Nebraska Equity Share Agreement

Description

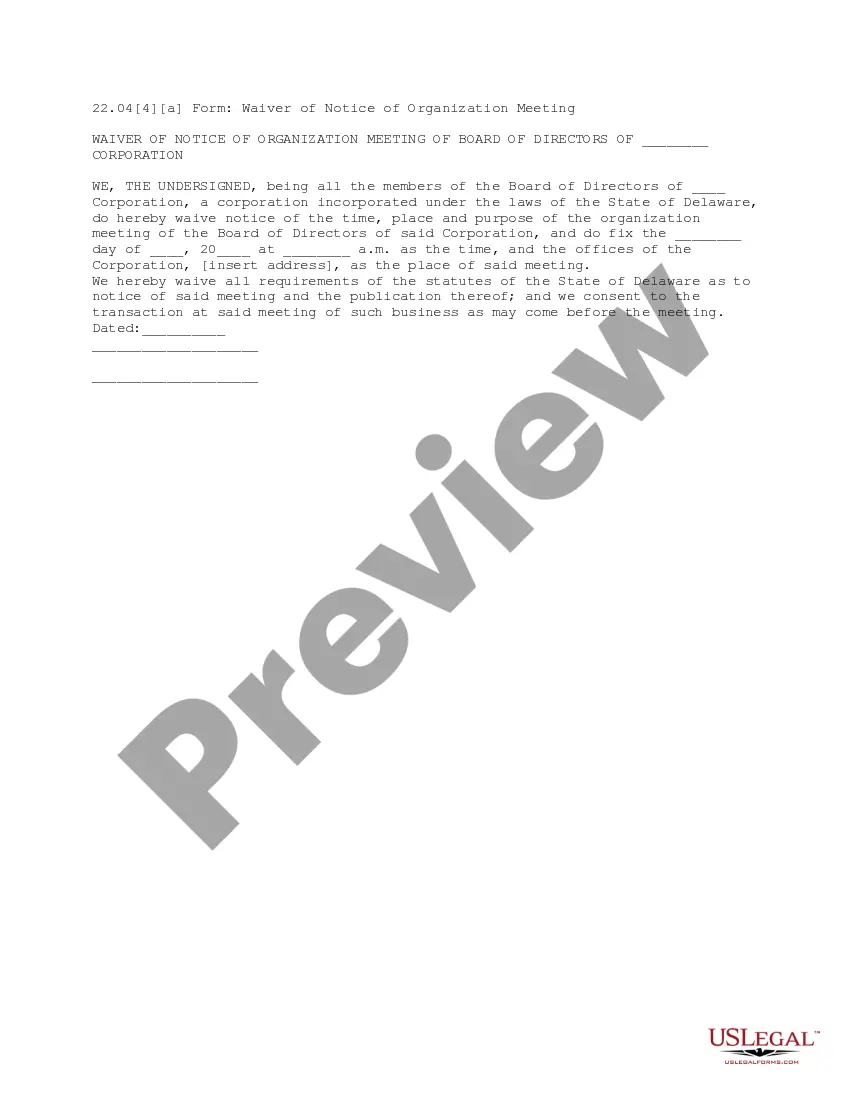

How to fill out Equity Share Agreement?

Locating the correct legal document template can be challenging.

Certainly, there are numerous designs available online, but how can you obtain the legal form you require.

