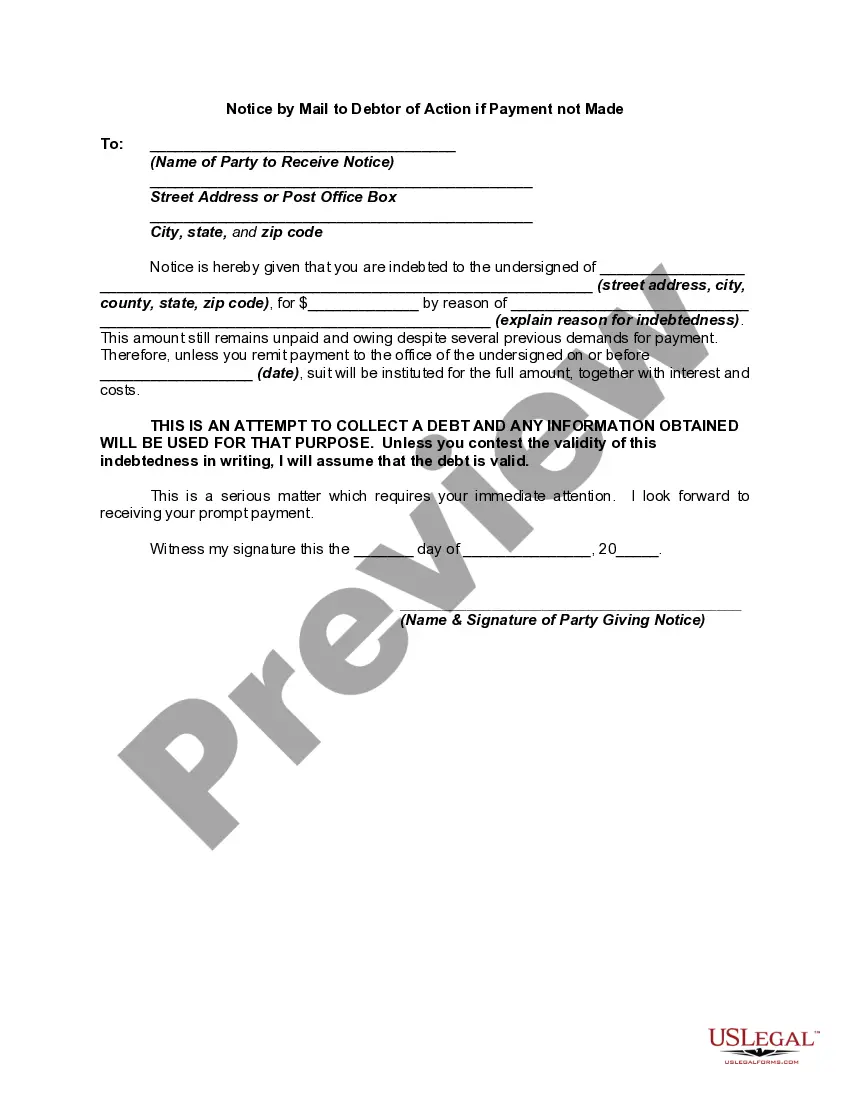

This notice is not from a debt collector but from the party to whom the debt is owed.

