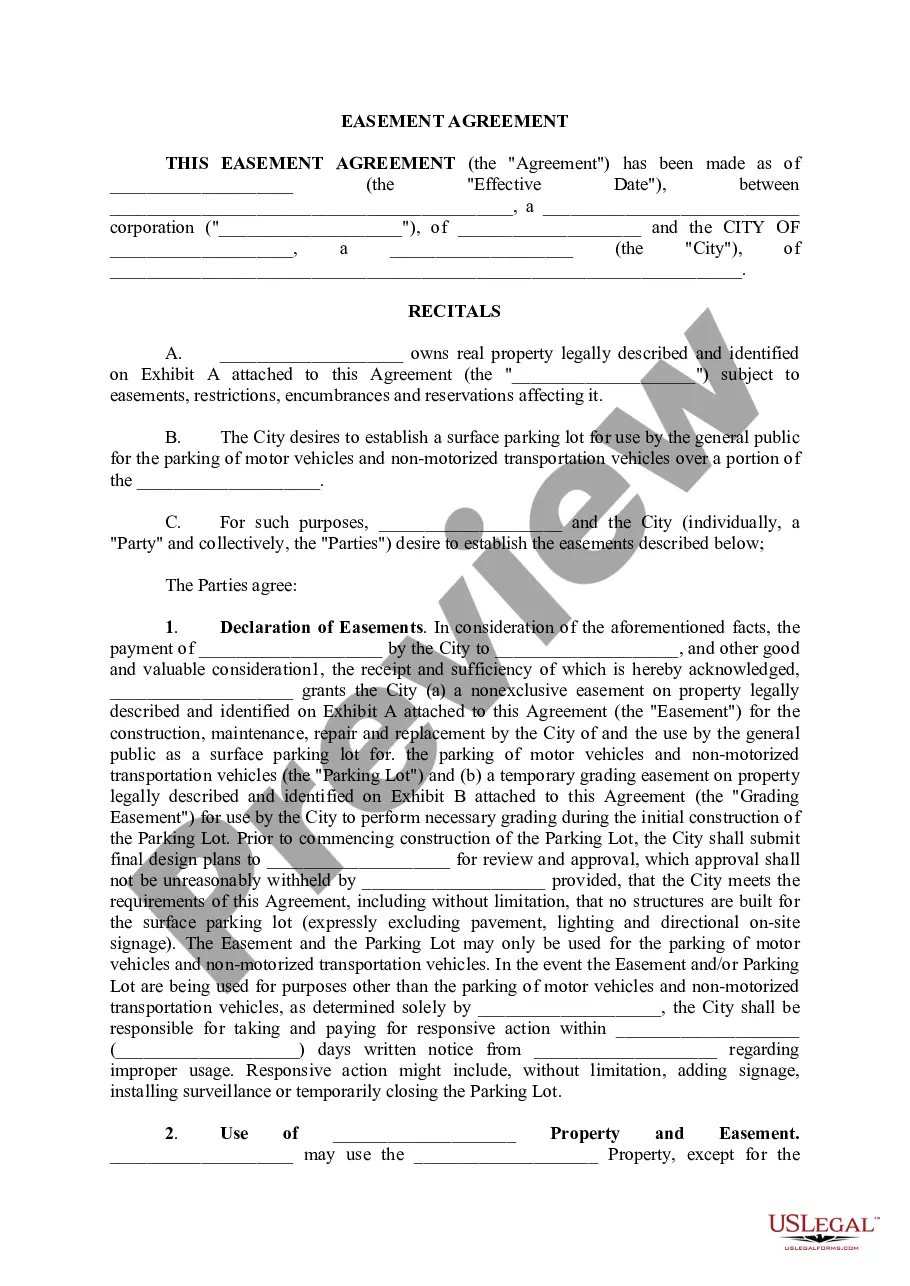

Nebraska Loan Commitment Agreement

Description

How to fill out Loan Commitment Agreement?

Choosing the right lawful papers web template could be a struggle. Of course, there are a lot of themes available on the Internet, but how would you obtain the lawful develop you need? Take advantage of the US Legal Forms internet site. The services gives thousands of themes, such as the Nebraska Loan Commitment Agreement, that can be used for company and private requirements. Every one of the varieties are inspected by pros and meet up with federal and state specifications.

If you are previously signed up, log in for your account and click on the Obtain switch to have the Nebraska Loan Commitment Agreement. Make use of account to check with the lawful varieties you possess ordered earlier. Proceed to the My Forms tab of your respective account and have an additional version in the papers you need.

If you are a whole new consumer of US Legal Forms, here are simple guidelines so that you can adhere to:

- Initial, make sure you have chosen the correct develop for your personal metropolis/area. You are able to check out the form making use of the Preview switch and study the form explanation to make certain it will be the best for you.

- In case the develop fails to meet up with your needs, utilize the Seach field to find the appropriate develop.

- When you are positive that the form is proper, click the Get now switch to have the develop.

- Select the pricing prepare you desire and enter in the required info. Build your account and pay money for an order making use of your PayPal account or credit card.

- Select the document format and down load the lawful papers web template for your system.

- Comprehensive, modify and print out and sign the received Nebraska Loan Commitment Agreement.

US Legal Forms is the biggest local library of lawful varieties for which you can see a variety of papers themes. Take advantage of the company to down load appropriately-manufactured papers that adhere to express specifications.

Form popularity

FAQ

A loan commitment is an agreement by a commercial bank or other financial institution to lend a business or individual a specified sum of money.

The agreement's contents include loan type, parties involved, expiration date, loan amount, terms and conditions, cancellation policy, interest rate, and others. The six types involve revolving, non-revolving, secured, unsecured, conditional, and standby commitments.

We can define a commitment letter as a formal and legally binding document that a lender issues to a loan applicant. The commitment letter indicates that a loan applicant has passed the various underwriting guidelines and that their loan agreement or mortgage note has been approved.

It's important to note that just because your mortgage company created the commitment letter, doesn't mean you shouldn't be able to still back out. Nothing is final for the borrower until the loan is funded and all the closing documents are signed.

A loan commitment generally is given to an individual or business in the form of a letter from a lending institution, which may be a commercial bank, mortgage bank, or credit union. The letter spells out the financial institution's promise to lend a certain amount under certain terms in the future.

The qualification of the loan is dependent on the borrower's income and credit history. A loan commitment is when a financial institution makes an agreement to lend a certain amount of cash to an individual or business.

As mentioned above, mortgage commitment letters have expiration dates specified by the lender, after which your approval and any rate lock you had are rendered void. The length of commitment can vary between lenders, but a mortgage commitment letter typically expires after 30 days.