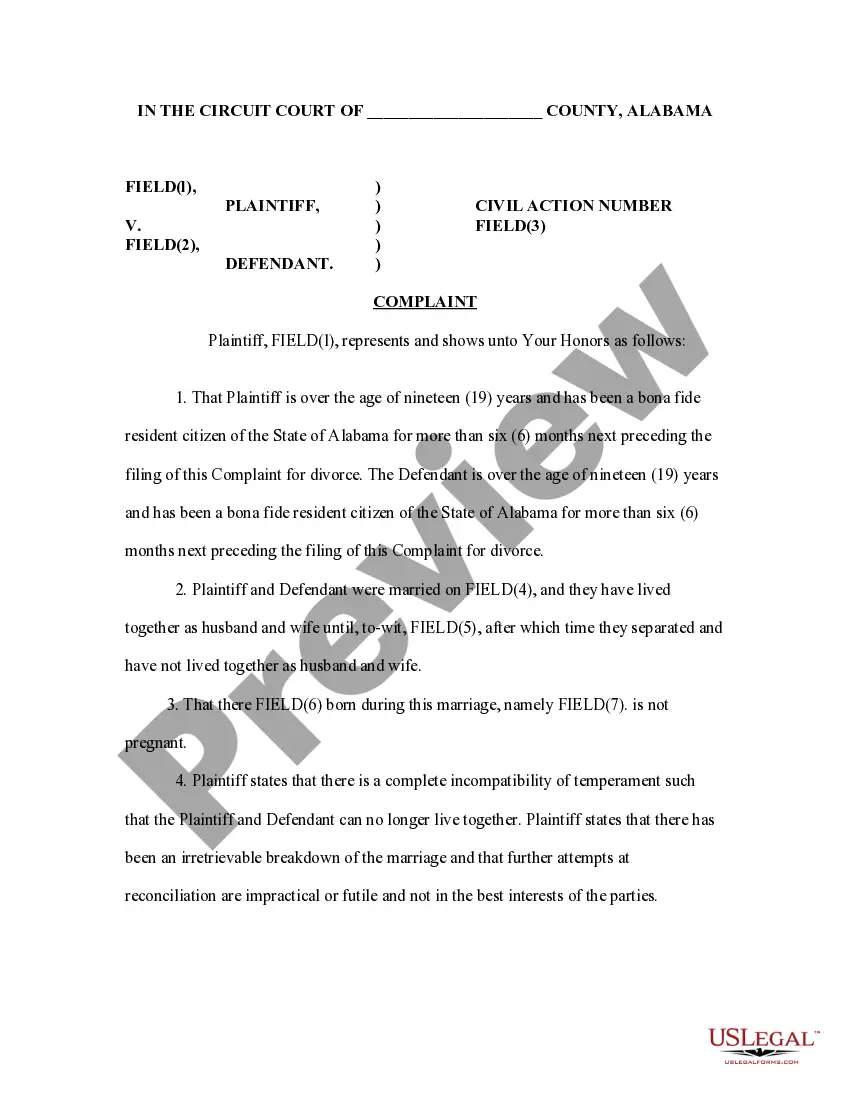

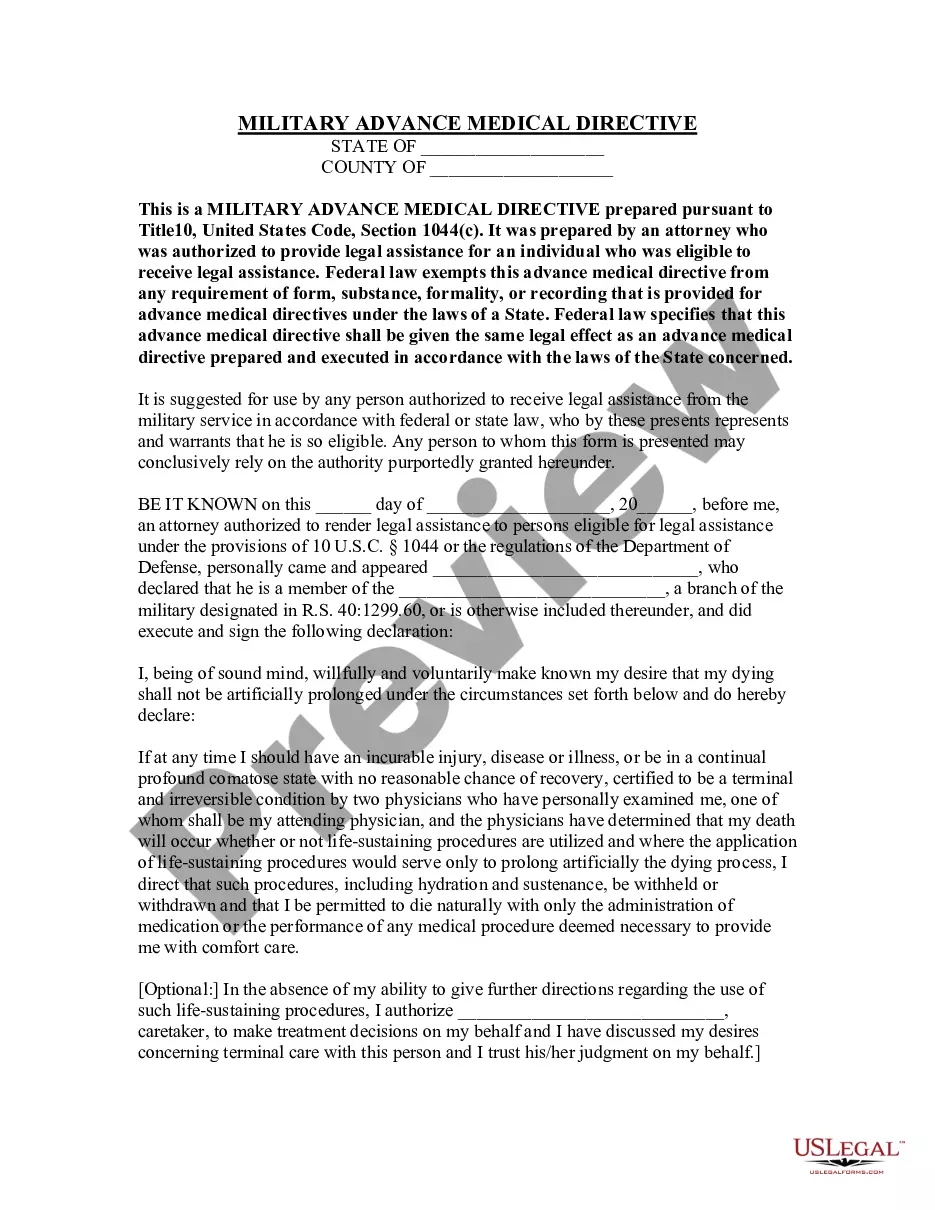

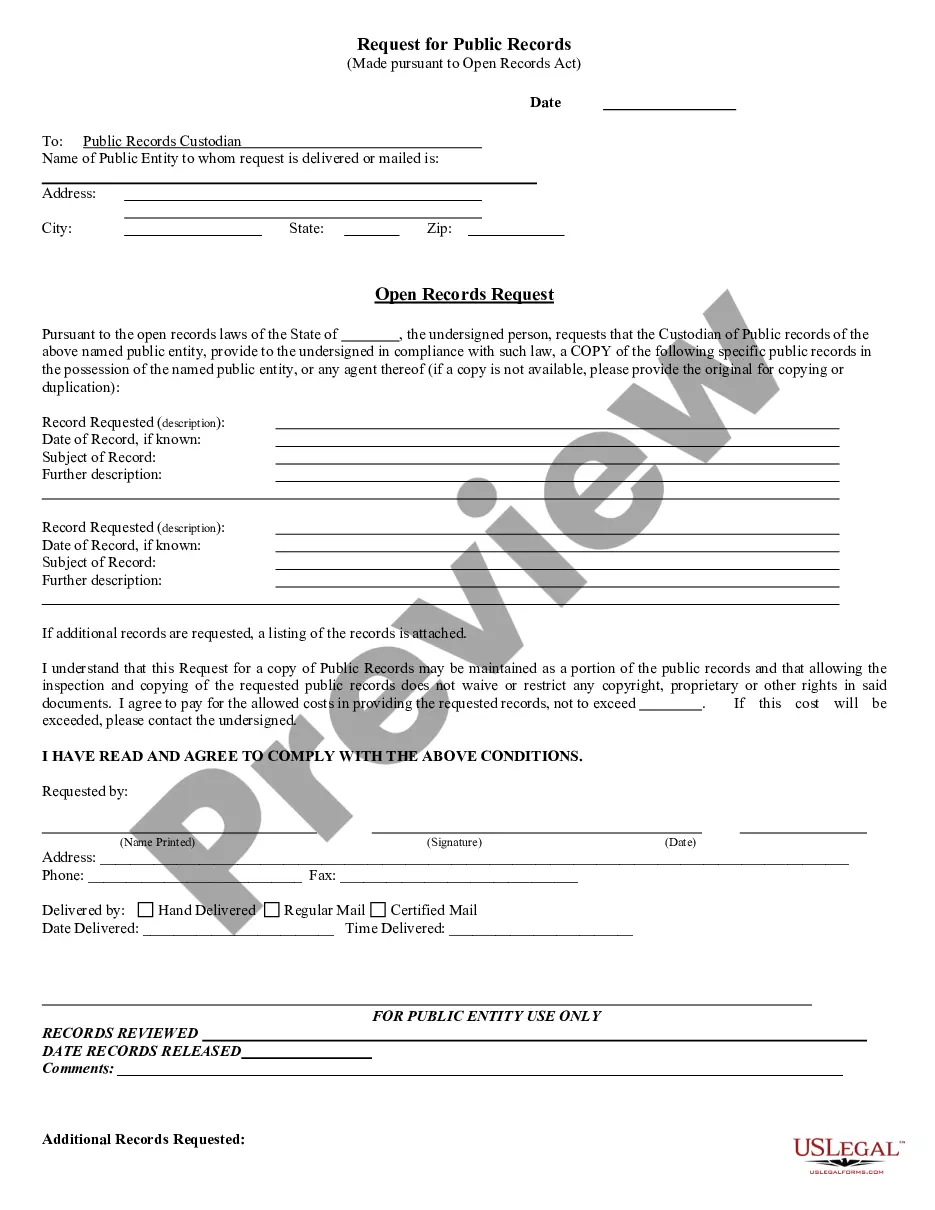

Utilize the US Legal Forms website. The service offers a wealth of templates, including the Nebraska Equity Share Agreement, which can be utilized for both business and personal purposes.

If the form does not suit your needs, use the Search section to find the correct form. Once you are certain that the form is appropriate, click on the Acquire now button to obtain it. Choose your desired pricing plan and enter the required information. Create your account and place an order using your PayPal account or Visa or Mastercard. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Nebraska Equity Share Agreement. US Legal Forms is the best library of legal templates where you can find numerous document layouts. Use the service to obtain professionally crafted documents that adhere to state specifications.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Acquire button to download the Nebraska Equity Share Agreement.

- Use your account to view the legal forms you have previously purchased.

- Navigate to the My documents section of your account to download an additional copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