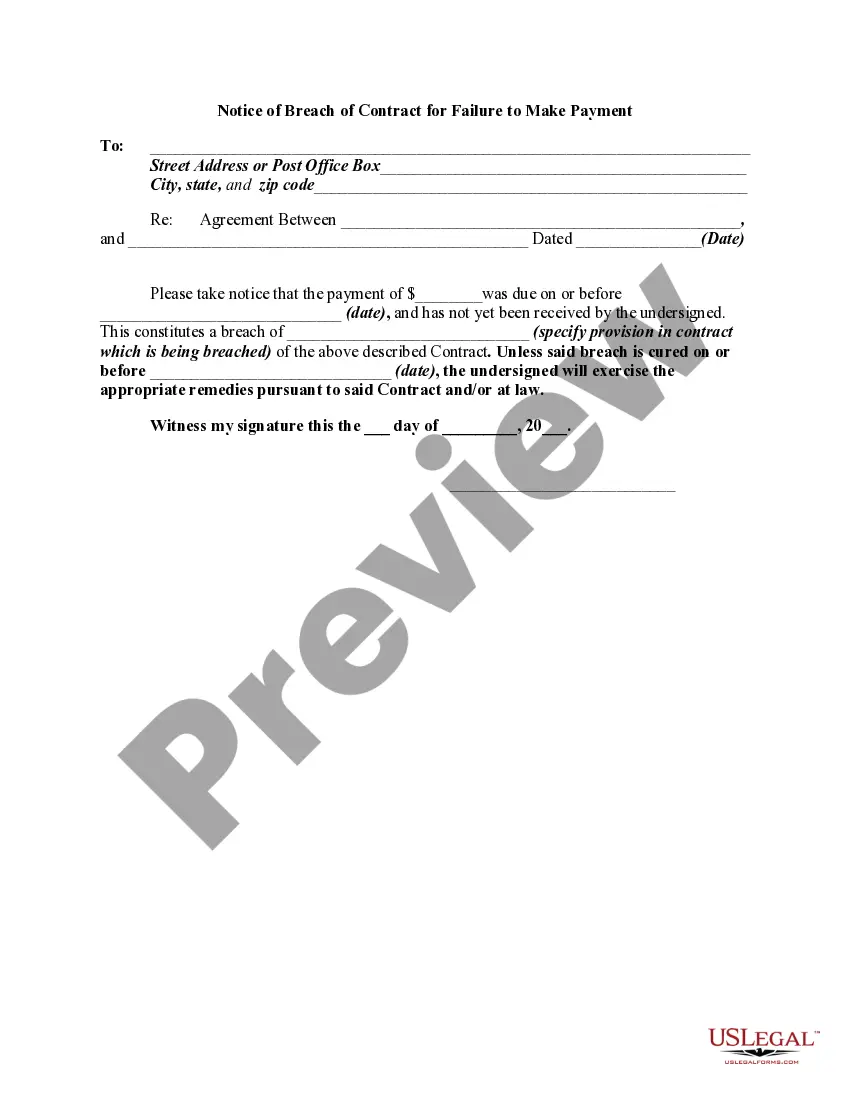

Nebraska Notice by Mail to Debtor of Action if Payment not Made

Description

How to fill out Notice By Mail To Debtor Of Action If Payment Not Made?

Choosing the best legitimate record format can be a battle. Of course, there are a variety of web templates available on the net, but how can you discover the legitimate develop you require? Make use of the US Legal Forms internet site. The support offers thousands of web templates, including the Nebraska Notice by Mail to Debtor of Action if Payment not Made, which can be used for enterprise and private demands. Each of the varieties are checked by professionals and meet up with state and federal requirements.

When you are presently registered, log in for your account and click the Acquire key to have the Nebraska Notice by Mail to Debtor of Action if Payment not Made. Utilize your account to search from the legitimate varieties you may have bought earlier. Proceed to the My Forms tab of your account and obtain another copy of the record you require.

When you are a new consumer of US Legal Forms, listed here are basic guidelines for you to adhere to:

- First, make certain you have chosen the correct develop to your city/state. You can examine the form while using Preview key and study the form description to make certain this is basically the right one for you.

- In case the develop fails to meet up with your preferences, take advantage of the Seach discipline to discover the right develop.

- Once you are sure that the form is acceptable, select the Acquire now key to have the develop.

- Pick the prices prepare you would like and type in the essential information and facts. Build your account and buy the transaction with your PayPal account or charge card.

- Opt for the file structure and obtain the legitimate record format for your gadget.

- Total, change and produce and sign the obtained Nebraska Notice by Mail to Debtor of Action if Payment not Made.

US Legal Forms is definitely the biggest library of legitimate varieties that you can find numerous record web templates. Make use of the company to obtain expertly-created papers that adhere to state requirements.

Form popularity

FAQ

007.01 At any time within three years after any amount of tax to be collected is assessed, or within ten years after the last recording of the state tax lien or continuation statement, the Tax Commissioner may bring an action in the District Court of Lancaster County, or in the courts of any other state, or the United ...

?And then through the process, after a period of time, if those taxes still haven't been paid, then they can claim the property.? In Nebraska, whoever pays your unpaid property tax bill can file a deed to the home if you don't pay within three years and nine months.

No action at law or equity may be brought or maintained attacking the validity or enforceability of or to rescind or declare void and uncollectible any written contract entered into pursuant to, in compliance with, or in reliance on, a statute of the State of Nebraska which has been or hereafter is held to be ...

The investor must wait until three years expires before taking the necessary steps to obtain ownership of the property. This three?year period is called a ?redemption period.? So, the owner gets at least this long to pay off the tax debt and reclaim the property.

In Nebraska, the statute of limitations on debt is 5 years from the last payment made. That means that creditors cannot sue you after that 5-year statute of limitations has run out. If the agreement was verbal, then that number is reduced to 4 years.

In Nebraska, the statute of limitations on debt is five years for credit card, medical, student loan, auto loan, personal loan, mortgage debt as well as judgments. For debts resulting from an oral contract, the NE statute of limitations is four years.

What Are the Consequences of Not Being Able to Pay Property Taxes in Nebraska? If the taxes haven't been paid in full on or before the first Monday of March after they become delinquent, the property is subject to sale on or after that date.

The Nebraska homestead exemption program is a property tax relief program for three categories of homeowners: A. Persons over age 65; B. Qualified disabled individuals; or C.