Nebraska Certification of Completion by Contractor

Description

How to fill out Certification Of Completion By Contractor?

If you want to accumulate, download, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you require.

A selection of templates for commercial and specific purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan that suits you and provide your information to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the payment.

- Use US Legal Forms to acquire the Nebraska Certification of Completion by Contractor with just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to get the Nebraska Certification of Completion by Contractor.

- You can also access forms you previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Make sure you have selected the form for your correct city/state.

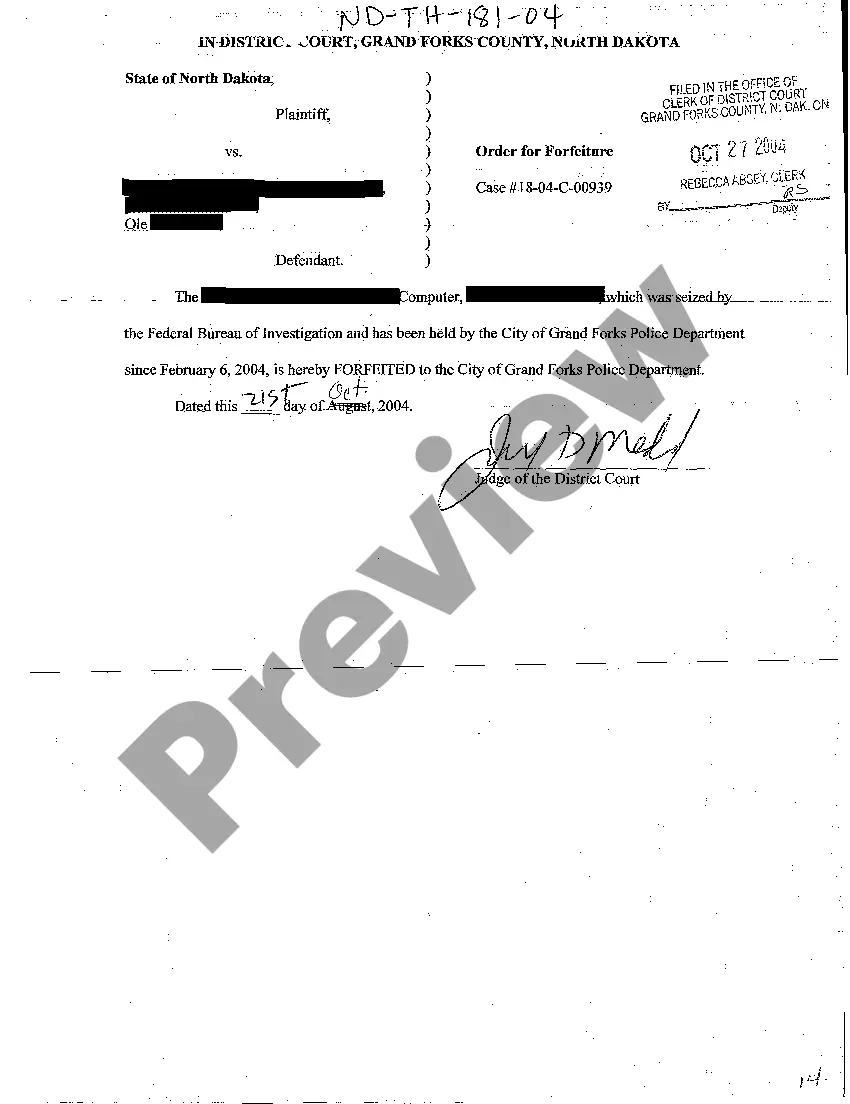

- Step 2. Use the Preview option to review the content of the form. Make sure to check the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

In Nebraska, construction services are generally taxable, but the specifics can vary based on the nature of the service. Labor performing repairs or improvements to real estate usually incurs sales tax. However, contractors who obtain a Nebraska Certification of Completion by Contractor can clarify their obligations and ensure proper handling of tax responsibilities. This approach helps to ensure that you remain compliant while providing top-tier service.

Yes, sales tax does apply to construction work in Nebraska, particularly when tangible property is involved. Materials and supplies purchased for construction projects typically incur sales tax. To navigate these regulations effectively, contractors often rely on the Nebraska Certification of Completion by Contractor, ensuring they align with tax obligations while providing quality service. Understanding these tax requirements is vital in maintaining compliance.

Generally, professional services, such as legal or accounting services, are not subject to sales tax in Nebraska. This allows professionals to focus on providing value without the added burden of tax on their services. For those involved in construction, holding a Nebraska Certification of Completion by Contractor may exempt certain aspects of project costs from sales tax, allowing you to better manage your finances.

Yes, Nebraska requires contractors to obtain a license to operate legally. This is crucial for ensuring that contractors meet the state's standards for safety and performance. By holding a valid Nebraska Certification of Completion by Contractor, you demonstrate compliance with state regulations, which can enhance your reputation and build trust with clients. Obtaining a license is an essential step for any contractor wanting to succeed in Nebraska.

In Nebraska, certain services are not subject to sales tax, including personal and professional services. For example, medical services provided by licensed professionals are exempt from taxation. Additionally, services related directly to real property, like repairs and maintenance by contractors holding a Nebraska Certification of Completion, may also have different tax implications. Understanding these nuances can help you maximize savings.

Yes, roofers in Nebraska must be licensed to perform work legally. This requirement helps ensure that they meet the necessary skills and safety standards. As a part of the licensing process, obtaining the Nebraska Certification of Completion by Contractor is essential in demonstrating your qualifications and commitment to quality work.

Yes, Nebraska requires businesses to obtain a business license in addition to any contractor licensing. The business license ensures that your operation is recognized legally and is compliant with local regulations. As a contractor, having the Nebraska Certification of Completion by Contractor and a valid business license boosts your credibility and trustworthiness.

Form 13 in Nebraska is necessary for contractors who apply for licensure. This form demonstrates your qualifications and outlines your relevant experience. When aiming for the Nebraska Certification of Completion by Contractor, completing Form 13 accurately is a vital step in compliance with state regulations.

Yes, contractors must be licensed in Nebraska for most building projects. Gaining the Nebraska Certification of Completion by Contractor allows contractors to operate legally and assures clients of their professionalism. This requirement protects both the contractor and the consumer by ensuring that all work meets industry standards.

Yes, Nebraska requires contractors to have a license to perform work legally within the state. This includes obtaining the Nebraska Certification of Completion by Contractor, which demonstrates that you meet specific standards and regulations. Licensing ensures consumer protection and maintains quality in construction work.