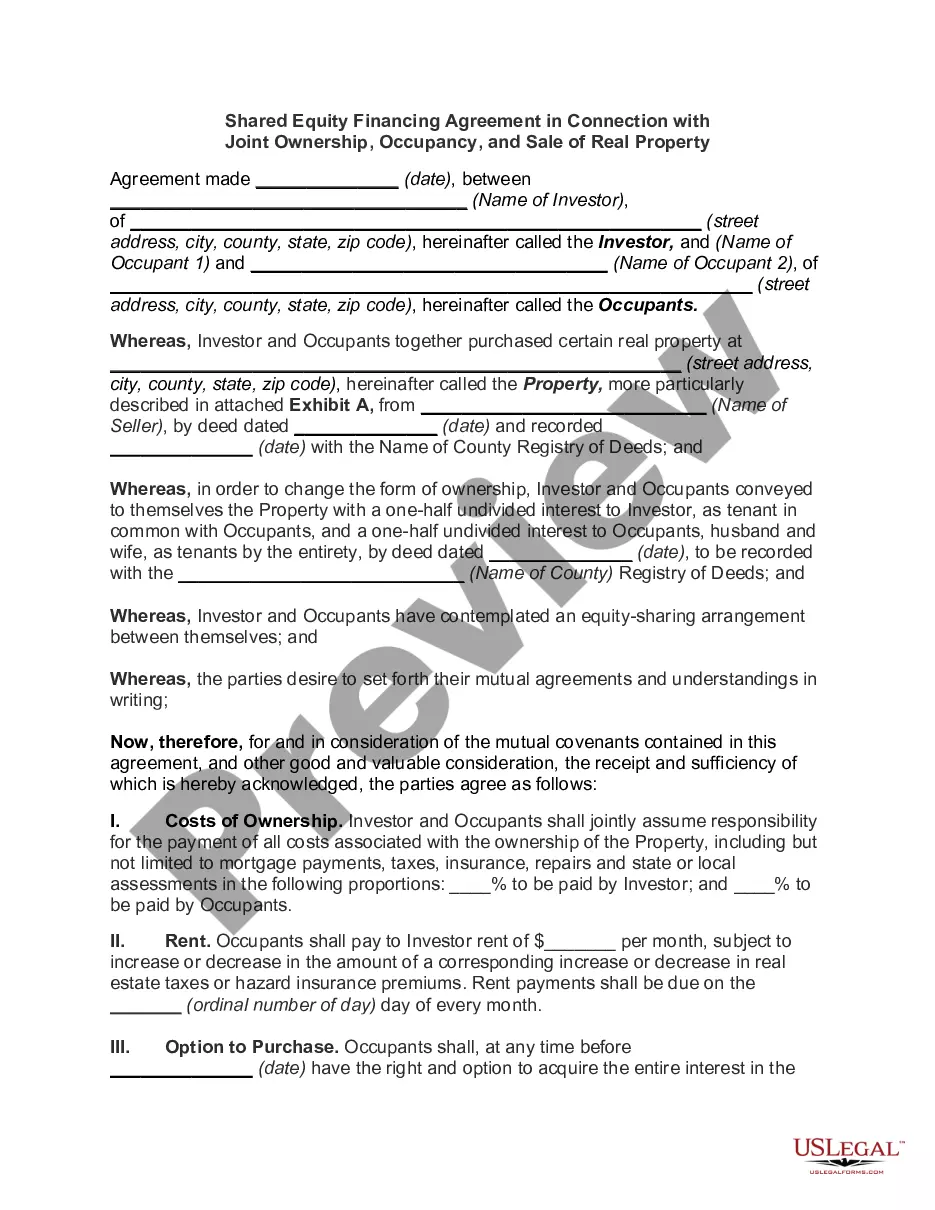

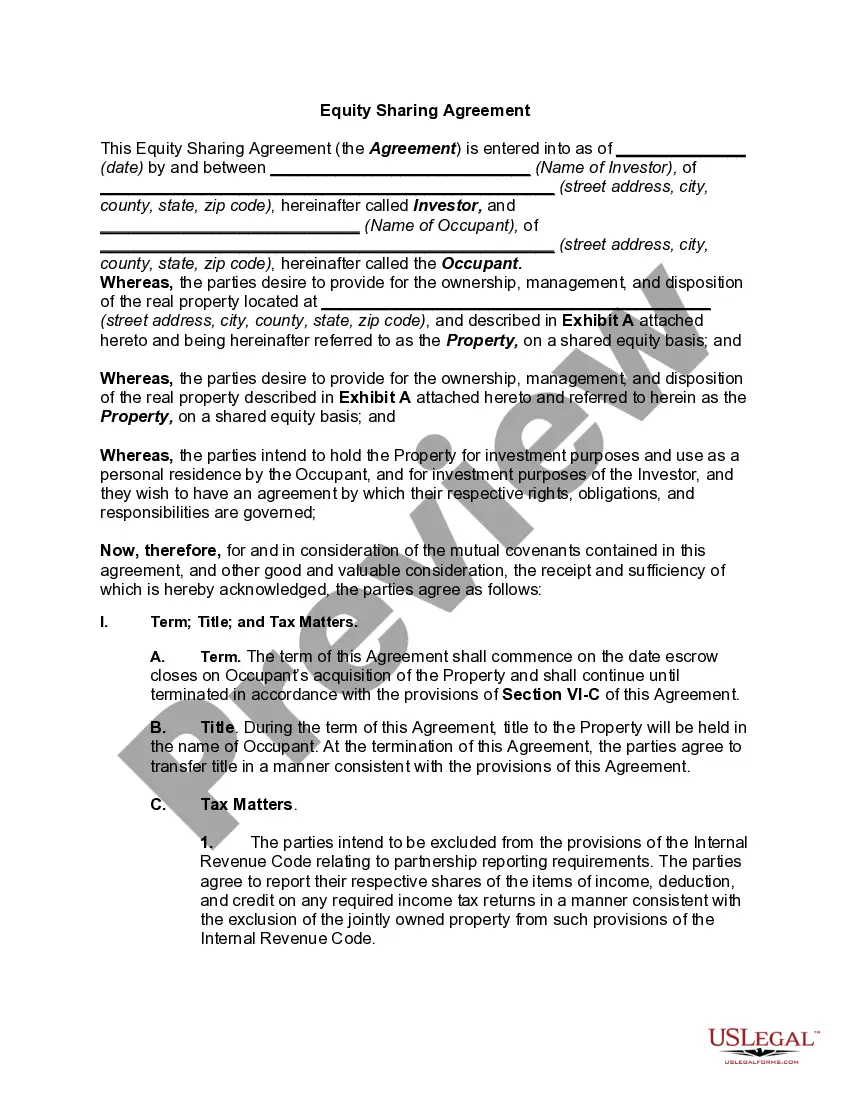

- First, ensure you have chosen the appropriate form for your area/region. You can check the document using the Review button and read the form description to make sure it’s suitable for you.

Form popularity

FAQ

Finding the best lender for a home equity agreement involves researching financial institutions that specialize in equity sharing. Look for lenders with clear terms, competitive rates, and positive reviews. US Legal Forms can help you navigate the Nebraska Equity Share Agreement process, including connecting you with reliable lenders who fit your needs.

Obtaining a home equity agreement requires understanding how much equity you have in your property. Next, you should check with potential lenders to find the best options available. Utilizing resources from US Legal Forms can simplify the documentation process for your Nebraska Equity Share Agreement, making it easier to manage and finalize your agreement.

To secure a home equity investment (HEI), start by evaluating your current home value and existing mortgage balance. You can then explore various financing options that align with your goals. It's often beneficial to consult platforms like US Legal Forms, which can provide you with documents and guidance related to a Nebraska Equity Share Agreement, ensuring a smooth process.

Some negatives of a home equity agreement include potential loss of equity and the shared appreciation model, which may not benefit the homeowner in the long run. Furthermore, if property values decline, the investor's terms may still hold, leaving you without substantial benefits. It’s advisable to consult a trusted resource like UsLegalForms when navigating a Nebraska Equity Share Agreement to ensure you understand the implications.

The percentage taken by a home equity agreement varies based on the agreement's specific terms and the investor's policies. Generally, investors may take a percentage of the future appreciation of your home, often ranging from 10% to 30%. By understanding the details of the Nebraska Equity Share Agreement, homeowners can make informed decisions regarding their potential returns.

A home equity agreement (HEA) can be a good idea for homeowners who prefer flexibility and want to avoid traditional lending structures. However, it’s vital to closely assess your financial situation and long-term plans. A Nebraska Equity Share Agreement can serve as a beneficial tool for those looking to maintain ownership of their home while accessing necessary funds for other investments or expenses.

One downside to a home equity agreement is that you may have to share a portion of your home's future appreciation with the investor. This means that while you benefit from avoiding typical mortgage payments, you could potentially earn less when selling your home. It is essential to evaluate the terms of a Nebraska Equity Share Agreement carefully to understand what you are agreeing to.

