Nebraska Triple Net Lease

Description

How to fill out Triple Net Lease?

Selecting the appropriate legal document template can be challenging.

Certainly, there are numerous templates accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The platform provides thousands of templates, such as the Nebraska Triple Net Lease, which can be utilized for both business and personal purposes.

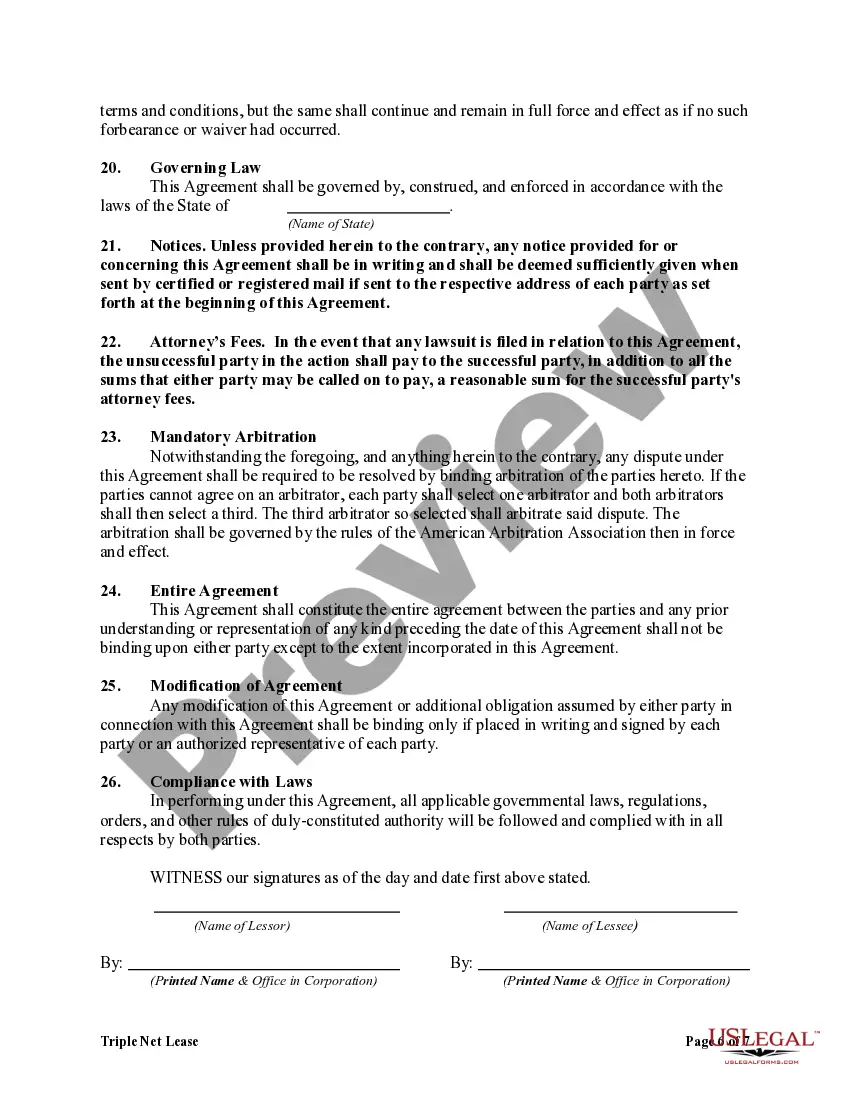

You can view the form using the Preview button and inspect the form details to ensure it is the right one for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident that the form is correct, click the Get Now button to obtain the form. Select the payment plan you want and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, revise, print, and sign the received Nebraska Triple Net Lease. US Legal Forms is the largest repository of legal documents where you can find various document templates. Utilize the service to download properly crafted documents that comply with state requirements.

- All of the documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Nebraska Triple Net Lease.

- Use your account to search through the legal documents you have previously acquired.

- Go to the My Documents tab in your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps you can follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

A net lease REIT, or Real Estate Investment Trust, focuses on properties leased under a triple net lease structure. In a Nebraska Triple Net Lease arrangement, tenants typically cover property expenses like taxes, insurance, and maintenance, allowing the REIT to generate steady, predictable income. This model benefits both investors and tenants, as it often leads to lower overhead costs for tenants while offering reliable returns for investors. You can learn more about how to navigate these leases on the US Legal Forms platform, which provides valuable resources.

The largest triple net lease REIT is Realty Income Corporation, known for its monthly dividend payouts and stable investment returns. This company focuses on acquiring and managing properties under Nebraska Triple Net Leases, providing a steady income stream. Investors often look to Realty Income for its proven track record in the NNN sector, making it a go-to choice for many.

While many states offer opportunities for a Nebraska Triple Net Lease, states like Florida, Texas, and California are particularly favorable due to their strong commercial real estate markets. These states provide diverse investment options, attracting both tenants and landlords. It's essential to analyze local market conditions, as well as the economic climate, before making any decisions.

One disadvantage of a Nebraska Triple Net Lease is that tenants assume additional responsibilities, including maintenance and property taxes. This can lead to unexpected costs that may strain the budget. Moreover, if the property requires significant repairs, tenants can face financial burdens. Understanding these risks is important before entering into a lease agreement.

Yes, the terms of a Nebraska Triple Net Lease can often be negotiated. Tenants and landlords typically discuss various aspects such as rent, maintenance responsibilities, and property taxes. When negotiating, it's crucial to communicate clearly and aim for a mutually beneficial agreement. Engaging with a knowledgeable professional can help both parties navigate these discussions effectively.

Calculating a Nebraska Triple Net Lease starts with determining the base rent of the property. From there, you must add the estimated costs for property tax, insurance, and maintenance fees. You can break these down monthly or annually to gain a clearer picture of total expenses. This method allows tenants to plan their budgets effectively, ensuring they cover all necessary costs associated with their lease.

Properties most likely to have a triple net lease include commercial real estate such as retail spaces, office buildings, and industrial properties. These types of properties benefit from long-term tenants who are willing to manage additional costs. In Nebraska, savvy investors often look for these investment opportunities due to their potential for stable, passive income. Identifying suitable properties can simplify finding a profitable Nebraska triple net lease.

Structuring a triple net lease involves clearly outlining responsibilities for costs related to property maintenance, insurance, and taxes. It's vital to specify what expenses the tenant must cover and what the landlord retains control over. A well-drafted Nebraska triple net lease offers protections for both parties and encourages a transparent relationship. Using platforms like uslegalforms can help ensure that your lease meets legal standards and protects your investment.

Calculating a triple net lease involves identifying the base rent and adding the total expenses associated with the property. These expenses usually include taxes, insurance, and maintenance costs. Once you have the combined amount, you can either divide it by the property's square footage for a per-foot rate or outline it as separate line items in the lease. Understanding this calculation is essential for both landlords and tenants in Nebraska.

The best triple net lease tenants typically include established companies with strong financial backgrounds, such as retail chains or healthcare providers. These businesses often have the resources to manage operational expenses, ensuring timely payments. Additionally, a reputable tenant can enhance the property’s value and minimize risk for landlords. Thus, in Nebraska, selecting high-quality tenants is crucial for a successful triple net lease.