Nebraska Agreement to Redeem Interest of a Single Member in an LLC

Description

How to fill out Agreement To Redeem Interest Of A Single Member In An LLC?

Have you been in a place in which you need to have documents for sometimes company or personal reasons nearly every day? There are a lot of legitimate record web templates accessible on the Internet, but finding types you can rely on is not straightforward. US Legal Forms provides a huge number of type web templates, such as the Nebraska Agreement to Redeem Interest of a Single Member in an LLC, that happen to be published to meet federal and state specifications.

In case you are currently familiar with US Legal Forms site and have a merchant account, basically log in. Following that, you can down load the Nebraska Agreement to Redeem Interest of a Single Member in an LLC format.

Should you not come with an profile and wish to begin to use US Legal Forms, follow these steps:

- Obtain the type you will need and make sure it is for your appropriate city/state.

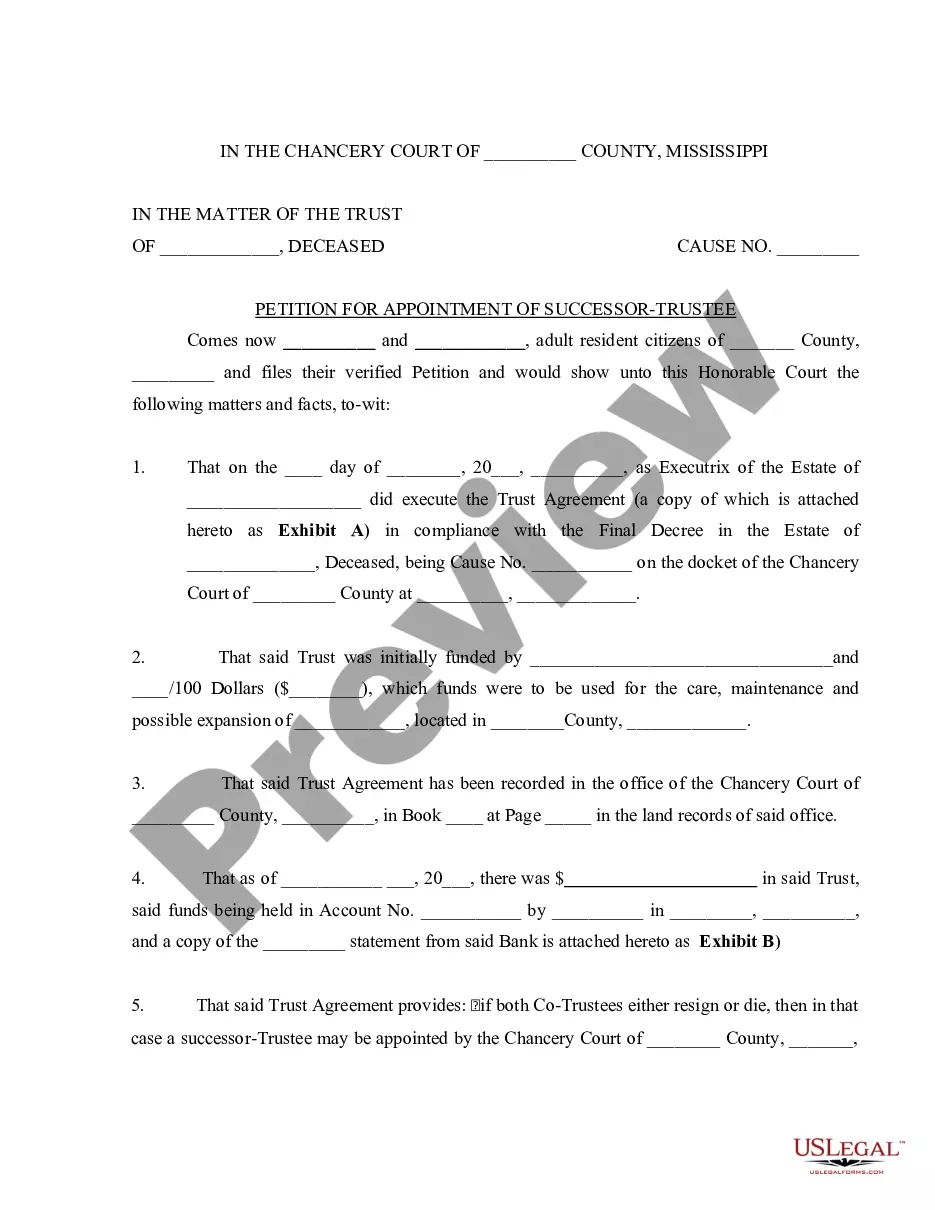

- Utilize the Preview button to check the form.

- Look at the outline to ensure that you have selected the right type.

- If the type is not what you`re searching for, utilize the Lookup discipline to discover the type that meets your requirements and specifications.

- When you get the appropriate type, click Get now.

- Select the pricing plan you need, submit the specified information to produce your money, and purchase the transaction with your PayPal or Visa or Mastercard.

- Decide on a convenient paper structure and down load your copy.

Discover each of the record web templates you might have purchased in the My Forms menu. You can obtain a more copy of Nebraska Agreement to Redeem Interest of a Single Member in an LLC any time, if possible. Just go through the necessary type to down load or print the record format.

Use US Legal Forms, the most substantial collection of legitimate kinds, to conserve efforts and steer clear of errors. The service provides skillfully manufactured legitimate record web templates which you can use for a variety of reasons. Make a merchant account on US Legal Forms and begin generating your lifestyle a little easier.

Form popularity

FAQ

Single member LLCs are treated the same as sole proprietorships. Profits are reported on Schedule C as part of your individual 1040 tax return. Self-employment taxes on Nebraska LLC net income must be paid just as you would with any self-employment business.

As a rule, a single-member LLC is considered a separate legal entity from its owner. This means that the owner's personal assets are shielded from any debts and liabilities incurred by your LLC.

Transferring Ownership in an LLC When the ownership transfer is a sale of the LLC, a buy-sell agreement may be necessary. An operating agreement should specify the process for ownership transfer, but if it doesn't, you must follow state guidelines. Under some circumstances, the state may require you to form a new LLC.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...

An operating agreement isn't mandatory. But it's a great idea to have one in place, even if your LLC only has one member and you'll be in charge of making all of the decisions. So why am I doing all this extra work? Because having a written operating agreement lends credibility to your LLC.

An operating agreement is a document that outlines the way your LLC will conduct business. Nebraska doesn't require an LLC to file an operating agreement, but it is an essential component of your business.

What should a single member LLC operating agreement include? Article I: Company Formation. ... Article II: Capital Contributions. ... Article III: Profits, Losses and Distributions. ... Article IV: Management. ... Article V: Compensation. ... Article VI: Bookkeeping. ... Article VII: Transfers. ... Article VIII: Dissolution.

An operating agreement isn't mandatory. It also helps show that your LLC is a legitimate business entity that's separate from you, not just some sham that's been created to avoid liability.