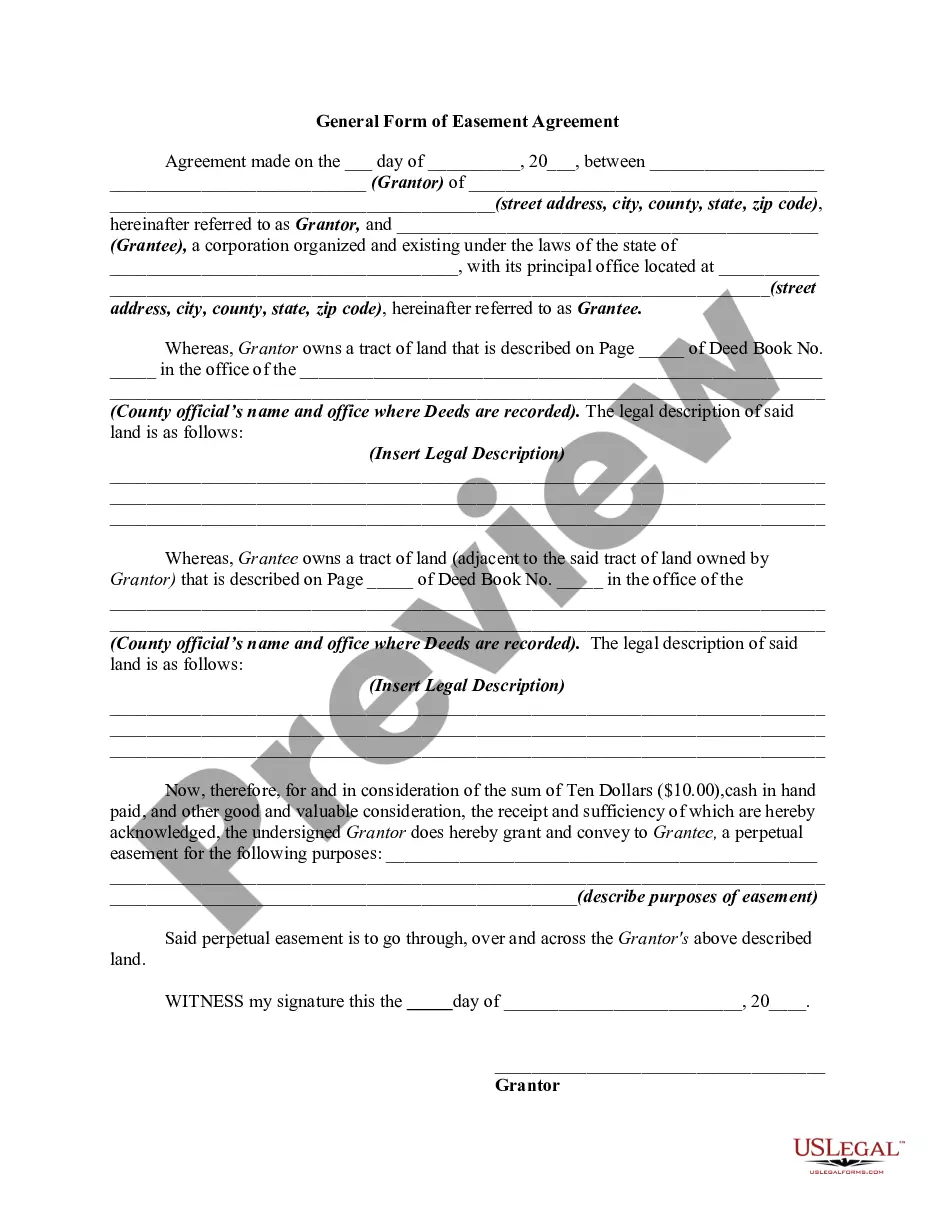

An equity share agreement is a contract that allows an investor to provide funds for a homeowner in exchange for a share in the property’s future value. This type of agreement can be ideal for individuals looking to avoid traditional mortgages while still building equity. In the context of a Nebraska Equity Share Agreement, this approach can help homeowners in Nebraska leverage their property’s appreciation without the burden of monthly payments.

Wyoming is known for having no corporate income tax, making it a popular choice for businesses seeking to maximize their profits. However, if you're considering a Nebraska Equity Share Agreement, it's essential to weigh the benefits of local regulations against the allure of states without corporate taxes. This decision could significantly impact your business strategy.

Nebraska's state tax rate includes various taxes such as individual income tax and corporate income tax, which are tiered based on income levels. For businesses utilizing a Nebraska Equity Share Agreement, understanding these rates is essential for long-term financial planning and compliance. It's wise to consult with a professional for personalized insights.