Nebraska Security Agreement regarding Member Interests in Limited Liability Company

Description

How to fill out Security Agreement Regarding Member Interests In Limited Liability Company?

Have you found yourself in a situation where you need documents for both business or personal reasons on a daily basis.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, including the Nebraska Security Agreement regarding Member Interests in Limited Liability Company, which can be tailored to meet federal and state requirements.

Once you obtain the correct document, click Purchase now.

Select the pricing plan you want, provide the necessary information to create your account, and make payment via PayPal or credit card. Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can download an additional version of the Nebraska Security Agreement regarding Member Interests in Limited Liability Company whenever needed. Click the required document to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Nebraska Security Agreement regarding Member Interests in Limited Liability Company template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the document you require and ensure it corresponds to your specific city/county.

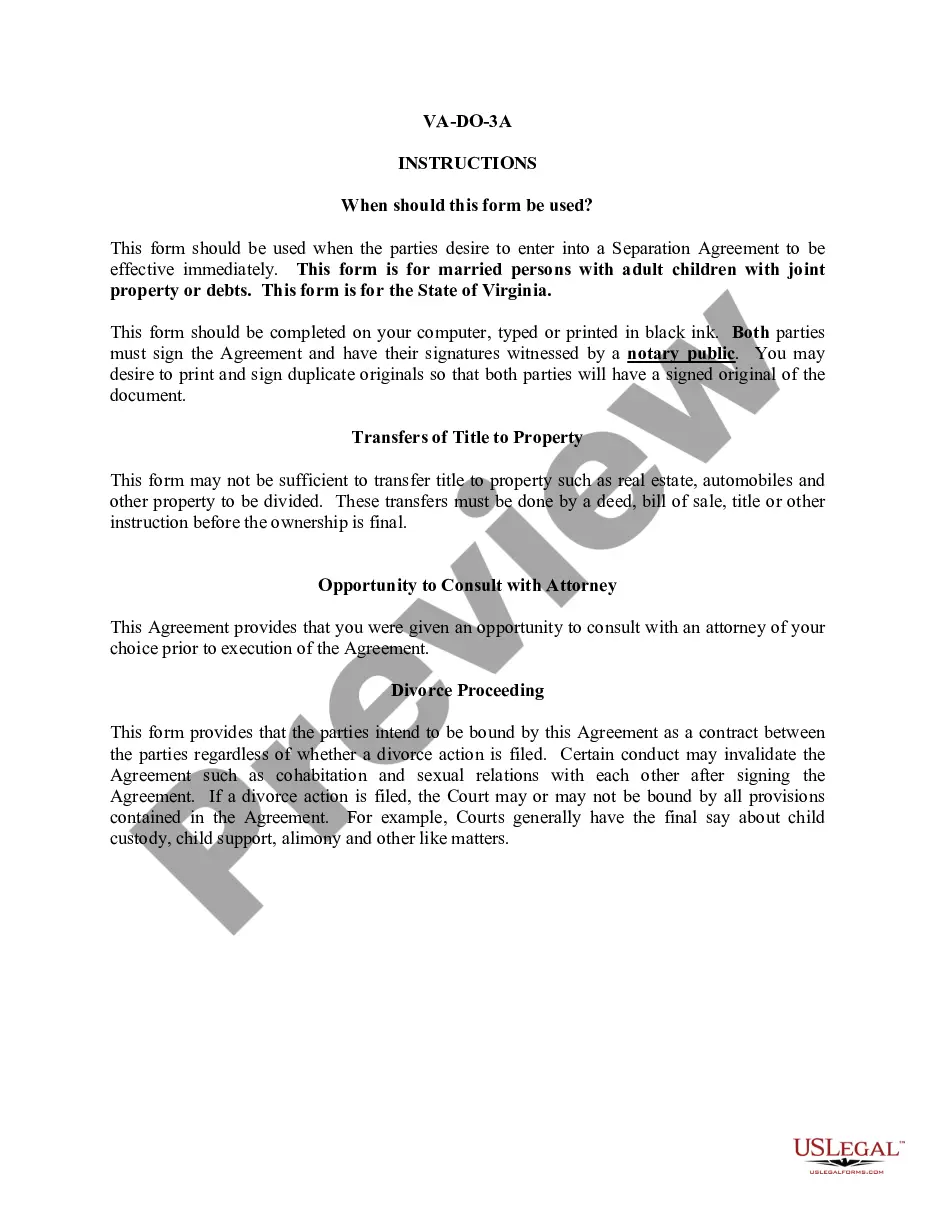

- Use the Preview option to review the form.

- Read the description to confirm you have selected the right document.

- If the document isn’t what you desire, utilize the Research field to find the document that meets your needs.

Form popularity

FAQ

Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities. There is no maximum number of members. Most states also permit single-member LLCs, those having only one owner.

Excerpt from The LLC Handbook. The term member refers to the individual(s) or entity(ies) holding a membership interest in a limited liability company. The members are the owners of an LLC, like shareholders are the owners of a corporation. Members do not own the LLC's property.

In states that have adopted the ULLCA, the LLC must purchase the interest at fair value within 120 days after the dissociation. If the member's dissociation violates the LLC's operating agreement, it is considered legally wrongful, and the dissoci-ated member can be held liable for damages caused by the dissociation.

It has been enacted in 19 U.S. jurisdictions: Alabama, Arizona, California, Connecticut, the District of Columbia, Florida, Idaho, Illinois, Iowa, Minnesota, Nebraska, New Jersey, North Dakota, Pennsylvania, South Dakota, Utah, Vermont, Washington, and Wyoming.

By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers. However, the limited liability provided by an LLC is not perfect and, in some cases, depends on what state your LLC is in. 4) the LLC's liability for other members' personal debts.

Every Nebraska LLC owner should have an operating agreement in place to protect the operations of their business. In addition to being legally required by the state, an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.

To create a limited liability company: they must file a certificate of organization with the secretary of state and should create an operating agreement, although an operating agreement is not required.

Limited liability - The company has its own legal entity so the liability of members or shareholders is limited and generally they will not be personally liable for the debts of the company.

LLC members and managers are generally not liable for the LLC's debts and other liabilities. However, California Corporations Code Section 17703.04 establishes specific instances in which members or managers may be held personally liable for company debts and other liabilities.