Nebraska Property or Boundary Line Agreement

Description

How to fill out Property Or Boundary Line Agreement?

Selecting the optimal legal document format can be somewhat challenging.

Of course, there are numerous templates available online, but how do you find the legal document you need.

Utilize the US Legal Forms website. The service offers a wide array of templates, including the Nebraska Property or Boundary Line Agreement, suitable for business and personal purposes.

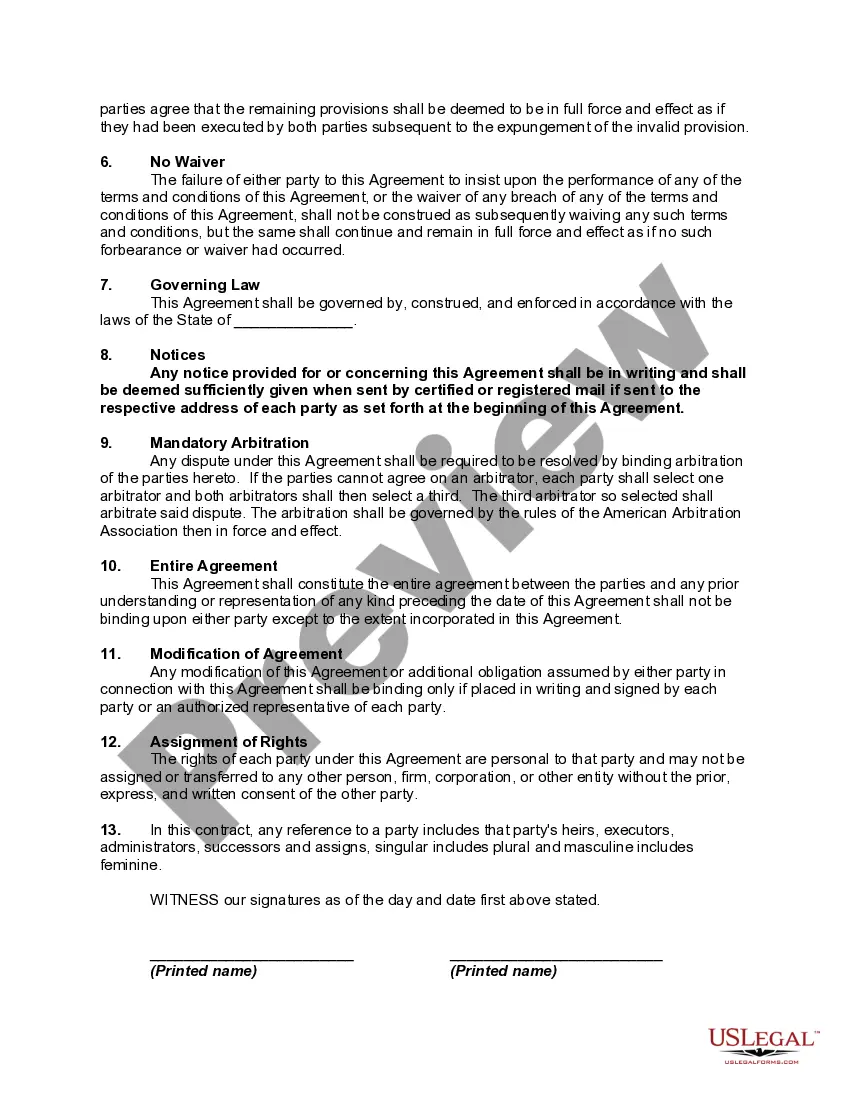

If the document does not fulfill your requirements, use the Search field to find the correct form. When you are confident that the form is adequate, click the Get now button to obtain the document. Choose the pricing plan you wish and input the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the document format and download the legal document to your device. Fill out, modify, print, and sign the obtained Nebraska Property or Boundary Line Agreement. US Legal Forms is the largest repository of legal documents where you can discover a variety of file formats. Take advantage of the service to download professionally crafted documents that adhere to state requirements.

- All documents are verified by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Nebraska Property or Boundary Line Agreement.

- You can use your account to search through the legal documents you have obtained previously.

- Visit the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward steps to follow.

- First, ensure you have selected the correct document for your city/state. You can review the form using the Preview feature and read the form description to confirm it is the right one for you.

Form popularity

FAQ

To change a boundary line, start by discussing the proposed changes with your neighbor. Both parties must agree on the new boundary, which can be formalized through a Nebraska Property or Boundary Line Agreement. This agreement should detail the new line and any conditions involved. Once finalized, you should file this agreement with your local land records office to ensure it holds legal weight.

Yes, property boundaries can sometimes be changed through mutual agreement between the property owners. A Nebraska Property or Boundary Line Agreement is a useful tool in these situations, as it allows both parties to formally document the new boundaries. However, keep in mind that changes might need to be recorded with local authorities to ensure they are legally binding and recognized.

When faced with neighbors who do not respect property boundaries, the first step is to communicate openly and calmly with them. You may find that a simple conversation can resolve misunderstandings. If discussions do not lead to a solution, consider drafting a Nebraska Property or Boundary Line Agreement to clearly define the boundaries and expectations. This legal document can help prevent future disputes.

Personal property tax assesses items owned by individuals or businesses, including vehicles, machinery, and equipment. The tax is based on the item's value and contributes to local funding for essential services. A Nebraska Property or Boundary Line Agreement may ensure clarity over property ownership and boundaries, potentially influencing your overall tax obligations. Familiarizing yourself with what constitutes personal property can aid in effective tax planning.

To find the assessed value of your property in Nebraska, you can contact your local county assessor's office or visit their website for online resources. The assessed value is typically a percentage of the market value, and local public records often detail this information. Engaging in a Nebraska Property or Boundary Line Agreement can also help verify property boundaries, which may affect assessments. Taking these steps can help you understand your property’s financial standing.

In Nebraska, personal property tax applies to tangible items like machinery, equipment, and business inventory. The assessment for personal property is separate from real estate tax, and the state requires business owners to report their personal property annually. Utilizing tools such as a Nebraska Property or Boundary Line Agreement can clarify ownership issues, which may influence your tax liabilities. It's beneficial to understand these distinctions to ensure accurate compliance.

Property taxes in Nebraska are based on the assessed value of real estate, which local county assessors determine. These taxes fund various local services, including schools, roads, and emergency services, making them essential to community support. Engaging in a Nebraska Property or Boundary Line Agreement may help ensure that your property is accurately assessed and that any boundary disputes are resolved. Understanding these principles can empower you in managing your property tax responsibilities.

In Nebraska, there isn't a mandatory age at which property taxes automatically cease. However, individuals aged 65 and older may qualify for certain exemptions or credits that can significantly reduce their property tax burden. Utilizing a Nebraska Property or Boundary Line Agreement can also help seniors manage property lines effectively, potentially impacting tax assessments. Always check with local tax authorities for age-specific benefits.

Avoiding property tax in Nebraska requires understanding available exemptions and credits. Homeowners may benefit from programs like the Nebraska Property or Boundary Line Agreement, which can help clarify property boundaries and may affect your tax status. Consulting with a local tax authority or legal expert can provide insights tailored to your situation. By actively engaging in these resources, you can better navigate your tax obligations.

The 7 year fence law relates to property boundaries and claims in some states, including Nebraska. This law states that if a fence has been maintained by an owner for seven years or more, it can be considered a legal boundary between properties. Understanding this concept can be crucial, especially when drafting a Nebraska Property or Boundary Line Agreement.