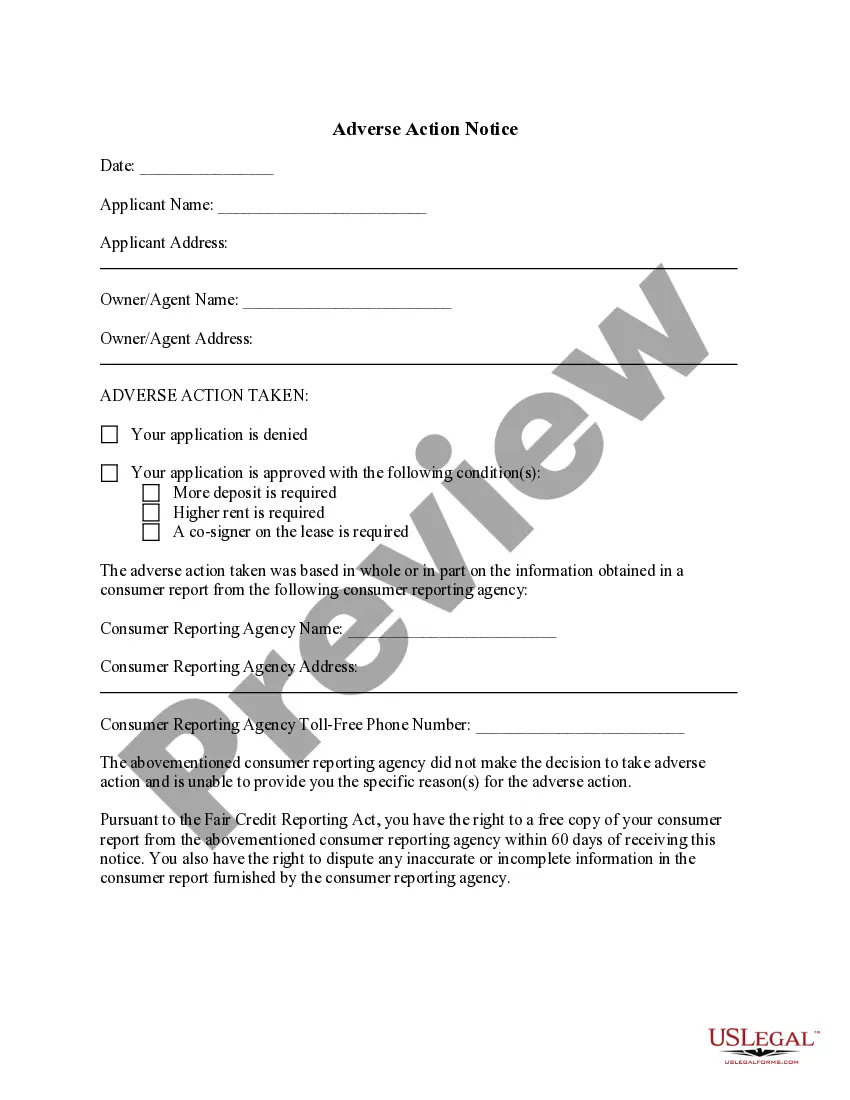

The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

Nebraska Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency

Description

How to fill out Request For Disclosure Of Reasons For Increasing Charge For Credit Regarding Credit Application Where Action Was Based On Information Not Obtained By Reporting Agency?

US Legal Forms - among the greatest libraries of lawful kinds in the USA - offers a variety of lawful papers web templates you can down load or print out. Utilizing the site, you can get thousands of kinds for organization and personal purposes, categorized by classes, claims, or keywords.You can get the latest versions of kinds such as the Nebraska Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency within minutes.

If you already have a membership, log in and down load Nebraska Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency from the US Legal Forms library. The Download button will show up on each and every develop you view. You have access to all formerly downloaded kinds in the My Forms tab of your own profile.

If you want to use US Legal Forms the very first time, here are simple recommendations to get you started off:

- Be sure to have picked out the correct develop for your personal metropolis/region. Go through the Review button to examine the form`s content material. Read the develop information to actually have selected the proper develop.

- In the event the develop does not match your requirements, make use of the Look for field at the top of the screen to find the the one that does.

- In case you are happy with the shape, verify your option by clicking the Acquire now button. Then, choose the prices plan you favor and supply your references to register to have an profile.

- Method the purchase. Make use of your Visa or Mastercard or PayPal profile to finish the purchase.

- Select the formatting and down load the shape on the device.

- Make alterations. Load, revise and print out and signal the downloaded Nebraska Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.

Each and every web template you included in your money does not have an expiration particular date and it is yours permanently. So, if you would like down load or print out another copy, just check out the My Forms portion and click around the develop you need.

Get access to the Nebraska Request for Disclosure of Reasons for Increasing Charge for Credit Regarding Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency with US Legal Forms, the most substantial library of lawful papers web templates. Use thousands of expert and state-distinct web templates that fulfill your organization or personal needs and requirements.

Form popularity

FAQ

Finally, your pre-adverse action notice should contain ?A Summary of Your Rights Under the Fair Credit Reporting Act.? This document advises you of the rights you have under the FCRA, including the right to: Know if information about you in a consumer report has been used in an adverse manner against you.

A statement of action taken by the creditor. Either a statement of the specific reasons for the action taken or a disclosure of the applicant's right to a statement of specific reasons and the name, address, and telephone number of the person or office from which this information can be obtained.

If you're rejected because of the background check, you'll receive an adverse action notice that is slightly different from the one that you'd receive if you were denied credit.

Dear [Applicant Name], We regret to inform you that based on our hiring criteria, we are unable to consider you further for an employment opportunity with our organization. This decision was made in part from the information we received from _____________________, our employment screening vendor.

The Dodd-Frank Act also amended two provisions of the FCRA to require the disclosure of a credit score and related information when a credit score is used in taking an adverse action or in risk-based pricing. On December 21, 2011, the CFPB restated FCRA regulations under its authority at 12 CFR Part 1022 (76 Fed.

Notice is not required if: The transaction does not involve credit; A credit applicant accepts a counteroffer; A credit applicant expressly withdraws an application; or.

Removals, demotions, and suspensions of Federal employees are ?adverse actions.?1 A removal action terminates the employment of an individual.

If the disputed information is wrong or can't be verified, the company is required by law to delete or change the information. It also has to notify all of the credit reporting companies to which it provided the wrong information, so the credit reporting companies can update their files with the correct information.